Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 103, no. 7: Articles]: February 15, 1919

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

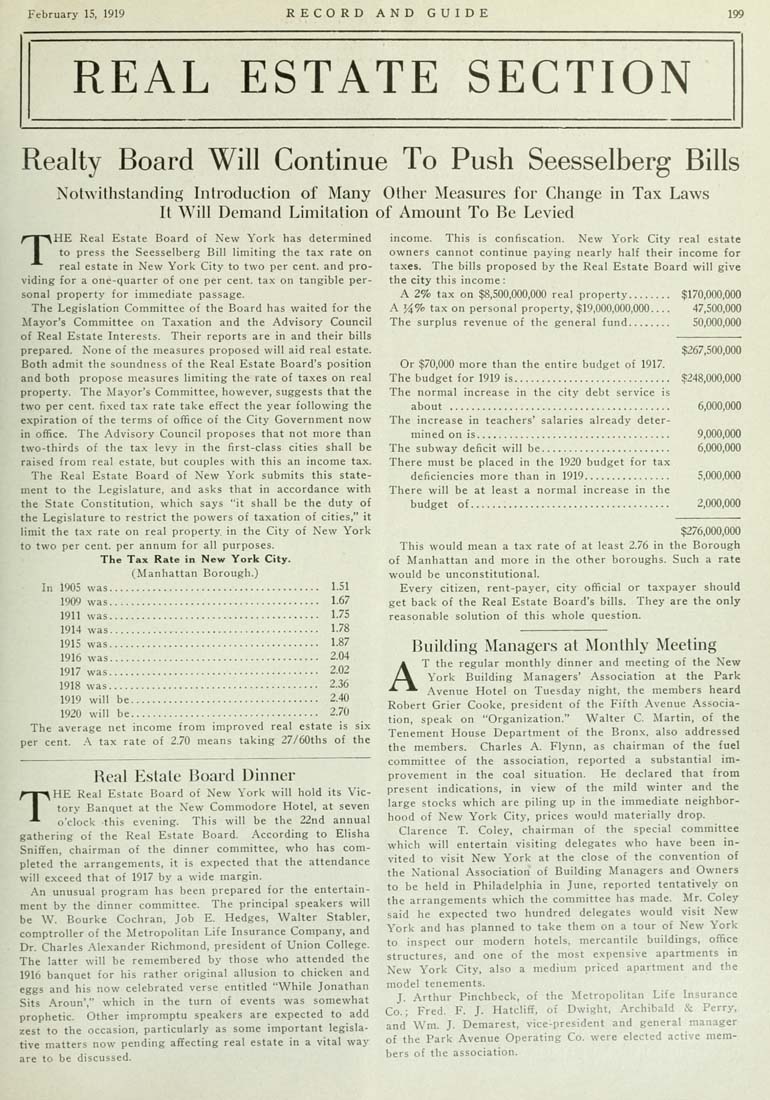

February 15. 1919 RECORD AND GUIDE 199 Realty Board Will Continue To Push Seesselberg Bills Notwithstanding Introduction of Many Other Measures for Change in Tax Laws It Will Demand Limitation of Amount To Be Levied THE Real Estate Board of New York has determined to press the Seesselberg Bill limiting the tax rate on real estate in New York City to two per cent, and pro¬ viding for a one-quarter of one per cent, tax on tangible per¬ sonal property for immediate passage. The Legislation Committee of the Board has waited for the Mayor's Committee on Taxation and the Advisory Council of Real Estate Interests. Their reports are in and their bills prepared. None of the measures proposed will aid real estate. Both admit the soundness of the Real Estate Board's position and both propose measures limiting the rate of taxes on real property. The Mayor's Committee, however, suggests that the tw^o per cent, fixed tax rate take effect the year following the expiration of the terms of office of the City Government now in office. The Advisory Council proposes that not more than two-thirds of the tax levy in the first-class cities shall be raised from real estate, but couples with this an income tax. The Real Estate Board of New York submits this state¬ ment to the Legislature, and asks that in accordance with the State Constitution, which says "it shall be the duty of the Legislature to restrict the powers of taxation of cities," it limit the tax rate on real property, in the City of New York to two per cent, per annum for all purposes. The Tax Rate in New York City. (Manhattan Borough.) In 1905 was....................................... 1.51 1909 was....................................... 1.67 1911 was....................................... 1.75 1914 was....................................... 1.78 1915 was....................................... 1.87 1916 was....................................... 2.04 1917 was....................................... 2.02 1918 was....................................... 2.36 1919 will be................................... 2.40 1920 will be................................... 2.70 The average net income from improved real estate is six per cent. A tax rate of 2.70 means taking 27/60ths of the Real Estate Board Dinner THE Real Estate Board of New York will hold its Vic¬ tory Banquet at the Xew Commodore Hotel, at seven o'clock this evening. This will be the 22nd annual gathering of the Real Estate Board. According to Elisha Snitfen, chairman of the dinner committee, who has com¬ pleted the arrangements, it is expected that the attendance will exceed that of 1917 by a wide margin. An unusual program has been prepared for the entertain¬ ment by the dinner committee. The principal speakers will be W. Bourke Cochran, Job E. Hedges, Walter Stabler, comptroller of the Metropolitan Life Insurance Company, and Dr. Charles Alexander Richmond, president of Union College. The latter will be remembered by those who attended the 1916 banquet for his rather original allusion