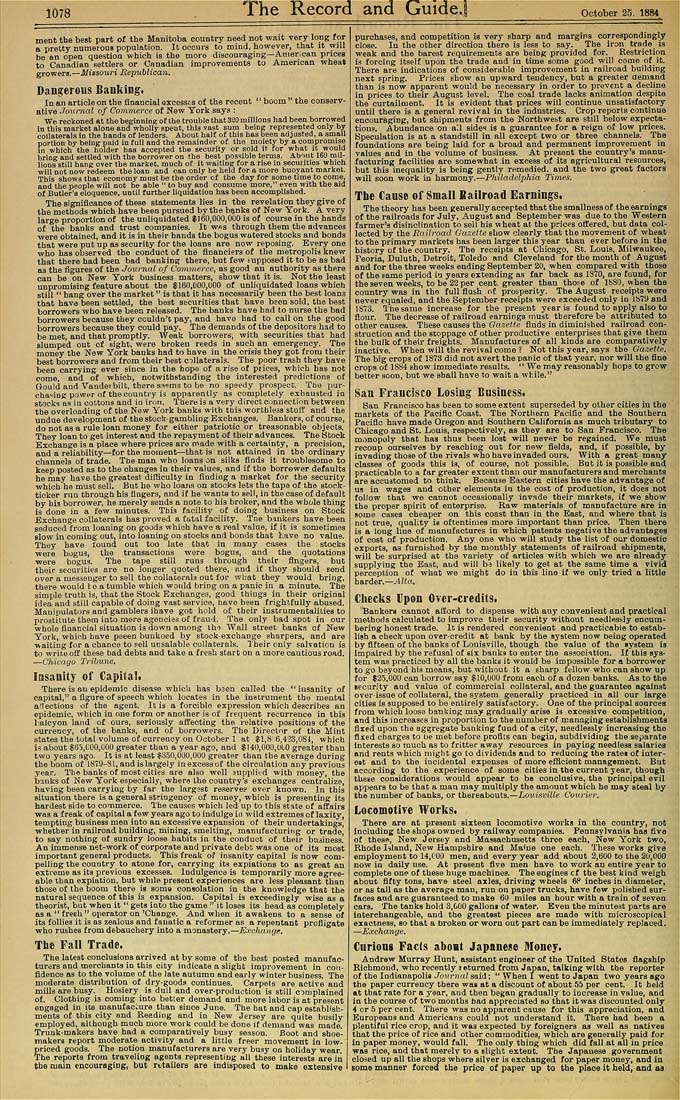

1078

The Record and Guide.!

October 25, 1884

ment the best part of tbe Manitoba country need not wait very long for

a pretty numerous population. It occurs to mind, however, that it will

be an open question wbich is the more discouraging—American prices

to Canadian settlers or Canadian improvements to American wheat

growers.—Missouri Republican.

Dangerous Banking.

In an article on the financial excesses of the recent " boom " the conserv¬

ative Journal of Commerce of New York says :

We reckoned at the beginning of the trouble that 330 millions had been borrowed

in this market alone and wholly spent, this vast sum bein? represented only by

collaterals in the hands of lenders. About half of this hasbeen adjusted, a small

portion by being paid in full and the remainder of the moiety by a compromise

in which the bolder has accepted the security or sold it for what it would

bring and settled with the borrower on the best possible terms, Abtut 160 md-

lions still hanK over the market, much oC it waiting for a rise in securities which

wilt not now redeem the loan and can only be held for a more buoyant market.

This shows that economy must be the order of the day for aome time to come,

and the people will not be able " tn buy and consume more," even with the aid

of Butler's eloquence, until further liquidation haa been accomplished.

