Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 71, no. 1817: January 10, 1903

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

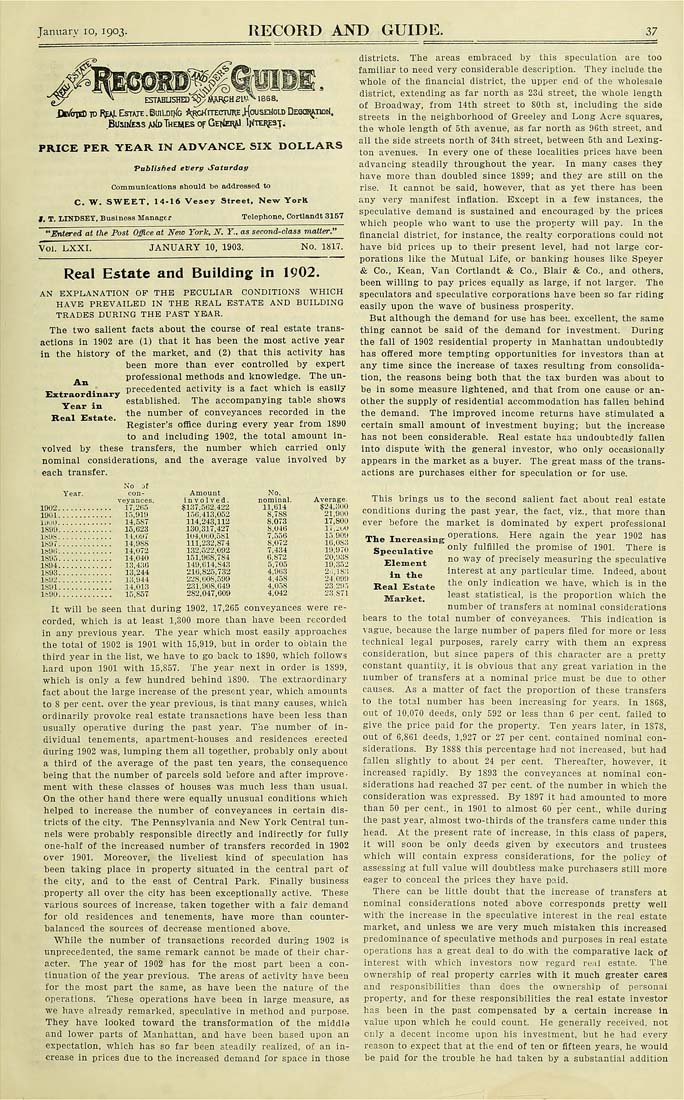

January lo, 1903. RECORD AND GUIDE. 37 e> ito&iiO TO RpJkL EsTWE. BihLoij/g A.RC'ifrrEcmn^ ,h(mjsnJou) DEOCntftiiDiJ. Busitfeas aiId Themes of GeHer^ lKTCRp3-ii PRICE PER YEAR IN ADVANCE, SIX DOLLARS Pabtlshed eVerp Satardag Communications should be addressed to C. W. SWEET. 14-16 Vesey Street, New Yortt 1. T. LINDBET, Business Manager Telephone. Cortlandt 3157 "Entered at the Post Office at New York, N. Y., as second-class matter." NO. I)il7. Vol. L,XXI. JANUARY 10, 1903. Real Estate and Building in 1902. AN EXPLANATION OF THE PECULIAR CONDITIONS WHICH HAVE PREVAILED IN THE REAL, ESTATE AND BUILDING TRADES DURING THE PAST YEAR. The two salient facts about the course of real estate trans¬ actions in 1902 are (1) tliat it lias been the most active year in the history of the market, and (2) that this activity has been more than ever controlled by expert . professional methods and knowledge. The un- _, ^ ,,■ precedented activity is a fact which is easily „ . established. The accompanying table shows ^ , „, . , the number of conveyances recorded in the Real Estate, _ , „ , . ^ ,o,„. Register s office during every year from 1S90 to and including 1902, the total amount in¬ volved by these transfers, the number which carried only nominal considerations, and the average value involved by each transfer. .S"0 it Year, con- Amount No. veyances. involved. nominal. Average. 1002............. 17.260 $137,562,422 11,614 $-J4,;W0 11)01............. 15,019 l.>0,413,052 8,7S8 21,01X1 \.:f.s\)............. 14.5ST 114,243,112 8,073 17,800 1809............. 15,623 130.317,427 - 8,046 17,iW) latlS............. 14,<'y7 1U4,U1jO,5S1 7,556 lo.OOil Ihyr............. 14,9SS 111,2.32,874 8,072 16.08:! last;............. 14,072 132,022.002 7,434 19,070 1895............. 14,040 151,9158,784 6,872 20,938 1894............. VA.-i-'-H 149,U14,S43 5,705 19,352 1893............. 13,244 216,825,732 4,963 2u,]S.-i IftO^............. 13.944 228,60H,i)99 4,458 24.699 1891............. 14,013 2.31,908,649 4.0-)8 23,2!!.', 1590............. 15,857 282,047,609 4,042 23,S7t It will be seen that during 1902, 17,265 conveyances were re¬ corded, which is at least 1,300 more than have been recorded in any previous year. The year which most easily approaches the total of 1802 is 1901 with 15,919, but in order to obtain the third year in the list, we have to go back to 1890, which follows hard upon 1901 with 15,S57. The year next in order is 1S99, which is only a few hundred behind 1890. The extraordinary fact about the large increase of the present year, which amounts to 8 per cent, over the year previous, is that macy causes, which ordinarily provoke real estate transactions have been less than usually operative during the past year. The number of in¬ dividual tenements, apartment-houses and residences erected during 1902 was, lumping them all together, probably only about a third of the average of the past ten years, the consequence being that the number of parcels sold before and after improve¬ ment with these classes of houses was much less than usual. On the other hand there were equally unusual conditions which helped to increase the number of conveyances in certain dis¬ tricts of the city. Tbe Pennsylvania and New York Central tun¬ nels were probably responsible directly and indirectly for fully one-half of the increased number of transfers recorded in 1902 over 1901. Moreover, the liveliest Itind of speculation has been taking place in property situated in the central part of the city, and to the east of Central Park. Finally business .property all over the city has been exceptionally active. These various sources of increase, taken together with a fair demand for old residences and tenements, have more than counter¬ balanced the sources of decrease mentioned above. While the number of transactions recorded during 1902 is unprecedented, the same remark cannot be made of their char¬ acter. The year of 1902 has for the most part been a con¬ tinuation of the year previous. The areas of activity have been for the most part the same, as have been the nature of the operations. These operations have been in large measure, as we have already remarked, speculative in method and purpose. They have, looked toward the transformation of the middle and lower parts of Manhattan, and have been based upon an expectation, which has so far been steadily realized, of an in¬ crease in prices due to the increased demand for space ia those districts. The areas embraced by this speculation are too familiar to need very considerable description. They include the whole of the financial district, the upper end of the wholesale district, extending as far north as 23d street, the whole