Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 99, no. 2570: Articles]: June 16, 1917

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

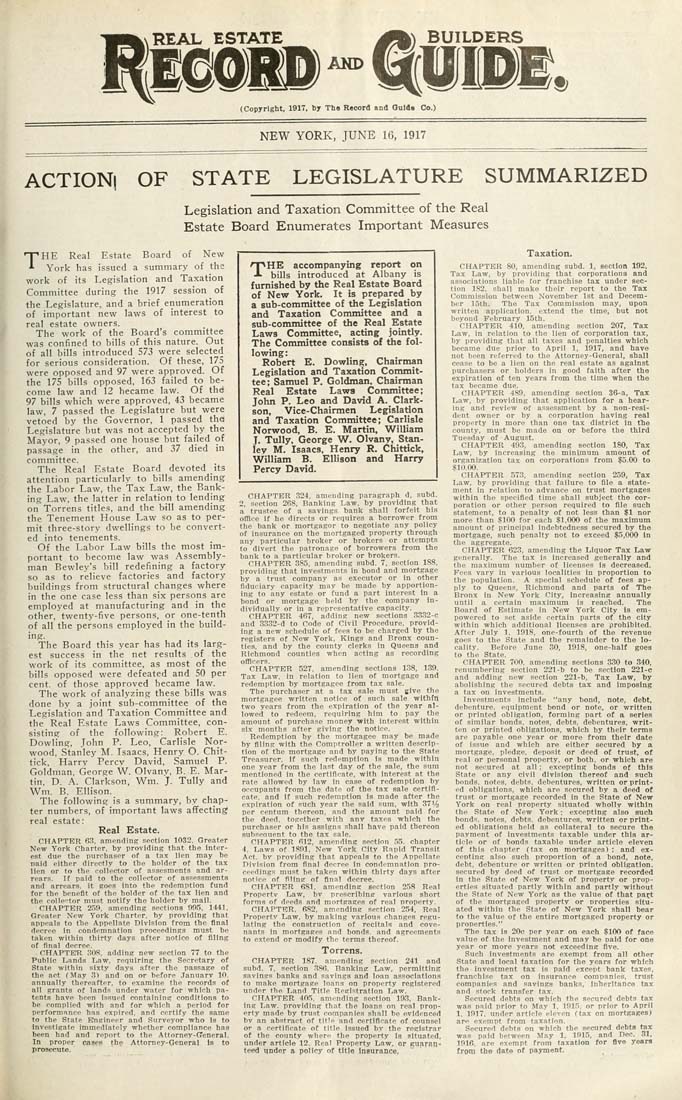

REAL ESTATE AND (Copyright, 1917, by The Record and Oulde Co.) NEW YORK, JUNE 16, 1917 ACTION! OF STATE LEGISLATURE SUMMARIZED Legislation and Taxation Committee of the Real Estate Board Enumerates Important Measures THE Real Estate Board of New York has issued a summary of the work of its Legislation and Taxation Committee during the 1917 session of the Legislature, and a brief enumeration of important new laws of interest to real estate owners. The work of the Board's committee was confined to bills of this nature. Out of all bills introduced 573 were selected for serious consideration. Of these, 175 were opposed and 97 were approved. Of the 175 bills opposed, 163 failed to be¬ come law and 12 became law. Of thei 97 bills which were approved, 43 became law, 7 passed the Legislature but were vetoed by the Governor, 1 passed thei Legislature but was not accepted by the Mayor, 9 passed one house but failed of passage in the other, and 37 died in committee. The Real F.state Board devoted its attention particularly to bills amending the Labor Law. the Tax Law, the Bank¬ ing Law, the latter in relation to lending on Torrens titles, and the bill amending the Tenement House Law so as to per¬ mit three-story dwellings to be convert¬ ed into tenements. Of the Labor Law bills the most im¬ portant to become law was Assembly¬ man Bewley's bill redefining a factory so as to relieve factories and factory buildings from structural changes where in the one case less than six persons are employed at manufacturing and in the other, twenty-five persons, or one-tenth of all the persons employed in the build¬ ing. The Board this year has had its larg¬ est success in the net results of the work of its committee, as most of the bills opposed were defeated and SO per cent, of those approved became law. The work of analyzing these bills was done by a joint sub-committee of the Legislation and Taxation Committee and the Real Estate Laws Committee, con¬ sisting of the following: Robert E. Dowling, John P. Leo, Carlisle Nor¬ wood, Stanley M. Isaacs, Henry O. Chit¬ tick. Harrv Percv David, Samuel P. Goldman, George W. Olvany, B. E. Mar¬ tin, D. A. Clarkson, Wm. J. Tully and Wm. B. Ellison. The following is a summary, by chap¬ ter numbers, of important laws affecting real estate: Real Estate. CHAPTER 6.'?, amending section 1032. Greater New York Charter, by providing that the inter¬ est due the purchaser ot a tax lien may be paid either directly to tbe holder of the tax lien or to tbe collector of assesments and ar¬ rears. It paid to the collector of assessments and arrears, it goes into the redemption fund for the benefit of the bolder of the tax lien and tbe colle'^tor must notify tbe holder by mail. CHAPTER 2."!), amending sections n!1.5, 1441, Greater New York Charter, by providing tbat appeals to the Appellate Division from tho final decree in condemnation proceedings must be taken within thirty days after notice of filing of final decree. CHAPTE'R 30S, adding new section 77 to the Public Lands Law. requiring the Secretary of State within sixty days after the passage of tbe act (May .31 and on or before .Tanuarv 10. annually thereafter, to examine the records of all grants of lands under water for which pa¬ tents have been issued containing conditions to be complied with and for wliich a period for performance bas expired, and certify the same to tbe State Engineer and Surveyor who Is to Investigate immediately whether compliance bas been had and report to tbe Atforney-Ceneral. In proper cases the Attorney-General Is to prosecute. THE accompanying report on bills introduced at Albany is furnished by the Real Estate Board of New York. It is prepared by a sub-committee of the Legislation and Taxation Committee and a sub-committee of the Real Estate Laws Committee, acting jointly. The Committee consists of the fol¬ lowing: Robert