Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: [v. 100, no. 2579: Articles]: August 18, 1917

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

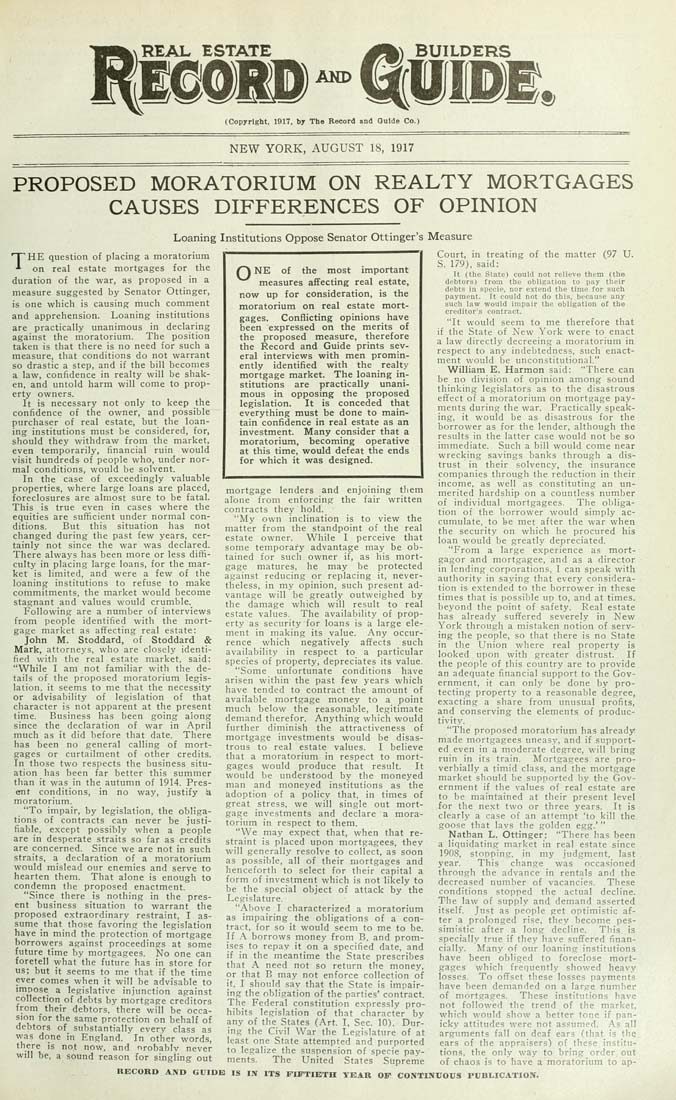

REAL ESTATE AND (Copyright, 1917, by The Record and Guide Co.) NEW YORK, AUGUST 18, 1917 PROPOSED MORATORIUM ON REALTY MORTGAGES CAUSES DIFFERENCES OF OPINION Loaning Institutions Oppose Senator Ottinger's Measure THE question of placing a moratorium on real estate mortgages for the duration of the war, as proposed in a measure suggested by Senator Ottinger, is one which is causing much comment and apprehension. Loaning institutions are practically unanimous in declaring against the moratorium. The position taken is that there is no need for such a measure, that conditions do not warrant so drastic a step, and if the bill becomes a law, confidence in realty will be shak¬ en, and untold harm will come to prop¬ erty owners. It is necessary not only to keep the confidence of the owner, and possible purchaser of real estate, but the loan¬ ing institutions must be considered, for, should they withdraw from the market, even temporarily, financial ruin would visit hundreds of people who, under nor¬ mal conditions, would be solvent. In the case of exceedingly valuable properties, where large loans are placed, foreclosures are almost sure to be fatal. This is true even in cases where the equities are sufficient under normal con¬ ditions. But this situation has not changed during the past few years, cer¬ tainly not since the war was declared. There always has been more or less diffi¬ culty in placing large loans, for the mar¬ ket is limited, and were a few of the loaning institutions to refuse to make commitments, the market would become stagnant and values would crumble. Following are a number of interviews from people identified with the mort¬ gage market as affecting real estate: John M. Stoddard, of Stoddard & Mark, attorneys, who are closely identi¬ fied with the real estate market, said: "While I am not familiar with the de¬ tails of the proposed moratorium legis¬ lation, it seems to me that the necessity or advisability of legislation of that character is not apparent at the present time. Business has been going along since the declaration of war in April much as it did before that date. There has been no general calling of mort¬ gages or curtailment of other credits. In those two respects the business situ¬ ation has been far better this summer than it was in the autumn of 1914. Pres¬ ent conditions, in no way, justify ^ moratorium. '*To impair, by legislation, the obliga¬ tions of contracts can never be justi¬ fiable, except possibly when a people are in desperate straits so far as credits are concerned. Since we are not in such straits, a declaration of a moratorium would mislead our enemies and serve to hearten them. That alone is enough to condemn the proposed enactment. "Since there is nothing in the pres¬ ent business situation to warrant the proposed extraordinary restraint, I as¬ sume that those favoring the legislation have in mind the protection of mortgage borrowers against proceedings at some future time by mortgagees. No one can foretell what the future has in store for us; but it seems to me that if the time ever comes when it will be advisable to impose a legislative injunction against collection of debts by mortgage creditors from their debtors, there will be occa¬ sion for the same protection on behalf of debtors of substantially every class as was done in England. In other words, there is not now, and nrobablv never vi'ill be, a sound reason for singling out r) NE of the most important measures affecting real estate, now up for consideration, is the moratorium on real estate mort¬ gages. Conflicting opinions have been expressed on the merits of the proposed measure, therefore the Record and Guide prints sev¬ eral interviews with men promin¬ ently identified with the realty mortgage market. The loaning iti- stitutions are practically unani¬ mous in opposing the proposed legislation. It is conceded that everything must be done to main¬ tain confidence in real estate as an investment. Many consider that a moratorium, becoming operative at this time, would defeat the ends for which it was designed. mortgage lenders and enjoining them alone from enforcing the fair written contracts they hold. "My own inclination is to view the matter from the standpoint of the real estate owner. While I perceive that some temporary advantage may be ob¬ tained for such owner if, as his mort¬ gage matures, he may be protected against reducing or replacing it, never¬ theless, in my opinion, such present ad¬ vantage will be greatly outweighed by the damage which will result to real estate values. The availability of prop¬ erty as security for loans is a large ele¬ ment in making its value. Any occur¬ rence which negatively affects such availability in respect to a particular species of property, depreciates its value. "Some unfortunate