Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 25, no. 624: February 28, 1880

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

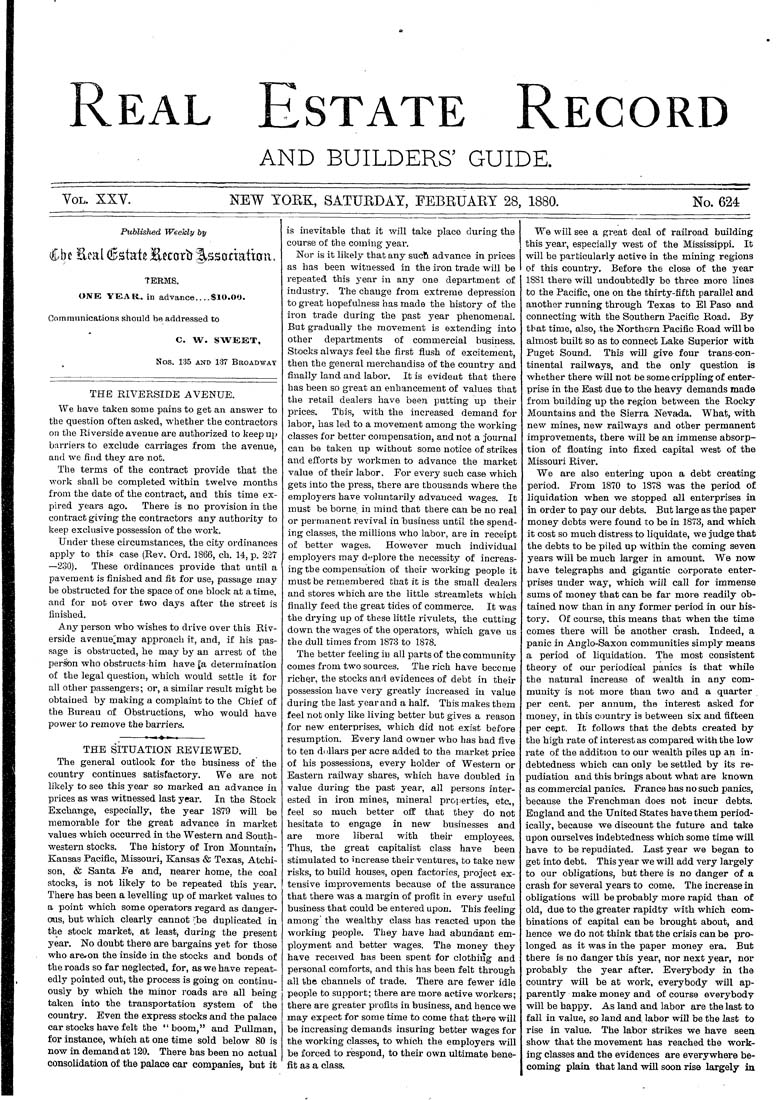

EAL Estate Record AND BUILDERS' GUIDE. YoL. XXY. NEW YORK, SATURDAY, FEBRUARY 28, 1880. No. 624 Published Weekly by Cbe Eeal €statBEetorb l^ssonatbu. TERMS. OIVE YEAR, in advance.. ..SIO.OO. Communications should be addressed to C. W. SA^^EET, Nos. 135 AND 137 Broadway THE RIVERSIDE AVENUE. We have taken some pains to get an answer to the question often asked, whether the contractors on the Riverside avenue are authorized to keep up barriers to exclude carriages from fche avenue, and we fiud fchey are nofc. The terms of the contract provide that the work shall be completed within twelve months from the date of the contract, and this time ex¬ pired years ago. There is no provision in the contract giving the contractors any authority fco keep exclusive possession of fche work. Under these circumstances, the city ordinances apply to this case (Rev. Ord. 1866, ch. 14, p. 227 —230). These ordinances provide that until a pavement is finished and fit for use, passage may be obstructed for the space of one block at a time, and for not over two days after the street is finished. Anj^ person who wishes to drive over this Riv¬ erside avenue;;may approach it, and, if his pas¬ sage is obstructed, he may by an arrest of the person who obsfcrucfcs him have {a defcermination of fche legal quesfcion, which would settle it for al! other passengers; or, a similar result might be obtained by making a complaint to the Chief of the Bureau of Obstructions, who would have power to remove the barriers. THE SITUATION REVIEWED. The general outlook for the business of the country continues safcisfacfcory. We are nofc likely to see this year so mai'ked an advance in prices as was witnessed last year. In the Stock Exchange, especially, the year 1879 will be memorable for the great advance in markefc values which occurred in the Western and South¬ western stocks. The history of Iron Mountain. Kansas Paciflc, Missouri, Kansas & Texas, Atchi¬ son, & Santa Fe and, nearer home, the coal sfcocks, is not likely to be repeated this year. There has been a levelling up of mai-ket values to a point which some operators regard as danger- ows, but which clearly cannot "be duplicated in the stock market, at least, during the present year. No doubt there are bargains yet for those who arcon fche inside in the sfcocks and bonds of the roads so far neglected, for, as we have repeat¬ edly pointed out, the process is going on continu¬ ously by which the minor roads are all being taken into the transportation system of the country. Even the express stocks and the palace car sfcocks have felfc the " boom," and Pullman, for instance, which at one time sold below 80 is now in demand at 120. There has been no actual consolidation of the palace car companies, but it is inevitable that it will take place during the course of the coming year. Nor is it likely that any sucft advance in prices as has been witnessed in the iron trade will be repeated this year in any one department of industry. The chauge from extreme depression to great hopefulness has made the history of the iron trade during the past year phenomenal. But gradually the movement is extending into other departments of commercial business. Stocks always feel the firsfc flush of excitement, then the general merchandise of the country and finally land and labor. It is evident that there has been so great an enhancement of values that the retail dealers have been pufcfcing up their prices. This, with the increased demand for labor, has led to a movement among the working classes for better compensation, and not a journal can be taken up without some notice of strikes and efforfcs by workmen to advance the market value of their labor. For every such case which gets into the press, there are thousands where the employers have voluntarily advanced wages. It must be borne in mind fchat fchere can be no real or permanenfc revival in business until the spend¬ ing classes, the millions who labor, are in receipt of better wages. However much individual employers maj^ deplore the necessity of increas¬ ing tbe compensation of their working people it must be remembered that it is the small dealers and stores which are fche little streamlets which finally feed the greac tides of commerce. It was the drying up of these little rivulets, the cutting down the wages of the operators, which gave us fche dull fcimes from 1873 to 1878. The better feeling iu all parts of the community comes from two sources. The rich have become richer, the stocks and evidences of debt in their possession have very greatly