December 8, 1887

The 'Record and Guide.

1611

10T9 39th street, near Sd avenue. Two five-story stores and tene¬

ments. Mortgage $25,000, Rent $4,000.................. 84,000

2003 Brooklyn, N. Y. Fine improved property, free and clear, to

exchange for New York business property................ 85,000

2002 To exchange: $150,000 worth of free and clear lots for New

York improved property..................................

--------•--------

The Mayor has officially extended the time for completing the books,

raaps and indices for " recording and indexing conveyances and instru¬

ments relating to land in New York city, according to limited areas,"

till the 30th day of June, 1888. The act relative to the matter is to go

into effect on that date.

-------------------------------------------------------------------------------------•-----------------------------------------------------------------------------------■

Principles for the Correct Valuation of. Real Estate.

Editor Record and Guide:

Tbe subject of proper valuations of realty in our cities, whether for pur¬

poses of taxation, appropriation under right of eminent domain, or simple

purchase and sale between ordinary buyers or sellers, is one of constantly

increasing importance. The various valuations put upon the several pieces

of property for the contemplated use of public markets in Newark illus¬

trates this. How differently are the several localities, in general, estimated;

for example, the location between Broad, Comraerce.^Mulberry and'Canal

streets; secondly, the location temporarily used In East Newark or Harri¬

son; thirdly, the old burying-eround; fourthly, the Orange street prop¬

erty, etc. But waiving for the present the most important factor—the

convenience of the people—what are the other tests of the money'values of

properties iu these several localities? Descending to individual pieces

located vpithin any one of these separate tracts, how varied are|tbe different

teets of value, and how great the discrepancy in the valuations themselves,

OS made by different parties. In some future letter you may .care to hear

of the astonishing disparity in the valuations, both of businesa property

and resident property, iu a dozen of our large cities, running all the way

from $6,000 to $500 a front foot for business property, and from $500 to

$50 for resident property. Many reported valuations of realty in the City

of Newark are made with a singular want of accuracy and sound prin¬

ciple. We have just heard of oue expert estimating a certain piece of prop¬

erty at $40,000, and another expert estimating tbe same as worth $18,000,

and that in the best street of this city.

In arriving at correct valuations in the cities of the United States, com¬

parisons with properties similarly situated in European cities should be

made with peculiar care. The tests of value iu Germany. In France, in

Russia, in Great Britain vary soraewhat; but as the United States of

America is growing faster than any other firstclass country, as more of

our large cities are growing quicker than those of any otber country, and as

the Metropolitan District of New York is, for the present century at least,

by far the most progressive in numbers, wealth and commercial import¬

ance, it is clear that the starting point for the correct estimate of real

estate here is different and quite independent of some considerations which

affect other regions.

Newark is a very close neighbor of New York. It is not, strictly. Its

suburb or under-city, because It is itself the metropolis of a different sov¬

ereign State. It is under a different constitution and different laws, has a

different civilization and policy, however largely tbey may be qualified by

proxiraity to its neighbor. At tbe same time this very proximity, and

indeed its owu location, are both important elements in shaping its char¬

acter. Its proximity affords its residents all the advantages of an actual,

vital connection with New York ; sharing the markets of the metropolis,

and aU the advantages of railroads, water-ways (natural and artificial),

telegraphs, etc., while its general location favors accessibility to coal mines.

Iron mines and rich agricultural districts. Thus many important factors

unite in determining the practical value of the real e.state within its Umits.

