Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 24, no. 602: September 27, 1879

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

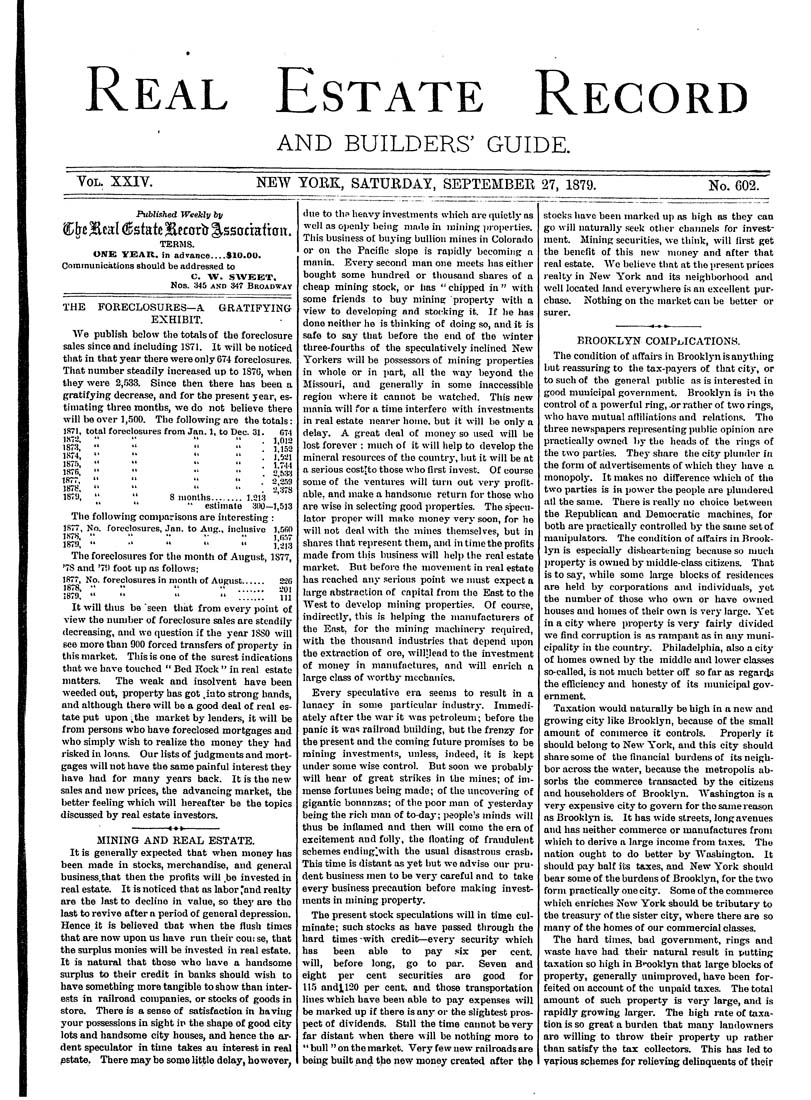

Real Estate Record AND BUILDERS' GUIDE. Vol. XXIV. NEW TORK, SATURDAY, SEPTEMBER 27, 1879. No. 602. Published Weekly by W^^t Seal Estate Setorlr ^ssccmttoit. TERMS. ONK YEAR. Jn advance___SIO.OO. Communications should be addressed to C. W. SAVEET. Nos. 345 AND 347 Broadway THE FORECLOSURES—A GRATIFYING EXHIBIT. We publish below the totals of the foreclcsure sales since and including 1S71. It will be noticed that in that year there wei-e only 674 foreclosures. That number steadily increased up to 1S7G, when they were 2,.533. Since then there has been a gratifying decrease, and for the present year, es¬ timating three months, we do not believe there will be over 1,.500. The following are the totals: 1871, total foreclosures from Jan. 1, to Dec. 31. 071 W-V2, " •• " " . 1,012 1873. " " " " . 1,152 1874. " " " " . J.521 187.5, " " " " . 1.7.M 1876, " " •' •• . 2,bH:i 1877. " " " " 2 359 1875. " " " '• ■ 2*378 187'J, " " 8 months........ 1.213 ■' estimate 300—1,513 The following comparisons are interesting : 1877, No. foreclo.sures, Jan. to Aug., inclusive 1.5fiO 1878, " " •• •• " ],(i.',r 1879, " •' " " " ilaia The foreclosures for the month of August, 1S77, '78 and '7!) foot up as follows; 1877. No. foreclosures in month of Aupust...... 22G 1878. •• » " •' ....... 20, 1879. " " " " ....... Ill It will thus be seen that from every point of view the number of foreclosure sales are steadily decreasing, and we question if the year ISSO will see more than 900 forced transfers of property in tin's market. This is one of the surest indications that we have touched " Bed Kock " in real estate matters. The weak and insolvent have been weeded out, property has got .iato strong hands, and although there will be a good deal of real es¬ tate put upon ithe market by lenders, it will be from pei-sons who have foreclosed mortgages and who simply wish to realize the monej-- they had risked in loans. Our lists of judgments and mort¬ gages will not have the same painful interest they have had for many years back. It is the new sales and new prices, the advancing market, the better feeling which will hereafter be the topics discussed by real estate investors. -----------------«-»-»----------------- MINING AND REAL ESTATE. It is genei-ally expected that when money lias been made in stocks, merchandise, and general business.that then the profits will be invested in real estate. It is noticed that as labor *and realty are the last to decline in value, so thej' are tho last to revive after a period of general depression. Hence it is believed that when the flush times that are now upon us have run their com se, that the surplus monies w^ill be invested in real estate. It is natural that those who have a handsome sxurplus to their credit in banks should wish to have something more tangible to show than inter- e.sts in railroad companies, or stocks of goods in store. There is a sense of satisfaction in having your possessions in sight in the shape of good city lots and handsome city houses, and hence the ar¬ dent speculator in time takes au interest in real estate. There may be some little delay, however, due to tliR heavy investments which are quietlj- as well as openly being nmde in mining jiioperties. This business of buying bullion mines in Colorado or on the Pacific slope is rapidly becoming a mania. Every second man one meets has either bought some hundred or thousand shares of a cheap mining stock, or has " chipped in " with some friends to buy mining property with a view to developing and stO(;king it. If he has done neither he is thinking of doing so, and it is safe to say that before the end of the winter three-fourths of the speculatively inclined New Yorkers will be possessoi-s of mining properties in whole or in part, all the way beyond the Jlissouri, and generally in some inaccessible regiou where it cannot be watched. This new mania will for a time interfere with investments in real estate nearer home, but it will be only a delay. A great deal of monej- so used will be lost forever : much of it will help to develop the mineral resources of the countrj-, but it will be at a .serious costrto those who first invest. Of course some of the ventures will turn out very profit¬ able, and make a handsome return for those who are wise in selecting good properties. The .specu¬ lator proper will make money verj- soon, for he will not deal with the mines themselves, but in shares that represent them, and in time the profits made from this business will help the real estate market. But before