Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 97, no. 2499: Articles]: February 5, 1916

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

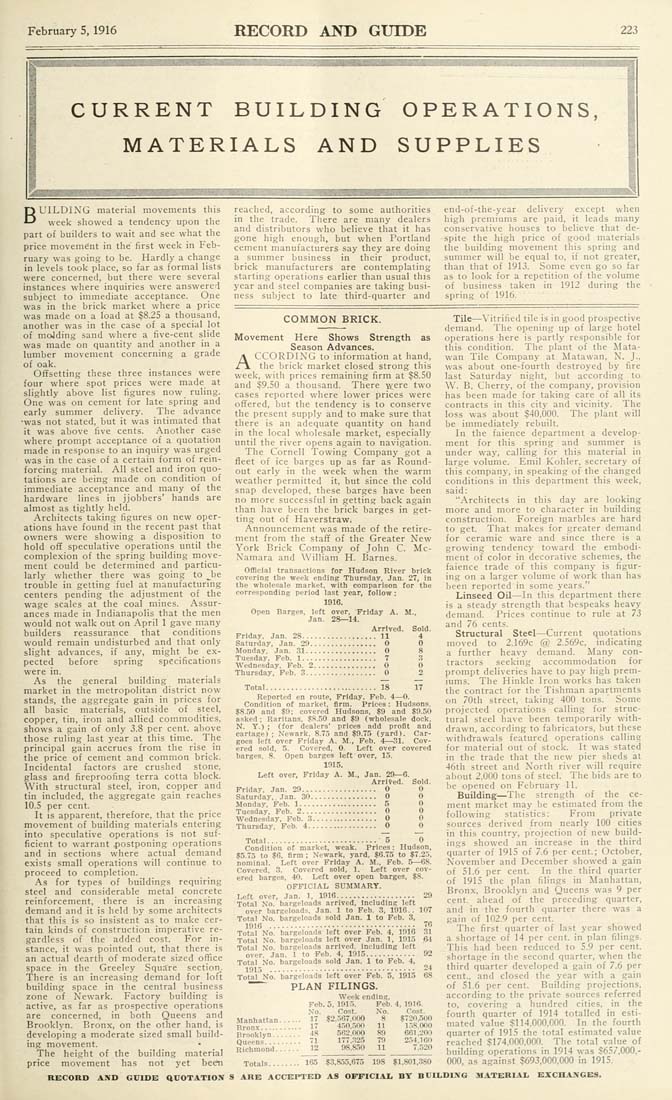

February 5, 1916 RECORD AND GUTOE 223 BUILDING material movements this week showed a tendency upon the part of builders to wait and see what the price movement in the first week in Feb¬ ruary was going to be. Hardly a change in levels took place, so far as formal lists were concerned, but there were several instances where inquiries were answered subject to immediate acceptance. One was in the brick market where a price was made on a load at $8.25 a thousand, anotlier was in the case of a special lot of moJding sand where a five-cent slide was made on quantity and another in a lumber movement concerning a grade of oak. Offsetting these three instances were four where spot prices were made at slightly above list figures now ruling. One was on cement for late spring and early summer delivery. The advance •was not stated, but it was intimated that it was above five cents. Another case where prompt acceptance of a quotation made in response to an inquiry was urged was in the case of a certain form of rein¬ forcing material. All steel and iron quo¬ tations are being made on condition of immediate acceptance and many of the hardware lines in jjobbers' hands are almost as tightly held. Architects taking figures on new oper¬ ations have found in the recent past that owners were showing a disposition to hold off speculative operations until the complexion of the spring building move¬ ment could be determined and particu¬ larly whether there was going to __be trouble in getting fuel at manufacturmg centers pending the adjustment of the wage scales at the coal mines. Assur¬ ances made in Indianapolis that the men would not walk out on April 1 gave many builders reassurance that conditions would remain undisturbed and that only slight advances, if any, might be e.x- pected before spring specifications were in. As the general building materials market in the metropolitan district now stands, the aggregate gain in prices for all basic materials, outside of steel, copper, tin, iron and allied commodities, shows a .gain of only 3.8 per cent, above those ruling last year at this time. The principal gain accrues from the rise in the price of cement and common brick. Incidental factors are crushed stone, glass and fireproofing terra cotta block. With structural steel, iron, copper and tin included, the aggregate gain reaches 10.5 per cent. It is apparent, therefore, that the price movement of building materials entering into speculative operations is not suf¬ ficient to warrant postponing operations and in sections where actual demand exists small operations will continue to proceed to completion. As for types of buildings requiring steel and considerable metal concrete reinforcement, there is an increasing demand and it is held by some architects that this is so insistent as to make cer¬ tain kinds of construction imperative re¬ gardless of the added cost. For in¬ stance, it was pointed out, that there is an actual dearth of moderate sized office space in the Greeley SquSre section. There is an increasing demand for loft building space in the central business zone oif Newark. Factory building is active, as far as prospective operations are concerned, in both Queens and Brooklyn. Bronx, on the other hand, is developin.g a moderate sized small build¬ ing movement. The height of the building material price movement