Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 34, no. 869: November 8, 1884

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

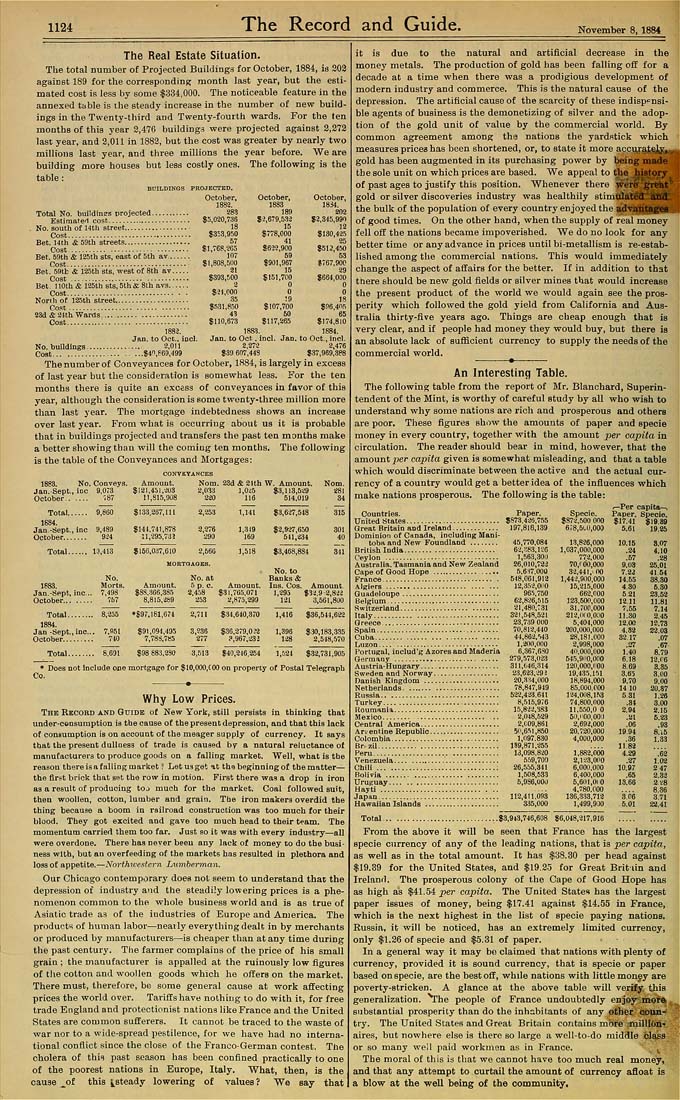

1124 The Record and Gui November 8, 1884 The Real Estate Situation. The total number of Projected BuiliJings for October, 1884, is 303 against 189 for the corresponding month last year, but the eeli- mated cost is less by some $334,000. The noticeable feature in the annexed table is the steady increase in the number of new build¬ ings in the Twenty-third and Twenty-fourth wards. For the ten months of this year 2,476 buildings were projected against 2,273 last year, and 3,011 in 1883, but the cost was greater by nearly two millions last year, and three millions the year before. We are building more houses but lees costly ones. The following is the table: BHILDINGS PROJECTED. October, 1882. Total No. buildinffs orojected........... 283 Estimaie-I cost........................ $5,020,736 No. south of 14tli street................... 18 Cost................................... $353,950 Bet. 14th Sc 59th streets................... 57 Cost ............................... $1,768,285 107 $1,808,5110 31 $393,500 2 $21,000 .55 $531,850 ■13 $110,673 October, 1883 189 $3,679,533 15 8778.000 41 $633,900 60 $901,967 15 $151.TCO 0 0 19 $107,700 GO $n7,S!65 October, ]8i4. aoa $2,345,991 la $130,435 25 $512,450 53 |i767.900 29 $664.0DD 0 0 18 $96 4m 65 $174,810 1884. Jan. to Oct. incl. Jan, to Oct., incl. 3,272 a,476 $39 607,443 $37,969,388 Bet, 59th Sc laSth sts, east oE Sth av Cost.............................. Bet. 59tt & 125th sts, west of 8th av Cost ............................ Bet. ! lOtb Sc 195tti sts, 5tli & 8th avs. Cost.............................. Norrli of 195th street................ Cost........................... 23d & a4th Wards................... Cost............................ 1883. las'). Jan. to Oct.. incl. No. buildings................ 2,011 Cost.......................$4",E69,499 Thenumberof Conveyances for October, 1884, is largely in excess of last year but the consideration is somewhat less. For the ten months there is quite an excess of conveyances in favor of this year, although the consideration is eome twenty-three million more than last year. The mortgage indebtedness shows an increase over last year. From what is occurring about us it is probable that in buildings projected and transfers the past ten months make a better showing than will the coming ten months. The following is the table of the Conveyances and Mortgages: CONVKTANCES 1883. No. Conveys. Amount. Nom. 23d & 21th W. Amount. Jan.-Sept., ice 9,073 $121,451,-.ata 2,033 1,0^5 $3,113,529 October...... ^87 11,815.908 320 116 514,019 Total...... 9,860 1884. Jan,-Sept., inc 9,489 October....... 934 Total...... ia,413 $133,267,111 $I4},74!,878 11,295,73 J 2,253 3,376 290 1,141 $3,627,548 1,319 169 $3,927,650 511,234 $l5G.0a7,C10 2,666 UORTOAOES. 1,518 $3,468,884 Nom. 281 34 315 301 40 341 1883. Jan.-Sf'pt, inc.. October........ Total....... 1884. Jan-Sept., inc., October........ No. Marts. 7,498 757 Amount. $88,366,3^5 8.815,2B9 No, At .5 p. c. 2.458 253 . No. to Banks Sc Amount. lus. Cos. Amount. 