Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

The Record and guide: v. 35, no. 900: June 13, 1885

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

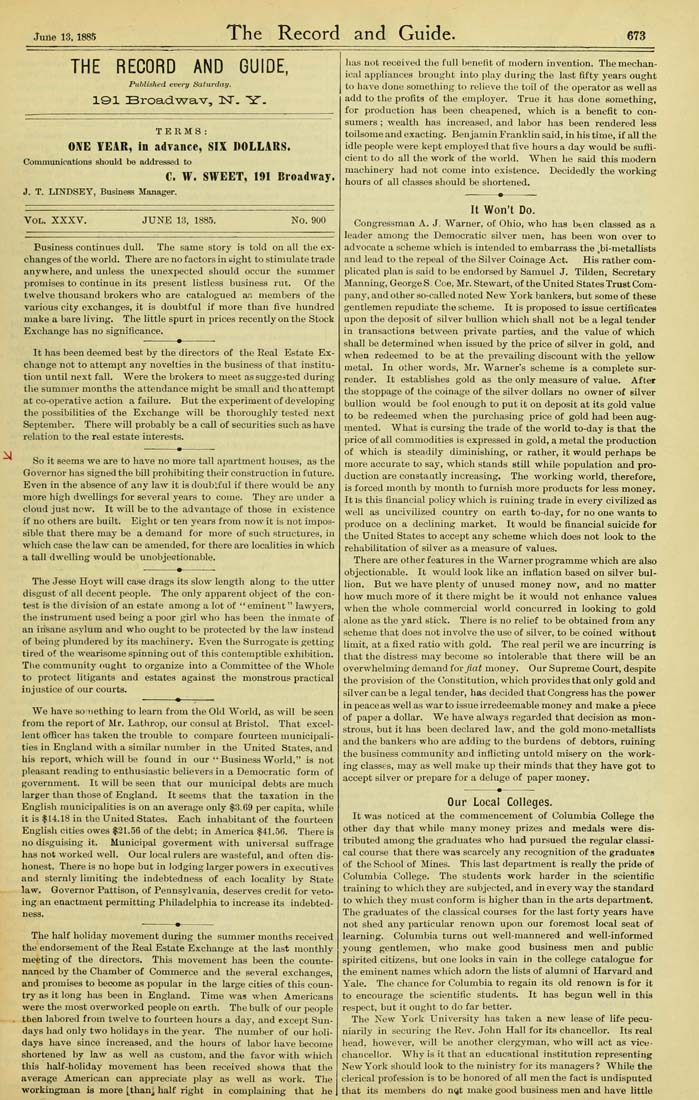

June 13, 1885 The Record and Guide. 673 THE RECORD AND GUIDE, Publi.-ilu'd every Satnrdatj. 191 Broadwav, 1>T. "ST. TERMS: ONE TEAR, in advance, SIX DOLLARS. Cotnmunications should be addi-essed to C. W. SWEET, 191 Broadway. 3. T. LINDSEY, Business Mauager. Vol. XXXV. JUNE 13, 1885. No. 900 Business continues dull. The same story is told on all tbe ex¬ changes of the world. There are no factors in eight to stimulate trade anywhere, and unless the unexpected should occur the summer promises to continue iu its present listless business rut. Of tbe twelve thousand brokers who are catalogued ar, members of the various city exchanges, it is doubtful if more than five hundred make a bare living. The little spurt in jirices recently on the Stock Exchange has no significance. It has been deemed best by the directors of the Real Estate Ex¬ change not to attempt any novelties in the business of that institu¬ tion until next fall. Were the brokers to meet as suggested during the summer months the attendance might be small and tho attempt at co-operative action a failure. But the experiment of developing the possibilities of the Exchange will be thorougldy tested next September. There will probably be a call of securities such as have relation to the real estate interests. So it seems we are to have no more tall apartmeut houses, as the Governor has signed the bUl prohibiting their construction in future. Even in the absence of any law it is doublful if there would be any more high dwellings for several years to come. They are under a cloud just now. It will be to the advantage of those in existence if no others are built. Eight or ten years from now it is not impos¬ sible that there may be a demand for more of such structures, in which case the law can be amended, for there are localities in which a tall dwelling would be unobjectionable. The Jesse Hoyt will case drags its slow length along to the utter disgust of all decent people. The only apparent object of the con¬ test is the division of an estate among a lot of " eminent" lawyers, the instrument used being a poor girl who has been the inmate of an insane asylum and who ought to be protected by the law instead of being plundered by its machinery. Even the Surrogate is getting tired of the wearisome spinning out of this contemptible exhibition. The community ought to organize into a Committee of the Whole to protect litigants and estates against the monstrous practical injustice of our courts. We have souething to learn from the Old World, as will be seen from the report of Mr. Lathrop, our consul at Bristol. That excel¬ lent officer has taken the trouble to compare fourteen municipali¬ ties in England with a similar number in the United States, and his report, which will be found in our " Business World," is not pleasant reading to enthusiastic believers in a Democratic form of governmeut. It will be seen that our municipal debts are much larger than those of England. It seems that the taxation in the English municipalities is on an average only .|3.69 per capita, while it is 114.18 in the UuitedStates. Each inhabitant of the fourteen English cities owes $21.56 of the debt; in America $41.56. There is no disguising it. Municipal goverment with universal suffrage has not worked well. Our local rulers are wasteful, and often dis¬ honest. There is uo hope but in lodging larger powers in executives and sternly limiting the indebtedness of each locality by State law. Governor Pattison, of Pennsylvania, deserves credit for veto¬ ing an enactment permitting Philadelphia to increase its indebted¬ ness. The half holiday movement during the summer months received the endorsement of the Real Estate Exchange at the last monthly meeting of the directors. This movement has been the counte¬ nanced by the Chamber of Commerce and the several exchanges, and promises to become as popular in the large cities of this coun¬ try as it long has been in England. Time was when Americans were the most overworked people on earth. The bulk of our people then labored from twelve to fourteen hours a day, and except Sun¬ days had only two holidays in the year. The number of our holi¬ days have since increased, and the hours of labor have become shortened by law as well as custom, and the favor with which this half-holiday movement has been received shows that the average American can appreciate play as well as work. The workingman is more [than^ half right in complaining that he has uot received the full benefit of modern invention. The mechan¬ ical appliances brought into play during the last fifty years ought to have done something to relieve the toil of the operator as well as add to the profits of the employer. True it has done something, for production has been cheapened, which is a benefit to con¬ sumers ; wealth has increaseil, and labor has been rendered less toilsome and exacting. Benjamin Frankliu said, in his time, if all the idle people were kept employed that five hours a day would be suffi¬ cient to do all the work of the world. When he said this modern machinery had not come into existence. Decidedly the working hours of all classes should be shortened. It Won't Do. Congressman A. J. Warner, of Ohio, who has bten classed as a leader among the Democratic silver men, has been won over to advocate a scheme which is intended to embarrass the ,bi-nietallists and lead to the repeal of the Silver Coinage Act. His rather com¬ plicated plan is said to be endorsed by Samuel J. Tilden, Secretary Manning, George S, Coe, Mr. Stewart, of the United States Trust Com¬ pany, aud other so-called noted New York bankers, but some of these gentlemeii repudiate the scheme. It is proposed to issue certificates upon the deposit of silver bullion which shall not be a legal tender in transactions between private parties, and the value of which shall be determined when issued by the price of silver in gold, and when redeemed to be at the prevailing discount with the yellow metal. In other words, Mr. Warner's scheme is a complete sur¬ render. It establishes gold as the only measure of value. After the stoppage of the coinage of the silver dollars no owner of silver bullion would be fV)ol enough to put it on deposit at its gold value to be redeemed wheu the purchasing price of gold had been aug¬ mented. What is cursing the trade of the world to-day is that the price of all commodities is expressed in gold, a metal the production of which is steadily diminishing, or rather, it would perhaps be more accurate to say, which stands still while population and pro¬ duction are constaatly increasing. The working world, therefore, is forced mouth by month to furnish more products for less money. It is this financial policy which is ruining trade in every civilized as well as uncivilized country on earth to-day, for no one wants to produce on a declining market. It would be financial suicide for the United States to accept any scheme which does not look to the rehabilitation of silver as a measure of values. There are other features in the Warner programme which are also objectionable. It would look like an inflation based on silver bul¬ lion. But we have plenty of unused money now, and no matter how mucli more of it there might be it would not enhance values when the whole commercial world concurred in looking to gold alone as the yard stick. There is no relief to be obtained from any scheme that does uot involve the use of sih'er, to be coined without limit, at a fixed ratio with gold. The real peril we are incurring is that the distress may become so intolerable that there will be an overwhelming demand tor fiat money. Our Supreme Court, despite the provision of the Constitution, which provides that only gold and silver can be a legal tender, has decided that Congress has the power in peace as well as war to issue irredeemable money and make a p'ece of paper a dollar. We have always regarded that decision as mon¬ strous, but it has been declared law, and the gold mono-metallists and the bankers who are adding to the burdens of debtors, ruining the business community and inflicting untold misery on the work¬ ing classes, may as well make up their minds that they have got to accept silver or prepare for a deluge of paper money. Our Local Colleges. It was noticed at the commencement of Columbia College the other day that while many money prizes and medals were dis¬ tributed among the graduates who had pursued tbe regular classi¬ cal course that there was scarcely any recognition of the graduates of the School of Mines. This last department is really the pride of Columbia College. The students work harder in the scientific training to which they are subjected, and in every way the standard to which they must conform is higher than in the arts department. The graduates of the classical courses for the last forty years have not shed any particular renown upon our foremost local seat of learning. Columbia turns out well-mannered and well-informed young gentlemen, who make good business men and public spirited citizens, but one looks in vain in the college catalogue for the eminent names which adorn the lists of alumni of Harvard and Yale. The chance for Columbia to regain its old renown is for it to encourage the scientific students. It has begun well in this respect, but it ought to do far better. The New York University has taken a new lease of life pecu¬ niarily in securing the Rev. John Hall for its chancellor. Its real head, however, will be another clergyman, who will act as vice- chancellor. Why is it that an educational institution representing NewYork should look to the ministry for its managers? While the clerical profession is to be honored of all men the fact is undisputed that its members do nijt make good business men and have little