Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 93, no. 2414: Articles]: June 20, 1914

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

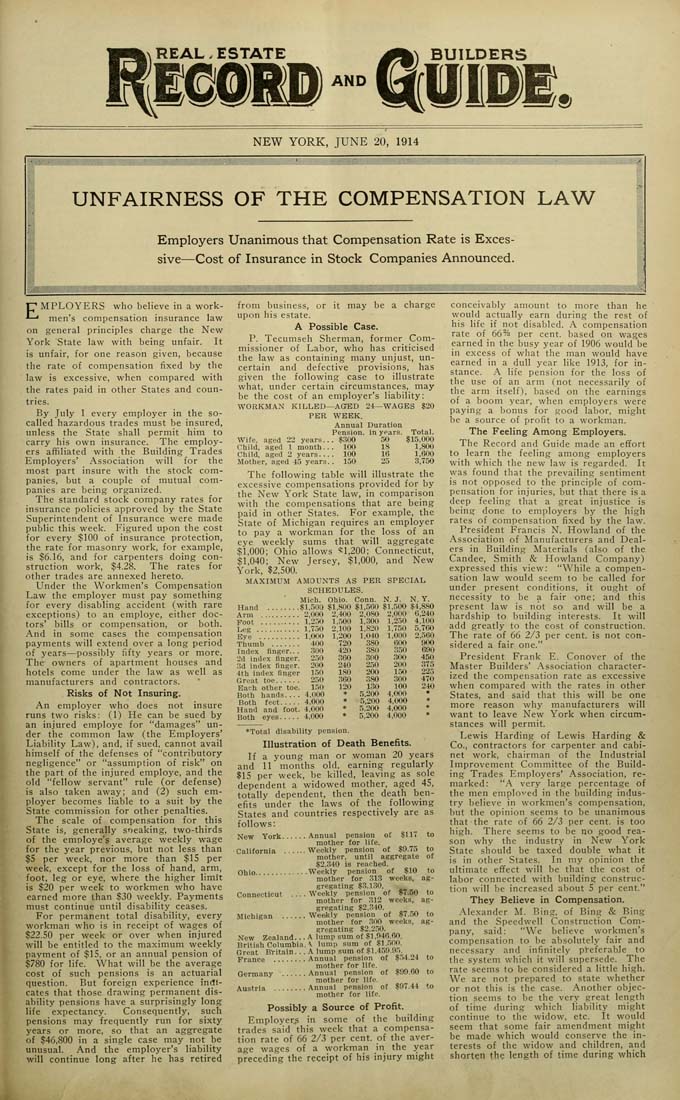

REAL. ESTATE AND NEW YORK, JUNE 20, 1914 m ■ UNFAIRNESS OF THE COMPENSATION LAW Employers Unanimous that Compensation Rate is Exces¬ sive—Cost of Insurance in Stock Companies Announced. ■■■■■■■I ■■■ ■■■■IIIIIM^^^^^ EMPLOYERS who believe in a work¬ men's compensation insurance law on general principles charge the New York "State law with being unfair. It is unfair, for one reason given, because the rate of compensation fixed by the law is excessive, when compared with the rates paid in other States and coun¬ tries. By July 1 every employer in the so- called hazardous trades must be insured, unless the State shall permit him to carry his own insurance. The employ¬ ers affiliated with the Building Trades Employers' Association will for the most part insure with the stock com¬ panies, but a couple of mutual com¬ panies are being organized. The standard stock company rates for insurance policies approved by the State Superintendent of Insurance were made public this week. Figured upon the cost for every $100 of insurance protection, the rate for masonry work, for example, is $6.16, and for carpenters doing con¬ struction work, $4.28. The rates for other trades are annexed hereto. Under the Workmen's Compensation Law the employer must pay something for every disabling accident (with rare exceptions) to an employe, either doc¬ tors' bills or compensation, or both. And in some cases the compensation payments will extend over a long period of years—possibly fifty years or more. The- owners of apartment houses and hotels come under the law as well as manufacturers and cpntractors. Risks of Not Insuring. An employer who does not insure runs two risks: (1) H,e can be sued by an injured employe for "damages" un¬ der the common law (the Employers' Liability Law), and, if sued, cannot avail himself of the defenses of "contributory negligence" or "assumption of risk" on the part of the injured employe, and the old "fellow servant" rule (or defense) is also taken away; and (2) such em¬ ployer becomes liable to a suit by the State commission for other penalties. The scale of. compensation for this State is, generaffly sneaking, two-thirds of the employe^^ average weekly wage for the year previous, but not less than $S per week, nor more than $1S per week, except for the loss of hand, arm, foot, leg or eye, where the higher limit is $20 per week to workmen who have earned more .than $30 weekly. Payments must continue until disability ceases. For permanent total disability, every workman who is in receipt of wages of $22.50 per week or over when injured will be entitled to the maximum weekly payment of $1S, or an annual pension of $780 for life. What will be the average cost of such pensions is an actuarial question. But foreign experience indi¬ cates that those drawing permanent dis¬ ability pensions have a surprisingly long life expectancy. Consequently, such pensions raay frequently run for sixty years or more, so that an aggregate of $46,800 in a single case may not be unusual. And the employer's liability will continue long after he has retired from business, or it may be a charge upon his estate. A Possible Case. P. Tecumseh Sherman, former Com¬ missioner of Labor, who has criticised the law as containing many unjust, un¬ certain and defective provisions, has given the following case to illustrate what, under certain circumstaiices, may be the cost of an employer's liability: WORKMAN KILLED—ACTED 24—WAGES $20 PER WEEK. Annual Duration Pension, in years. Total. Wife, aged 22 years... $300 50 $15,000 Child, aged 1 month... 100 18 1,800 Child, aged 2 years___ 100 16 1,600 Mother, aged 45 years.. 150 23 3,750 The following table will illustrate the excessive compensations provided for by the New York State law, in comparison with the compensations that are being paid in other States. For example, the State of Michigan requires an employer to pay a workman for the loss of an eye weekly sums that will aggregate $1,000; Ohio allows *1,200; Connecticut, $1,040; New Jersey, $1,000, and New York, $2,500. MAXIMUM AMOUNTS AS PER SPECIAL SCHEDULES. Mich. Ohio. Conn. N. J. N. Y. Hand ........$1,509 $1,800 $1,560 $1,500 $4,880 Arm .......... 2,000 2,400 2,080 2,000' 6,240 Foot .......... 1,250 1,500 1,300 1,250 4,100 Leg ........... 1,750 2,100 1,820 1,750 5,760 Eye ..........1,000 1,200 1,040 1,000 2,360 Thumb ....... 