Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 21, [no. 528]: April 27, 1878

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

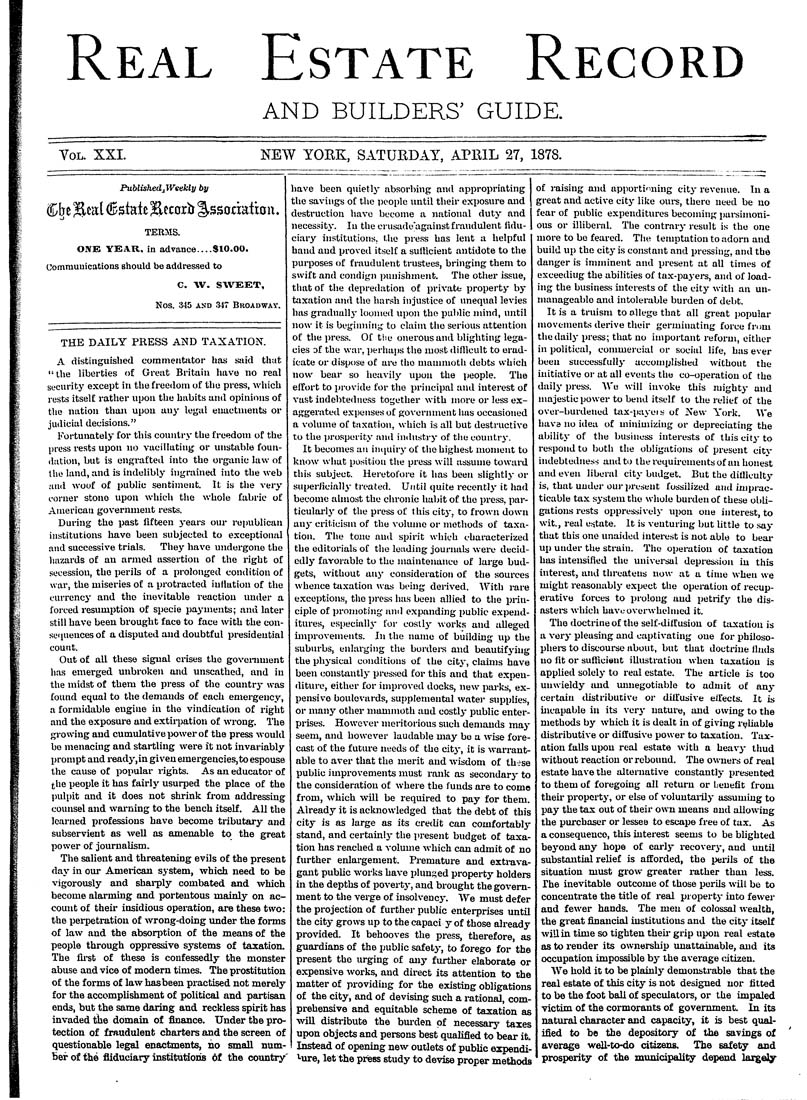

Real Estate Record AND BUILDERS' GUIDE. Vol. XXI. NEW YOEK, SATUEDAY, APEIL 27, 1878. Published^Weekly by Cfjc %vd Estate Efcorb ^ssonatxoii. TERMS. O.^E YEAR, in advance.,,,SIO.OO. Communications should be addressed to C. W. SWEET, Nos. 345 AND 347 Broadway. THE DAILY PRESS AND TAXATION. A distinguished commentator has said that "the liberties of Great Britain have uo real security except iu the freedom of the press, which rests itself rather upou the habits and opinions of the nation than upou au}- legal enactments or judicial decisions." Fortunately for this country the freedom of the press rests upou uo vacillating or unstable fouu- diition, but is engrafted iuto tho organic law of the laud, and is indelibly ingrained iuto the web nud woof of public sentiment It is the very corner stone upou w-hich the w-hole fabric of American government rests. During the past fifteen years our republican institutions have beeu subjected to exceptional .ind successive trials. They have undergone tbe lui-/.ards of au armed assertion of the right of .secession, the perils of a prolonged couditiou of war, the miseries of a protracted iullatiou of the currency and tho inevitable reaction uuder a forced resumption of specie pa3'ments; and later still have been brought face to face with the con¬ sequences of a disputed aud doubtful presidential count Out of all these signal ci-ises the goveiimient has emerged unbroken aud unscathed, and iu the midst of them the press of the countr}' was found equal to the demands of each emergency, a formidable engine iu tho vindication of right and the exposure aud extii-pation of wrong. The growing and cumulative power of the press would bo menacing aud startling w-ere it not invariably prompt and i-eady,in given emergencies, to espouse the cause of popular rights. As an educator of the people it has fairly usurped the place of the indpit and it does not shrink from addressing counsel aud wai^ning to the bench itself. All the learned professions have become tributary and subservient as well as amenable to the great power of journalism. The salient aud threatening evils of the present day in our American system, -which need to be vigorously and shai-ply combated and -which become alarming and portentous mainly on ac¬ count of their insidious operation, are these two: the perpetration of wrong-doing under the forms of law and the absorption of the means of the people through oppressive systems of taxation. The fii-st of these is confessedly the monster abuse and vice of modern times. The prostitution of the forms of law has been pi-actised not merely for the accomplishmant of political and partisan ends, but the same daring and reckless spirit has invaded tlie domain of finance. Under the pro¬ tection of fraudulent charters and the screen of questionable legal enactments, no small num¬ ber of the fiiduciary institutions of the country' have been quietly absorbing aud appropriating the savings of the jieople until their exposure aud destruction have become a national duty aud necessity. Iu the crusadc"againstfraudulent fidu¬ ciary institutions, the press has lent a helpful hand aud proved itself a sullicieut antidote to the purposes of fraudulent trustees, bringing them to swift and condign punishment The other issue, that of the depredation of private propertj' by tiixatiou and the harsh injustice of unequal levies has graduallj- loomed upon the public mind, until now it is beginning to claim the serious attention of the pres.s. OC the onerous and blighting lega¬ cies of the war, perliaps the most diflicult to erad¬ icate or dispose of are tho maiumoth debts which now bear so heavily upou the p^op^e. The effort to provide for the principal and interest of vast indebtedness together with more or less ex¬ aggerated expenses of goverumeut 1ms occasioned a volume of taxation, which is all but destructive to the prosperity and industry of the countrj-. It becomes an iuquirj- of the highest uiomeut to know what position tbe press will assume toward this subject Heretofore it has been slightlj- or superlicial I J- treated. Until quite recently it had become almost the chronic habit of tho press, par- ticulai-ly of the press of this citj-, to frown down anj- criticism of the volume or methods of taxa¬ tion. The tone aud spirit which characterized the editorials of the loading journals were decid¬ edly favorable to the uiaiuteuaiice of large bud¬ gets, without auj' consideration of the sources whence taxation was being derived. With rare exceptions, tho jiress has beeu allied to the prin¬ ciple of prouiotiug and expanding public expend¬ itures, especiallj- for cosllj' works aud alleged uuprovements. In the name of building up the suburbs, enlarging the bordei-s aud beautifying the physical conditions of the citj-, claims have beeu