Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 17, no. 422: April 15, 1876

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

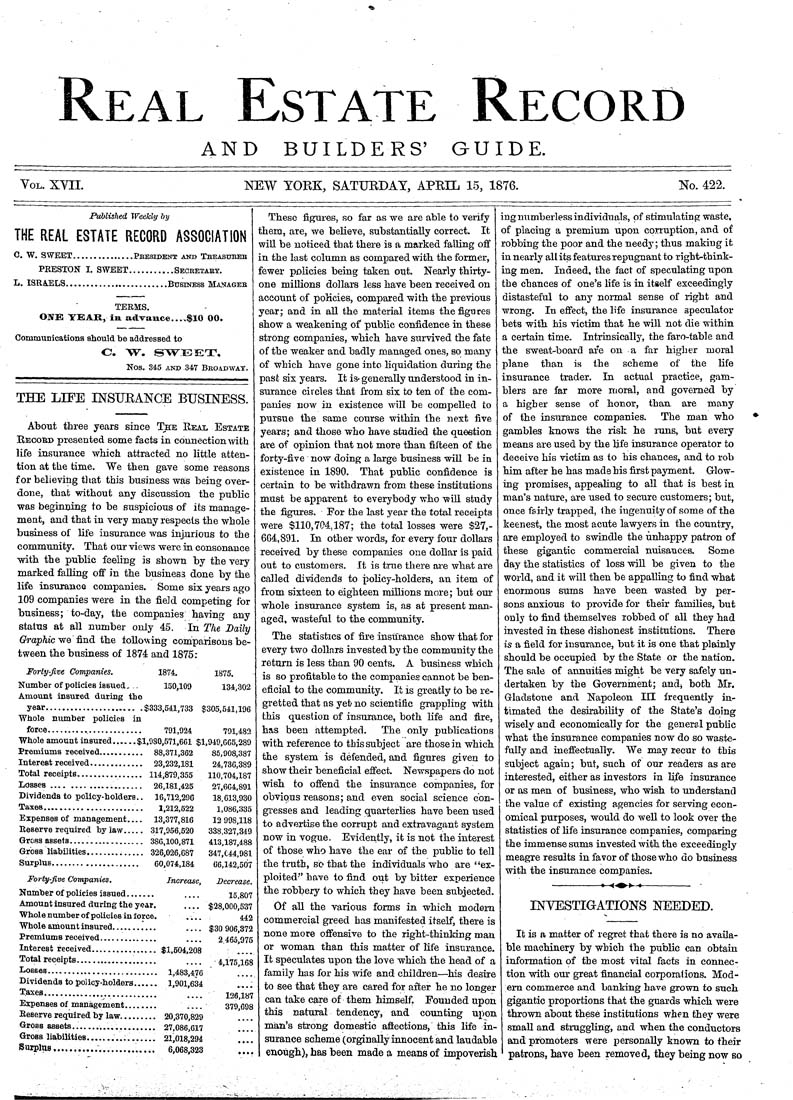

Real Estate Record AND BUILDERS' GUIDE. Vol. XVII. NEW YOEK, SATUEDAY, APEIL 15, 1876. No. 422. Published Weekly by THE REAL ESTATE RECORD ASSOCIATION 0. W. SWEET...............Pbesident and Tbeasubeb PEESTON L SWEET...........Secbetaet. L. ISRAELS.........................Business Ma.nageb TEEMS. ONE YEAR, in. advance....$10 00. Communications should be addressed to C. SV. ^SVm'E.lO. Nos. 345 and 347 Bboadwat. THE LIFE INSUEANCE BUSINESS. About three years since The Reai Estate Recobd presented some facts in connection Avith life insurance whicb attracted no little atten¬ tion at the time. We then gave some reasons for believing tliat this business was being over¬ done, that without any discussion the public was beginning to be suspicious of its manage¬ ment, and that in very many respects the whole business of life insurance was injurious to the community. That our views were in consonance with the public feeling is shown by the very marked falling off in the business done by the life insurance companies. Some six years ago 109 companies were in the field competing for business; to-day, tbe companies having any status at all number only 45. Tn The DaUy (??'apfi,ic we find the lollowing coniparisous be¬ tween the business of 1874 and 1875: Forty-five Companies. 1874. 1875. Number of poUcies issued, .. 150,109 134,302 Amount insured during the year...................... .$333,541,733 $305,541,196 Whole number policies in force........................ 791,924 791,482 Whole amount insured......$1,930,571,601 $1,949,065,289 Premiums received........... 88,371,362 85,908,387 Interest received............. 23,232,181 24,736,389 Total receipts................ 114,879.355 110,704,187 Losses..................... 26,181,425 27,604,891 Bividends to policy-holders.. 16,712,290 18,613,930 Taxes........................ 1.212,522 1,086,335 Expenses of management___ 13,377,816 12 998,118 Beserve required by law..... 317,956,520 338.327,319 Gross assela.................. 380,100,871 413,187,488 Gross liabilities........,..... 326,026,687 347,044,981 Surplus..................... 60,074,184 60,142,507 Forty-five Companies, Increase, Decrease. Number of policies issued....... ___ 15,807 Amount insured during the year, ___ $28,000,537 Whole number ofpoliciea in force. .... 442 Whole amount insured........... ___ $30 906,372 Premiums received.............. ___ 2 465 975 Interest received................ $1,604,208 Total receipts.................... ___ 4,175168 I-osses........................... 1,483,476 ' .... Dividends to policy-holders...... 1,901,634 Taxes............................ _ __ 126,187 Expenses of management........ .... 379 698 Beserve required by law......... 20,370,829 Gross asseta..................... 27,086,617 Grosa liabilities................. 21,018,294 Surplus.....................,.,. 6,068,323 .... These figures, so far as we are able to verify them, are, we believe, substantially correct. It will be noticed that there is a marked falling off in the last column as compared with the former, fewer policies being taken out. Nearly thirty- one millions dollars less have been received on account of poHcies, compared with the previous year; and in all the material items the figures show a weakening of public confidence in these strong companies, which have survived the fate of the weaker and badly managed one,?, so many of which have gone into liquidation during the past six years. It is- generally understood in in¬ surance circles that from six to ten of the com¬ panies now in existence will be compelled to pursue tbe same course within the next five years; and those who have studied the question are of opinion that not more than fifteen of the forty-five now doing a large business wiU be in existence in 1890. That public confidence is certain to be withdrawn from these institutions must be apparent to everybody who will study the figures. For the last year the total receipts were $110,704,187; the total losses were $27,- 664,891. In other words, for every four dollars received by these companies one dollar is paid out to customers. It is true there are what are called dividends to poKcy-holders, an item of from sixteen to eighteen millions more; but