Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 98, no. 2542: Articles]: December 2, 1916

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

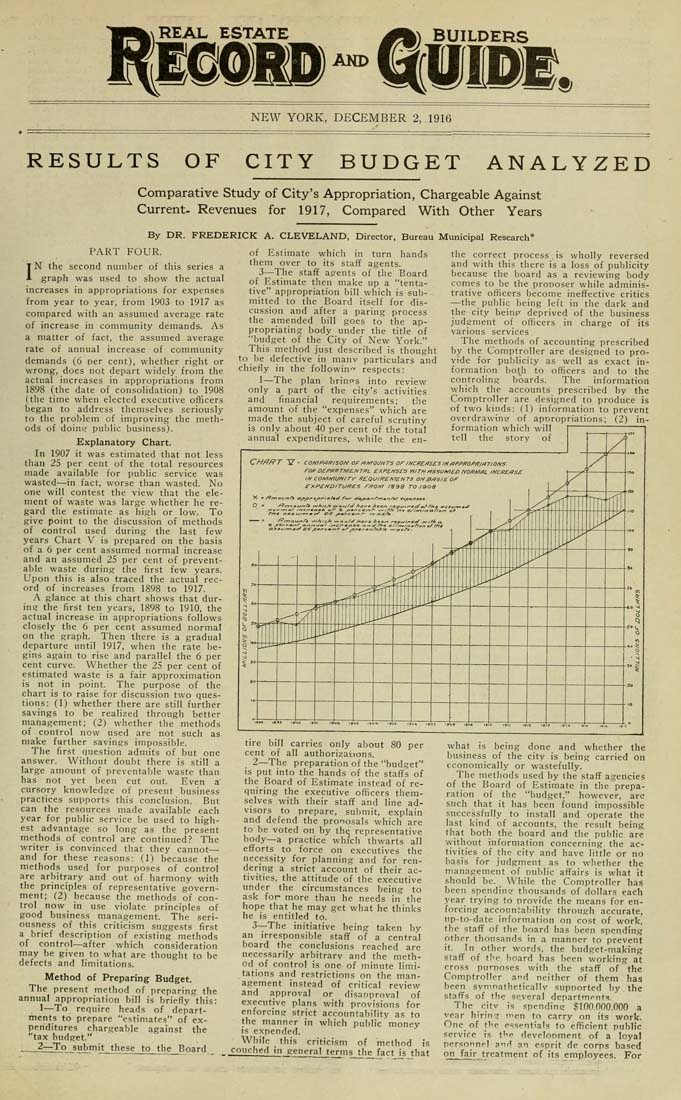

REAL ESTATE AND NEW YORK, DECEMBER 2, 1916 RESULTS OF CITY BUDGET ANALYZED Comparative Study of City's Appropriation, Chargeable Against Current. Revenues for 1917, Compared With Other Years By DR. FREDERICK A. CLEVELAND, Director, Bureau Municipal Research PART FOUR. ' N the second nuinber of this series a A graph was used to show the actual increases in appropriations for expenses from year to year, from 1903 to 1917 as compared with an assumed average rate of increase in community demands. As a matter of fact, the assumed average rate of annual increase of community demands (6 per cent), whether right or wrong, does not depart widely from the actual increases in appropriations from 1898 (the date of consolidation) to 1908 (the time when elected e.xecutive officers began to address themselves seriously to the problem of improving the meth¬ ods of doinif public business). Explanatory Chart. In 1907 it was estimated that not less than 25 per cent of the total resources made available for public service was wasted—in fact, worse than wasted. No one will contest the view that the ele¬ ment of waste was large whether he re¬ gard the estimate as high or low. To give point to the discussion of methods of control used during the last few years Chart V is prepared on the basis of a 6 per cent assumed normal increase and an assumed 25 per cent of prevent¬ able waste durin.g the first few years. Upon this is also traced the actual rec¬ ord of increases from 1898 to 1917. A glance at this chart shows that dur¬ ing the first ten years, 1898 to 1910, the actual increase in appropriations follows closely the 6 per cent assumed normal on the graph. Then there is a gradual departure until 1917, when the rate be¬ gins again to rise and parallel the 6 per cent curve. Whether the 25 per cent of estimated waste is a fair approximation is not in point. The purpose of the chart is to raise for discussion two ques¬ tions: (1) whether there are still further savings to be realized through better management; (2) whether the methods of control now used are not such as make further savings impossible. The first question admits of but one answer. Without doubt there is still a large amount of preventable waste than has not yet been cut out. Even a cursory knowledge of present business practices supports this conclusion. But can the resources made available each year for public service be used to high¬ est advantage so long as the present methods of control are continued? The writer is convinced that they cannot— and for these reasons: (1) because the methods used for purposes of control are arbitrary and out of harmony with the principles of representative govern¬ ment; (2) because the methods of con¬ trol now in use violate principles of good business management. The seri¬ ousness of this criticism suggests first a brief description of existing methods of control—after which consideration may be given to what are thought to be defects and limitations. Method of Preparing Budget. The present method of preparing the annual appropriation bill is briefly this: 1—To require heads of depart- rnents to prepare "estimates" of ex¬ penditures chargeable against the "tax bud.get." ___22rJp_submitthese to the Board of Estimate which iu turn hands them over to its staff agents. 