Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 17, no. 407: January 1, 1876

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

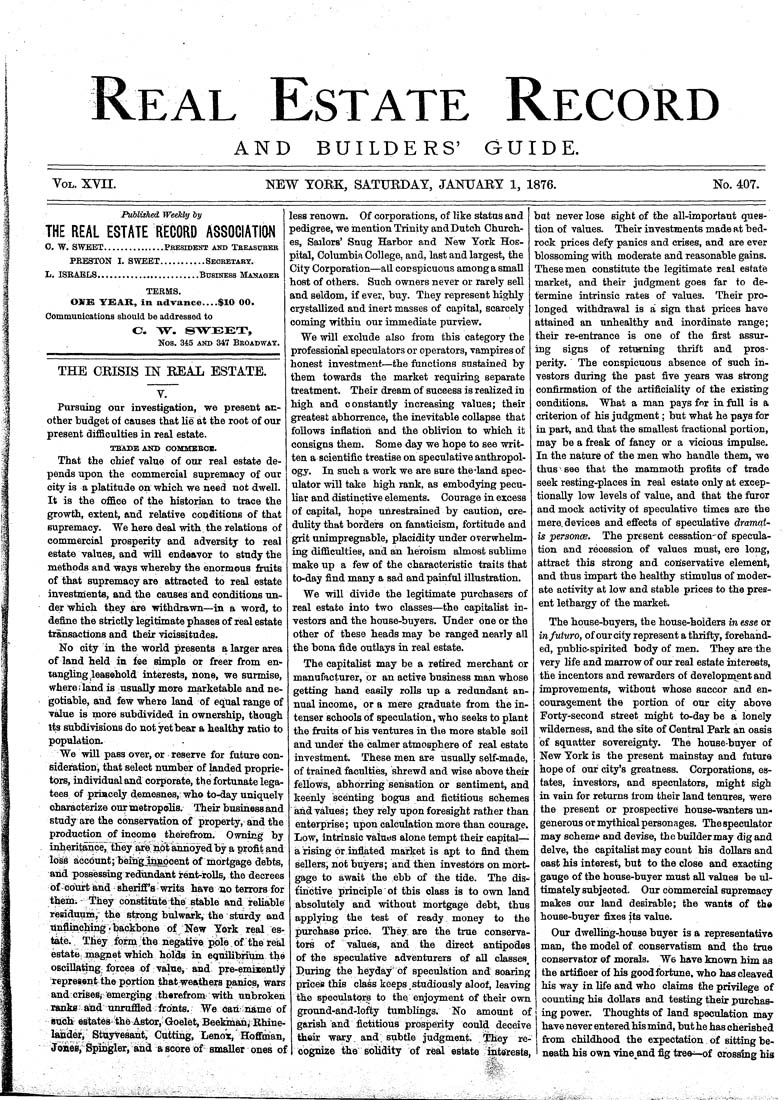

Real Estate Record AND BUILDERS' GUIDE. Vol. XVII. NEW TOEK, SATUEDAY, JANUARY 1, 1876. No. 407. Published Weekly iy THE REAL ESTATE RECORD ASSOCIATION 0. W. SWEET___...........Pbesident and Tbeasuber PRESXON I. SWEET...........Seobetabt. L. ISRAELS.........................Business Manageb TERMS. OirS YSAR, in advance___$10 00. Commanications should be addressed to Nos. 3i5 AND 347 Bboadwat. THE CRISIS IN REAL ESTATE. Pursuing our investigation, we present an¬ other budget of causes that lie at the root of our present difficulties in real estate. TBABB KSD OOMMEBOI. That the chief value of oar real estate de¬ pends upon the commercial supremacy of our city is a platitude on which we need not dwell. It is the office of the historian to trace the growth, extent, and relative conditions of that supremacy. We here deal with, the relations of commercial prosperity and adversity to real estate values, and ynM endeavor to study the methods and ways whereby the enormous fruits of that supremacy are attracted to real estate investaients, and the causes and conditionB un¬ der Which they are withdrawn—in a word, to define the strictly legitimate phases of real estate toansactions and their vicissitudes. No city in the world presents a larger area of land held in fee simple or freer from en¬ tangling leasehold interests, none, we surmise, where; land is usually more marketable and ne¬ gotiable, and few where land of equal range of value is more subdivided in ownership, though Its subdivisions do not yet bear a healthy ratio to population. We will pass over, or reserve for future con¬ sideration, that select number of landed proprie¬ tors, individual and corporate, the fortunate lega¬ tees of priacely demesnes, who to-day uniquely characterize our metropolis. Their business and study are the conservation of property, and the production of income theirefrom. Owning by inheritance, they are not annoyed by a profit and loss account; beingJinnooent of mortgage debts, and possessing redundant rent-rolls, the decrees of court and sheriflfs writs have no terrors for them. - They constitute the stable and reliable residuum,- the strong bulwark, the sturdy and unflinching.backbone of New York real es¬ tate. They form the negative pole of the real estate magnet which holds in equilibrium the oscillating forces of value, and pre-enuxently represent the portion that weathers panics, wars and crises, emerging therefrom- with unbroken ranks and unruffled fronts. We can name of Buch estates- the Astor, Goelet, Beekman, Rhine- lander, Stuyvesant, Cutting, Lenox, Hoflfman, Jonee, Spingler, and a score of smaller ones of less renown. Of corporations, of like status and pedigree, we inention Trinity and Dutch Church¬ es, Sailors' Snug Harbor and New York Hos¬ pital, Columbia College, and, last and largest, the City Corporation—all conspicuous among a small host of others. Such owners never or rarely sell and seldom, if ever, buy. They represent highly crystallized and inert masses of capital, scarcely coming within our immediate purview. We will exclude also from this category the professional speculators or operators, vampires of honest investment—the functions sustained by them towards the market requiring separate treatment. Their dream of success is realized in high and constantly increasing values; their greatest abhorrence, the inevitable coUapse that follows inflation and the oblivion to which it consigns them. Some day we hope to see writ¬ ten a scientific treatise on speculative anthropol¬ ogy. In such a work we are sure the-land spec¬ ulator will take high rank, as embodying pecu¬ liar and distinctive elements. Courage in excess of capital, hope unrestrained by caution, cre¬ dulity that borders on fanaticism, fortitude and grit unimpregnable, placidity under overwhelm¬ ing difficulties, and an heroism almost sublime make up a few of the characteristic traits that to-day find many a sad and painful illustration. We will divide the legitimate purchasers of real estate into two classes—the capitalist in¬ vestors and the house-buyers. Under one or the other of these heads may be ranged nearly all