Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 41, no. 1041: February 25, 1888

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

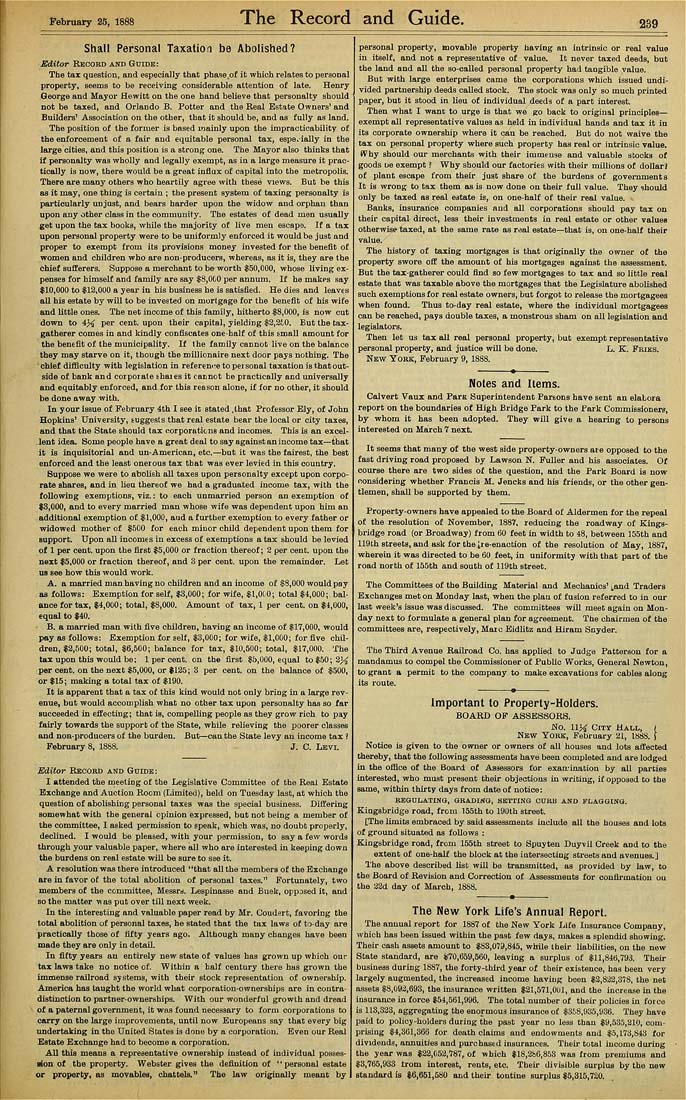

February 25, 1888 The Record and Guide. 239 Shall Personal Taxation be Abolished? Editor REGoan anu Guide: The tax question, and especially that phase.of it which relates to peraonal property, seema to be receiving considerable attention of late. Henry George and Mayor Hewitt on the one hand believe that personalty should not be taxed, and Orlando B. Potter and the Real Estate Owners'and Builders' Association ou the other, that it should ba, and as fully as land. The position of the former is based mainly upon the impracticability of the enforcement of a fair and equitable personal tax, especially in the large cities, and this position is a strong one. The Mayor also thinks that if personalty was wholly and legally exempt, as in a large measure it prac¬ tically is now, there would be a great influx of capital into the metropolis. There are many others who heartily agree with these views. But be this as it may, one thing is certain ; the present system of taxing personalty is particularly unjust, and bears harder upon the widow and orphan tban upon any other class in the community. The estates of dead men usually get upon the tax books, while the majority ot live men escape. If a tax upon personal property were to be uniformly enforced it would be just aud proper to exempt from its provisions money invested for the beneflt of women aud children who are non-pro due ers, whereas, as it is, they are the chief sufferers. Suppose a merchant to be worth $50,000, whose living ex- penaea for himaelf and family are say $8,OCO per annum. If he makes eay 110,000 to ^13,000 a year in bis business be is satisfied. He dies and leaves all his estate by will to be invested on mortgage for the beneflt of his wife and Uttle ones. The net income of tbia family, hitherto $S,000, is now cut down to 4}4 P^r cent, upon their capital, yielding $2|8£0. But tbe tax- gatherer comes in and kindly conflscates one-half of this small amount for the benefit of the municipality. If the family cannot live on the balance they may starve on it, though the millionaire next door pays nothing. The chief difficulty with legislation in refereniie topeisonal taxation is that out¬ side of bank and corporate thaies it cannot be practically and universally and equitably enforced, and for tbia reason alone, if for no other, it should be done away with. In your isaue of February 4th I see it stated ,that Professor Ely, of John Hopkins' University, Buggeats tbat real estate bear the local or city taxea, and that the State should tax corporations and incomea. This is an excel¬ lent idea. Some people have a great deal to say against an income tax—tbat it is inquisitorial and un-American, etc.—but it was the fairest, the best enforced and tbe least onerous tax that was ever levied in this couutry. Suppose we were to aboUsh all taxes upon personalty except upon corpo¬ rate shares, and in lieu thereof we had a graduated income tax, with the following exemptions, viz.: to each unmarried person an exemption of $3,000, and to every married man whose ^ife was dependent upon him an additional exemption of $1,000, aud a further exemption to every father or widowed mother of $500 for each minor child dependent upon them for support. Upon all incomes in excess of exemptions a tax should be levied of 1 per cent, upon the first $5,000 or fraction thereof; 2 per cent, upon the next $5,000 or fraction thereof, and 3 per cent, upon the remainder. Let UB see how this would work. A. a married man having no children and an income of S8,000wouIdpQy as foUowE: Exemption for self, $3,000; for wife, $l,0CO; total $4,000; bal¬ ance fortax, $4,000; total, $8,000. Amount of tax, 1 per cent, on $4,000, equal to $40. B, a married man with five children, having an income of $17,000, would pay as follows: Exemption for self, $3,000; for wife, $1,000; for five chil¬ dren, $3,500; total, $6,500; balance