692

Record and Guide,

itovember 22,18d6

speciflc securitiea attacbed to tbem. Of tbese l,e64,000f. tbere were

«)0,0002. which one of tbe directors very can<iidly confessed must be con¬

sidered as totally bad. and which ought to have been written off long

before, but which still remained in the account as good debts. The

capital of the concern was 6^6,0002. nominally, but in reality it was consid¬

erably less than that; because in Ib47 tfaey faad been in trouble, and in

order to get out of tfaat tiouble they faad made a call of 52. to 11)2. a share,

wfaich was not paid upon some of tfae shares, which shares were forfeited

and taken by tfaem into tfae stock of tfaeir bank, to be reissued should occa¬

sion warrant their doing so. The consequence was that the subscribed

capital of the bank was about 6c'(),0002. Tbis statement at once showed that

any attempt to help tbem. short of taking up the whole concern and

liquidating it for tbem, would be perfectly useless. It was evident tbat

tfae whole capital was gone; and, looking at the character of the securities,

Mr. Hodgson came to tfae conclusion not oidy tfaat tfae capital was gone,

Imt that the bank was totally insolvent. Being very much struck witb tfae

extraordinary loss wfaich bad teken place in the bank, wbich, when a

private bank, be knew to faave been a very flourishing one, fae inquired

whether there was not some old sore of wfaich nothing faad as yet been

said. He was told that there was one; tbere was ratfaer a disincUnation

to mention what it was, but he felt it his duty to press it, and they told

him tfaey had a very large debt witb tbe Derwent Iron Company. He

inquired the amount of this debt, and foimd, much to bis astonishment,

that it amounted to 750,0002., tbe capital of the bauk being 600,OOC2. For

that debt tbere was a kind of security, which consisted of *'JiiD,OO0l, ut what

were called Derwent Iron Company's debentures, which were, bowever, in

reaUty, nothing bnt the promissory notes of the directors, there being

very few persons in this Derwent Iron Company. Tbe bank had also

100,0002. morteruge on the plant, and the remaining 400,0002. was totally

unsecured. In addition to this original debt, then mentioned, of

750,0002. tbere is^now another charge upon it of 197,0002. resulting from

bil'8 wbicb have not been paid, and which, in order that the Derwent

Iron Company migfat get tfaem discounted, tfae bank had indors<'d or

otberwise guaranty. These faave now come back, so tbat tfae total

Uabilitv for which the Derwent Iron Company is indebted to the bank

is about 947,0002., very nearly 1,000,0002. Tfae Derwent Iron Company

appears to faave been almost frcan the time of the conversion of the bank

into a joint-stock bank very intimately cojnected with it. Mr. Jonathan

Richardson, wbo was the moving spring of the wfaole bank, in fact tbe

person that managed everything, was, though not a partner in the Der¬

went Iron Company, very largely interested in it, as holding the royal¬

ties upon the minends which tney worbed. It appears that the concern

bas beeu worked extremely badly: thai it bas never made any proflts at

all, even in tfae very flnest years, f )r tbe ironmasters, and it has gone an

absorbing the money of tht bank unckecked by the directors.

Mr. Hodgsoa says that 1,000,0002. of securities were taken of the most

extraordinary nature for any bank to hold tfaat he ever &aw; tbat

1,000,0002. of securities, wfaich was tfae only tangible asset wfaich tfaey

had against the 2,600,0002. of liabilities, consisted of 350,0002. of tfae Der¬

went Iron Company's obligations, 250,0002. being debentures aud 100,0002.

mortgage on the plant. Tbey bad besides tfaese 100,0002. on a building

speculation at Elswick, near Newcastie, wfaicfa faowever was not a

primary mortgage, there being a mortgage of 20,0002. on that land

belongiug to Mr. Hodgson Hinde. Tfaey bad also auotfaer ICO,0002. on

otber building land and faouses in the neigfaborbood of Newcastle. They

bad about 350,0002. in securities of works and manufactures of different

sorts, aud they had about 50,0002. in navigation bonds guaranteed by the

railway, but wbicb railway was tfae only security to wbicb tfaey could look

in any given time to realize any sum of money; that made abf>ut 1,000,0002.

altogetber. The otber securities were absolutely unmarketable. This

bank had derived assistance from tfae Bank of England in tfae former crisis,

that of 1847. Almost exactly tfae same circumstences arose then wbicfa

arose in ISfi?. and almost from the same cause. Tbe bank, bowever, appUed

at tfaat time to the agent of tbe Bank of England at Newcastle, aud he, on

his own responsibility, made them a very large advance, which carried

tbem through; he taking at tfae same time a very considerable security

from tfaena m various mortgages, pretty mucb of the character whicfa has

been above mentioned, but bettor in quality, although not any mere bank¬

ing securitifs than tbese; between 70li,0002. and S0(i,0002. altogetber.

