Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 34, no. 870: November 15, 1884

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

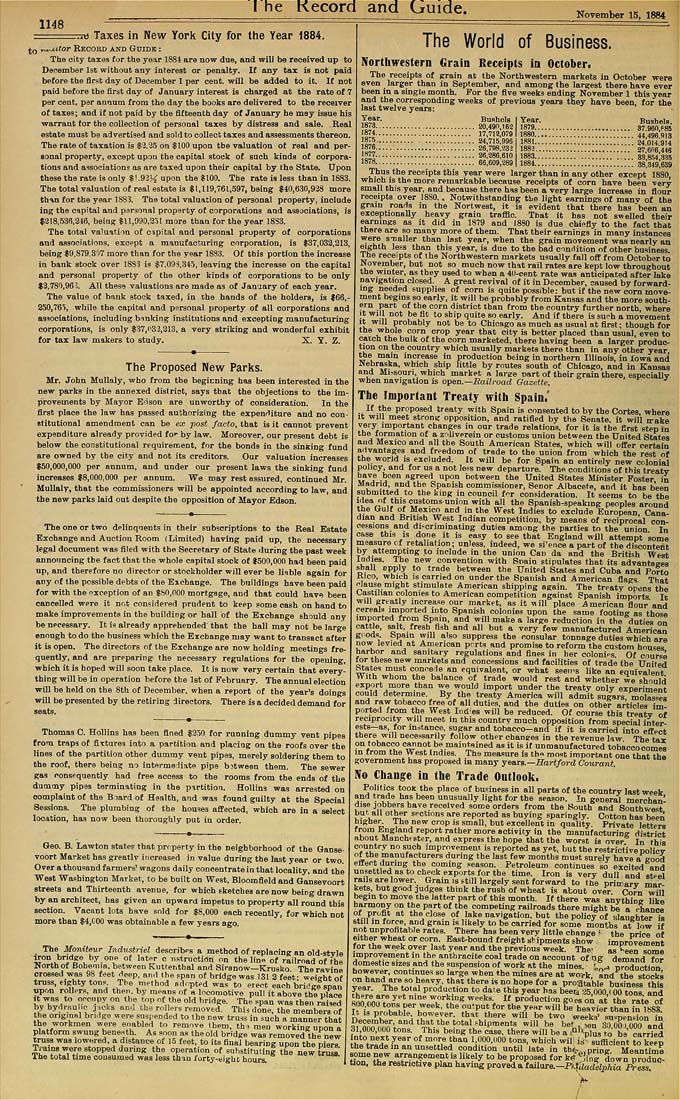

I he Kecord and Guide, 1148 November 15, 1884 imtf Taxes in New York City for the Year 1884. Jo „^-Mtor Record and Guide : The oity taxes for the year ISSi are now due, and will be received up to December Isl without any interest or penalty. If any tax is not paid before the flrst day of December 1 per cent, will be added to it. If not paid before the first day of January interest is charged at the rate of 7 per ceut. par annum from the day the books are delivered to the receiver of taxes; and if not paid by the flfteenth day of January he may issue his warrant for the collection of personal taxes by diatreas and sale. Real estate must be advertised aod sold to collect taxea aod aaaeaaments thereon. The rate of taxation ia $3.25 on $100 upon tbe valuation ot real aod per¬ sonal property, except upoo the capital stock of such kioda of corpora¬ tions aod associations aa are taxed upon their capital by the State. Upoo these the rate is only $'.93|^ upoo the $100. The rate ia less than in 1883. The total valuation of real estate is $1,119,761,597, being $40,630,938 more thin for tbe year ISSi. Tho total valuation of peraonal property, include ing the capital and parsoual property of corporations and associations, ia ?318,5311,246, being $11,990,351 more than for the year 1833. The total valuation of capital and personal property of corporations and associations, except a manufacturing corporation, is $37,032,213, being $9,879,317 more than for the year 1833. Of this portion the increase in bank stock over 1883 is $7.09^,3*5, leaving the increase oo the capital and personal property of the other kinds of corporations to be only $3,780,96'.. All these valuations are made as of January of each year. The value of bank stock taxed, in the hands of the holders, is $66,- 350,76i, while the capital and personal property of all corporatioos aod associatioDs, including b