3—The staflf agents of the Board of Estimate then make up a "tenta¬ tive" appropriation bill which is sub¬ mitted to the Board itself for dis¬ cussion and after a paring process the amended bill goes to the ap¬ propriating body under the title of "budget of the City of New York." This method just described is thought to be defective in manv particulars and chiefly in the followin'^ respects: 1—The plan brings into review only a part of the city's activities and financial requirements; the amount of the "expenses" which are made the subject of careful scrutiny is only about 40 per cent of the total annual expenditures, while the en- the correct process, is wholly reversed and with this there is a loss of publicity because the board as a reviewing body conies to be the proooser while adminis¬ trative officers become ineffective critics —the public being left in the dark and the city being deprived of the business judgment of officers in charge of its various services The methods of accounting prescribed by the Comptroller are desi.gned to pro¬ vide for publicity as well as exact in¬ formation both to officers and to the controling boards. The information which the accounts prescribed by the Comptroller are designed to produce is of two kinds: (1) information to prevent overdrawinc? of apnropriations; (2) in¬ formation which will tell the story of tire bill carries only about 80 per cent of all authorizations. 2—The preparation of the "budget" is put into the hands of the staffs of the Board of Estimate instead of re¬ quiring the executive officers them¬ selves with their staff and line ad¬ visors to prepare, submit, explain and defend the proposals which are to be voted on by the representative body—a practice which thwarts all efforts to force on executives the necessity for planning and for ren¬ dering a strict account of their ac¬ tivities, the attitude of the executive under the circumstances being to ask for more than he needs in the hope that he may get what he thinks he is entitled to. 3—The initiative bein.g taken by an irresponsible staff of a central board the conclusions reached are necessarily arbitrary and the meth¬ od of control is one of minute limi¬ tations and restrictions on the man¬ agement instead of critical review and approval or disanproval of executive plans with provisions for enforcing strict accountability as to the manner in which public money is expended. While this criticism of method is couched in general terms the fact is that what is being done and whether the business of the city is being carried on economically or wastefully. The methods used by the staff agencies of the Board of Estimate in the prepa¬ ration of the "budget," however, are such that it has been found impossible successfully to install and operate the last kind of accounts, the result being that both the board and the public are vvithout information concerning the ac¬ tivities of the city and have little or no basis for judgment as to whether the management of nublic affairs is what it should be. While the Comptroller has been spending- thousands of dollars each year trying to provide the means for en¬ forcing accountability through accurate, up-to-date information on cost of work, tbe staff of the board has been spending other thousands in a manner to prevent it. In other words, the budget-making staff of tbe board has been working at cross purposes with the staff of the Comptroller and neither of them has been svmnatheticallv supported by the staffs of the several departments. The citv is spending $100,000,000 a vear hiring men to carry on its work. One of tlie essentials to efficient public service is t^-e develonment of a loyal personnel aiH an esprit de corps based on fair treatment of its employees. For