Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 29, no. 730: March 11, 1882

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

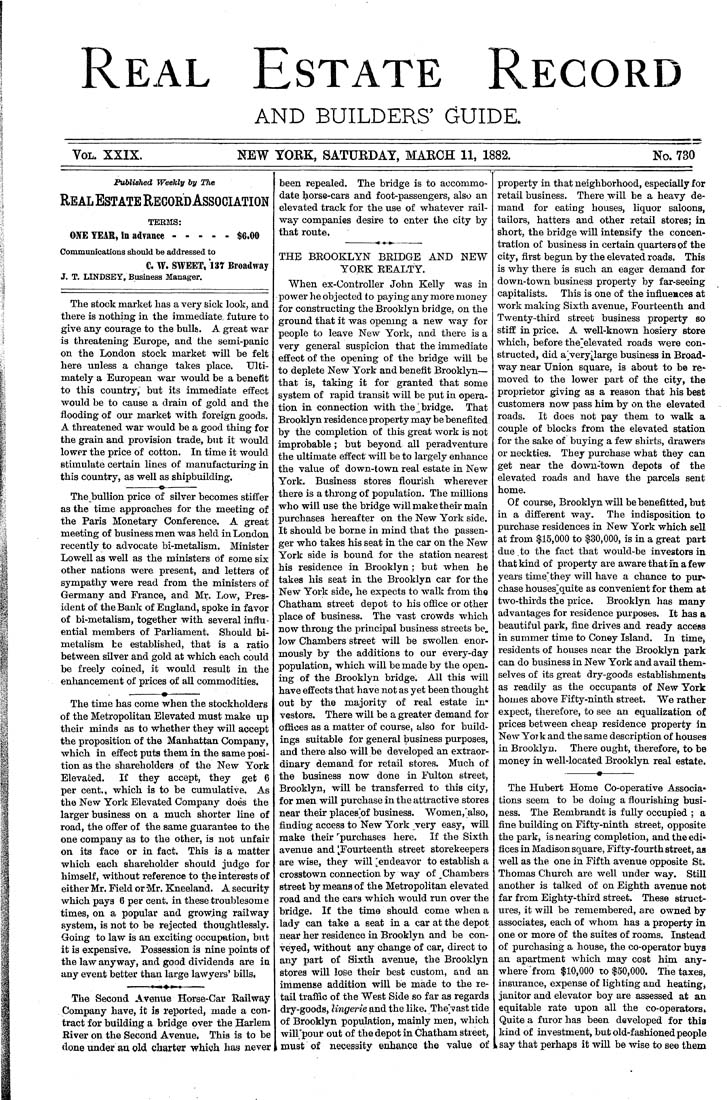

Real Estate Record AND BUILDERS^ GUIDE. Vol. XXIX. NEW YOEK, SATUEDAY, MAECH 11. 1882, No. 730 Published Weekly by The Real Estate Record Association TERMS: 0]^E ¥EiR, in adrance.....$6.00 Communications should be addressed to C. W. SWEET, 131 Broadway J. T. LINDSEY, Business Manager. The stock market lias a very sick look, and there is nothing in the immediate future to give any courage to the bulls. A great war is threatening Europe, and the semi-panic on the London stock market wUl be felt here unless a change takes place. Ulti¬ mately a European war would be a benetit to this country, but its immediate effect would be to cause a drain of gold and the flooding of our market with foreign goods. A threatened war would be a good thing for the grain and provision trade, but it would lower the price of cotton. In time it would stimulate certain lines of manufacturing in this country, as well as shipbuilding. The bullion price of silver becomes stiffer as the time approaches for the meeting of the Paris Monetary Conference. A great meeting of business men was held in London recently to advocate bi-metalism. Minister Lowell as well as the ministers df some six other nations were present, and letters of sympathy were read from the ministers of Germany and France, and Mr. Low, Pres¬ ident of the Bank of England, spoke in favor of bi-metalism, together with several influ¬ ential members of Parliament. Should bi- metalism be established, that is a ratio between silver and gold at which each could be freely coined, it would result in the enhancement of prices of all commodities. The time has come when the stockholders of the Metropolitan Elevated must make up their minds as to whether they will accept the proposition of the Manhattan Company, which in effect puts them in the same posi¬ tion as the shareholders of the New York Elevated. If they accept, they get 6 per cent., which is to be cumulative. As the New York Elevated Company does the larger business on a much shorter line of road, the offer of the same guarantee to the one company as to the other, is not unfair on its face or in fact. This is a matter which each shareholder should judge for himself, without reference to the interests of either Mr. Field or Mr, Kneeland. A security which pays 6 per cent, in these troublesome times, on a popular and growing railway system, is not to be rejected thoughtlessly. Going to law is an exciting occupation, but it is expensive. Possession is nine points of the law anyway, and good dividends are in any event better than large lawyers' bills. »^i ♦ ^» The Second Avenue Horse-Car Railway Company have, it is reported, made a con¬ tract for building a bridge over the Harlem lliver on the Second Avenue. This is to be done under an old charter which hag never been repealed. The bridge is to accommo¬ date horse-cars and foot-passengers, also an elevated track for the use of whatever rail¬ way companies desire to enter the city by that route. THE BROOKLYN BRIDGE AND NEW YORK REALTY. When ex-Controller John Kelly was in power he objected to paying any more money for constructing the Brooklyn bridge, on the ground that it was openmg a new way for people to leave New York, and there is a very general suspicion that the immediate effect of the opening of the bridge will be to deplete New York and beneflt Brooklyn— that is, taking it for granted that some system of rapid transit will be put in opera¬ tion in connection with the',bridge. That Brooklyn residence property may be benefited by the completion of this great work is not improbable ; but beyond all peradventure the ultimate effect will be to largely enhance the value of down-town real estate in New York. Business stores flourish wherever there is a throng of population. The milhons who will use the bridge wiU make their main purchases hereafter on the New York side. It should be borne in mind that the passen¬ ger who takes his seat in the car on the New York side is bound for the station nearest his residence in Brooklyn ; but when he takes his seat in the Brooklyn car for the New York side, he expects to walk from the Chatham street depot to his oflSce or other place of business. The vast crowds which now throng the principal business streets be,, low