conditions have arisen within the past few years which have tended to contract the amount of available mortgage money to a point much below the reasonable, legitimate demand therefor. Anything which would further diminish the attractiveness of mortgage investments would be disas¬ trous to real estate values. I believe that a moratorium in respect to mort¬ gages would produce that result. It would be understood by the moneyed man and moneyed institutions as the adoption of a policy that, in times of great stress, we will single out mort¬ gage investments and declare a mora¬ torium in respect to them. "We may expect that, when that re¬ straint is placed upon mortgagees, they will generally resolve to collect, as soon as possible, all of their mortgages and henceforth to select for their capital a form of investment which is not likely to be the special object of attack by the Legislature. "Above I characterized a moratorium as impairing the obligations of a con¬ tract, for so it would seem to me to be. If A borrows money from B, and prom¬ ises to repay it on a specified date, and if in the meantime the State prescribes that A need not so return the money, or that B may not enforce collection of it. I should say that the State is impair¬ ing the obligation of the parties' contract. The Federal constitution expressly pro¬ hibits legislation of that character by any of the States (Art. I, Sec. 10). Dur¬ ing the Civil War the Legislature of at least one State attempted and purported to legalize the suspension of specie pay¬ ments. The United States Supreme Court, in treating of the matter (97 U. S. 179), said: It (the State) could not relieve them (the debtors) from the obligation to pay their debts in specie, nor extend the time for such payment. It could not do this, because any such law would impair the obligation of the creditor's contract. "It would seem to me therefore that if the State of New York were to enact a law directly decreeing a moratorium in respect to any indebtedness, such enact¬ ment would be unconstitutional." William E. Harmon said: "There can be no division of opinion among sound thinking legislators as to the disastrous effect of a moratorium on mortgage pay¬ ments during the war. Practically speak¬ ing, it would be as disastrous for the borrower as for the lender, although the results in the latter case would not be so immediate. Such a bill would come near wrecking savings banks through a dis¬ trust in their solvency, the insurance companies through the reduction in their income, as well as constituting an un¬ merited hardship on a countless number of individual mortgagees. The obliga¬ tion of the borrower would simply ac¬ cumulate, to be met after the war when the security on which he procured his loan would be greatly depreciated. "From a large experience as mort¬ gagor and mortgagee, and as a director in lending corporations, I can speak with authority in saying that every considera¬ tion is extended to the borrower in these times that is possible up to, and at times, beyond the point of safety. Real estate has already suffered severely in New York through a mistaken notion of serv¬ ing the people, so that there is no State in the Union where real property is looked upon with greater distrust. If the people of this country are to provide an adequate financial support to the Gov¬ ernment, it can only be done by pro¬ tecting property to a reasonable degree, exacting a share from unusual profits, and conserving the elements of produc¬ tivity. "The proposed moratorium has already) made mortgagees uneasy, and if support¬ ed even in a moderate degree, will bring ruin in its train. Mortgagees are pro¬ verbially a timid class, and the mortgage market should be supported by the (Gov¬ ernment if the values of real estate are to be maintained at their present level for the next two or three years. It is clearly a case of an attempt 'to kill the goose that lavs the golden egg.'" Nathan L. Ottinger: "There has been a liquidating market in real estate since 1908, stopping, in my judgment, last year. This change was occasioned through the advance in rentals and the decreased number of vacancies. These conditions stopped the actual decline. The law of supply and demand asserted itself. Just as people get optimistic af¬ ter a prolonged rise, tliey become pes¬ simistic after a long decline. This is specially true if they have suffered finan¬ cially. Many of our loaning institutions have been obliged to foreclose mort¬ gages which frequently showed heavy losses. To offset tliese losses payments have been demanded on a large number of mortgages. These institutions have not followed the trend of the market, which would show a better tone if pan¬ icky attitudes were not assumed. As all arguments fall on deaf ears (that is the ears of the appraisers) of these institu¬ tions, the only way to bring order out of chaos is to have a moratorium to ap- RBCORD AND GUIDB IS IX ITS FIFTIETH YEAR OF CONTINUOUS PUBLICATION.