E. Dowling, Chairman Legislation and Taxation Commit¬ tee; Samuel P. Goldman, Chairman Real Estate Laws Committee; John P. Leo and David A. Clark¬ son, Vice-Chairmen Legislation and Taxation Committee; Carlisle Norwood, B. E. Martin, William T. Tully, George W. Olvanv, Stan- lev M. Isaacs, Henry R. Chittick, William B. Ellison and Harry Percy David. CHAPTER S24. amending paragraph d, subd. 2, section 268, Banking Law, by providing that a trustee of a savings bank shall forfeit his office if he directs or requires a borrower from tbe bank or mortgagor to negotiate any policy of insurance on the mortgaged property through any particular broker or brokers or attempts to divert the patronage ot borrowers from the bank to a particular broker or brokers. CHAPTER 385, amending subd. 7, section 188, providing that investments in bond and mortgage by a trust company as executor or in other fiduciary capacity may be made by apportion¬ ing to any estate or fund a part interest In a bond or mortgage beld by the company in¬ dividually or in a representative capacity. CHAPTER 467, addine new sections .3332-c and 3.3.32-d to Code of Civil Procedure, provid¬ ing a new schedule of fees to be charged by tbe registers ot New York, Kings and Bronx coun¬ ties, and by the county clerks in Queens and Richmond counties when acting as recording officers. CHAPTER 527. amending sections 1.38, 139. Tax Law, In relation to lien of mortgage and redemption by mortgagee from tax sale. The purchaser at a tax sale must give the mortgagee written notice ot sucb sale withtii two years from the expiration of the year al¬ lowed to redeem, requiring him to pay tbe amount of purchase money with interest within six months after giving the notice. Redemption by tbe mortgagee may be made hy filing with the Comptroller a written descrip¬ tion of tbe mortgage and by paying to the State Treasurer. If such redemption Is made within one year from the last day of tbe sale, the sum mentioned in tbe certificate, with interest at the rate allowed by law in case of redemption by occupants from the date of the tax sale certifi¬ cate, and If such redemption la made after tbe expiration of such year ttie said sura, with 37Ms per centum thereon, and the amount paid for the deed, together with anv taxes which tbe purchaser or his assigns shall have paid thereon subsenuent to the tax sale. CHAPTER 612, amending section 35. chapter 4. Laws of 1891, New York City Rapid Transit Act. bv providing tbat appeals to the Appellate Division from final decree in condemnation pro¬ ceedings must be taken within thirty days after notice of filing of final decree. CHAPTER 681, amending section 258 Real Propertv Law, bv prescribine various short forms of deeds and mortgages of real property. CHAPTER. 682, amending section 254, Real Propertv Law, by making various changes regu¬ lating the construction of recitals and cove¬ nants in mortgages and bonds, and agreements to extend or modify the terms thereof. Torrens. CHAPTER 187. amending section 241 and subd. 7, section 3,86, Banking Law, permitting savines banks and savings and loan associations to make mortgage loans on property registered under tbe Land Title Registration Law. CHAPTER 405, amending section 193, Bank¬ ing Law. providing that tbe loans on real prop¬ erty made by trust companies shall be evidenced bv an abstract of title and certificate of counsel or a certificate of title issued by the registrar of the county where tbe property Is situated, under article 12. Real Property Law, or guaran¬ teed under a policy of title Insurance, Taxation. CHAPTER 80, amending subd. 1, section 192, Tax Law, by providing that corporations and associations liable for franchise tax under sec¬ tion 182. shall make their report to the Tax Commission between November 1st and Decem¬ ber lath. The Tax Commission may, upon written application, extend the time, but not beyond February 15th. CHAPTER 410, amending section 207, Tax Law, in relation to the lien of corporation tax, by providing that all taxes and penalties which became due