has not j'et bee^i RECORD AND GUIDE QUOTATION reached, according to some authorities in the trade. There are many dealers and distributors who believe that it has gone high enough, but when Portland cement manufacturers say they are doing a summer business in their product, brick manufacturers are contemplating starting operations earlier than usual this year and steel companies are taking busi¬ ness subject to late third-quarter and end-of-the-year delivery except when high premiums are paid, it leads many conservative houses to believe that de¬ spite the high price of good materials the building movement this spring and summer will be equal to, if not greater, than that of 1913. Some even go so far as to look for a repetition of the volume of business taken in 1912 during the spring of 1916. COMMON BRICK. Movement Here Shows Strength as Season Advances. ACCORDING to information at hand, the brick market closed strong this week, with prices remaining firm at $8.50 and $9.50 a thousand. There were two cases reported where lower prices were offered, but the tendency is to conserve the present supply and to make sure that there is an adequate quantity on hand in the local wholesale market, especially until the river opens again to navigation. The Cornell Towing Company got a fleet of ice bar,ges up as far as Round- out early in the week when the warm weather permitted it, but since the cold snap developed, these barges have been no more successful in gettin.g back again than have been the brick barges in get¬ ting out of Haverstraw. Announcement was made of the retire¬ ment from the staff of the Greater New York Brick Company of John C. Mc- Namara and \Villiam H. Barnes. Official transactions for Hudson River brick covering the week ending Thursday. Jan. 27, in the wholesale market, with comparison for the corresponding period last year, follow: 1916. Open Barges, left over, Friday A. M., Jan. 2S—14. Arrived. Sold. Friday, Jan. 28..................11 4 Saturd.iy, Jan. 29................ 0 0 Monday. Jan. 31................. 0 8 Tuesday, Feb. 1.................. 7 3 Wednesday, Feb. 2............... 0 0 Thursday, Feb. 3................. 0 2 Total........................... 18 17 Reported en route, Friday. Feb. 4—0. Condition of market, firm. Prices : Hudsons. $8.50 and $9; covered Hudsons, .$9 and $9.50 asked ; Raritans. $8..50 and $9 (wholesale dock, N. Y.) ; (for dealers' prices add profit and cartage) : Newark, 8.75 and .$9.75 (yard). Car¬ goes left over Friday A. M., Feb. 4—31. Cov¬ ered sold, 5. Covered, 0. Left over covered barges, 8. Open barges left over, 15. 1915, Left over, Friday A. M., Jan. 29—6. Arrived. Sold. Friday, Jan. 29.................. 0 0 Saturday, Jan. 30................ 0 0 Monday, Feb. 1................... 5 0 Tuesday, Feb. 2.................. 0 0 Wednesday, Feb. 3................ 0 0 Thursday, Feb. 4................. 0 0 Total........................... 5 0 Condition of market, weak. Prices: Hudson, .$5.75 to $6, firm ; Newark, yard, $6.75 to $7.25, nominal. Left over Friday A. M.. Feb. 5—08. Covered. 3. Covered sold, 1. Left over cov¬ ered barges, 40. Left over open barges, $8. OFFICIAL SUMMARY. Left over. Jan. 1, 1916................... 29 Total No. bargeloads arrived. Including left over bargeloads, Jan. 1 to Feb. 3, 1916.. 107 Total No. bargeloads sold Jan. 1 to Feb. 3, 1916 ................................... 'i^ Total No. bargeloads left over Feb. 4, 1916 31 Total No. bargeloads left over Jan. 1, 1915 .64 Total No. bargeloads arrived, including left over, Jan. 1 to Feb. 4, 1915............ 