Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 69, no. 1767]: January 25, 1902

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

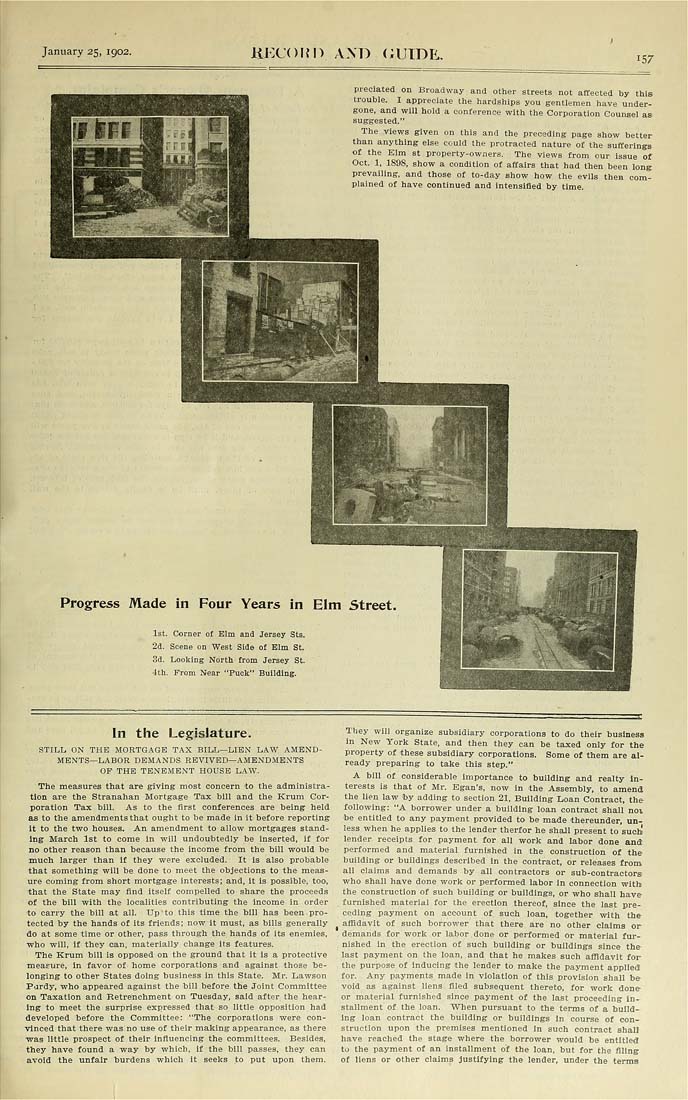

January 25, igo2. llKCOUn A\D <;UTDE, 157 predated on Broadway and other streets not affected by this trouhle. I appreciate the hardships you gentlemen have under¬ gone, and will hold a conference with the Corporation Counsel as suggested." The views given on this and the preceding page show better than anything else ccuid the protracted nature of the sufferings of the Elm st property-owners. The views from our issue of Oct. 1, 1S9S, show a condition of affairs that had then been long prevailing, and those of to-day show how the evils then com¬ plained of have continued and intensified by time. Progress Made in Four Years in Elm Street 1st. Corner of Elm and Jersey Sta. 2d, Scene on West Side of Elm St. 3d, Looking North from Jersey St. 4th. From Near "Puck" Building. In the Legislature. STILL ON THE MORTGAGE TAX BILi,—LIEN L,AW AMEND¬ MENTS—LABOR DEMANDS REVIVED—AMENDMENTS OF THE TENEMENT HOUSE LAW, The m.easures that are giving most concern to the administra¬ tion are the Stranahan Mortgage Tax bill and the Krum Cor¬ poration Tax bill. As to the first conferences are being held as to the amendments that ought to he made in it before reporting it to the two houses. An amendment to allow mortgages stand¬ ing March 1st to come in will undoubtedly be inserted, if for no other reason than because the income from the bill would be much larger than if they were excluded. It is also probable that something will be done to meet the objections to the meas¬ ure coming from short mortgage interests; and, it is possible, too, ■that the State may find itself compelled to share the proceeds of the bill with the localities contributing the income in order to carry the bill at all. Up'to this time the bill has been pro¬ tected by the hands of its friends; now it must, as bills generally do at some time or other, pass through the hands of its enemies, who will, if they can, materially change its features. The Krum bill is opposed on the ground that it is a protective measure, in favor of home corporations and against those be¬ longing to other States doing business in this State, Mr. Lawson Pardy, who appeared against the bill before the Joint Committee on Taxation and Retrenchment on Tuesday, said after the hear¬ ing to tneet the surprise expressed that so little opposition had developed before the Committee: "The corporations were con¬ vinced that there was no use of their making appearance, as there was little prospect of their Influencing the committees. Besides, they have found a w^ay by which, if the bill passes, they can avoid the unfair hurdens which it seeks to put upon them. They wili organize subsidiary corporations to do their business in New Tork State, and then they can be taxed only for the property of these subsidiary corporations. Some of them are al¬ ready preparing to take this step." A bill of considerable importance to building and realty In¬ terests is that of Mr. Egan's, now in the Assembly, to amend the lien law by adding to section 21, Building Loan Contract, the following: "A borrower under a building loan contract shall noi he entitled to any payment provided to be made thereunder, un¬ less when he applies to the lender therfor he shall present to such lender receipts for payment for all work and labor done and performed and material furnished in the construction of the building or buildings described in the contract, or releases from all claims and demands by all contractors or sub-contractors who shall have done work or performed labor in connection with the construction of such building or buildings, or who shall have- furnished material for the erection thereof, since the last pre¬ ceding payment on account of such loan, together with the- ^ affidavit of such borrower that there are no other claims or . demands for work or labor done or performed or material fur¬ nished in the erection of such building or buildings since the- last payment on the loan, and that he makes such affidavit for the purpose of inducing the lender to make the payment appliea for. Any payments made in violation of this provision shall be- void as against liens filed subsequent thereto, for work done or material furnished since payment of the last proceeding in¬ stallment of the loan. When pursuant to the terms of a build¬ ing loan contract the building or buildings in course of con¬ struction upon the premises mentioned In such contract shall have reached the stage where the borrower would be entitled to the payment of an installment of the loan, but for the filing of liens or other claims justifying the lender, under the terms