Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 34, no. 867: October 25, 1884

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

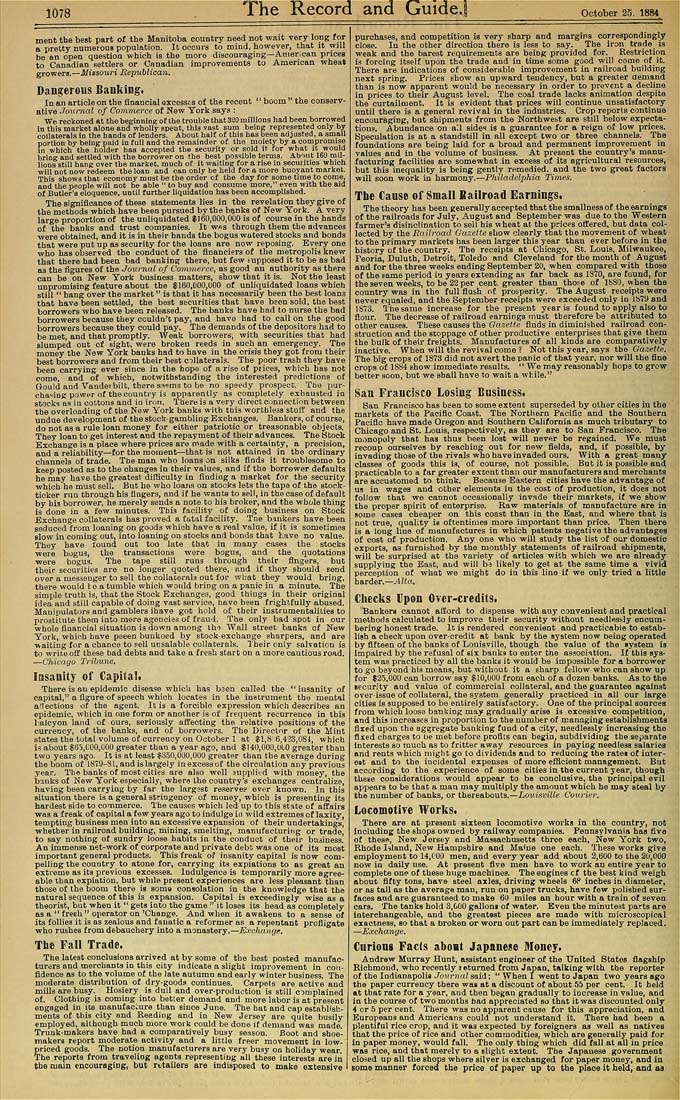

1078 The Record and Guide.! October 25, 1884 ment the best part of tbe Manitoba country need not wait very long for a pretty numerous population. It occurs to mind, however, that it will be an open question wbich is the more discouraging—American prices to Canadian settlers or Canadian improvements to American wheat growers.—Missouri Republican. Dangerous Banking. In an article on the financial excesses of the recent " boom " the conserv¬ ative Journal of Commerce of New York says : We reckoned at the beginning of the trouble that 330 millions had been borrowed in this market alone and wholly spent, this vast sum bein? represented only by collaterals in the hands of lenders. About half of this hasbeen adjusted, a small portion by being paid in full and the remainder of the moiety by a compromise in which the bolder has accepted the security or sold it for what it would bring and settled with the borrower on the best possible terms, Abtut 160 md- lions still hanK over the market, much oC it waiting for a rise in securities which wilt not now redeem the loan and can only be held for a more buoyant market. This shows that economy must be the order of the day for aome time to come, and the people will not be able " tn buy and consume more," even with the aid of Butler's eloquence, until further liquidation haa been accomplished. The significance of these statements lies in tbe revelation they give of the methods which have been pursued by the banks of New Tork, A very large proportion of the unliquidated $160,000,0tl0 is of course in the hands of the banks and trust companies. It wna through them tbe advances were obtained, and it is in their hands the bogus watered stocks and bonds tbat were put up as security for the loans are now reposing. Every one ■who has observed the conduct of tbe financiers of the metropolis knew that there had been bad banking tbere, but few supposed it to be as bad as tbe figures of the Jowi-nal of Commerce, as good au authority as there can ba on New York business matters, show that it is. Hot the least unpromising feature about the 1160,000,000 of unliquidated loans which stiil " hang over the market" is that it has necessarily been the best loans that have been settled, tbe beat securities that have been sold, tbe best borrowers who have been released. The banks have had to nurse the bad borrowers because they couldn't pay, and have had to call on the good borrowers because they could pay. The demands of tbe depositors had to be met, and that promptly. Weak borrowers, with securities tbat had Blumped out cf sight, were broken reeds in such an emergency. Tbe money the New York bauks had to have in the crisis they got from their best borrowers and from their best collaterals. The poor trash they have been carrying ever since in the hope of a rise of piices, which bas not come, and of which, notwithstanding the interested predictions of Gould and Vanderbilt, there S'S'ims to be no speedy prospect. Tbe pur¬ chasing power of the country is apparently as completely exhausted in stocks aa in cottons and iu iron. '1 here is a very direct couuection between tbe overloading of the New York banka witb this worthless stuff aud the undue development of the stock-gambling Exchanges. Bankers, of course, do not as a rule loan money for either patriotic or treasonable objects. They loan to get interest and tbe repayment of their advances. The Stock Exchange is a place where prices are made with a certainty, a precision, and a reliability—for the moment—that ia not attained in the ordinary channels of trade. The man who loans on silks flnds it troublesome to keep posted aa to the changes in their valuea, and if the borrower defaults he may have the greotest difflculty in finding a market for the security which he must sell. But he who loans on stocks lets the taps of the stock- ticker run through his flngers, and if he wants to seli, in the case of default by his borrower, he merely sends a