Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 22, no. 559: November 30, 1878

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

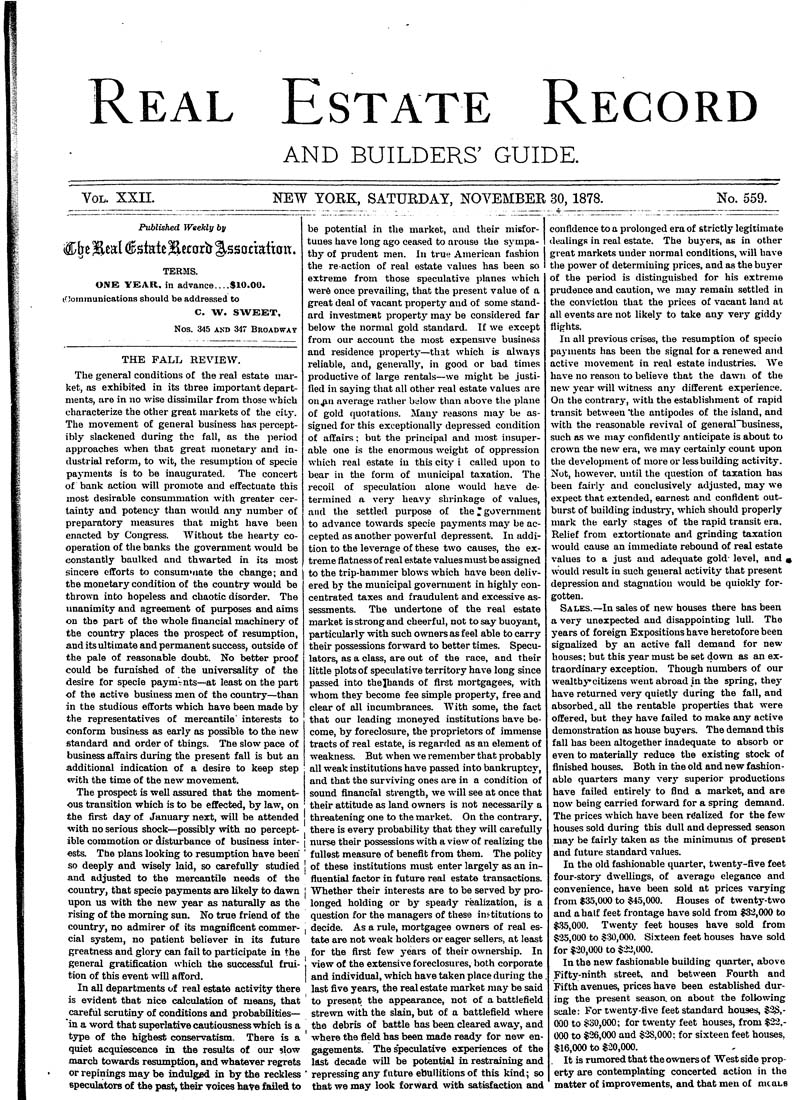

Real Estate Record AND BUILDERS' GUIDE. Vol. xxn. NEW YORK, SATURDAY, NOVEMBER 30,1878. No. 559. Published Weekly by t^ht %mi €>sMt %icoxti g,ssadaüan. TERMS. ONE YEAR. in advance....SlO.OO. (Oommunications should be addressed to C. W. SWEET, Nos. 345 AND 347 Broadway THE FALL REVIEW. Tbe general conditions of the real estate mar¬ ket, as exhibit«! in its three important depart- ments, are in no wise dissimilar from those which cbaracterize the other great markets of the city. The movement of general business has percept¬ ibly slackened during the fall, as the period approaches when that great luonetarj' and in¬ dustrial reform, to wit, the resumption of specie payments is to be inaugurated. The concert of bank actiou will promote and effectuate tbis most desirable consummation with greater cer¬ tainty and potency than would any number of preparatory measures that might have been enacted by Congress. Without the hearty co- operation of the banks the government would be I constantly baulked and thwarted in its most " sincere efforts to consum>iiate the change; and the monetary conditiou of the country would be thrown into hopeless and chaotic disorder. The nnanimity and agreement of purposes and aims " on th© part of the whole financial machinery of the country places the prospect of resumption, aud its ultimate and permanent success, outside of the pale of reasonable doubt. No better proof could be furnished of the universality of the desire for specie paym-ruts—at least on the part of the aetive business men of the country—than in the studious efforts which have been made by the representatives of mercantile" interests to conform business as early as possible to the new Standard and order of things. The slow pace of business affairs during the present fall is but an additional indication. of a desire to keep step tvith the time of the new movement. The prospect is well assured that the moment- ous transition which is to be effected, by law, on the first day of January next, will be attended with no serious shock—possibly with no percept¬ ible commotion or disturbance of business inter¬ ests. The plans looking to resumption have been so deeply and wisely laid, so carefully studied and adjusted to the mercantile needs of the country, that specie payments are likely to dawn upon US with the new year as naturally as the rising of the moming sun. No true friend of the country, no admirer of its magidflcent commer¬ cial System, no patient believer in its future greatness and glory can fail to participate in the general gratification which the successful frui- tion of this event will afford. In all departments of real estate activity there is evident that nice calculation of means, that careful scrutiny of conditions and probabilities— in a word that Superlative cautiousness which is a type of the highest conservatism. There is a quiet acquiescence in the resuits of our slow march towards resumption, and whatever regrets or repinings may be indulged in by the reckless speculators of the past, their voices haVe faüed to be potential in the market, and their misfor¬ tunes have long ago ceased to aroiiso the sympa¬ thy of prudent men. In true American fashion the reaction of real estate values has been so extreme from those speculative planes which wei'ö once prevailing, that the present value of a great deal of vacant property aud of some Stand¬ ard investmcHt property may be considered far below the normal gold Standard. If we except from our account the most expensive business and residence property—that which is always reliable, and, generally, in good or bad times productive of large rentals—we might be justi¬ fied in saying that all other real estate values are on^n average rather balow than above the plane of gold quotations. Mauy reasons may be as¬ signed for this exceptionally depressed coudition of affairs; but the principal and most iusuper¬ able one is tbe enormous weight of oppression which real estate iu this city i called upon to bear iu the form of municipal taxation. The recoil of speculatiou alone would have de¬ termined a very heavy shrinkage of values, and the settled purpose of the J government to advance towards specie payments may be ac¬ cepted as another powerful depressent. In addi¬ tion to the leverage of these two causes, the ex¬ treme flatness of real estate values must be assigned to the trip-hammer blows which have been deliv¬ ered by the municipal government in highly con¬ centrated taxes and fraudulent and excessive as¬ sessments. The undertone of the real estate market is strong and cheerful, not to say buoyant, particularly with such owners as feel able to carry their possessions forward to better times. Specu¬ lators, as a class, are out of the race, and their little plots of speculative