prior to April 1, 1917, and have not been referred to the Attorney-General, shall cease to be a lien on the real estate as against purchasers or holders in good faith after the expiration of ten years from the time when the tax became due. CHAPTER 489, amending section 36-a, Tax Law, by providing that application for a hear¬ ing and review of assessment by a non-resi¬ dent owner or by a corporation having real property In more than one tax district in tile county, must be made on or before the third Tuesday of August. CHAPTER 493, amending section 180, Tax Law, by increasing tbe minimum amount of organization tax on corporations from $5.00 to .flO.OO. CHAPTER 573, amending section 259, Tax Law, by providing that failure to file a state¬ ment In relation to advance on trust mortgages within the specified time shall subject the cor¬ poration or other person required to file such statement, to a penalty of not less tlian $1 nor more tban .$100 for each $1,000 of the maximum ainount of principal indebtedness secured by the mortgage, such penalty not to exceed $5,000 in the aggregate. CHAPTER 623, amending the Liquor Tax Law generally. The tax Is Increased generally and the maximum number of licenses is decreased. Fees vary in various localities In proportion to the population. A special schedule of fees ap¬ ply to Queens, Richmond and parts of The Bronx in New York City, increasing annually until a certain maximum is readied. The Board of Estimate in New York City Is em¬ powered to set aside certain parts of tbe city within which additional licenses are prohibited. After July 1. 1018, one-fourth of the revenue goes to tbe State and the remainder to the lo¬ cality. Before June 30, 1918, one-half goes to the State. CHAPTER 700, amending sections 330 to 340, renumbering section 221-b to be section 221-c and adding new section 221-b, Tax Law, by abolishing the secured debts tax and imposing a tax on investments. Investments include "any bond, note, debt, debenture, equipment bond or note, or written or printed obligation, forming part of a series of similar bonds, notes, debts, debentures, writ¬ ten or printed obligations, which by their terms are payable one year or more from their date of issue and which are either secured by a mortgage, pledge, deposit or deed of trust, of real or personal property, or both, or which are not secured at all : excepting bonds of this State or any civil division thereof and sucTi bonds, notes, debts, debentures, written or print¬ ed obligations, which are secured by a deed of trust or mortgage recorded in the State of New York on real nroperty situated wholly within tbe State of New York; excepting also such bonds, notes, debts, debentures, written or print¬ ed obligations held as collateral to secure tbe payment of investments taxable under this ar¬ ticle or of bonds taxable under article eleven of tbis chapter (tax on mortgages) : and ex¬ cepting also such proportion of a bond, note, debt, debenture or written or printed obligation, secured by deed of trust or mortgage recorded in tbe State of New York of property or prop¬ erties situated partly within and partly without the State of New York as the value of that pa^t of the mortgaged property or properties situ¬ ated within tbe State of New York shall bear to the value of the entire mortgaged property or properties." The tax is 20c per year on each $100 ot face value of the investment and may be oaid for one year or more years not exceeding five. Such investments are exempt from all other State and local taxation for the years for which the investment tax is paid except bank taxes, franchise tax on insurance companies, trust companies and savings banks, Inheritance tax and stock transfer tax. Secured debts on which tbe secured debts tax was paid prior to May 1. 1915, or prior to April 1, 1917, under article eleven (tax on mortgages) are exempt from taxation. Secured debts on which the secured debts tax was paid between May 1, 1915, and Dec. 31. 1916, are exempt from taxation for flve years trom the date of payment.