constantly pressed for this and that expen¬ diture, either for improved docks, new pm-ks, ex¬ pensive boulevards, supplemental water supplies, or many other mammoth aud costly public enter¬ prises. However meritorious such demauds may seem, and however laudable may bo a w-ise fore¬ cast of the future needs of the citj-, it is warrant¬ able to aver that the merit aud wisdom of these public improvements must rank as secondary to the consideration of where the funds are to come from, which will be required to pay for them. Already it is acknowledged that the debt of this city is as large as its credit can comfortably stand, and certainly the present budget of taxa¬ tion has reached a volume w-hich can admit of no further enlargement. Premature aud extrava¬ gant public -works have plunged property holders in the depths of poverty, and brought the govern¬ ment to the verge of insolvency. We must defer the projection of further public enterprises until the city gro%vs up to the capaci y of those already provided. It behooves the press, therefore, as guardians of the public safety, to forego for the present tho urging of auy further elaborate or expensive works, aud direct its attention to the matter of providing for the existing obligations of the city, and of devising such a rational, com¬ prehensive and equitable scheme of taxation as will distribute the bm-den pf necessarj' taxes upon objects and persons best qualified to bear it. Instead of opening new outlets of public expendi- i-ure, let the press study to de-vdse proper methods of raising aud apportif-uing city revenue. In a great and active citj- like oui-s, thero need be uo fear of public expenditures becoming pai-simoui- ous or illiberal. The contrary result is the one more to bo feared. The temptation to adorn aud build up the city is constant aud pressing, and the danger is imminent and present at all times of exceediug the abilities of tax-payei-s, and of load¬ ing the busiuess interests of the city w-ith an un¬ manageable and intolerable burden of debt. It is a truism to allege that all great popular movements derive their germinating force from the dailj- press; that uo important reform, either in political, commercial or social life, has ever beeu successfullj- accomplished w-ithout the initiative or at all events the co-operatioii of the daily press. We will invoke this luightj- and majestic power to bend itself to the relief of the over-burdened tiix-pajcis of New York. We have uo idea of minimizing or depreciating the abilitj- of the business interests of this citj- to respond to both the obligations of present city indebtedness and to the requirements of au honest and even liberal city budget. But tbe difficulty is, that uuder our present fossilized and imprac¬ ticable tax system the whole burden of these obli¬ gations rests oppressively uixm oue interest, to w-it., real estate. It is venturing but little to say that this oue unaided interest is not able to beai- up uuder the strain. The operatiou of taxation has iuteusified the universal depression iu this interest, and threatens now at a time wheu we might reasonably expect the operation of recup¬ erative forces to prolong aud petrify the dis- astei-s which have overwhelmed it The doctrine of the self-diffusion of taxation is a verj- pleasing and captivating oue for philoso- pliei-s to discourse about, but that doctrine finds uo fit or sufficient illustration wheu taxation is applied solelj' to real estate. The article is too unwieldy and uuuegotiable to admit of anj- certain tlistributive ov dilTusive eil'ects. It is incapable iu its vcrj- nature, aud owing to the methods by which it is dealt in of giving reliable distributive or diffusive power to taxation. Tax¬ ation falls upou real estate w-ith a heavj- thud without reaction or rebound. The owuei-s of real estate have the alternative coustantly presented to them of foregoing all return or beuefit from their property, or else of voluutai-ily assumiug to pay the tax out of their own means aud allowing the purchaser or lessee to escape free of tux. As a consequence, this interest seems to be blighted beyond any hope of eai-ly recoverj-, aud until substantial relief is afforded, the perils of the situation must grow greater i-ather than less. The inevitable outcome of those perils will be to concentrate the title of real propertj- into fewer and fewer hands. The meu of colossal wealth, the great financial institutions and the city itself will in time so tighten theu- grip upou real estate as to render its ownership tmattainable, aud its occupation impossible by the average citizen. We hold it to be plainly demonstrable that the real estate of this city is not designed nor fitted to be the foot ball of spectdators, or the impaled victim of the cormorants of government In its natural character and capacity, it is best qual¬ ified to be the depository of the savings of average well-to-do citizens. Tbe safety and prosperity of the mimicipality depend largely