increased iu value during the last year and a half. This makes them feel not only like living better but gives a reason for new enterprises, which did not exist before resumption. Every land owner who has had five to ten di illars per acre added to the markefc price of his possessions, every holder of Western or Eastern railway shares, which have doubled in value during the past year, all persons inter¬ ested in iron mines, mineral projierties, etc., feel so much better off that they do not hesitate to engage in new businesses and are more liberal with their employees. Thus, the great capitalist class have been stimulated to increase their ventures, to take new risks, to build houses, open factories, project ex¬ tensive improvements because of the assurance that there was a margin of profit in every useful business that could be entered upon. This feeling among' the wealthy class has reacted upon the working people. They have had abundant em¬ ployment and better wages. The money they have received has been spent for clothing and personal comforts, and this has been felt through all the channels of trade. There are fewer idle people to support; there are more active workers; there are greater profits in business, and hence we may expect for some time to come fchat fchere will be increasing demands insuring befcter wages for the working classes, to which the employers will be forced to respond, to their own ultimate bene¬ fit as a class. We will see a great deal of railroad building this year, especially west of the Mississippi. Ifc will be parfcicularly acfcive in the mining regions of this country. Before tbe close of the year 1881 there will undoubtedly be three more lines to the Pacific, one on the thirty-fifth parallel and another running through Texas to El Paso and connecting with the Southern Pacific Pcoad. By that time, also, the Northern Pacific Road will be almost built so as to connect Lake Superior with Pugefc Sound. This will give four trans-con¬ tinental railways, and the only question is whether there will not be some crippling of enter¬ prise in the East due to the heavy demands made from building up the region between the Rocky Mountains and the Sierra Nevada. What, with new mines, new railways and other permanent improvements, there will be an immense absorp¬ tion of floating into fixed capital west of the Missouri River. We are also entering upon a debt creating period. From 1870 to 1S78 was the period of liquidation when we stopped all enterprises in in order to pay our debts. But large as the paper money debts were found to be in 1873, and which ifc cost so much distress to liquidate, we judge that the debts to be piled up within fche coming seven years will be much larger in amount. We now have telegraphs and gigantic corporate enter¬ prises under way, which will call for immense sums of money that can be far more readily ob¬ tained now than in any former period in our his¬ tory. Of course, this means that when the time comes there will be another crash. Indeed, a panic in Anglo-Saxon communities simply means a period of liquidation. The most consistent theory of our periodical panics is that while the natural increase of wealth in any com¬ munity is not more than two and a quarter per cenfc. per annum, the interest asked for money, in fchis counfcry ia befcween six and fifteen per cejifc. It follows that the debts created by the high rate of interest as compared with the low rate of the addition to our wealth piles up ap in¬ debtedness which can only be settled by its re¬ pudiation and this brings about whafc are known as commercial panics. France has no such panics, because fche Frenchman does nofc incur debts. England and the United States have them period¬ ically, because we discount the future and take upon ourselves indebtedness which some time will have to be repudiated. Lasfc year we began to get into debt. This year we will add very largely to our obligations, but there is no danger of a crash for several years to come. The increase in obligations will be probably more rapid than of old, due to the greater rapidty with which com¬ binations of capital can be brought about, and hence we do not think thafc the crisis can be pro¬ longed as ifc was in the paper money era. But there is no danger this year, nor next year, nor probably the year after. Everybody in the country will be afc work, everybody will ap¬ parently make money and of course everybody will be happy. As land and labor are the last to fall in value, so land and. labor will be the lasfc to rise in value. The labor strikes we have seen show that the movement has reached the work¬ ing classes and the evidences are everywhere be¬ coming plain that land will soon rise largely in