Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 93, no. 2413: Articles]: June 13, 1914

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

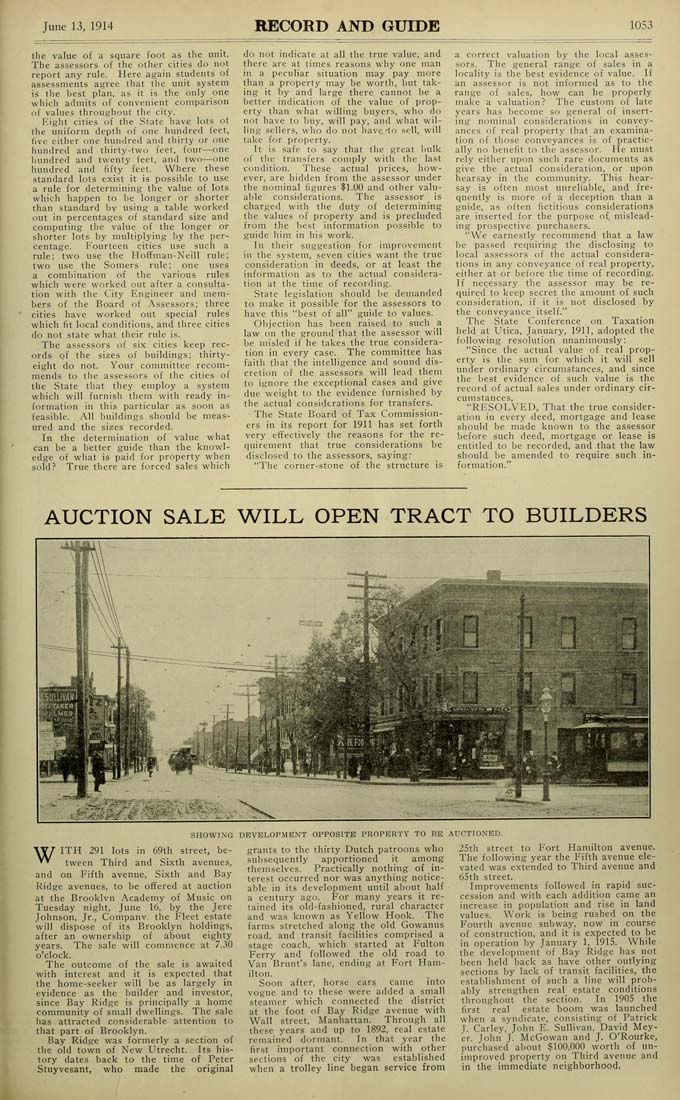

June 13, 1914 RECORD AND GUIDE 1053 the value of a square foot as the unit. The assessors of the other cities do not report any rule. Here again students of assessments agree that the unit system is the best plan, as it is the only one which admits of convenient comparison of values throughout the city. Eight cities of the State have lots ot the uniform depth of one hundred feet, five either one hundred and thirty or one hundred and thirty-two feet, four—one hundred and twenty feet, and two—one hundred and fifty feet. Where these standard lots exist it is possible to use a rule for determining the value of lots which happen to be longer or shorter than standard by using a table worked out in percentages of standard size and computing the value of the longer or shorter lots by multiplying by the per¬ centage. Fourteen cities use such a rule; two use the Hoffman-Neill rule; two use the Somers rule; one uses a combination of the various rules which were worked out after a consulta¬ tion with the City Engineer and mem¬ bers of the Board of -Assessors; three cities have worked out special rules which fit local conditions, and three cities do not state what their rule is. The assessors of six cities keep rec¬ ords of the sizes of buildings; thirty- eight do not. Your committee recom¬ mends to the assessors of the cities of the State that they employ a system which will furnish them with ready in¬ formation in this particular as soon as feasible. All buildings should be meas¬ ured and the sizes recorded. In the determination of value what can be a better guide than the knowl¬ edge of what is paid for property when sold? True there are forced sales which do not indicate at all the true value, and there are at times reasons why one man in a peculiar situation may pay more than a property may be worth, but tak¬ ing it by and large there cannot be a better indication of the value of prop¬ erty than what willing buyers, who do not have to buy, will pay, and what wil¬ ling sellers, who do not have'to sell, will take for property. It is safe to say that the great bulk of the transfers comply with the last condition. These actual prices, how¬ ever, are hidden from the assessor under the nominal figures $1.00 and other valu¬ able considerations. The assessor is charged with the duty of determining the values of property and is precluded from the best information possible to guide him in his work. In their suggestion for improvement in the system, seven cities want the true consideration in deeds, or at least the information as to the actual considera¬ tion at the time of recording. State legislation should be demanded to make it possible for the assessors to have this "best of all" guide to values. Objection has been raised to such a law on the ground that the assessor will be misled if he takes the true considera¬ tion in every case. The committee has faith that the intelligence and sound dis¬ cretion of the assessors will lead them to ignore the exceptional cases and give due weight to the evidence furnished by the actual considerations for transfers. The State Board of Tax Commission¬ ers in its report for 1911 has set forth very effectively the reasons for the re¬ quirement that true considerations be disclosed to the assessors, saying; "The corner-stone of the structure is a correct valuation by the local asses¬ sors. The general range of sales in a locality is the best evidence of value. If an assessor is not informed as to the range of sales, how can he properly make a valuation? The custom of late years has become so general of insert¬ ing nominal considerations in convey¬ ances of real property that an examina¬ tion of those conveyances is of practic¬ ally no