to chicken and eggs and his now celebrated verse entitled "While Jonathan Sits Aroun'," which in the turn of events was somewhat prophetic. Other impromptu speakers are expected to add zest to the occasion, particularly as some important legisla¬ tive matters now pending affecting real estate in a vital way are to be discussed. income. This is confiscation. New York City real estate owners cannot continue paying nearly half their income for taxes. The bills proposed by the Real Estate Board will give the city this income: A 2% tax on $8,500,000,000 real property........ $170,000,000 A J4% tax on personal property, $19,000,000.000.... 47,500,000 The surplus revenue of the general fund........ 50,000,000 $267,500,000 Or $70,000 more than the entire budget of 1917. The budget for 1919 is............................. $248,000,000 The normal increase in the city debt service is about ......................................... 6,000,000 The increase in teachers' salaries already deter¬ mined on is.................................... 9,000,000 The subway deficit will be........................ 6,000,000 There must be placed in the 1920 budget for tax deficiencies more than in 1919................ 5,000,000 There will be at least a normal increase in the budget of..................................... 2.000,000 $276,000,000 This would mean a tax rate of at least 2.76 in the Borough of Manhattan and more in the other boroughs. Such a rate would be unconstitutional. Every citizen, rent-payer, city official or taxpayer should get back of the Real Estate Board's bills. They are the only reasonable solution of this whole question. Building Managers at Monthly Meeting AT the regular monthly dinner and meeting of the New York Building Managers' Association at the Park Avenue Hotel on Tuesday night, the members heard Robert Grier Cooke, president of the Fifth Avenue Associa¬ tion, speak on "Organization." Walter C. Martin, of the Tenement House Department of the Bronx, also addressed the members. Charles A. Flynn. as chairman of the fuel committee of the association, reported a substantial im¬ provement in the coal situation. He declared that from present indications, in view of the mild winter and the large stocks which are piling up in the immediate neighbor¬ hood of New York City, prices would materially drop. Clarence T. Coley, chairman of the special committee which will entertain visiting delegates who have been in¬ vited to visit New York at the close of the convention of the National Association of Building Managers and Owners to be held in Philadelphia in June, reported tentatively on the arrangements which the committee has made. Mr. Coley said he expected two hundred delegates would visit New York and has planned to take them on a tour of New York to inspect our modern hotels, mercantile buildings, office structures, and one of the most expensive apartments in New York City, also a medium priced apartment and the model tenements. J. Arthur Pinchbeck, of the Metropolitan Life Insurance Co.; Fred. F. J. Hatcliff, of Dwight, Archibald & Perry, and Wm. J. Demarest, vice-president and general manager of the Park Avenue Operating Co. were elected active mem¬ bers of the association.