the bona fide outlays in real estate. The capitalist may be a retired merchant or manufacturer, or an active business man whose getting hand easily rolls up a redundant an¬ nual income, or a mere graduate from the in- tenser schools of speculation, who seeks to plant the fruits of his ventures in the more stable soil and under the calmer atmosphere of real estate investment. These men are usually self-made, of trained faculties, shrewd and wise above their fellows, abhorring sensation or sentiment, and keenly scenting bogus and fictitious schemes and values; they rely upon foresight rather than enterprise; upon calculation more than courage. Low, intrinsic values alone tempt their capital— a rising or inflated market is apt to find them sellers, not buyers; and then investors on mort¬ gage to await the ebb of the tide. The dis¬ tinctive principle ol this class is to own land absolutely and without mortgage debt, thus applying the test of ready money to the purchase price. They are the true conserva¬ tors of values, and the direct antipodes of the speculative adventurers of all classes^ During the heyday' of speculation and soaring prices this class keeps studiously aloof, leaving the speculators to the enjoyment of their own ground-and-lofty tumblings. No amount of garish and fictitious prosperity could deceive their wary and subtle judgment. They re¬ cognize the solidity of real estate interests. but never lose sight of the all-important ques¬ tion of values. Their investments made at bed¬ rock prices defy panics and crises, and are ever blossoming with moderate and reasonable gains. These men constitute the legitimate real estatie market, and their judgment goes far to de¬ termine intrinsic rates of values. Their pro¬ longed withdrawal is a' sign that prices have attained an unhealthy and inordinate range; their re-entrance is one of the first assur¬ ing signs of returning thrift and pros¬ perity. The conspicuous absence of such in¬ vestors during the past five years was strong confirmation of the artificiality of the existing conditions. What a man pays for in full is a criterion of his judgment; but what he pays for in part, and that the smallest fractional portion, may be a freak of fancy or a vicious impulse. In the nature of the men who handle them, we thus* see that the mammoth profits of trade seek resting-places in real estate only at excep¬ tionally low levels of value, and that the furor and mock activity ot speculative times are the mere, devices and effects of speculative dramat¬ is personce. The present cessation-of specula¬ tion and recession of values must, ere long, attract this strong and coniservative element, and thus impart the healthy stimulus of moder¬ ate activity at low and stable prices to the pres¬ ent lethargy of the market. The house-buyers, the house-holders in esse or in future, of our city represent a thrifty, forehand¬ ed, public-spirited body of men. They are the very life and marrow of our real estate interests, the incentors and rewarders of development and improvements, without whose succor and en¬ couragement the portion of our city above Forty-second street might to-day be a lonely wUdemess, and the site of Central Park an oasis of squatter sovereignty. The house-buyer of New York is the present mainstay and future hope of our city's greatness. Corporations, es¬ tates, investors, and speculators, might sigh in vain for returns Irom their land tenures, were the present or prospective house-wanters un¬ generous or mythical personages. The speculator may schem«> and devise, thebuildermay digand delve, the capitalist may count his dollars and oast his interest, but to the close and exacting gauge of the house-buyer must all values be ul¬ timately subjected. Our commercial supremacy makes our land desirable; the wants of the house-buyer fixes its value. Our dwelling-house buyer is a representative man, the model of conservatism and the true conservator of morals. We have known him as the artificer of his good fortune, who has cleaved his way in life and who claims the privilege of counting his dollars and testing their purchas¬ ing power. Thoughts of land speculation may have never entered his mind, but he has cherished from childhood the expectation of sitting be¬ neath his own vine^and fig tree^of crossing his