Therefore, it may well be asked, why does real estate in Newark command

such unreasonably low figures ? Tbat the valuations are low is apparent to

any one who has given the matter attention. Suffice it to say that none of

the reasons assigned for the under-valuations of property there are now

operative, or justified by facts. It is now au old story that tbe absorption

of large numbers of properties by corporations which had loaned money

and taken tbese properties under foreclosure, has placed many houses on

the market and thus depressed properties. The fact Is that almost all these

properties have already been picked up by keen investors. Had tbe prac¬

tice existed of publish'ng the quotations of the values of tbeir moneyed

corporations, and full reports of their investments also appeared ; had tbe

people been thoroughly informed of the different doings of its banks, insur¬

ance companies and other institutions, it never would have happened that

so many failures would have suddenly occurred, to the astonisbmont of the

public, and particularly of those interested; nor would so many corpora¬

tions have been unduly loaded up with bad loans and unproductive prop¬

erties. But this, fortunately, is now a thing of the past,

Secondly. There is no doubt iu the minds of impartial observers that

the prevailing system of purchase and sale of properties through real estate

agents in Newark and vicinity is faulty. Were a piece of property placed

in the hands of oue agent exclusively that agent could maintain its proper

price. As it is, almost every real estate agent seems to feel at liberty to

list on bis books any piece of property of wbich he can, by any method,

obtain tbe description. There is no necessity of this hawking property

about; for if one agent had the exclusive handling of it, any other who has

actually contributed to its purchase or sale for him could, ordinarily, share

the former's commissions. But, so hungry are certain of tbese agents for

a transaction, that even when a piece of property is offered for sale by one

of their number, it becomes at the mercy of the whole profession, who

encourage the would-be purchaser to believe that, by crying down tbe

property, by postponing action, and by other questionable methods, the

property can be bought at a lower price. Thia practice haa tended not

only to depress valuations of tbe best property in Newark far below ita

legitimate worth, but it has encouraged a horde of cheap, irresponsible

operators in getting possession of vacant lots at little cost, then erecting

small, monotonous cabins, which they sell at an enormous profit. Such

policy is detrimental to the substantial growth of any respectable city.

Were a party to purchase first a lot at a fair price, then build his own

bouse, he would effect a great saving and own property. Tbe system of

building loau associations—aiding the individual iu becoming bis own

householder—is, however, something greatly to be encouraged.

Thirdly. A brief reierence to one other erroneous and unwarrantable

practice in estimating realty will suffice for this article. Many preju¬

diced and short-sighted persons are so infatuated with the "peculiar"

value of property witbin a stone^a throw of a certain locality—tbe cor¬

ner of Broad and Market streets, in Newark, for instance—as to think

tbat no other property in that great city of 1T0,000 inhabitants is at all

valuable for certain commercial or financial purposes ! How ridiculous

thia seems, when one reflects that both Centre street station, and the

station on tbe Newark and New York Railroad, near Fair street, are both

nearer WaU street, than is their much glorified corner of Broad and Mar¬

ket streets; that thousands of Newarkers transact their daUy business in

New York, and that many of their banks and other moneyed institutions

make their important exchanges and deposits in the latter city.

Only lately did we hear two of their old and substantial citizens expreaa

the persistent opinion t^tat any property north of Commerce street, or south

of Mechanic street, ou Broad, was unsuitable for financial business I

Probably the coucrete fact of the Prudential Insurance Company's build¬

ing, presently to be erected on the corner of Franklin and Broad streets,

will ''scatter into smithereens" all such nonsense. In tbe greatest cities,

London, New York, etc., in fact in all cities of upwards of 50,000 inhab-

itants, some of the leading moneyed institutions are located remotely from

the chief business centres. The stock of the Second National Bank,

located on the corner of 23d street and 5th avenue, New York, is

quoted at SOO. In New Haven, Hartford and elsewhere, the best banks

are scattered throughout different parts of these cities. Recently

we heard a party disparage the value of property situated lesa than two

blocks frora the corner of Broad and Market streeta aa worth only one-

thira of similar property somewhat nearer such comer, whereas the

former contained nearly three times as many square feet. We know that

it will be urged tbat the best test of the value of real property is, *' what

will it fetch In open market?" True; but, further, such price is largely

determined by what rental does tbe property bring or can fairly be made

to bring ? Wbat we contend for is, that in determining what use certain

property can be put to in order to be more productive and therefore more

valuable, purchasers should honestly consider the actual merits and

material facts; such as the size of the property, locality, its accessibility,

etc.; in a word, tbey should as far as possible intelUgently consider all the

possible aud prospective factors, according to those rules wbich are now,

and loug have been, generally applied, in estimating the value of property

in the most enlightened social and business centres of the world. It would

be well if all property-holders in Newark will evince their intelligence and

local pride by insisting on applying the same sound principles and uniform

tests of values which have not only long prevailed in old and large cities,

but which have been found indispensable to just dealingeven in om' smaUer,

but more progressive municipalities of the enterprising West.

