Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 22, no, 555: November 2, 1878

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

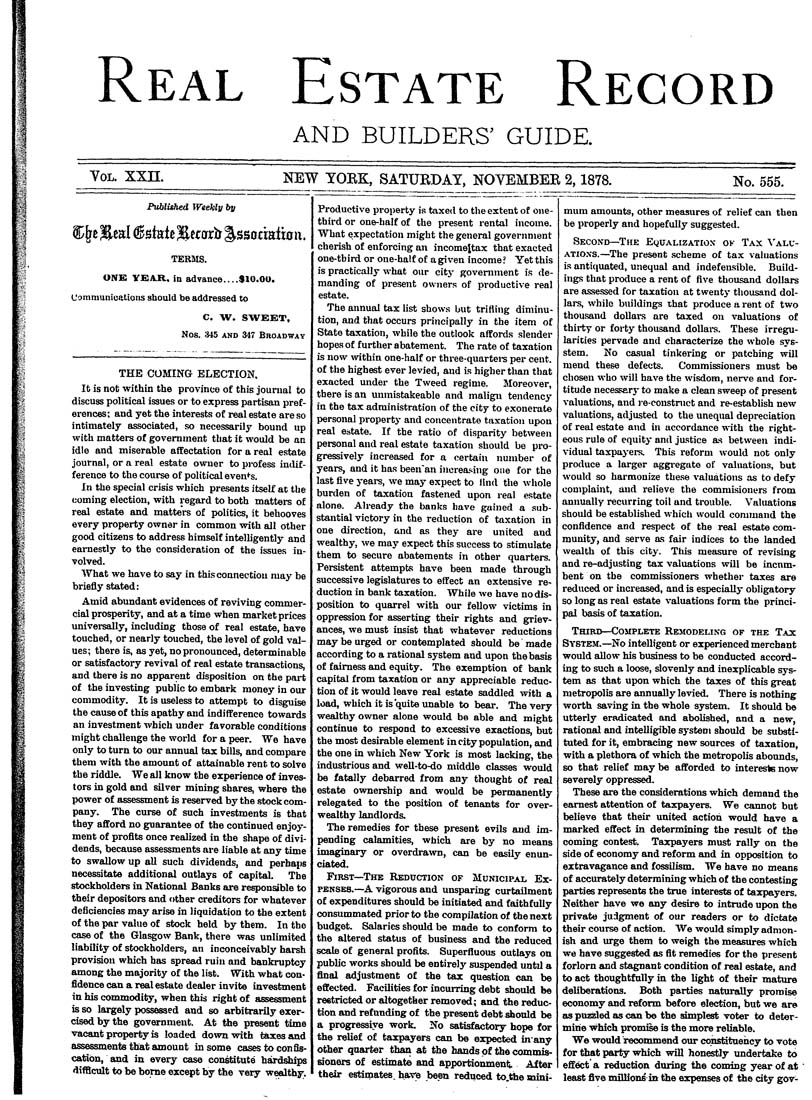

Real Estate Record AND BUILDERS^ GUIDE. Vol. xxn. NEW TOBK, SATUBDAT, NOYEMBEB 2,1878. No. 555. fi.- Published Weekly by W>^t %ml €stuh %mx)s Association. TERaiS. ONE YEAR. in advance....SJO.OU. Communications should be addressed to C. W. SWEET, Nos. ;145 AND 347 Broadway THE COMING ELECTION. It is not within the province of this jourual to discuss political issues or to express partisan pref- erences; and yet the interests of real estate are so intimately tissociated, so necessarily bound up with matters of government that it would be an idle and miserable affectation fora real estate Journal, or a real estate owuer to profess indif¬ ference to the course of political events. In the special crisis which presents itself at the Coming election, with regard to both matters of real estate and matters of politics, it behooves every property owner in common with all other good Citizens to address himself intelligently and eamestly to the consideration of the issues in¬ volved. What we have to say in thisconnectiou may be briefly stated: Amid abundant evidenees of reviving commer¬ cial prosperity, and at a time when market prices universaily, including those of real estate, have touched, or nearly touched, the level of gold val¬ ues; there is, as yet, no pronounced, determinabie or satisfactory revival of real estate transactions, and there is no apparent disposition on the part of the investing public to embark money in our commodity. It is useless to attempt to disguise the cause of this apathy and indifference towards an investment wbich under favorable conditions might challenge the world for a peer. We have only to turn to our annual tax bills, and compare them with the amount of attainable rent to solve the riddle. We all know the experience ot inves- tors in gold and silver mining shares, where the power of assessment is reserved by the stock Com¬ pany. The curse of such investments is that they afford no guarantee of the continued enjoy¬ ment of profits once realized in the shape of divi¬ dends, because assessments are liable at any time to swallow up all such dividends, and perhai« necessitate additional outlays of capital. The stockholders in National Banks are responsible to their depositors and other creditors for whatever deficiencies may arise in liquidation to the extent of the par value of stock held by them. In the case of the Glasgow Bank, there was unllmited liability of stockholders, an inconceivably harsh Provision wliich has spread ruin and bankruptcy among the majority of the list. With what con¬ fidence can a real estate dealer invite investment in his commodity, when this right of assessment isso largely possessed and so arbitrarily exer¬ cised by the government. At the present time vaeant property is loaded down-mth täxesand assessments that amount in some cases to confis- catibn, and in every case constitute härdships difficult to be borne except by the veiy wealthy. Productive property is taxed to the extent of one- third or one-balf of the present rental income. What expectation might the general government cherish of enforcing an incomeltax that exacted one-third or one-half of agiven income? Yet this is practically what our citj- government is de¬ manding of present owners of productive real estate. The annual tax list shows but trifling diminu¬ tion, and that occurs principally in the item of State taxation, while the outlook affords slender hopes of further abatement. The rate of taxation is now mthin one-half or three-quartei-s per ceut. of the highest ever levied, and is higher than that exacted under the Tweed regime. Moreover, there is an unmistakeable and malign tendency in the tax adrainistration of the city to exonerate personal property and concentrate taxation upon real estate. If the ratio of disparity between personal and real estate taxation should be pro- gressively increased for a certain number of years, and it has been'an increasing one for the last five yeare, we may expect to find the whole bürden of taxation fastened upon real estate alone. Already the t)anks have gained a sub¬ stantial victory in the reduction of taxation in one direction, and as they are united and wealthy, we may expect this success to stimulate them to secure abatements in other quarters. Persistent attempts have been made through successive legislatures to effect an extensive re¬ duction in bank taxation. While we have no dis¬ position to quarrel with our fellow victims in oppression for asserting their rights and griev¬ ances, we must insist that whatever reductions may be urged or contemplated should be made according to a