note to his broker, and the whole tbing is done in a few minutes. Tbis facility of doing business on Stock Exchange collaterals has proved a fatal facility, Tne bankers have been seduced from loaning on goods which have a real value, if it is sometimes slow in coming out, into loaning ou stocks and bonds that have no value, Tbey have found out too late that in many cases the stocks were bogus, the transactions were bogus, and the quotations were bogus. The tape still runs through their flngers, but their securities are no longer quoted there, and if thoy should send over a messenger to sell the collaterals out for what they would bring, there would te atumble which would bring on apanic in a minute. The simple truth is, tbat the Stock Exchanges, good things in their original idea and still capable of doing vast service, have been frightfully abused. Manipulators and gamblers ibave got hold of their instrumentalities to prostitute them into mere agencies of fraud. The only bad spot in our whole financial situation is down among lhe Wall street banks of New Tork, which have peeen bunkoed hy stock-exchange sharpers, and are waiting for a chance to sell unsalable collaterals. Their only salvation is to write off these bad debts and take a fresh start on a more cautious road, —Chicago Tribune, Insanity of Capital. There is QU epidemic disease which has bsen called the "insanity of capital," a figure of speech which locates in the instrnuieut the mental ailections of the agent. It is a forcible expression which describes an epidemic, which in one form or another is of frequent recurrence in thia halcyon land of ours, seriously affecting the relative positions of the currency, of the banks, and of borrowers. The Director of the Mint states tbe total volume of currency on October 1 at 11,8'6,4'?3,0SI, wbich is about JOJ.COO.UOO greater tban a year ago, and $l4y,000,t)C0 greater than two years ago. It is at least $350,000,000 greater than tbe average during the boom of 1879-81. and is largely iu excess of tbe circulation any previous year, Tbe banks of most cities are alao well supplied with money, tbe banks of New York especially, where the country's exchanges centralize, having been carrying by far the largest reserve? evur known. In tbis situation there is a general stringency of money, wbich is presenting its hardest side to commerce. The causes which led up to this state of affairs was a freak of capital a few yeara ago to indulge io wild extremes of laxity, tempting business men into an excessive expansion of their undertakings, whether in railroad buildiug, mining, smelting, manufacturing or trade, to say nothing of sundry loose babita in the conduct of their business. An immense net-work of corporate and private debt was one of its moat important general products. This freak of insanity capital is now com¬ pelling tbe country to atone for, carrying its expiations to as great an extreme as its previous excesses. Indulgence is temporarily more agree¬ able than expiation, but while present experiences are less pleasant than those of the boom there is soma consolation iu the knowledge that the natural sequence of this is expansion. Capital is exceedingly wise as a theorist, but when it " gets into tho game " it loses its head aa completely as a "fresh" operator on'Change, And wben it awakens to a sense of its follies it is as zealous and fauatic a reformer aa a repentant profligate who rushes from debauchery into a monastery.—E,vchange, The Fall Trade. The latest conclusions arrived at by aome of the best posted manufac¬ turers and merchants in this city indicate a slight improvement in con¬ fidence as to the volume of the late autumn and early winter business. The moderate distribution of dry-goods continues. Carpets are active and mills are busy. Hosiery^ is dull and over-production is still complained of. Clothing is coming into betler demand nud more labor is at present engaged in its manufacture than since June. The hat and cap establish¬ ments of this city and Reading and iu New Jersey are quite busily employed, although much more work could be done if demand was made Trunk-makers