Joseph C. Jackson,

80 Broadway, New York, November 22, 188T.

The World of Business.

The Circulation.

The annual reports of the Uuited States Treasurer and of the Director

of the Mint provide the data for a precise comparison of the currency in

circulation at different periods. It appears from the statement of the Mint

that the gold coin in circulation November 1st, 18S7, exceeded the amount

in the Treasury by $393,585,770. It is especially necessary in tbese com¬

parisons not to overlook the fact that bullion, whether imported or derived

from the mines, is not to be reckoned as currency until it has passed through

the Miut, and in consequence the large additions to the stock of gold in the

country, by foreign importations and otherwise during the past few

months, are as yet but partially represented in the actual circulation. Tbe

stock of silver dollars in circulation steadily increases, aud the demand for

small coins and notes is so great that the Treasury is able to find use for a

constantly increasing part of the unavailable subsidiary silver formerly

held. Bringing together data derived from the two reports we have the

following comparative statement of coin and paper in circulation at the

beginning of the month, at tbe beginniug of the fiscal year, and June

SOth, 1886:

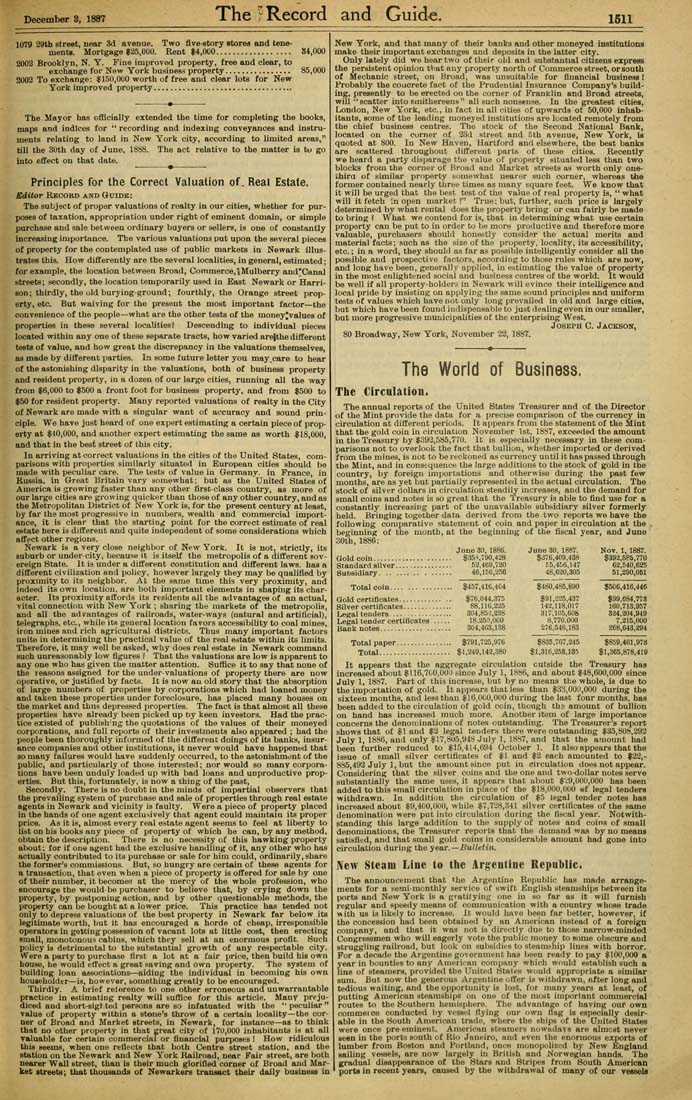

June 30, 1886. June 30, 1887. Nov. 1, 1887.