831,765,071 1,295 $3-J.9-2,832 12L 2,875,399 3,561,800 8,255 *$9r,l61,6r4 2,711 $.34,640,370 1,416 $36,511,622 7,051 740 $91,094,495 7,T88,7H5 3,938 277 $36,379,0->2 ^,967,23 i 1.396 128 $:M,183,335 2,548,570 Total........ 6.691 $98 88.3,230 3,513 $40,916,954 1,521 $32,731,905 ' Does not include one mortgage for $10,000,COO on property of Postal Telegraph Co. Why Low Prices. The Record ahd Guide of New York, still persists in thinking that under-con sump tion ia the cause of ths present depression, aad that this lack of conaumption is on account of the meager supply of currency. It aays tbat the present dultoess of trade is caused by a natural reluctance ol manufacturers to produce goods on a failing market. Well, what is tbe reason thereisa falling market ? Let us get at the beginning of the matter— the firs^t brick that set the row in motion. First there waa a drop in iron as a result of producing toj much for the market. Coal followed suit, then woollen, cotton, lumber and grain. Tfae iron makers overdid the thing because a boom in railroad construction was too much for their blood. They got excited aod gave too much head to their team. The momentum carried them too far. Just so it was with every industry—all were overdone. There has uever been any lack of money to do the busi¬ ness with, but au overfeeding nf the markets has resulted in plethora and loss of appetite.—Northtvestem iiondennoii. Our Chicago contemporary does not seem to understand that the depression of industry and the steadily lowering prices is a phe¬ nomenon common to the whole business world and is as true of Asiatic trade aa of the iudustries of Europe and America. The products of human labor—neatly everything dealt in by merchants or produced by manufacturers—^is cheaper than at any time during the past century. The farmer complains of the price of his small grain ; the manufacturer is appalled at the ruinously low figures of tlie cotton and woollen goods which he offers on the market. There must, therefore, be some general cause at work affecting prices the world over. Tariffs have nothing to do with it, for free trade England and protectionist nationa like France and the United States are common sufferers. It cannot be traced to the waste of war nor to a wide-spread pestilence, for we have had no interna¬ tional conflict since the close of the Franco-German contest. The cholera of this past season has been confined practically to one of the poorest nations in Europe, Italy. What, then, is the cause _of this ^^steady lowering of values ? "We say that ii it is due to the natural and artificial decrease in the money metals. The production of gold has been falling off for a decade at a time when there was a prodigious development of modern industry and commerce. This is the natural cause of the depression. The artificial cause of the scarcity of these indisp'^nsi- ble agents of business is the demonetizing of silver and the adop¬ tion of the gold unit of value by the commercial world. By common agreement among tha nations the yardstick which measures prices has been shortened, or, to state it more accu,rateiyH gold has been augmented in its purchasing power by being made the sole unit on which prices are based. We appeal to the history of past ages to justify this position. Whenever there were" great ' gold or silver discoveries industry was healthily stimulated Afi