have had a comparatively busy season. Boot and shoe¬ makers report moderate activity and a little freer movement in low- priced goods. The notion manufacturers are very busy on holiday wear. The reports from traveling agents representing all tbese interests are in the main encouraging, but rttailers are indisposed to moke extensive purchases, and competition ia very sharp and margins correspondingly close. In the other direction there is less to say. The iron trade_ is weak and the barest requirements are being provided for. Restriction is forcing itself upon tbe trade and iu time some good will come of it. There are indications of considerable improvement in railroad building next spring. Piiees show an upward tendency, but a greater demand than is now apparent would be necessary in order to prevent a decline in prices to their August level. The coal trade lacks animation despite the curtailment. It is evident tbat prices will continue unsatisfactory until there is a general revival in the industries. Crop reporia continue encouraging, but shipments from the Nortbwebt are still below expecta¬ tions, Abundance ou ail sides is a guarantee for a reign of low prices. Speculation is at a standstill in all except two or three channels. The foundations are being laid for a broad and permanent improvement in values and in the volume of business. At present the country's manu¬ facturing facilities are somewhat in excess of its agricultural resources, but thia inequality is being gently remedied, and tbe two great factors will soon work in harmony.—Philadelphia Times, The Cause of Small Eailroad Earnings. The theory has been generally accepted that tbe smallness of the earnings of tbe railroads for July, Auguat and September was due to the Western farmer's disinclination to sell his wheat at the prices offered, but data col¬ lected by the Eailroad Gazette show clearly that the movement of wheat to the primary markets bas been larger this year than ever before iu the history of the country. The receipts at Chicago, St. Louis, Milwaukee, Peoria, Duluth, Detroit, Toledo and Cleveland for the month of August and for the three weeks ending September 20, when compared with those of the same period in years extending as far back as 1370, nre found, for the seven weeks, to be 22 per cent, greater thau those of lb80, when the country was in the full flush of prosperity. Tbe August receipts were never equaled, and the September receipts were exceeded only iu IbTO and 1873. Thesame increase for tbe present year is found to apply also to flour. The decrease of railroad earnings must therefore be attributed to other causes. These causes the GareHe flnds in diminished railroad con¬ struction and the stoppage of other productive enterprises tbat give them the bulk of their freights. Manufactures of all kinds are comparatively inactive. When will the revival come? Not tbis year, says the Gaseiti: The big crops of 1873 did not avert the panic of that year, nor will the flne cropa of 18S4show immediate results, " We may reasonably hope to grow better soon, but we shall have to wait a wbile." San Fraueisco Losing Business. San Francisco bas been to some extent superseded by other cities in the markets of the Paciflc Coast, Tbe Northern Pacific and the Southern Paciflc have made Oregon and Southern California as much tributary to Chicago and St. Louia, respectively, as they are to San Francisco, The monopoly that has thus been lost will never be regained. We must recoup ourselves by reaching out for new fields, and, if possible, by invading those of the rivals who have invaded ours. With a great many classes of goods this ia, of course, not possible. But it is posaible and practicable to a far greater extent than our manufacturers and merchants are accustomed to think. Because Eastern cities have the advantage of UB in wagea and other elements in the cost of production, it does not follow that we cannot occasionally invade their markets, if we ahow the proper spirit of enterprise. Raw materials of manufacture are in some cases cheaper on this coast than in the East, aud where that is not true, quality is