Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 30, no. 772: Articles]: December 30, 1882

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

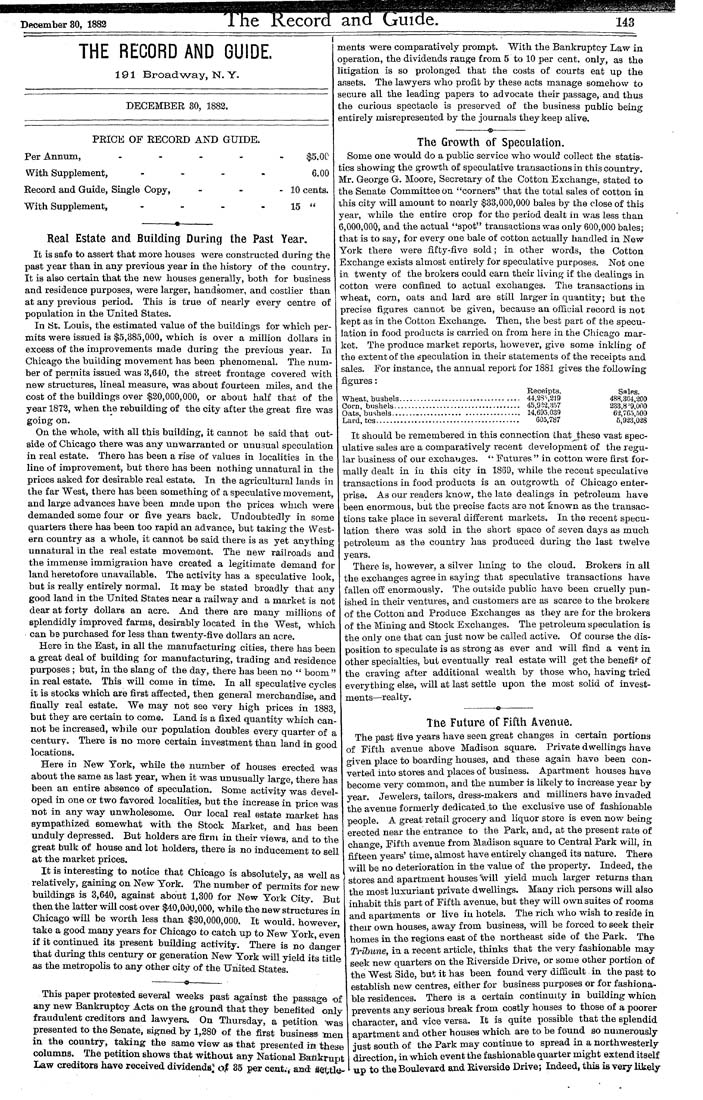

December 30, 1883 143 THE RECORD AND GUIDE. 191 Broadway, N. Y. DECEMBER 30, 1883. PRICE OF RECORD AND GUIDE. Per Annum, . - - - With Supplement, - . _ , Record and Guide, Single Copy, With Supplement, - _ _ . $5,0C 6,00 10 cents, 15 " ments were comparatively prompt. With the Bankruptcy Law in operation, the dividends range from 5 to 10 per cent, only, as the litigation is so prolonged that the costs of courts eat up the assets. The lavryers who proflt by these acts manage somehow to secure all the leading papers to advocate their passage, and thus the curious spectacle is preserved of the business public being entirely misrepresented by the journals they keep alive. Real Estate and Building During the Past Year. It is safe to assert that more houses were constructed during the past year than in any previous year in the history of the country. It is also certain thafc the new houses generally, both for business and residence purposes, were larger, handsomer, and costlier than at any previous period. This is true of nearly every centre of population in the United States. In St. Louis, the estimated value of the buildings for which per¬ mits were issued is $5,885,000, which is over a million dollars in excess of the improvements made during the previous year. In Chicago the building movement has been phenomenal. The num¬ ber of permits issued was 3,640, the street frontage covered with new structures, lineal measure, was about fourteen miles, and the cost of the buildings over $20,000,000, or about half that of the year 1873, when the rebuilding of the city after the great fire was going on. On the whole, with all this building, it cannot be said that out- aide of Chicago there was any unwarranted or unusual speculation in real estate. There has been a rise of values in localities in the line of improvement, but there has been nothing unnatural in the prices asked for desirable real estate. In the agricultural lands in the far West, there has been something of a speculative movement, and large advances have been made upon the prices which were demanded some four or five years back. Undoubtedly in some quarters there has been too rapid an advance, but taking the West¬ ern country as a whole, it cannot be said there is as yet anything unnatural in the real estate movement. The nevv railroads and the immense immigration have created a legitimate demand for land heretofore unavailable. The activity has a speculative look, but is really entirely normal. It may be stated broadly that any good land in the United States near a railway and a market is not dear at forty dollars an acre. And there are many millions of splendidly improved farms, desirably located in the West, which can bs purchased for less than twenty-flve dollars an acre. Here in the East, in all the manufacturing cities, there has been a great deal of building for manufacturing, trading and residence purposes ; but, in the slang of the day, there has been no " boom" in real estate. This will come in time. In all speculative cycles it is stocks which are flrst affected, then general merchandise, and finally real estate. We may not see very high prices in 1883 but they are certain to come. Land is a fixed quantity which can¬ not be increased, while our population doubles every quarter of a century. There is no more certain inveatment than land in good locations. Here in New York, while the number of houses erected was about the same as last year, when it was unusually large, there has been an entire absence of speculation. Some activity was devel¬ oped in one or two favored localities, but the increase in price was not in any way unwholesome. Our local real estate market has sympathized somewhat with the Stock Market, and has been unduly depressed. But holders are firm in their views, and to the great bulk of house and lot holders, there is no inducement to sell afc the market prices. The Growth of Speculation. Some one would do a public service who would collect the statis¬ tics showing the growth of speculative transactions in this country. Mr. George G. Moore, Secretary of the Cotton Exchange, stated to the Senate Committee on "corners" that the total sales of cotton in this city will amount to nearly $33,000,000 bales by the close of this year, while the entire crop for the period dealt in was less than 6,000,000, and the actual "spot" transactions was only 600,000 bales; that is to say, for every one bale of cotton actually handled in New York there were fifty-five sold; in other words, the Cotton Exchange exists almost entirely for speculative purposes. Not one in twenty of the brokers could earn their living if the dealings in cotton were confined to actual exchanges. The transactions in wheat, corn, oats and lard are still larger in quantity; but the precise flgures cannot be given, because an official record is not kept as in the Cotton Exchange. Then, the best part of the specu¬ lation in food products is carried on from here in the Chicago mar¬ ket. The produce markefc reports, however, give some inkling of the extent of the speculation in their statements of the receipts and sales. For instance, the annual report for 1881 gives the following flffures: Receipts. Wheat, bushels.................................. 