Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 97, no. 2518: Articles]: June 17, 1916

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

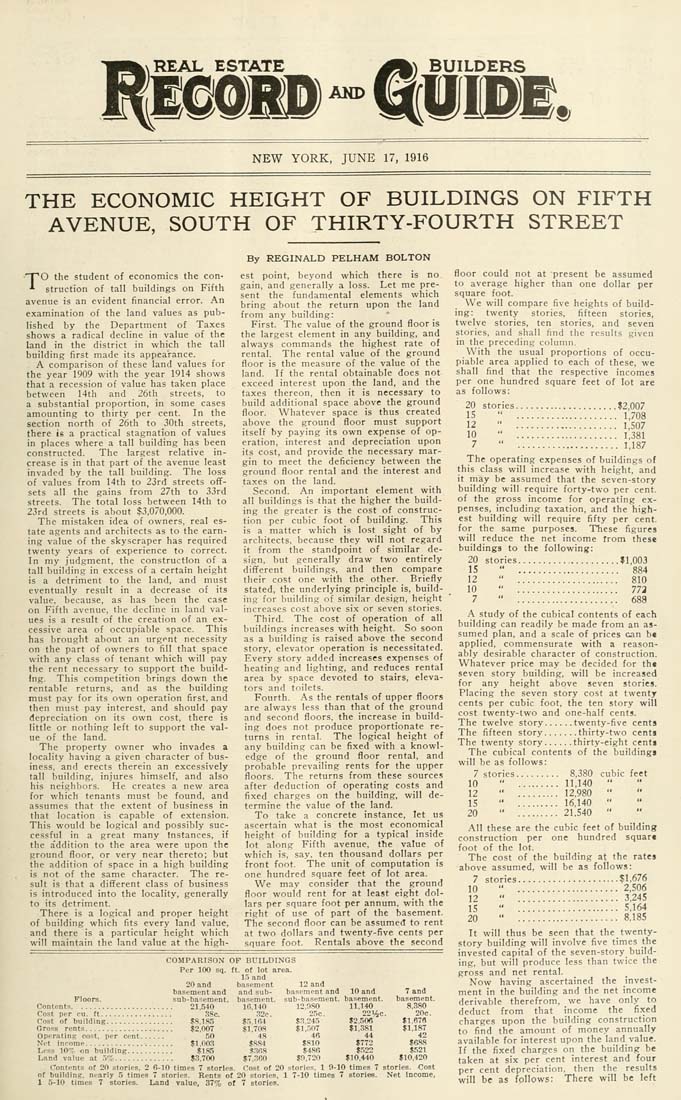

kxREAL ESTATE AND NEW YORK, JUNE 17, 1916 THE ECONOMIC HEIGHT OF BUILDINGS ON FIFTH AVENUE, SOUTH OF THIRTY-FOURTH STREET By REGINALD PELHAM BOLTON TO the student of economics the con- est point, beyond which there is no struction of tall buildings on Fifth gain, and generally a loss Let me pre- ., ^ r • , A sent the fundamental elements which avenue is an evident financial error. An ^^.^^^ ^^^^^ ^^^ ^^^^^^ ^^^^ ^^^ ,^„j e.xamination of the land values as pub- from any building: lished by the Department of Taxes First. The value of the grotind floor is shows a radical decline in value of the the largest element in any building, and land in the district in which the tall always commands the highest rate of building first made its appearance. rental. The rental value of the ground A comparison of these land values for floor is the measure of the value of the the year 1909 with the year 1914 shows land. If the rental obtainable does not that a recession of value has taken place exceed interest upon the land, and the between 14th and 26th streets, to taxes thereon, then it is necessary to a substantial proportion, in some cases build additional space above the ground amounting to thirty per cent. In the floor. Whatever space is thus created section north of 26th to 30th streets, above the grouiid floor must support there is a practical stagnation of values itself by paying its own expense of op- in places where a tall building has been eration, interest and depreciation upon constructed. The largest relative in- its cost, and provide the necessary mar- crease is in that part of the avenue least gin to meet the deficiency between the invaded by the tall building. The loss ground floor rental and the interest and of values from 14th to 23rd streets ofif- taxes on the land. sets all the gains from 27th to 33rd Second. An important element with streets. The total loss between I4th to all buildings is that the higher the build- 23rd streets is about $3,070,000. ing the greater is the cost of construc- The mistaken idea of owners, real es- tion per cubic foot_ of building. This tate agents and architects as to the earn- is a matter which is lost sight of by ing value of the skyscraper has required architects, because they will riot regard twenty years of experience to correct. it from the standpoint of similar de¬ in my judgment, the construction of a sign, but generally draw two entirely tall building in excess of a certain height different buildings, and then compare is a detriment to the land, and must their cost one with the other. Briefly eventually result in a decrease of its stated, the underlying principle is, bttild- value, because, as has been the case ing for building of similar design, height on Fifth avenue, the decline in land val- increases cost above six or seven stories, ues is a result of the creation of an ex- Third. The cost of operation of all cessive area of occupiable space. This buildings increases with height. So soon has brought about an urgent necessity as a building is raised above the second on the part of owners to fill that space story, elevator operation is necessitated, with any class of tenant which will pay Every story added increases expenses of the rent necessary to support the build- heating and lighting, and reduces rental Ing. This competition brings down the area by space devoted to stairs, eleva- rentable returns, and as the building tors and toilets. must pay for its own operation first, and Fourth. As the rentals of upper floors then must pay interest, and should pay are always less than that of the grotind depreciation on its own cost, there is and second floors, the increase in build- little or nothing left to support the val- ing does not produce proportionate re- ue of the land. turns in rental. The logical height of The property owner who invades a any building can be fixed with a knowl- locality having a given character of bus- edge of the ground floor rental, and iness, and erects therein an excessively probable prevailing rents for the upper tall building, injures himself, and also floors. The returns from these sources his neighbors. He creates a new area after deduction of operating costs and for which tenants must be found, and fixed charges on the building, will de- assumes that the e.xtent of business in tcrmine the value of the land, that location is capable of extension. To take a concrete instance, let us This would be logical and possibly sue- ascertain what is the most economical