" Tbe whole of tfae advance made in 1847 was repaid to tbe Bank of Eng¬

land, was it not ?" " Yes. With regard to the late occasion I represent^

at tbe same time that though tfae bank could not be assisted, yet tfae fact

of ite failing, wbicfa it would do tfae moment it was known tbat tfae Bank

of England would not faelp it, would be at tfaat moment a very serious

tfaing lor the district, because it was so much connected with the coUieries

and ironworks tfaat it paid eve^ week, eitfaer lor persons wbo had balances

witb it, or for persons whose bills it discounted, and tbus gave them tbe

money, about 35,0002., on which tbe wages of 30,000 people were dependent;

and as tbeir pay-day was on Friday, and the bank would stop on the

Thursday, it was very desirable that something should be done to prevent

the confusion which would arise il there was no preparation made for that

conjuncture. In consequence of that the Bank of England requested me to go

down again that night with full powers to make ari-angemente witfa all

persons wfao m>ght bave any tangible and good security, though perhaps

uot perfectly regular security, so as to provide them with the means of

makmg tbeir pays on the Friday. I went don n accordingly and arranged

witfa almost everybody, or with everybody, I may say, to make such

advances as would enable tbem to meet tfae pays for tfaat week and for

the next should it be necessary. I ^so advised the manager of the

tavings bank to open his bank on Saturday for payments, though it was

not the usual day, aud authorized him to draw upon tbe Bank of England

for any sum of money whicb he might require for the purpose of

making any payment; but owing to the fact of the Bank of England

tbus enabling the proprietors, the coal mines, and tbe works, to make

tbeir weekly payments tbere was no run wfaatever upon tfae savings bank,

and everything passed off quite quietly.

" Was tbere auy limit to tbe authority wbich you faad from the Bank of

England to give assistance in Newcastle f " So, there was no limit, it

was left to my discretion to do what migfat be necessary. We knew very

well tfaat it Ct.uld not amount to a sum, under any circumsances, of mucn

more tfaan from .50,0002. to 70,0002."

" Are tfaere any otfaer particulars connected witfa tfae Newcastle Bank

wfaich you are able to lay before the Committee f ** I will, if the Com¬

mittee wish, give tbem the actual result of the accounts ol the bank wben

it was finally wound up in January tbis year bs compared vrith those in

November, 1857; it will show a Uttle difference. In November, 1867, tbe

UabiUties of tbe bauk were 2,600,0002.; these consisted of deposite,

1,350,0002.; accounte current, 1,150,0002 ; and estimated liabihtiea on

rediscounts, 110 0002. In Januai^, wben the bank \»as positively wound

up and the tfaing ascertained, it appeared tbat tfaere were of deposite

l,256j0002., in accounts current, 766,(X)02., and in UabiUties on rediscounte,

231,O0o2. The only great difference was in tbe accounts current, wbicb

were diminished about 4i 0,000£. This was principaUy, I beUeve, from the

fact that many persons wbo had accounte cun-ent had deposit accoimte

also; tbey kept two accounte, one of wbich had a balance in ite favor, and

tbe otber was overdrawn; therefore, one account being set against the

otfaer, it diminished it by so mucb, aud at tbe same time dinainisbed the

amount of overdrawn accounte; tfae assete wbicfa were estimated In Novem¬

ber at 2,V 0,0002. faad faUen in January to 2.000,0002.; and tfaere was one

peculiarity, wbicfa was, tfaat while tfae debt of tfae Derwent Iron Company

was taken as an asset in November at 7.')U,0002.. in January it was taken as

an asset at 947,0002., and that it is an asset of a very doubtful nature; the

position of the bank is much toorse in reality than is shown by th*

$taiement of ihe figures.

This disclosure was tbe result of an examination whicb lasted about two

hours; yet the bank had declared, at the last half-yearly meeting, a

divitiend of 7 per cent, making to the shareholders a statement tlie sub¬

stance of which showed a very prosperous state of things. Mr. Hodgson

mentions tLathe remarked on tbe fact ol their having declared a dividend

in June, wfaen it vtas admitted tfaat hall tbe capital was lost, and he asked

faow tfaey could faave doLe so; it was stated, in reply, tfaat tbere were so

many persons wfao depended entirely for tbeir Uvelifaood on tbe dividends

received, tfaat tbey really could not bear to face tfaem vritfaout paying any

dividend.

