Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 18, no. 455: December 2, 1876

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

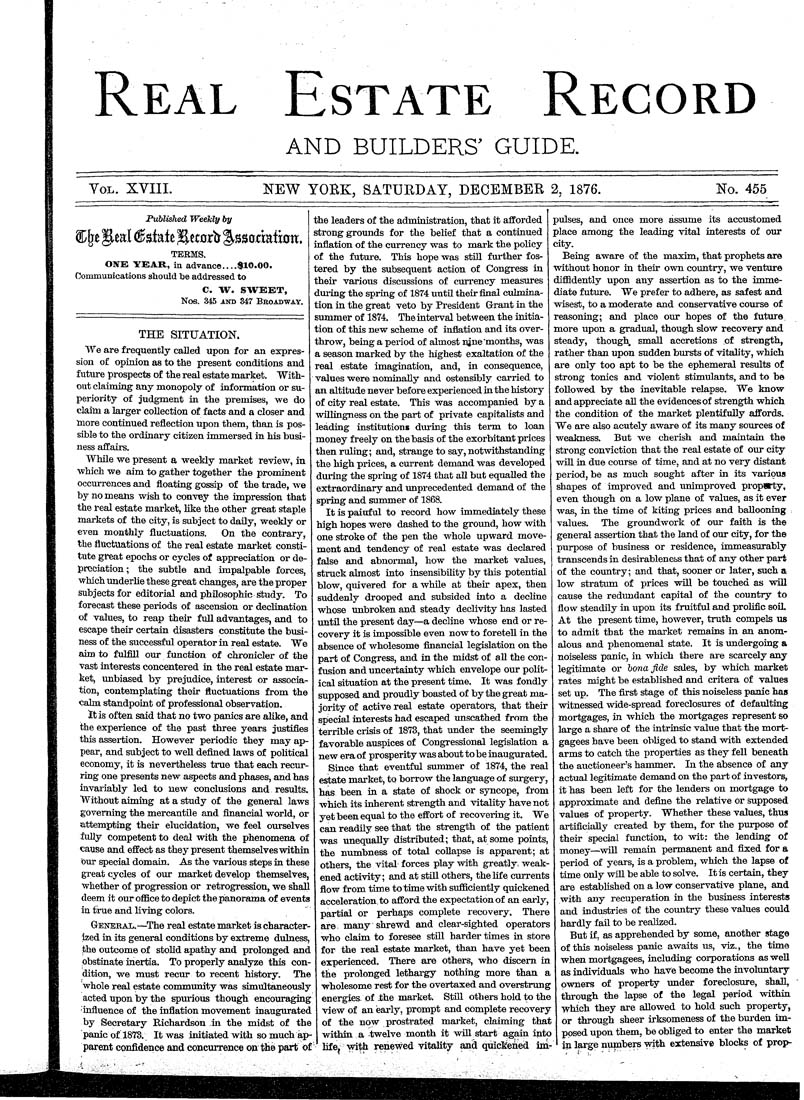

Real Estate Record AND BUILDERS' GUIDE. Vol. XVIII. NEW YOBK, SATURDAY, DECEMBER 2, 1876. No. 455 Published Weekly by Cljfi gea,( (Estate %uaxii %SBQcmixan, TERMS. OXE YEAR, in advance....$10.00. Communications should be addressed to C. W. SWEET, Nos. 345 AND 347 Broadway. THE SITUATION. AVe are frequently caUed upon for an expres¬ sion of opinion as to the present conditions and future prospects of the real estate market. With¬ out claiming any monopoly of information or su¬ periority of judgment in the premises, we do claim a larger coUection of facts and a closer and more continued reflection upon them, than is pos¬ sible to the ordinary citizen immersed in his busi¬ ness affairs. WhUe we present a weekly market reAdew, in which we aim to gather together the prominent occurrences and floating gossip of the trade, -we by no means Avish to con-vey the impression that the real estate market, like the other great staple markets of the city, is subject to daUy, Aveekly or even monthly fluctuations. On the contrary, the fluctuations of the real estate market consti¬ tute great epochs or cycles of appreciation or de¬ preciation; the subtle and impalpable forces, which underUe these great changes, are the proper subjects for editorial and phUosophic study. To forecast these periods of ascension or declination of values, to reap their full advantages, and to escape their certain disasters constitute the busi¬ ness of the successful operator in real estate. We aim to fuMU our function of chronicler of the vast interests concentered in the real estate mar¬ ket, unbiased by prejudice, interest or associa¬ tion, contemplating their fluctuations from the calm standpoint of professional observation. It is often said that no two panics are alike, and the experience of the past three years justifies this assertion. However periodic they may ap¬ pear, and subject to weU defined laws of poUtical economy, it is nevertheless true that each recur¬ ring one presents new aspects and phases, and has iuA^riably led to new conclusions and results. Without aiming at a study of the general laws governing the mercantUe and financial Avorld, or attempting their elucidation, we feel ourselves fuUy competent to deal Avith the phenomena of cause and effect as they present themselves Avithiu bur special domain. As the various steps in these great cycles of our market develop themselves, whether of progression or retrogression, we shall deem it our office to depict the panorama of events in frue and liAong colors. General.—^The real estate market is character¬ ized in its general conditions by extreme didness, the outcome of stoUd apathy and prolonged and obstinate inertia. To properly analyze this con¬ dition, Ave must recur to recent history. The whole real estate community was simultaneously acted upon by the spurious though encouraging influence of the inflation movement inaugurated by Secretary Richardson in the midst of the panic of 1873. It-was hUtiated Avith so much ap¬ parent confidence and concurrence on the part of the leaders of the adimnistration, that it afforded strong grounds for the belief that a continued inflation of the currency was to mark the poUcy of the future. This hope -was stUl further fos¬ tered by the subsequent action of Congress in their various discussions of cun-ency measures dm-ing the spring of 1874 untU their final culmina¬ tion in the great veto by President Grant in the summer of 1874. The interval between the initia¬ tion of this new scheme of inflation and its over¬ throw, being a period of almost ujne months, was a season marked by the highest exaltation of the real estate imagination, and, in consequence, values were nominaUy and ostensibly carried to an altitude never before experienced in the history of city real estate. This was accompanied by a willingness on the part of private capitaUsts and leading institutions during this term to loan money freely on the basis of the exorbitant prices then ruling; and, strange to say, notAvithstanding the high prices, a current demand was developed during the spring of 1874 that aU but equaUed the extraordinary and unprecedented demand of the spring and summer of 1868. It is painful to record how immediately these high hopes were dashed to the ground, how with one stroke of the pen the Avhole upward move¬ ment and tendency of real estate was declared false and abnormal, how the market values, struck almost into insensibUity by this potential blow, quivered for a AvhUe at their apex, then suddenly drooped and subsided into a decline whose unbroken and steady decliAdty has lasted imtU the present day—a decline whose end or re¬ covery it is impossible even now to foreteU