Gold coin..................... $35-<,790,428 $376,409,438 $393,585,770

Standard silver................ 52,469,720 55,456,147 62,540,625

Subsidiary................ 46,156,256 48,620,305 51,290,051

Totalcoin................ $457,4ltJ,4C4 $480,485,890 $506,416,446

Gold certificates.............. $76,044,375 $91,225,437 $99,684,773

Silver certificates.............. 88.116,2;i5 142,118,017 160,713,957

Le^al tenders................. 304,85 i,238 317.105,008 324,204,949

Legal tender certificates ..... 18,25^,000 8,770.000 7.315,000

Bank notes................... 304,463,138 276,548,183 268,643,294

Total paper................ $791,725,970 $835,767,245 $859,461,973

Total.................... $1,249,I42,.S80 $1,316,258,185 $1,365,878,419

It appears that the aggregate circulation outside the Treasury haa

increased about $116,7CO,00:) since July 1, 18»6, and about $48,600,000 since

July 1, 18S7. Part of this increase, but by no meana the whole, is due to

the importation of gold. It appears that less than $33,000,000 during tbe

sixteen months, aud less than $16,000,000 during the last four raonths, haa

been added to the circulation of gold coin, though tho amount of bullion

on hand has increased much more. Another item of large importance

concerns the denonjiuations of notes outstanding. The Treasurer's report

shows that of $1 and $2 legal tenders there were outstanding $35,808,292

July 1, 1886, and only $17,805,948 July 1, 18S7, and that the amount had

been further reduced to $15,414,694 October 1. It also appears tbat the

issue of small silver certificates of $1 and $2 each amounted to $22,-

885,492 July 1, but the amount since put iu circulation does not appear.

Considering tbat the silver coins and tbe one and two-dollar notes serve

substantially the same uses, it appears Ihat about $i9,000,000 bas been

added to tbis small circulation in place of tbe $18,000,000 ®f legal tenders

withdrawn. In addition the circulation of $5 legal tender notes bas

increased about $9,400,000, while $7,728,341 silver certificates of the same

denomination were put into circulation during the fiscal year. Notwith¬

standing this large addition to the supply of notes and coins of small

denominations, the Treasurer reports that tbe demand was by no means

satisfied, and that small gold coins in considerable amount had gone into

circulation during the yea.r.—Bulletin.

New Steam Line to the Argentine Republic.

The announcement that *he Argentine Republic has made arrange¬

ments for a bemi-montbly service of swift English steamships between its

ports and New York is a gratllying one in so far as it will furnish

regular and speedy means of communication with a country whose trade

with us is likely to increase. It would have been far better, however, if

the concession had been obtained by an American instead of a foreign

company, und that it waa not is directly due to those narrow-minded

Congressmen who will eagerly vote the public money to some obscure and

struggling railroad, but look on subsidies to steamssliip lines with horror.

For a decade the Argentine government has been ready to pay $100,0(X> a

year in bounties to any American cottipany which would establish such a

line of steamers, provided the United States would appropriate a similar

sum. But now the generous Argentine offer ia withdrawn, after long and

tedious waiting, and the opportunity is lout, for many years at least, of

putting American steamships on one of the most important commercial

routes to the Southern hemisphere. The advantage of having our own

commerce conducted by vessel flying our owu flag is especiaUy desir¬

able in the South American trade, where tbe ships of the United States

were once pre eminent. American steamers nowadays are almnst never

seen in tbe ports south of Rio Janeiro, and even the enormous exports of

luraber from Boaton and Portland, once monopolized by New England

sailing vessels, are now largely in British and Norwegian hands. The

gradual disappearance of the Stars and Stripes from South Araerican

ports in recent years, caused by tbe withdrawal of many of our vessels