92 Total No. bargeloads sold Jan. 1 to Feb. 4, 1915 ................................... 24 Total No. bargeloads left over Feb. 5, 1915 68 ------PLAN FILINGS. Week ending. Manhattan...... 1^ Bronx........... 1* Brooklyn....... 48 Queens......... 71 Richmond...... 12 Feb. 5, 1915. No. Cost. Feb.4, 1916. $2,567,000 450.500 562.000 177..325 98.850 No. 8 11 89 79 11 Cost. $720,500 1.58.000 661,200 2.54.100 7.520 Totals........ 165 $3,855,675 198 $1,801,380 Tile—Vitrified tile is in good prospective demand. The opening up of large hotel operations here is partly responsible for this condition. The plant of the Mata- wan Tile Company at Matawan, N. J., was about one-fourth destroyed by fire last Saturday night, but according to \V. B. Cherry, of the company, provision has been made for taking care of all its contracts in this city and vicinity. The loss was about $40,000. The plant will be immediately rebuilt. In the faience department a develop¬ ment for this spring and summer is under way, calling for this material in large volume. Emil Kohler, secretary of this company, in speaking of the changed conditions in this department this week, said: ".Architects in this day are looking more and more to character in building construction. Foreign marbles are hard to get. That makes for greater demand for ceramic ware and since there is a growing tendency toward the embodi¬ ment of color in decorative schemes, the faience trade of this company is figur¬ ing on a larger volume of work than has been reported in some years." Linseed Oil—In this department there is a steady strength that bespeaks heavy demand. Prices continue to rule at 73 and 76 cents. Structural Steel—Current quotations moved to 2.169c (a) 2.569c, indicating a further heavy demand. Many con¬ tractors seeking accommodation for prompt deliveries have to pay high prem¬ iums. Tlie Hinkle Iron works has taken tlie contract for the Tishman apartments on 70tli street, taking 400 tons. ' Some projected operations calling for struc¬ tural steel have been temporarily with¬ drawn, according to fabricators, but these withdrawals featured operations calling for material out of stock. It was stated in the trade that the new pier sheds at 46th street and North river will require aljout 2,000 tons of steel. The bids are to he opened on February 11. Building—The strength of the ce¬ ment market may be estimated from the following statistics: From private sources derived from nearly 100 cities in this country, projection of new build¬ ings showed an increase in the third quarter of 1915 of 7.6 per cent.; October, November and December showed a gain of 51.6 per cent. In the third quarter of 1915 the plan filings in Manhattan, Bronx, Brooklyn and Queens was 9 per cent, ahead of the preceding quarter, and in tlie fourth quarter there was a gain of 102.9 per cent. The first quarter of last year showed a shortage of 14 per cent, in pian filings. This had been reduced to 5.9 per cent, shortage in the second quarter, when the third quarter developed a gain of 7.6 per cent., and closed the year with a gain of 51.6 per cent. Building projections, according to the private sources referred to, covering a hundred cities, in the fourth quarter of 1914 totalled in esti¬ mated value $114,000,000. In the fourth quarter of 1915 the total estimated value reached $174,000,000. The total value of building operations in 1914 was $657,000,- 000, as^against $693,000,000 in 1915. S ARE ACCEPTED AS OFFICIAL BY BUILDING MATKRIAX EXCHANGES.