rational system and upou the basis of faimess and equity. The exemption of bank capital from taxation or any appreciable reduc¬ tion of it would leave real estate saddled -with a Ioad, which it is quite unable to bear. The very wealthy owner alone would be able and might continue to respond to excessive exactions, but the most desirable element in city population, and the one in which New York is most lacking, the industrious and well-to-do middle classes would be fatally debarred from any thought of real estate ownership and wotdd be permanently relegated to the position of tenants for over- wealthy landlords. The remedies for these present evils and im- pending calamities, which are by no means imaginary or overdrawn, can be easily enun¬ ciated. First—The Reduction of Municipal Ex¬ penses.—A vigorous and unsparing curtailment of expenditures should be initiated and faithfully consummated prior to the compilation of the next budget. Salaries should be made to conform to the altered status of business and the reduced scale of general profits. Superfluous outlays on pubhc works should be entirely suspended until a final adjustment of the tax question can be effected. Facilities for incurring debt should be restricted or altogether removed; and the reduc¬ tion and refunding of the present debt should be a progressive work. 2fo satisfactory hope for the relief of taxpayers can be expected inany other quarter than at the hands pf the commis¬ sioners of estimate and apportionment Älter their estimates. hare been reduced to.the mini¬ mum amoimts, other measures of relief can then be properly and hopefully suggested. Secon-i>—The Eqüalizatio-x ok Tax \'alc- ATio.vs.—The present .scheme of tax valuations is antiquated, unequal and indefensible. Build¬ ings that produce a rent of five thousand dollars are assessed for taxation at twenty thousand dol¬ lars, whilo buildings that produce a rent of two thou.sand dollars are taxed on valuations of tbirty or forty thousand dollare. These irregu- larities pervade and cbaracterize the w-hole sys- stem. No casual tinkering or patching will mend these defects. Commissioners must be chosen w-ho will have the wisdom, nerve and for- titude necessary to make a clean sweep of present valuations, and re-constnict and re-establish new valuations, adjusted to the unequal depreciation of real estate aud in accordance 'sv-ith the right- eous rule of equity and justice as betw-een indi¬ vidual taxpayers. This reform would not only produce a larger aggi-egate of valuations, but w-ould so harmonize these valuations as to defy complaint, aud relieve the comraLsioners from aniiually recurring toil and trouble. Valuations should be established which would command the confidence and respect of the real estate com¬ munity, and serve as fair indices to the landed wealth of this city. This measure of revising and re-adjusting tax valuations will be incum¬ bent on tbe commissioners whether taxes are reduced or increased, and is especially obligatory so long as real estate valuations form the princi¬ pal basis of taxation. Thikd—Complete Remodeling of the Tax System.—No intelligent or experienced merchant would allow his business to be conducted accord¬ ing to such a loose, slovenly and inexplicable Sys¬ tem as that upon which the taxes of this g^eat nietropolis are annuaUy le-vied. There is nothing worth saving in the whole system. It should \m utterly eradicated and abolished, and a new, rational and intelligible system should be substi¬ tuted for it, embracing new sources of taxation, with a Plethora of which the metropolis abounds, so that relief may be afforded to intereste now severely oppressed. These are the considerations which demand the earnest attention of taxpayers. We cannot but believe that their united action would have a marked effect in determining the result of the Coming contest. Taxpayers must rally on the side of economy and reform and in Opposition to extravagance and fossilism. We have no means of accurately determining which of the contesting parties represeuts the true interests of taxpayers. Neither have we any desire to intrude upon the private ju.igment of our readers or to dictate their course of action. We would simply admon¬ ish and urge them to weigh the measures which we have suggested as fit remedies for the present forlom and stagnant condition of real estate, and to act thoughtfully in the light of their mature deliberations. Both parties naturally promise economy and reform before election, but we are as pnzzled as can be the simplest voter to deter¬ mine -which promise is the more reliable. We would recommend our constituency to vote for that party which ■will honestly undertake to effect a reduction during the coming yearof at least five millions in the esqpenses of the city gov-