Chambers street will be swollen enor¬ mously by the additions to our every-day population, which will be made by the open- ing of the Brooklyn bridge. All this will have effects that have not as yet been thought out by the majority of real estate in' vestors. There wUl be a greater demand for oflices as a matter of course, also for build¬ ings suitable for general business purposes, and there also will be developed an extraor¬ dinary demand for retail stores. Much of the business now done in Fulton street, Brooklyn, will be transferred to this city, for men will purchase in the attractive stores near their places]of business. Women,'also, finding access to New York very easy, will make their ""purchases here. If the Sixth avenue and I^Fourteenth street storekeepers are wise, they will Endeavor to establish a crosstown connection by way of ^Chambers street by means of the Metropolitan elevated road and the cars which would run over the bridge. If the time should come when a lady can take a seat in a car at the depot near her residence in Brooklyn and be con¬ veyed, without any change of car, direct to any part of Sixth avenue, the Brooklyn stores will lose their best custom, and an immense addition will be made to the re¬ tail traffic of the West Side so far as regards dry-goods, lingerie and the like. Thejast tide of Brooklyn population, mainly men, which win'pour out of the depot in Chatham street, must of necessity enhance the value of property in that neighborhood, especially for retail business. There will be a heavy de¬ mand for eating houses, liquor saloons, tailors, hatters and other retail stores; in short, the bridge will intensify the concen¬ tration of business in certain quarters of the city, first begun by the elevated roads. This is why there is such an eager demand for down-town business property by far-seeing capitalists. This is one of the influeaces at work making Sixth avenue, Fourteenth and Twenty-third street business property so stiff in price. A well-known hosiery store which, before the'elevated roads were con¬ structed, did a'very^arge business in Broad¬ way near Union square, is about to be re» moved to the lower part of the city, the proprietor giving as a reason that his best customers now pass him by on the elevated roads. It does not pay them to walk a couple of blocks from the elevated station for the sake of buying a few shirts, drawers or neckties. They purchase what they can get near the down-town depots of the elevated roads and have the parcels sent home. Of course, Brooklyn will be benefitted, but in a different way. The indisposition to purchase residences in New York which seU at from $15,000 to $30,000, is in a great part due to the fact that would-be investors in that kind of property are aware that in a few years time'they will have a chance to pur* chase houses^^quite as convenient for them at two-thirds the price. Brooklyn has many advantages for residence purposes. It has a beautiful park, fine drives and ready access in summer time to Coney Island. In time, residents of houses near the Brooklyn park can do business in New York and avail them¬ selves of its great dry-goods establishments as readily as the occupants of New York homes above Fifty-ninth street. We rather expect, therefore, to see an equalization of prices between cheap residence property in New York and the same description of houses in Brooklyn. There ought, therefore, to be money in well-located Brooklyn real estate. The Hubert Home Co-operative Associa* tions seem to be doing a flourishing busi¬ ness. The Rembrandt is fully occupied ; a fine building on Fifty-ninth street, opposite the park, is nearing completion, and the edi¬ fices in Madison square. Fifty-fourth street, aa well as the one in Fifth avenue opposite St. Thomas Church are well under way. Still another is talked of on Eighth avenue not far from Eighty-third street. These struct¬ ures, it will be remembered, are owned by associates, each of whom has a property in one or more of the suites of rooms. Instead of purchasinjg a house, the co-operator buys an apartment Avhich may cost him any- wherefrom $10,000 to $50,000. The taxes, insurance, expense of lighting and heating, janitor and elevator boy are assessed at an equitable rate upon all the co-operators» Quite a furor has been developed for this kind of investment, but old-fashioned people , say that perhaps it will be wise to see them