our whole insui-ance system is, as at present man¬ aged, wasteful to the community. The statistics of fire insurance show that for every two dollars invested by the community the return is less than 90 cents. A business which is 80 profitable to the companies cannot be ben¬ eficial to the community. It is greatly to be re¬ gretted that as yet no scientific grappling with this question of insurance, both hfe and fixe, has been attempted. The only publications with reference to this subject are those in which the system is defended, and figures given to show their beneficial effect. Newspapers do not wish to offend the insurance companiBS, for obvipus reasons; and even social science con¬ gresses and leading quarterhes have been used to advertise the corrupt and extravagant system now in vogue. Evidently, it is not the interest of those who have the ear of the pubhc to tell the truth, so that the individuals who are "ex¬ ploited'' have to find out by bitter experience the robbery to which they have been subjected. Of all the various forms in which modem commercial greed has manifested itself, there is none more offensive to the right-thinking man or woman than this matter of life insurance. It s]peculates upon the love which the head of a family has for his wife and children—^his desire to see that they are cared for after he no longer can take care of them himself, Founded upon this natural tendency, and counting upon man's strong domestic affections, this life in¬ surance scheme (orginally innocent and laudable enough), has been made a means of impoverish ing numberless individuals, pf stimulating waste, of placing a premium upon corruption, and of robbing the poor and the needy; thus making it in nearly all its features repugnant to right-think¬ ing men. Indeed, the fact of speculating upon the chances of one's life is in itself exceedingly distasteful to any normal sense of right and wrong. In effect, the life insurance speculator bets with his victim that he will not die within a certain time. Intrinsically, the faro-table and the sweat-board are on a far higher moral plane than is the scheme of the hfe insurance trader. In actual practice, gam¬ blers are far more moral, and governed by a higher sense of honor, than are many of the insurance companies. The man who gambles knows the risk he nms, but every means are used by the hfe insurance operator to deceive his victim as to his chances, and to rob him after he has made his first payment. Glow¬ ing promises, appeahng to all that is best in man's nature, are used to secure customers; but, once fsirly trapped, Ihe ingenuity of some of the keenest, the most acute lawyers in the country, are employed to swindle the unhapp.v patron of these gigantic commercial nuisances. Some day the statistics of Ipss wiU be given to the world, and it will then be appalling to find what enormous sums have been wasted by per¬ sons anxious to provide for their families, but only to find themselves robbed of all they had invested in these dishonest institutions. There is a field for insurance, but it is one that plainly should be occupied by the State or the nation. The sale of annuities might be very safely un¬ dertaken by the Governinent; and; both Mr. Gladstone and Napoleon IH frequently in¬ timated the desirability of the State's doing wisely and economically for the general public what the insurance companies now do so waste- fully and ineffectually. We may recur to this subject again; but, such of our readers as are interested, either as investors in hfe insurance or as men of business, who wish to understand the value of existing agencies for serving econ¬ omical purposes, would do well to look over the statistics of hfe insurance companies, comparing the immense sums invested with the exceedingly meagre results in favor of those who do business with the insurance companies. -----------> <^>> -*----------- INVESTIGATIONS NEEDED. It is a matter of regret that there is no availa¬ ble machinery by which the pubhc can obtain information of the most vital facts in connec¬ tion with our great financial corporations. Mod¬ em commerce and banking have grown to such gigantic proportions that the guards which were thrown about these institutions when they were smaU and struggling, and when the conductors and promoters were jpersonally knovm to their patrons, have been removed, they being now so