Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 91, no. 2357]: May 17, 1913

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

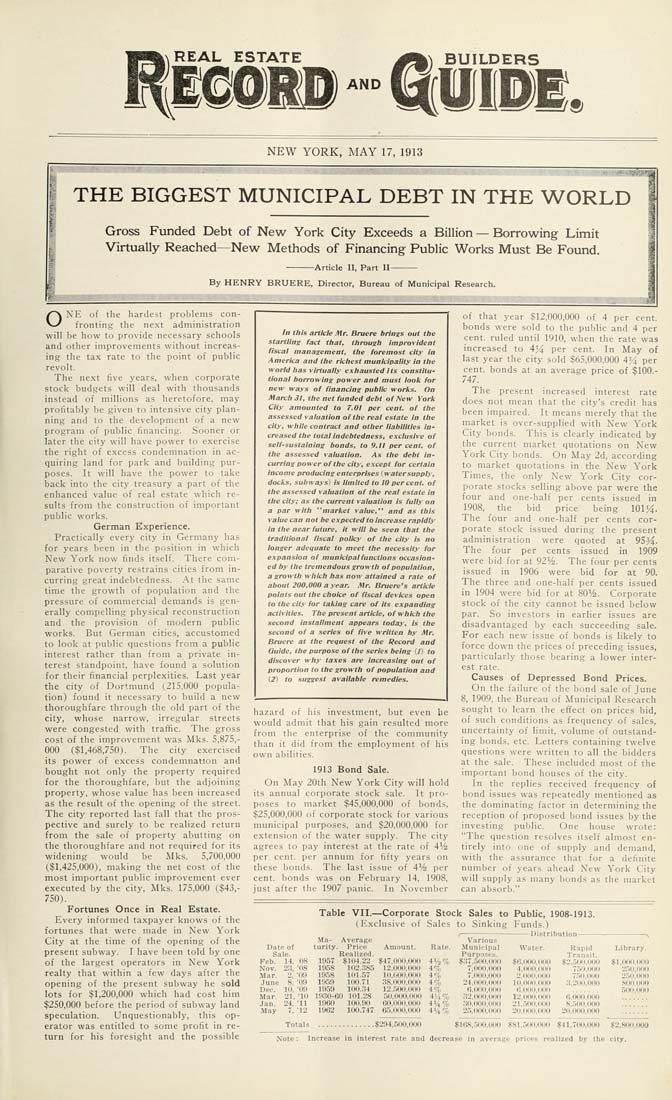

REAL ESTATE AND BUILDERS NEW YORK, MAY 17, 1913 ■■iiiiiiiiiiiiiiiiiiiiiia I THE BIGGEST MUNICIPAL DEBT IN THE WORLD Gross Funded Debt of New York City Exceeds a Billion — Borrowing Limit Virtually Reached—New Methods of Financing Public Works Must Be Found. ---------Article II, Part II-------- By HENRY BRUERE, Directot Bureau of Municipal Research, llilillllillilillllilllillllllllllillillll ONE of the hardest problems con¬ fronting the next administration will be how to provide necessary schools and other improvements without increas¬ ing the ta.x rate to the point of public revolt. The next five years, wheii corporate stock budgets will deal with thousands instead of millions as heretofore, may profitably be given to intensive city plan¬ ning and to the development of a new program of public financing. Sooner or later the city will have power to exercise the right of excess condemnation in ac¬ quiring land for park and building pur¬ poses. It will have the power to take back into the city treasury a part of the enhanced value of real estate which re¬ sults from the construction of important public works. German Experience. Practically every city in Germany has for years been in the position in which New York now finds itself. There com¬ parative poverty restrains cities from in¬ curring great indebtedness. At the same time the growth of population and the pressure of commercial demands is gen¬ erally compelling physical reconstruction and the provision of modern public works. But German cities, accustomed to look at public questions from a public interest rather than from a private in¬ terest standpoint have found a solution for their financial perplexities. Last year the city of Dortmund (215,000 popula¬ tion) found it necessary to build a new thoroughfare through the old part of the city, whose narrow, irregular streets were congested with traffic. The gross cost of the improvement was Mks, 5,875,- 000 ($1,468,750). The city exercised its power of excess condemnation and bought not only the property required for the thoroughfare, but the adjoining property, whose value has been increased as the result of the opening of the street. The city reported last fall that the pros¬ pective and surely to be realized return from the sale of property abutting on the thoroughfare and not required for its widening would be Mks, 5,700,000 ($1,425,000), making the net cost of the most important public improvement ever executed by the city, Mks. 175,000 ($43,- 750), Fortunes Once in Real Estate. Every informed taxpayer knows of the fortunes that were made in New York City at the time of the opening of the present subway. I have been told by one of the largest operators in New York realty that within a few days after the opening of the present subway he sold lots for $1,200,000 which had cost him $250,000 before the period of subway land speculation. Unquestionably, this op¬ erator was entitled to some profit in re¬ turn for his foresight and the possible fn this article Mr. Bruere brlnxs out the startling fact that, through Improvident fiscal management, the foremost city In America aad the richest municipality In the world has virtually exhausted Its constitu¬ tional borrowing power and must loolt for new ways of financing public worlis. On March 31, the net funded debt of New York City amounted to 7.Of per cent, ot the assessed valuation of the real estate In the city, while contract and other liabilities In¬ creased the total Indebtedness, exclusive of self-sustaining bonds, to 9. If per cent, of the assessed valuation. As ihe debt in¬ curring power of the city, e.xcept for certain Income producing enterprises (watersupply, dcKks, subways) is limited to 10 percent, of the assessed valuation of the real estate in the city; as the current valuation Is fully on a par with "market value," and as this value can not be expected to Increase rapidly la the near future. It will be seen that ihe traditional fiscal policy of the city is no longer adequate to meet ihe necessity for expansion of municipal functions occasion¬ ed by ihe tremendous growth of population, a growth which has now attained a rate of about 200,000 a