territory have long since passed into thelhands of first mortgagees, with whom they become fee simple property, free and clear of all incunibrances. With some, the fact that our leading moneyed institutions bave be¬ come, by foreclosure, the proprietors of immense tracts of real estate, is regarded as an element of weakness. But when we remember that probably all weak institutions have passed into bankruptcj', and that the surviving ones are in a condition of sound financial strength, we will see at once that their attitude as land owners is not necessarily a threatening one to the market. On the contrary. there is everj' probability that they will carefully nurse their possessions with a view of realizing the füllest measure of benefit from them. The polity of these institutions must enter largely as an in- fluential factor in future real estate transactions. Whether their interests are to be served by pro¬ longed holding or by speady realization, is a question for the nianagei-s of these ins-titutions to decide. As a rule, mortgagee owners of real es¬ tate are not weak holders or eager sellers, at least for the first few yeai-s of their ownership. In view o£ the extensive foreclosures, both corporate and individnal, which have taken place during the last five years, the real estate market may be said to present the appearance, not of abattlefield strewn with the slain, but of a battlefield where the debris of battle has been cleared away, and where the field has been made ready for new en¬ gagements. The s'peculative experiences of the last decade will be potential in restraining and repressing any future ebullitions of this kind; so that we may look forward with satisfaction and confidence to a prolonged era of strictly legitimate dealings in real estate. The buj'ers, as in other great markets under normal conditions, will have tbe power of determining prices, and as the buyer of the period is distinguished for his extreme prudence and caution, we may remain settled in the conviction that the prices of vacant land at all events are not likely to take any verj' giddj' flights. In all previous crises, tbe resumption of specie payments has been tbe signal for a renewed and aetive movement in real estate industries. We have no reason to believe that the dawn of the new y^ear will witness anj' different experience. On tbe contrary, with the establishment of rapid transit between "the antipodes of the island, and with the reasonable revival of general~business, such as we may confidently anticipate is about to crown the new era, we may certainly count upon tbe development of more or less building activity. Not, however. uutil the question of taxation has been fairlj' and conclusively adjusted, maj' we expect that extended, earnest and confident out- burst of building industry, which should properly mark tbe early stages of the rapid transit era. Relief from extortionate and grinding taxation would cause an immediate rebound of real estate values to a just aud adequate gold level, and « would result in such general activity that present depression aud stagnatiou would be quiokly for¬ gotten. Sal.es.—In sales of new houses there has been a very unexpected and disappointing lull. The years of foreign Expositions have heretofore been signalized by an aetive fall demand for new houses; but this year must be set down as an ex¬ traordinary exception. Though numbers of our wealthj'Citizens went abroad in the spring, they have returned very quietly during the fall, and absorbed, all the rentable properties that were offered, but they have failed to make any aetive demonstration as house buyers. The demand this fall heis been altogether inadequate to absorb or even to materially reduce the existing stock of finished houses. Both in the old and new fashion¬ able quarters many verj' superior productions have failed entirelj- to find a market, and are now being carried forward for a spring demand. The prices which have been röalized for the few houses sold during this dull and depressed season maj' be fairly taken as the minunums of present and future Standard vaiues. In the old fashionable quarter, twenty-five feet four-storj' dwellings, of average elegance and convenience, have been sold at prices varying from 835,000 to §45,000. Houses of twenty-two and a half feet frontage have sold from |3'i,000 to $,35,000. Twenty feet houses have sold from $35,000 to §:30,000. Sixteen feet houses have sold for $20,000 to S'i2,ü00. In the new fashionable building quarter, above Fifty-ninth street, and between Fourth and Fifth avenues, prices have been established dur¬ ing the present season on about the following Scale: For twenty-five feet Standard houses, §2$,- OOO to §30,000; for twenty feet houses, from $22,- 000 to $26,000 and $2S,000: for sixteen feet houses, $16,000 to $-20,000. It is rumored that the owners of West side prop¬ erty are contemplating concerted action in the matter of improvements, and that meu of nicaLs