Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

The Record and guide: v. 38, no. 964: September 4, 1886

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

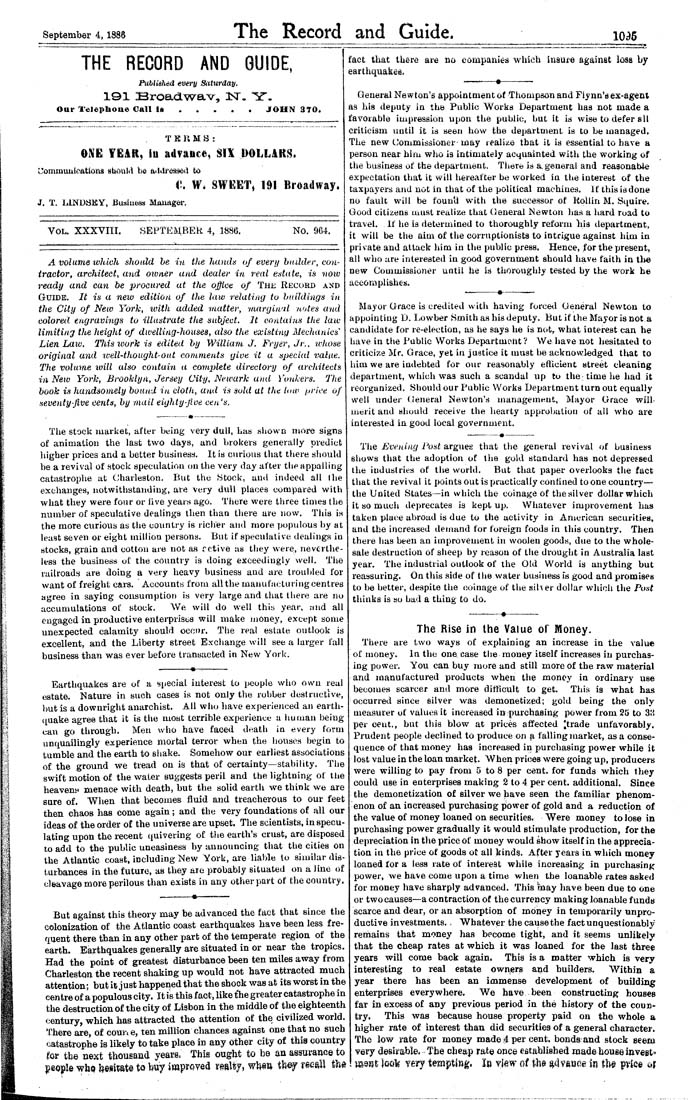

September 4, 1886 The Record and Guide. 1096 THE RECORD AND GUIDE, Publiihed every Saturday. Our Telepbone Call Is.....JTOHN 3T0. T K R M B : ONE ¥Eilt, in advauee, SIX DOLLARS. Cominmilcations sliould be artdi'essed fco i\ W, SWKETj 191 Broadway, J. T. LINDSEY, Business Mauager. Vol. XXXVIII. SEPTEMBER 4, 1S86, No. 964. A volume tohlch should he in tlie hands of every builder, con¬ tractor, architect, and owner and dealer in real estate, is now ready and can be procured at the office of The Record and Guide. It is a new edition of the law relating to huildings in the City of New York, tvith added matter, inargiwil ludes and colored engravings to illustrate the subject. It contains the law limiting the height of dwelling-houses, also tlie existiug Mechanics' Lien Laxv. Tliis loork is edited hy William J. Fryer, Jr.. wJtose original and well-thought-out comments give it a special value. The volume will also contain a complete directory of architects in New York, Brooklyn, Jersey City, Newark and Yonkers, The hook is handsomely hound in cloth, and is sold at the taw price of seventy five cents, by mail eighty-five cen's. The stock markefc, after beiug very dull, has siiown more signs of animation the lasfc two days, and brokers generally predict liigher prices and a better business. It is curious that there should be a revival of stock speculation on the very day after the appalling catastrophe at Charleston, But the Stock, and indeed all the exchanges, notwithstanding, ave very dull places compared with what they were four or live year.s ago. Tliere were three times the number of speculative dealings then thau tliere are now. This i.s the more curious as the country is richer and more populous by at least seven or eight millioQ persons. But if speculative dealings io stocks, grain and cotton are not as rctive as they were, neverthe¬ less the business of the country is doing exceedingly well. The railroads are doing a very heavy business aud are ti'oubled for want of freight cars. Accounts from all the manufacturing centres agree in saying consumption is very large and that there are no accumulations of stock. We will do well this year, .-ind all engaged in productive enterprises will make money, except some unexpected calamity should occur. The real estate outlook is excellent, and the Liberty street Exchange will see a larger fall business than was ever before transacted in New Yorlc Earthquakes are of a special interest to people who own real estate. Nature in such cases is not only the robber destructive, bufc is a downright anarchist. All who have experienced an earth¬ quake agree that it is the moat terrible experience a human being- can go through. Men who have faced death in every form unquailingly experience mortal terror when the houses begin to tumble and the earth to shake. Somehow our earliest associations of the ground we tread on is that of certainty—stability. The swift motion of the water suggests peril and the lightning of the heavens menace wifch death, but the solid earth we think we are sure of. When that becomes fluid and treacherous to our feet then chaos has come again; and the very foundations of all our ideas of the order of the universe are upset. The scientists, in specu¬ lating upon the recent quivering of tlie earth's crust, are disposed to add to the public uneasiness by announcing that the cities on the Atlantic coast, including New York, are liable lo similar dis¬ turbances in the future, as they are probably situated on a line of cleavage more perilous than exists in any other part of the country. fact that there are no companies which iusuie against loas by earthquakea, -—«-----•---------~ General Newton's appointment of Thompson and Flynn's ex-agent as hia deputy in the Public Works Department has not made a favorable impression upon the public, but it is wise to defer all criticism until ifc Ls seen how the department is to be managed. The new tJommissioner- may realise that it is essential to have a person near him who is Intimately acquainted with the working of the business of the department. Tiiere is a. general and reasonable expectation that it will hereafter be worked in the interest of the taxpayers and not in that of the political machines. If this i-j done no fault will be fount! with the succe.ssor of Rollin M. Squire. Good citizens must realize that General Newton has a hard road to travel. If he is determined to thoroughly reform liis department, it will be the aim of the corriiptionists to intrigue against him in private and attack him iu the public press. Hence, for the present, all who are interested in good governrnent should have faith in tlie new Commissioner until he is thoroughly tested