44,2.S\219 Corn, bushels.................................... 45,9?/2,857 Oats, bushels.................................... 14,69.5,039 Lard, tcs......................................... 005,787 Sales. 488,304,200 2.33,8'9,000 62,765,500 6,923,028 It should be remembered in this connection that^theso vast spec¬ ulative sales are a comparatively recent development of the regu¬ lar business of our exchanges. " Futures " in cotton were first for¬ mally dealt in in this city in 1869, while the recent speculative transactions in food products is an outgrowth of Chicago enter¬ prise. As our readers know, the late dealings in petroleum have been enormous, but the precise facts are not known as the transac¬ tions take place in several different markets. In the recent specu¬ lation there was sold in the short space of seven days as much petroleum as the country has produced during the last twelve years. There is, however, a silver lining to the cloud. Brokers in all the exchanges agree in saying that speculative transactions have fallen off enormously. The outside pablic have been cruelly pun¬ ished in their ventures, and customers are as scarce to the brokers of the Cotton and Produce Exchanges as they are for the brokers of the Mining and Stock Exchanges. The petroleum speculation is the only one that can just now be called active. Of course the dis¬ position to speculate is as strong as ever and will find a vent in other specialties, but eventually real estate will get the benefit of the craving after additional wealth by those who, having tried everything else, will at last settle upon the most solid of invest¬ ments—realty. The Future of Fifth Avenue. The past five years have seen great changes in certain portions of Fifth avenue above Madison square. Private dwellings have o-iven place to boarding houses, and these again have been con¬ verted into stores and places of business. Apartment houses have become very common, and the number is likely to increase year by year. Jewelers, tailors, dress-m.akers and milliners have invaded the avenue formerly dedicated ,to the exclusive use of fashionable people. A great retail grocery and liquor store is even now being erected near the entrance to the Park, and, at the present rate of change, Fifth avenue from Madison square to Central Park will, in fifteen years' time, almost have entirely changed its nature. There Indeed, the It is interesting to notice thafc Chicago is absolutelv as well as I ""'^^ ^" ^^ deterioration in fche value of fche property. . ...... — — - ^ '*"''"™"'®^y'^s ^®" as ' gj.^^^.gg ^^^j apaj-fcmenfc houses will yield much larger returns than relatively, gaining on New York, The number of permits for new buUdings is 3,640, against about 1,300 for New York City. But then the latter will cost over $40,000,000, while the new structures in Chicago will be worth less than $30,000,000. It would, however, take a good many years for Chicago to catch up to New York, even if ifc continued its presenfc bufiding activity. There is no danger that during this century or generation New York will yield its title as the metropolis to any other city of the United Sfcates. This paper protested several weeks past against the passage of any new Bankrupfccy Acfcs on the grouncl thafc fchey benefifced only fraudulent creditors and lawyers. On Thursday, a petition was presented to the Senate, signed by 1,380 of the first business men in the country, taking the same view as that presented iii these columns. The petition shows thafc without any National Baflkru]:»t Law creditors have received dividends] of 35 per cent., aad- fiettitt- the most luxuriant private dwellings. Many rich persons will also inhabit this part of Fifth avenue, but they will own suites of rooms and apartments or live in hotels. The rich who wish to reside in their own houses, away from business, wiU be forced to seek their homes in the regions east of the northeast side of the Park. The Tribune, in a recent article, thinks that the very fashionable may seek new quarters on the Riverside Drive, or some other portion of the West Side, bufc it has been found very difficult-in the past to establish new centres, either for business purposes or for fashiona¬ ble residences. There is a certain continuity in building whicn prevents any serious break from costly houses to those of a poorer character, and vice versa. Ifc is quite possible that the splendid apartment and other houses which are to be found so numerously just south of the Park may continue to spread in a northwesterly direction, in which event the fashionable quarter might extend itself up to the Boulevard and Riverside Drive; Indeed, this is very likely