cessful in a great many Instances, if height of bnilding for a typical inside the a'ddition to the area were upon the lot along Fifth avenue, the value of ground floor, or very near thereto; but which is, say, ten thousand dollars per the addition of space in a high building front foot. The unit of computation is is not of the same character. The re- one hundred square feet of lot area, suit is that a diflferent class of business We may consider that the ground is introduced into the locality, generally floor would rent for at least eight dol- to its detriment. lars per square foot per annum, with the There is a logical and proper height right of use of part of the basement, of building which fits every land value. The second floor can be assumed to rent and there is a particular height which at two dollars and twenty-five cents per will maintain the land value at the high- square foot. Rentals above the second COMPARISON OF BUILDINGS Per 100 sq. tt. of lot area. 13 and 20 and basement 12 and basement and and sub- basement and 10 and 7 and Floors. sub-basement, basement, sub-basement, basement. basement. Contents....................... 21,.340 16.140 12.980 11,140 8,,380 Cost per cu. ft................. 38c. .32c. 23c. 22M,c. 20c. Cost of building................ $8,185 $3,164 $3,243 $2,506 $1,676 Gross rents..................... $2,007 $1,708 $1,507 $1,.3S1 $1,187 Operating cost, per cent...... 50 48 46 44 42 Net income..................... $1,003 $8.84 $810 $772 $6.88 Less 10% on building........... $185 .1i368 $486 $322 $.321 Land value at 3%.............. $3,700 $7..360 $9,720 $10,440 $10,420 Contents of 20 stories. 2 6-10 times 7 stories. Cost of 20 stories, 1 9-10 times 7 stories. Cost of building, nearly 5 times 7 stories. Rents ot 20 stories, 1 7-10 times 7 stories. Net Income, 1 5-10 times 7 stories. Land value, 37% of 7 stories. floor could not at present be assumed to average higher than one dollar per square foot. We will compare five heights of build¬ ing: twenty stories, fifteen stories, twelve stories, ten stories, and seven stories, and shall find the results given in the preceding column. With the usual proportions of occu¬ piable area applied to each of these, we shall find that the respective incomes per one hundred square feet of lot are as follows: 20 stories.....................$2,007 15 " ..................... 1,708 12 " ..................... 1,507 10 " ..................... 1,381 7 " ..................... 1,187 The operating expenses of buildings of this class will increase with height, and it may be assumed that the seven-story building will require forty-two per cent, of the gross income for operating ex¬ penses, including taxation, and the high¬ est building will require fifty per cent, for the same purposes. These figures will reduce the net income from these buildings to the following: 20 stories.....................?1,003 IS " ..................... 884 12 " ..................... 810 10 " ..................... 773 7 " ..................... 688 A study of the cubical contents of each building can readily be made from an as¬ sumed plan, and a scale of prices can b« applied, commensurate with a reason¬ ably desirable character of construction. Whatever price may be decided for tht seven story building, will be increased for any height above seven stories. Placing the seven story cost at twenty cents per cubic foot, the ten story will cost twenty-two and one-half cents. The twelve story......twenty-five cents The fifteen story.......thirty-two cents The twenty story......thirty-eight cents The cubical contents of the buildings will be as follows: 7 stories......... 8,380 cubic feet 10 " ......... 11,140 " 12 " ......... 12,980 " 15 " ......... 16,140 " 20 " ......... 21,540 " All these are the cubic feet of building construction per one hundred squart foot of the lot. The cost of the building at the rates above assumed, will be as follows: 7 stories.....................$1.676 10 " .................... 2,506 12 " ..................... 3,245 15 " .................. 5,164 20 " ..................... 8,185 It will thus be seen that the twenty- story building will involve five times the invested capital of the seven-story build¬ ing, but will produce less than twice the gross and net rental. Now having ascertained the invest¬ ment in the building and the net income derivable therefrom, we have only to deduct from that income the fixed charges upon the building construction to find the amount of money annually available for interest upon the land value. If the fixed charges on the building be taken at six per cent interest and four per cent depreciation, then the results will be as follows: There will be left