for tax, $10,500; total, $17,000, The tax upon this would be; 1 per cent, on the flrst $5,000, equal to $50; 3)^ per cent, ou the next $5,000, or $125; 3 per cent, on the balance of $500, or $15; making a total tax of $190. It is apparent that a tax of thia kind would not only bring in a large rev¬ enue, but would accomplish what no otber tax upon personalty has ao far succeeded in effecting; that ia, compelling people as tbey grow rich to pay fairly towards the support of the State, while relieving the poorer classes and noB-producera of the burden. But—can the State levy an income tax ? Februarys, 18SS. J, C, Levi, Editor Record and Guide: I attended the meeting of the Legislative Committee of the Real Estate Exchange and Auction Room (Limited), held on Tuesday laat, at whicb the question of abohshing personal taxes was the special business. Differing somewhat with tbe general opinion expressed, but not being a member of the committee, I asked permisaion to speak, which waa, no doubt properly, declined, I would be pleased, with your permisaion, to say a few woi'da through your valuable paper, where all wbo are interested in keeping down the burdens on real estate will be sure to see it. A resolution was there introduced "that all tbe members of the Exchange are in favor of tbe total abolition of personal taxes." Fortunately, two members of the committee, Messrs. Leapinaaae and Buek, opposed it, and BO the matter v( as put over till next week. In the interesting and valuable paper read by Mr. Coud?rt, favoring the total abolition uf personal taxes, he stated that the tax laws of to-day are practically those of fifty years ago. Although many changes have been made they are only in detail. In fifty years an entirely new state of values has grown up which our tax laws take no notice of. Within a half century there haa grown tbe immense railroad systems, with their stock representation of ownership. America has taught the world what corporation-ownerships are in contra- diatmction to partner-ownerahipa. With our wonderful growth and dread of a paternal government, it was found necessary to form corporations to carry on the large improvements, until now Europeans say that every big undertaking in the United States ia done by a corporation. Even our Real Estate Exchange had to become a corporation. All tbis means a representative ownership instead of individual posses- ffion of tbe property. Webster gives the definition of "personal estate or property, as movables, chattels." The law originally meant by personal property, movable property having au intrinsic or real value in itaelf, and not a. representative of value. It never taxed deeds, but tbe land and all the so-called personal property had tangible value. But with large enterprises came the corporations which issued undi¬ vided partnership deeds called stock. The stock waa only so much printed paper, but it stood in beu of individual deeds of a part interest. Then what I want to urge is that we go back to original principles- exempt all representative valuea as held in individual hands and tax it in its corporate ownership where it can be reached. But do not waive the tax on personal property where such property has real or intrinsic value. Why should our merchants wilh their immeuae and valuable stocks of goods ue exempt ? Why should our factories with their millions of doUari of plant escape from their just share of the burdens of governments It is wrong to tax them aa is now done on their full value. They should only be taxed aa real eatate is, on one-half of their real value. Banka, insurance companies and all corporationa ahould pay tax on their capital direct, leas their investments iu real eatate or otber values otherwise taxed, at the aame rate as real eatate—that is, on one-half their value. The history of taxing mortgages is that originally tbe owner of the property swore off the amount of his mortgages against tbe aaaesament. But the tax-gatherer could flnd ao few mortgages to tax and so little real estate that was taxable above