length of Broadway, from 14th street to SOth st, including the side streets in the neighborhood of Greeley and Long Acre squares, the whole length of 5th avenue, as far north as 9Gth street, and all the side streets north of 34th street, between Sth and Lexing¬ ton avenues. In every one of these localities prices have been advancing steadily throughout the year. In many cases they have more than doubled since 1S99; and they are still on the rise. It cannot be said, however, that as yet there has been any very manifest inflation. Except in a few instances, the speculative demand is sustained and encouraged by the prices which people who want to use the property will pay. In the financial district, for instance, the realty corporations could not have bid prices up to their present level, had not large cor¬ porations like the Mutual Life, or banking houses like Speyer & Co., Kean, Van Cortlandt & Co., Blair & Co., and othea's, been willing to pay prices equally as large, if not larger. The speculators and speculative corporations have been so far riding easily upon the wave of business prosperity. Bat although the demand for use has beei. excellent, the same thing cannot be said of the demand for investment. During the fall of 1902 residential property in Manhattan undoubtedly has offered more tempting opportunities for investors than at any time since the increase of taxes resulting from consolida¬ tion, the reasons being both that the tax burden was about to be in some measure lightened, and that from one cause or an¬ other the supply of residential accommodation has fallen behind the demand. The improved income returns have stimulated a certain small amount of investment buying; but tbe increase has not been considerable. Real estate has undoubtedly fallen into dispute with the general investor, who only occasionally appeai-s in the market as a buyer. The great mass of the trans¬ actions are purchases either for speculation or for use. This brings us to the second salient fact about real estate conditions during the past year, the fact, viz., that more than ever before the market is dominated by expert professional operations. Here again the year 1902 has 'only fulfilled the promise of 1901. There is no way of precisely measuring tbe speculative interest at any particular time. Indeed, about the only indication we have, which is in tho least statistical, is the proportion which the number of transfers at nominal considerations bears to tbe total number of conveyances. This indication is vague, because the large number of papers filed for more or less technical legal purposes, rarely carry with them an express consideration, but since papers of this character are a pretty constant quantity, it is obvious that any great variation iu the number of transfers at a nominal price must be due to other causes. As a matter of fact the proportion of these transfers to the total number has been increasing for years. In 1S68, out of 10,070 deeds, only 592 or less than 6 per cent, failed to give the price paid for the property. Ten years later, in 1878, out of e,S61 deeds, 1,927 or 27 per cent, contained nominal con¬ siderations. By 1S8S this percentage hL=d not increased, but had fallen slightly to about 24 per cent. Thereafter, however, it increased rapidly. By 1893 the conveyances at nominal con¬ siderations bad reached 37 per cent, of the number in which the consideration was expressed. By 1S97 it had amounted to more than 50 per cent., in 1901 to almost 60 per cent., while during the past year, almost two-thirds of the transfers came under this head. At the present rate of increase, in this class of papers, it will soon be only deeds given by executors and trustees which will contain express considerations, for the policy of assessing at full value will doubtless make purchasers still more eager to conceal the prices they have paid. There can be little doubt that the increase of transfers at nominal considerations noted above corresponds pretty well with the increase in the speculative interest in the real estate market, and unless we are very much mistaken this increased predomiuanee of speculative methods and purposes in real estate operations has a great deal to do .with the comparative lack of Interest with which investors now regard ix-.-il e3t:ite. 'l"lie ownership of real property carries with it much greater cares and responsibilities than does the ownership of personal property, and for these responsibilities tbe real estate investor has been in the past compensated by a certain increase In value upon which he could count. He generally received, not only a decent income upon his investment, but he had every reason to expect that at the end of ten or fifteen years, he would be paid for the trouble he had taken by a substantial addition Tlie Increasing Speenlative Element in the Real Estate Market.