Each of these three banks bad been in peril in 1847, and thougfa

by tbe assistance of the Bank of England they were enabled to

surmount it they fell on tbe next occasion of severe commercial

pressure, under circumstances stiU more injurious. b3th to their

own proprietors and to the public. Two bUl-broking faouses in

London suspended payment in 1847; both afterwards resumed business.

In 1857 botb suspended again. The UabUities of one bouse in 1847 were,

in round numbers, 2,6^3,0002., with a capital of 180,0002.; tbe liabilities of

tbe same bouse in 1857 were 5,300,0002., tbe capitel mucfa smaUer, protmbly

not more tban one-fourth of what it was in ifH7. Tfae UabUities ol tfae

otfaer firm were between 3,000,0002. and 4,000,0002. at each period ol stq^h-

page, with a capital not exceeding 45,0002.

These five houses contributed fnore tban any others to tbe commercial

disaster and discredit of 1857. It is impossible for your Committee to

attribute the failure of such establishment to any otber cause tban to their

oum inherit unsoundness, tlis natural, the inevitable result of their own

misconduA:t.

Thus we bave traced a system under which extensive fictitious credite

bave been created by means ol accommodation bills and open credite,

great lacilities for which have been afforded by tfae practice of

joint-stock country banks discounting such bills, and rediscounting tfaem

with tbe biU brokers in tbe London market Upon the credit ol tbe bank

alone without reference to the quality of the bills otberwise. The redis-

counter relies on tbe belief tbat if tbe bank buspend and tbe bUls are not

met at maturity fae will obtain from tfae Bank of England sucfa immediate

assistance as wUl save bim from tbe consequences. Tfaus, Mr. Dixon

states: " In incidental conversation about tbe whole affair one of tbe bUl

brokers made tfae remark tfaat il it had not been lor Sir Robert Peel's Act

tfae Borough Bank need not have been suspended. In reply to that I said

that whatever mieht be tbe merite bf Sir Robert Peel's Act, for my own

murt, I would not nave been willing to lilt a finger to assist tfae Borough

Bank through ite difficulties il the so doing had involved tfae continuance

of sucfa a wretcfaed system of business as bad been practiced; and. I said, if

I bad only known faalf as mucfa ol tfae proceedings of tfae Borougfa Bank

while 1 waa a director (referring to the time previous to the 1st

of August, when I became a managing a director) as you must faave

known, by seeineagreat many of tfae bUis of the Borough Bank discounted,

you would never have caught me being a shareholder;" the rejoinder

to which was: " Nor wonld you bave caught me being a shareholder; it

was very well for me to discount tfae bills, but I would not faave been a

shareholder eitfaer."

Tfae subjoined iUustrative table supplies its own commentary:

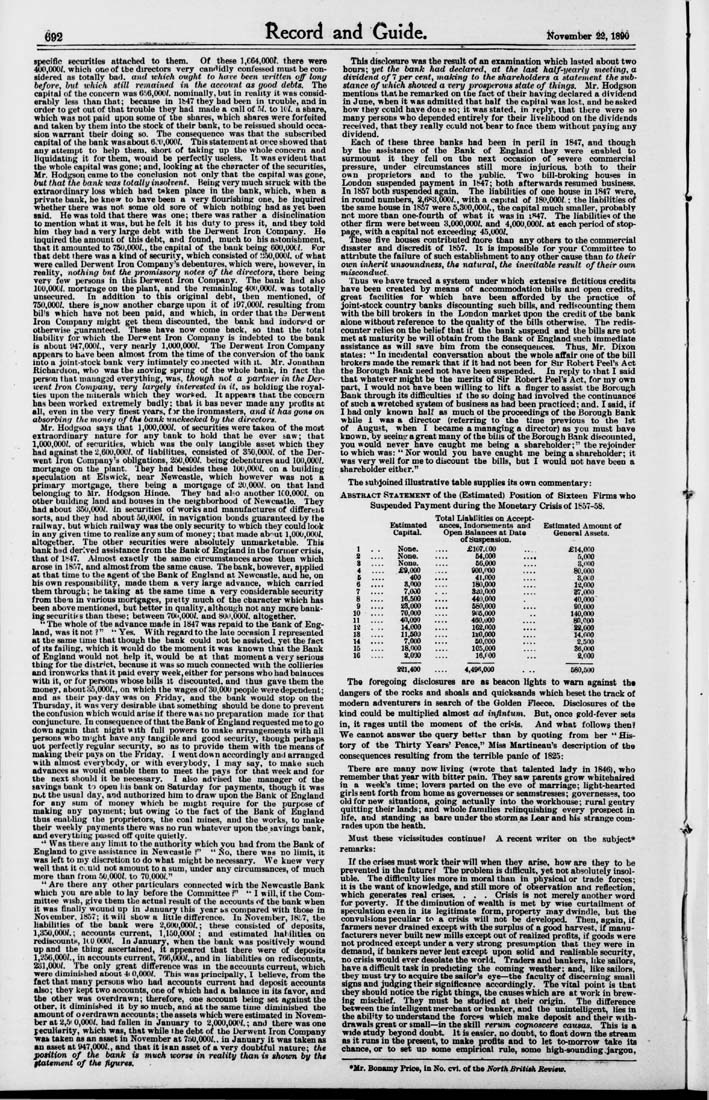

Abstract Statement of the (Estimated) Position of Sixteen Firms wbo

Suspended Payment during the Monetary Crisis of 1857-58.

Total Liabilities on Accept¬

Estimated

ances, Indorsements and

Estimated Amount of

CapitaL

Open Balances at Date

ofSuspeasion.

Gteneral Assete.

1 .

None.

jei07.C00

£14,000

s

None.

64,000

5,000

3

None.

66,000

8,000

4

£9,000

900,000

80,000

6

400

41,000

8,0C0

6 .

8,noo

180,000

1«,000

7 ..

7,000

ai«,ooo

87,000

8 ..

16,600

440,000

40,000

9 .

88,000

680,000

90,000

10 .

70,000

906,000

140,000

11

40,000

460,000

80,000

12

14,000

162,000

88,000

18

11,600

n!0,ooo

14.000

14

7,000

60,000

2,500

15 .

18,000

105,000

86,000

16 .

2,000

16,f00

8,000

821,400 .... 4,49A,000 . .. 560,500

The foregoing disclosures are as beacon lights to warn against ths

dangers of the rocks and shoals and quicksands wbich beset tbe track of

modern adventurers in search of tfae Gtolden Fleece. Disclosures of tfae

kind could be multiplied almost ad infintum. But, once gold-fever set's

in, it rages until tfae moment of tfae crisis. And wfaat follows then?

We cannot answer tfae query better tfaan by quoting from ber " His¬

tory of the Thirty Years' Peace," Miss Martineau's description of the

consequences resulting from the terrible panic of 1825:

There are many now Uring (wrote that talented lady in 1846), wfao

remember tbat year vritfa bitter pain. They saw parente grow whitefaaired

in a week's time; lovers parted on tfae eve of marriage; Ugbt-hearted

girls sent forth from home as governesses or seamstresses; governesses, too

old for new situations, going actuaUy into the workhouse; rural gentry

quitting tfaeir lands; and wfaole families relinquishing every prospect in

life, and standing as bare under tbe storm as Lear and bis* strange com¬

rades upon the heath.

Must theee vicissitudes continue? A recent writer on tbe subject*

remarks:

If the crises must work tbeir vrill when they arise, bow are they to be

prevented in tbe future? The problem is difficult, yet not absolutely insol¬

uble. Tfae difflculty Ues more in moral tfaan in physical or ixade forces;

it ia tfae want of knowledge, and stiU more of owervation and reflection,

wbich generates real crises. . . . Crisis is not merely another word

for povoty. If tbe diminution of wealth is met by wise curtailment of

speculation even in ite legitimate form, property may dvrindle, but the

convulsions pecuUar to a crisis will not be developed. Then, again, if

farmers never drained except witb the surplus of a good faarvest, if manu¬

facturers never built new miUs except out of realized profite, if goods were

not produced except under a very strong presumption tfaat they were in

demand, if bankers never lent except upon solid and reaUsable security,

no crisis would ever desolate the world. Traden and bankers, like sailors,

have a difficult task in predicting tbe coming weather; and, likesaUors,

tfaey must try to acquire tbe sailor's eye—tbe faculty of discerning small

signs and judging their significance accordingly. The vital point is tbat

tbey should notice tfae right tbings, tbe causes which are at work in brew¬

ing mischief. They must be studied at tbeir origin. The difference

between tbe inteUigent merchant or banker, and the unintelUgent, lies in

tbe ability to understand tbe forces which make deposit and their with¬

drawals great or smaU—in the skill rerum eognoscere cattscu. Thia is a

wide study beycmd doubt. It ia easier, no doubt, to float down the stream

as it runs in tbe raretent, to make proflte and to let to-morrow take ite

chance, or to aee np some emi^ncal rule, acmie high-sounding .jargon,

*Mr. Bonamy friea, in No. cri. of the North British Review.

i?

^