400 720 380 60O 900 Index finger... 300 420 380 350 690 2d index finger. 230 860 800 80O 450 3d index finger. 200 240 230 200 875 4th index finger 150 180 '200 130 ' 225 Great toe...... 250 860 380 300 470 Bach otber toe. 150 120 130 100 240 Both hands.... 4,000 * 5,200 4,000 • Both feet.....4,000 • -5,200 4,000 * Hand and foot. 4,000 • 5,200 4,000 • Both eyes.....4,000 * 5,200 4,000 • •Total disability pension. Illustration of Death Benefits. If a young man or woman 20 years and 11 months old, earning regularly $15 per week, be killed, leaving as sole dependent a widowed mother, aged 45, totally dependent, then the death ben¬ efits under the laws of the following States and countries respectively are as follows: New York......Annual pension of $117 to mother tor life. ■California ......Weekly pension of $9.75 to mother, until aggregate of $2,340 is reached. Ohio.............Weekly pension of $10 to mother tor 313 weeks, ag¬ gregating $3,130. !»*. Connecticut ___Weekly pension of ^^IRiO to mother for 312 weeks, ag¬ gregating $2,340. Michigan ......Weeikly pension of $7.50 to mother for 800 weeks, ag¬ gregating $2,250. New Zealand... A lump sum of $1,948.60. British Columbia. V lump sum of $1,500. Great B'ritain... A lump sum of $1,459.95^ France ........Annual pension of $o4.24 to mother for life. Germany ......Annual pension of .$99.60 to mother for life. Austria ........Annual pension of $97.44 to mother for life. Possibly a Source ot Profit. Eraployer,p in some of the building trades said this week that a compensa¬ tion rate of 66 2/3 per cent, of the aver¬ age wages of a workman in the year preceding the receipt of his injury might conceivably amount to more than he would actually earn during the rest of his life if not disabled. A compensation rate of 66% per cent, based on wages earned in the busy year of 1906 would be in excess of what the man would have earned in a dull year like 1913, for in¬ stance. A life pension for the loss of the use of an arm (not necessarily of the arm itself), based on the earnings of a boom year, when employers were paying a bonus for good labor, might be a source of profit to a workman. The Feeling Among Employers. The Record and Guide made an effort to learn the feeling among employers with which the new law is regarded. It was found that the prevailing sentiment is not opposed to the principle of com¬ pensation for injuries, but that there is a deep feeling that a great injustice is being done to employers by the high rates of compensation fixed by the law. President Francis N. Howland of the Association of Manufacturers and Deal¬ ers in Building Materials (also of the Candee, Smith & Howland Company) expressed this view: "While a compen¬ sation law would seem to be called for under present conditions, it ought of necessity to be a fair one; and this present law is not so and wUl be a hardship to building interests. It will add greatly to the cost of construction. The rate of 66 2/3 per cent, is not con¬ sidered a fair one." President Frank E. Conover of the Master Builders' Association character¬ ized the compensation rate as excessive when compared with the rates in other States, and said that this will be one more reason why manufacturers will want to leave New York when circum¬ stances will permit. Lewis Harding of Lewis Harding & Co., contractors for carpenter and cabi¬ net work, chairman of the Industrial Improvement Committee of the Build¬ ing Trades Employers' Association, re¬ marked: "A very large percentage of the men employed in the building indus¬ try believe in workmen's compensation, but the opinion seems to be unanimous that-the rate of 66 2/3 per cent, is too high. There seems to be no good rea¬ son why the industry in New York State should be taxed double^ 'what it is in other States. In my opinion the ultimate effect will be that the cost of labor connected with building construc¬ tion will be increased about S per cent." They Believe in Compensation. Alexander M. Bing, of Bing & Bing and the Speedwell Construction Com¬ pany, said: "We believe workmen's compensation to be absolutely fair and necessary and infinitely pteferabje to the system which it will supersede. "The rate seeins to be considered a little high. We are not prepared to state whether or not this is the case. Another objec¬ tion seems to be the very great length of time during which liability might continue to the widow, etc. It would seem that some fair amendment mi^ht be made which would conserve the in¬ terests of the widow and children, and shorten the length of time during which