by the work be accomplishes, ^--------a--------— Mayor Grace is credited with having forceil General Newton to appointing D. Lowber Smith as his deputy. But if the Mayor is not a candidate for re-election, as he says he is n<:)t, what interest can he have in the Public Works Departmoiit? We have not hesitated to criticize Mr. Grace, yet in justice it must be acknowledged that to him we are indebted for our reasonably eftlcLent street cleaning department, which was such a scandal up to the time he had it reorganized. Should our Public VVorks Department turn out equally well under Genera) Newton's management. Mayor Grace will merit and should receive the hearty approbation of all who are interested in good local government. But against this theory may be advanced the fact that since the colonization of the Atlantic coasfc earthquakes have been less fre¬ quent there than in any other parfc of the temperate region of the earth. Earthquakes generally are situated in or near the tropics. Had the point of greatest disturbance been ten miles away from Charleston the recent shaking up would not have attracted much attention; but it just happened that the shock was at its worst in the centre of a populous city. It is this fact, like t'he greater catasti'ophe in the destruction of the city of Lisbon in the middle of the eighteenth century, which has attracted the attention of the civilized world. There are, of com\e, ten million chances against one that no such catastrophe is likely to take place in any other city of this country for tbe oext thoueaad years. This ought to be an assurance to people who hesitate to buy improyed resltf, w\%m tb&y reeall thi The Evening Post argues that the general revival of business shows that the adoption of the gold standard has not depressed the industries of the world. But that paper overlooks the fact that the revival it points out is practically confined to one countrj*— the United States—in which the coinage of the silver dollar which it so much deprecates is kept up. Whatever improvement has taken place abroad is due to the activity in American securities, and the increased demand for foreign foods in tliis country. Then there has been an improvement in woolen goods, due to the whole¬ sale destruction of sheep by reason of the drought in Australia last year. The industrial outlook of the Old World is anything but reassuring. On this side of tlie water business is good and promises to be better, despite the coinage of the siher dollar which the Post thinks is so bad a thiuR' to do. The Rise in the Value of Money. There are two ways of explaining an increase in the value of money. In the one case the money itself increases iu purchas¬ ing power. You can buy more and still more of the raw material and manufactured products when the money in ordinary use becomes scarcer and more difficult to get. This is what has occurred since silver was demonetized; gold being the only measurer uf values it increased in purchasing power from 25 to 315 per cent., but this blow at prices afi'ected ^trade unfavorably. Prudent people declined to produce on a falling market, as a conse¬ quence of that money has increased in purchasing power while it lost value in the loan market. When prices were going up, producers were willing to pay from 5 to 8 per cent, for funds which they could use in enterprises making 2 to 4 per cent, additional. Since the demonetization of silver we have seien the familiar phenom¬ enon of an increased purchasing power of gold and a reduction of the value of money loaned on securities. Were money to lose in purchasing power gradually it would stimulate production, for the depreciation in the price of money would show itself in the apprecia¬ tion in the price of goods ot all kinds. After years in which money loaned for a less rate of intere&t while increasing in purchasing power, we have come upon a time when the loanable rates asked for money have sharply advanced. This may have been due to one or two causes—a contraction of the currency making loanable funds scarce and dear, or an absorption of money in temporarily unpro¬ ductive investments., Whatever the cause the fact unquestionably remains that money has become tight, and it seems unlikely that the cheap rates afc which ifc was loaned for the lasfc thre^ years will come back again. This is a matter which is very interesting to real estate owners and builders. Within a year there has been an immejise development of buildimg enterprises everywliere. We have been constructing houses far in excess of any previous period in the history of the coun¬ try. This was because house property paid on the whole a higher rate of interest than did securities of a general character. The low rate for money made 4 per cent, bonds: and stock seem very desirable. The cheap rate once established made house invfiet= mmt iGQ'k Tery temptlRg. Ia ?iew of ih^ %^ygms in t\i§ pi'ice uj