benefit to the assessor. He must rely either upon sucli rare documents as give the actual consideration, or upon hearsay in the community. This hear¬ say is often most unreliable, and fre¬ quently is more of a deception than a guide, as often fictitious considerations are inserted for the purpose of, mislead¬ ing prospective purchasers. "We earnestly recommend that a law be passed requiring the disclosing to local assessors of the actual considera¬ tions in any conveyance of real property, either at or before the time of recording. If necessary the assessor may be re¬ quired to keep secret the amount of such consideration, if it is not disclosed by the conveyance itself." The State Conference on Taxation held at Utica, January, 1911, adopted the following resolution unanimottsly: "Since the actual value of real prop¬ erty is the sum for which it will sell under ordinary circumstances, and since the best evidence of such value is the record of actual sales under ordinary cir¬ cumstances, "RESOLVED, That the true consider¬ ation in every deed, mortgage and lease should be made known to the assessor before such deed, mortgage or lease is entitled to be recorded, and that the law should be amended to require such in¬ formation." AUCTION SALE WILL OPEN TRACT TO BUILDERS SHOWING DEVELOPMENT OPPOSITE PROPERTY TO BE AUCTIONED- WITH 291 lots in 69th street, be¬ tween Third and Sixth avenues, and on Fifth avenue. Sixth and Bay Ridge avenues, to be offered at auction at the Brooklvn Academy of Music on Tuesday night, June 16, by the Jere Johnson, Jr., Companv. the Fleet estate will dispose of its Brooklyn holdings, after an ownership of about eighty years. The sale will commence at 7.30 o'clock. The outcome of the sale is awaited with interest and it is expected that the home-seeker will be as largely in evidence as the builder and investor, since Bay Ridge is principally a home community of small dwellings. The sale has attracted considerable attention to that part of Brooklyn. Bay Ridge was formerly a section of the old town of New Utrecht. Its his¬ tory dates back to the time of Peter Stuyvesant, who made the original grants to the thirty Dutch patroons who subsequently apportioned it among themselves. Practically nothing of in¬ terest occurred nor was anything notice¬ able in its development until about half a century ago. For many years it re¬ tained its old-fashioned, rural character and was known as Yellow Hook. The farms stretched along the old Gowanus road, and transit facilities comprised a stage coach, which started at Fulton Ferry and followed the old road to Van Brunt's lane, ending at Fort Ham¬ ilton. Soon after, horse cars came into vogue and to these were added a small steamer which connected the district at the foot of Bay Ridge avenue with Wall street, Manhattan. Through all these years and up to 1892, real estate remained dormant. In that year the first important connection with other sections of the city was established when a trolley line began service from 2Sth street to Fort Hamilton avenue. The following year the Fifth avenue ele¬ vated was extended to Third avenue and 6Sth street. Improvements followed in rapid suc¬ cession and with each addition came an increase in population and rise in land values. Work is being rushed on the Fourth avenue subway, now in course of construction, and it is expected to be in operation by January 1, 191S. While the development of Bay Ridge has not been held back as have other outlying sections by lack of transit facilities, the establishment of such a line will prob¬ ably strengthen real estate conditions throughout the section. In 190S the first real estate boom was launched when a syndicate, consisting of Patrick J. Carley, John E. Sullivan, David Mey¬ er, John J. McGowan and J. O'Rourke, purchased about $100,000 worth of un¬ improved property on Third avenue and in the immediate neighborhood.