oftentimes more important than price. Then there ia a long line of manufactures in which patents negative the advantages of coat of production. Any one who will study the list of our domestic exports, aa furnished by the monthly statements of railroad shipments, will be surprised at tbe variety of articles with wbich we are already supplying the East, and will b-i likely to get at the same time a vivid perception of what we might do in this line if we only tried a little harder,-.42(«. Checks Upon Over-credits. Bankers cannot afford to dispense with auy convenient and practical metbodscalculated to improve their security without needlessly encum¬ bering honest trade. Ic is rendered convenient aud practicable to estab¬ lish a check upon over-credit at bank by tbe system now being operated by flfteen of the banks of Louisville, though the value of the system is Impaired by the refusal of six banks to enter the association. If tbis sys¬ tem was practiced by all the banka it would be impossible for a borrower to go beyond his means, but without it a aharp fellow who can show up for $25,000 can borrow say $10,000 from each of a dozen banks. As to the lecurity and value of commercial collateral, and the guarantee against over-issue of collateral, the system generally practiced in all our large cities ia supposed to be entirely aatisfactory. One of the principal sources from which loose banking may gradually arise is excessive competition, and this increases in proportion to the number of managing establishments fixed upon the aggregate banking fuud of a city, needlessly increasing tho fired charges to be met before profits can begin, subdividiog the separate Interests so much as to fritter away resources in paying needless salaries and rents which might go to dividends aud to reducing the ratei of inter- eit and to tbe incidental expenses of more efficient management. But according to tbe experience of some cities in the current year, though these considerations would appear to be conclusive, the principal evil appears to be tbat a man may multiply the amount which he may steal by the numher of banka, or thereabouts,—Louisville Courier. Locomotive Works. There are at present sixteen locomotive works in the country, not including tbe shops owned by railway companies. Pennsylvania has five of theso, New Jersey and Massachusetts three each, New York two, Rhode Idand, New Hampshire and Maine one each. These works give employment to 14,C0I) men, and every year add about 2,(j00 to the 20,000 now iu daily use. At present five men have to work an entire year to complete one of these huge machines, Theengines cf the best kind weigh about fifty tons, have steel axles, driving wheels 6P inches in diameter, or as tall as the average man, run on paper trucks, have few polished sur¬ faces and are guaranteed to make 60 miles an hour with a train of seven cars. The tanks hold 3,000 gallons of water. Even the minutest parts are interchangeable, and the greatest pieces are mada with microscopical exactness, bo that a broken or worn out part can be immediately replaced. —Exchange. Cnrions Facts aboat Japanese Money. Andrew Murray Hunt, assistant engineer of tbe United Statea flagship Richmond, who recently returned from Japan, talking with the reporter of the Indianapolis Journal said: " When I went to Japan two years ago the paper currency tbere was at a discount of about 5b per cent. It held at that rate for a year, and then began gradually to increase ia value, and io tbe course of two months bad appreciated so tbat it was discounted only 4 or 5 per cent. There was no apparent cause for this appreciation, and Europeans and Americans could uot understand it. There had beeu a plentiful rice crop, aud it was expected by foreigners as well as natives that tbe price of rice and other commodities, which are generally paid for in paper money, would fall. The only thing which did fall at all in price was rice, and that merely to a slight extent. The Japanese government closed up all the shops where silver is exchanged for paper money, and in some manaer forced the price of paper up to the place it held, and aa