year. Mr. Bruere's article points out the choice of fiscal devices open to the city for taking care of Its expanding activities. The present article, of which ihe second Installment appears today, Is the second of a series of five written by Mr. Bruere at the request of Ihe Record and Guide, tbe purpose of the series being (I) to discover why taxes are Increasing out of proportion to the growth of population and (2) to suggest available remedies. hazard of his investment, but even he would admit that his gain resulted more from the enterprise of the community than it did from the employment of his own abilities, 1913 Bond Sale. On May 20th New York City will hold its annual corporate stock sale. It pro¬ poses to market $45,000,000 of bonds, $25,000,000 of corporate stock for various municipal purposes, and $20,000,000 for extension of the water supply. The city agrees to pay interest at the rate of 4% per cent, per annum for fifty years on these bonds. The last issue of 4% per cent, bonds was on February 14, 1908, just after the 1907 panic. In November of that year $12,000,000 of 4 per cent, bonds were sold to the public and 4 per cent, ruled until 1910, when the rate was increased to 4% per cent. In May of last year the city sold $65,000,000 AH per cent, bonds at an average price of $100,- 747. The present increased interest rate does not mean that the city's credit has been impaired. It means merely that the market is over-supplied with New York City bonds. This is clearly indicated by the current market quotations on New York City bonds. On May 2d, according to market quotations in the New York Times, the only New York City cor¬ porate stocks selling above par were the four and one-half per cents issued in 1908, the bid price being 101^. The four and one-half per cents cor¬ porate stock issued during the present administration were quoted at 95^. The four per cents issued in 1909 were bid for at 92%. The four per cents issued in 1906 were bid for at 90. The three and one-half per cents issued in 1904 were bid for at 80%. Corporate stock of the city cannot be issued below par. So investors in earlier issues are disadvantaged by each succeeding sale. For each new issue of bonds is likely to force down the prices of preceding issues, particularly those bearing a lower inter¬ est rate. Causes of Depressed Bond Prices. On the failure of the bond sale of June 8, 1909, the Bureau of Municipal Research sought to learn the efifect on prices bid, of such conditions as frequency of sales, uncertainty of limit, volume of outstand¬ ing bonds, etc. Letters containing twelve questions were written to all the bidders at the sale. These included most of the important bond houses of the city. In the replies received frequency of bond issues was repeatedly mentioned as the dominating factor in determining the reception of proposed bond issues by the investing puljlic. One house wrote: "The question resolves itself almost en¬ tirely into one of supply and demand, with the assurance that for a definite number of years ahead New York City will supply as many bonds as the market can absorb," Table VII,—Corporate Stock Sales to Public, 1908-1913. (E.xclusive of Sales to Sinking Funds.) ,■----------------------Distribution----------------------^ Ma- Average Various Date of turlty. Price Amount. Rate, Municipal AVater, Rapid Library- Sale- Realized. Purposes. Transit, Feb. 14, 08 1057 $104.22 $47,0011,0(111 4%% .$37„50U,(IOO $0,1X10.(100 ,$2,51 lll,0lill $1 .(klo.lHIO Nov- 2:!, '08 1958 102.385 12.nilll,(lll0 4% 7,(1(10,000 4,(1(1(1,0(10 7,"'>l 1,110(1 2.511,(1111) Mar, 2, '09 1958 101,57 lll,(.(lll.0ll(l 4% 7,00U,(l0n 2.0011,11(111 7,5(1,(11111 2,"">ll,ll(ll) June 8, '09 19,59 100.71 ,-W,llilll,IHlll 4% 24,(100,01111 lIl.dlKl.OIIO 3,2(10,000 ,800 11110 Dec, 10, '09 1959 100..34 12..".lKl.lllill 4% 6,0(10,(1(10 t;,IKlll,(illl) ....... ,10(1,1111(1 Mar, 21,'10 19,30-60 101.28 51 I.I UK (.mil I 414% :i2,n00,0(io IS.IKIiMKili O.Odii.iKIO ....... Jan, 24, '11 1960 100,90 (ll).llllll.llllll 4%% .30,000,000 21,.-i(NI,lillll s,.-.(lli.lll«l ....... May 7,'12 1062 100,747 ori,iliiii,iiii(i 414% 25,000,00(1 2(l,iiiKi,iiliO 2ii.iiiiii,iiuiJ ....... Totals ..............$294,500,000 $168,500,000 $81,300,000 $41,700,000 $2,800,000 Note : Increase in interest rate and decrease in average prices realized by the city.