the mortgagea that tbe Legislature abolished such exemptions for real estate owners, but forgot to release the mortgagees when found. Thua to-day real eatate, where tbe individual mortgagees can be reached, pays double taxea, a monstrous sham on all legislation and legislators. Then let us tax all real peraonal property, but exempt representative peraonal property, and juatice will be done, L, K, Feiks. New York, February 9, 1888. Notes and Items. Calvert Vaux and ParK Superintendent Parsona have sent an elabora report on the boundaries of High Bridge Park to the Park Commissioners, by whom it has been adopted. They will give a bearing to persons interested on March 7 next. It seems that many of the west side property-own ers ate opposed to the fast driving road proposed by Lawson N, Fuller and his associates. Of course there are two sides of the question, and tbe Park Board is now considering whether Francis M, Jencks and his friends, or tho other gen¬ tlemen, shall be supported by them. Property-ownera have appealed to the Board of Aldermen for the repeal of the resolution of November, 1887. reducing the roadway of Kings- bridge road (or Broadway) from (iO feet in width to 48, between 155th and 119tb atreeta, and ask for the jre-enaction of the resolution of May, 1887, wherein it was directed to be SO feet, in uniformity with that part of the road north of 155th and south of lldth street. The Committees of the Building Material and Mechanics' Land Traders Exchanges met on Monday last, when the plan of fusion referred to in our last week's iasue was discussed. The committees will meet again on Mon¬ day next to formulate a general plan for agreement. The chairmen of the committees are, respectively, Maic Eidlitz and Hiram Snyder. The Third Avenue Railroad Co. has apphed to Judge Patteraon for a mandamus to compel the Commissioner of Public Works, General Newton, to grant a permit to the company to make excavations for cables along its route. ---------•----—- Important to Property-Holders. BOARD OF ASSESSORS. No, 11>^ City Hall, I Nkw York, February 21, 188S. f Notice is given to the owner or owners of all houses and lota affected thereby, that the following asseasmenta have been completed and are lodged iu the office of the Board of Assesaora for exatrination by all parties intereated, who must present their objections in writing, if opposed to the aame, within thirty days from date of notice: regulating, qradimg, setting curb and flagging, Kingsbridge road, from 155th to 19Uth atreet. [The limits embraced by said assessments include all the houses and lota of ground situated aa follows : Kingsbridge road, from 155th street to Spuyten Duyvil Creek and to the extent of one-half the block at the iutersecting streets and avenues.] The above described list will be tranamitted, as provided by law, to tbe Board of Revision and Correction of Asaesameats for confirmation ou the a3d day of March, 18SS. The New York Life's Annual Report. The annual report for 1887 of the New York Life Insurance Company, whicb has been issued within the past few daya, makes a splendid showing. Their cash assets amount to $83,073,845, while their liabilities, on the new State standard, are $70,659,560, leaving a surplus of $11,840,793. Their business during 1887, the fortj-thlrd year of their existence, has been very largely augmented, the increased income having been $3,822,378, the net assets $8,093,693, the insurance written $21,571,01)1, and the increase iu the insurance in force $54,561,996. Tbe total number of their policies in force is 113.333, aggregating the enormous insurance of $358,935,936, They have paid lo policy-holders during the past year no lesa than $9,535,310, com¬ prising $4,361,368 for death claims aud endowments and $5,173,843 for dividends, annuities and purchased insurances. Their total income during the year was $23,053,787, of which $18,286,8,58 waa from premiuma and $3,765,933 Irom intereat, rents, etc. Their divisible surplus by the new Standard is $6,651,580 and their tontine surplus $5,315,720,