in the absence of Avholesome financial legislation on the part of Congress, and in the midst of aU the con¬ fusion and uncertainty which envelope our poUt¬ ical situation at the present time. It Avas fondly supposed and proudly boasted of by the great ma¬ jority of active real estate operators, that their special interests had escaped unscathed from the terrible crisis of 1873, that under the seemingly favorable auspices of Congressional legislation a new era of prosperity was about to be inaugurated. Since that eventful summer of 1874, the real estate market, to borrow the language of surgery, has been in a state of shock or s3mcope, from which its inherent strength and vitality have not yet been equal to the effort of recovering it. We can readUy see that the strength of the patient was unequally distributed; that, at some points, the numbness of total coUapse is apparent; at others, the vital forces playAvith greatly. Aveak- ened activity; and at stiU others, the life currents flow from time to time with sufficiently quickened acceleration to afford the expectation of an early, partial or perhaps complete recovery. There are many shrewd and clear-sighted operators who claim to foresee stUl harder times in store for the real estate market, than have yet been experienced. There are others, who discern in the prolonged lethargy nothing more than a -wholesome rest for the overtaxed and overstrung energies, of ihe market. StUl others hold to the view of an early, prompt and complete recovery of the now prostrated mai-ket, claiming that within a twelve month it wiU start again into life, with renewed vitaUty and quickened im¬ pulses, and once more assume its accustomed place among the leading Arital interests of our city. Being aware of the maxim, that prophets are without honor in their own country, we venture diffidently upon any assertion as to the imme¬ diate future. We prefer to adhere, as safest and Avisest, to a moderate and conservative course of reasoning; and place our hopes of the future more upon a gradual, though slow recovery and steady, though, smaU accretions of strength, rather than upon sudden bursts of -vitaUty, which are only too apt to be the ephemeral results of strong tomes and violent stimulants, and to be foUowed by the inevitable relapse. We know and appreciate aU the evidences of strength which the condition of the market plentifuUy affords. We are also acutely aware of its many sources of weakness. But we cherish and maintain the strong conviction that the real estate of our city wUl in due course of time, and at no very distant period, be as much sought after in its various shapes of improved and unimproved property, CA'en though on a low plane of values, as it ever was, in the time of kiting prices and baUooning values. The groundwork of our faith is the general assertion that the land of our city, for the purpose of business or residence, immeasurably transcends in desirableness that of any other part of the country; and that, sooner or later, such a low stratum of prices wUl be touched as will cause the redimdant capital of the country to floAV steadily in upon its fruitfid and proUflc soil. At the present time, however, truth compels us to admit tbat the market remains in an anom¬ alous and phenomenal state. It is undergoing a noiseless panic, in which there are scarcely any legitimate or lona fide sales, by which market rates might be established and critera of values set up. The first stage of this noiseless panic has witnessed wide-spread foreclosures of defaulting mortgages, in which the mortgages represent so large a share of the intrinsic value that the mort¬ gagees have been obUged to stand with extended arms to catch the properties as they f eU beneath the auctioneer's hammer. In the absence of any actual legitimate demand on the part of investors, it has been left for the lenders on mortgage to approximate and define the relative or supposed values of property. Whether these values, thus artificiaUy created by them, for the purpose of their special function, to wit: the lending of money—^vsdU remain permanent and fixed for a period of years, is a problem, which the lapse of time only wUl be able to solve. It is certain, they are estabUshed on a low conservative plane, and with any recuperation in the business interests and industries of the country these values could hardly fail to be realized. But it, as apprehended by some, another stage of this noiseless panic awaits us, -viz., the time when mortgagees, including corporations as weU as indiAriduals who have become the involuntary owners of property imder foreclosure, shall, through the lapse of the legal period -within -yyhich they are allowed to hold such property, or through sheer irksomeness of the bm-den im¬ posed upon them, be obUged to enter the market in large numbers with extensive blocks of proi>-