The significance of these statements lies in tbe revelation they give of

the methods which have been pursued by the banks of New Tork, A very

large proportion of the unliquidated $160,000,0tl0 is of course in the hands

of the banks and trust companies. It wna through them tbe advances

were obtained, and it is in their hands the bogus watered stocks and bonds

tbat were put up as security for the loans are now reposing. Every one

■who has observed the conduct of tbe financiers of the metropolis knew

that there had been bad banking tbere, but few supposed it to be as bad

as tbe figures of the Jowi-nal of Commerce, as good au authority as there

can ba on New York business matters, show that it is. Hot the least

unpromising feature about the 1160,000,000 of unliquidated loans which

stiil " hang over the market" is that it has necessarily been the best loans

that have been settled, tbe beat securities that have been sold, tbe best

borrowers who have been released. The banks have had to nurse the bad

borrowers because they couldn't pay, and have had to call on the good

borrowers because they could pay. The demands of tbe depositors had to

be met, and that promptly. Weak borrowers, with securities tbat had

Blumped out cf sight, were broken reeds in such an emergency. Tbe

money the New York bauks had to have in the crisis they got from their

best borrowers and from their best collaterals. The poor trash they have

been carrying ever since in the hope of a rise of piices, which bas not

come, and of which, notwithstanding the interested predictions of

Gould and Vanderbilt, there S'S'ims to be no speedy prospect. Tbe pur¬

chasing power of the country is apparently as completely exhausted in

stocks aa in cottons and iu iron. '1 here is a very direct couuection between

tbe overloading of the New York banka witb this worthless stuff aud the

undue development of the stock-gambling Exchanges. Bankers, of course,

do not as a rule loan money for either patriotic or treasonable objects.

They loan to get interest and tbe repayment of their advances. The Stock

Exchange is a place where prices are made with a certainty, a precision,

and a reliability—for the moment—that ia not attained in the ordinary

channels of trade. The man who loans on silks flnds it troublesome to

keep posted aa to the changes in their valuea, and if the borrower defaults

he may have the greotest difflculty in finding a market for the security

which he must sell. But he who loans on stocks lets the taps of the stock-

ticker run through his flngers, and if he wants to seli, in the case of default

by his borrower, he merely sends a note to his broker, and the whole tbing

is done in a few minutes. Tbis facility of doing business on Stock

Exchange collaterals has proved a fatal facility, Tne bankers have been

seduced from loaning on goods which have a real value, if it is sometimes

slow in coming out, into loaning ou stocks and bonds that have no value,

Tbey have found out too late that in many cases the stocks

were bogus, the transactions were bogus, and the quotations

were bogus. The tape still runs through their flngers, but

their securities are no longer quoted there, and if thoy should send

over a messenger to sell the collaterals out for what they would bring,

there would te atumble which would bring on apanic in a minute. The

simple truth is, tbat the Stock Exchanges, good things in their original

idea and still capable of doing vast service, have been frightfully abused.

Manipulators and gamblers ibave got hold of their instrumentalities to

prostitute them into mere agencies of fraud. The only bad spot in our

whole financial situation is down among lhe Wall street banks of New

Tork, which have peeen bunkoed hy stock-exchange sharpers, and are

waiting for a chance to sell unsalable collaterals. Their only salvation is

to write off these bad debts and take a fresh start on a more cautious road,

—Chicago Tribune,

Insanity of Capital.

There is QU epidemic disease which has bsen called the "insanity of

capital," a figure of speech which locates in the instrnuieut the mental

ailections of the agent. It is a forcible expression which describes an

epidemic, which in one form or another is of frequent recurrence in thia

halcyon land of ours, seriously affecting the relative positions of the

currency, of the banks, and of borrowers. The Director of the Mint

states tbe total volume of currency on October 1 at 11,8'6,4'?3,0SI, wbich

is about JOJ.COO.UOO greater tban a year ago, and $l4y,000,t)C0 greater than

two years ago. It is at least $350,000,000 greater than tbe average during

the boom of 1879-81. and is largely iu excess of tbe circulation any previous

year, Tbe banks of most cities are alao well supplied with money, tbe

banks of New York especially, where the country's exchanges centralize,

having been carrying by far the largest reserve? evur known. In tbis

situation there is a general stringency of money, wbich is presenting its

hardest side to commerce. The causes which led up to this state of affairs

was a freak of capital a few yeara ago to indulge io wild extremes of laxity,

tempting business men into an excessive expansion of their undertakings,

whether in railroad buildiug, mining, smelting, manufacturing or trade,

to say nothing of sundry loose babita in the conduct of their business.

An immense net-work of corporate and private debt was one of its moat

important general products. This freak of insanity capital is now com¬

pelling tbe country to atone for, carrying its expiations to as great an

extreme as its previous excesses. Indulgence is temporarily more agree¬

able than expiation, but while present experiences are less pleasant than

those of the boom there is soma consolation iu the knowledge that the

natural sequence of this is expansion. Capital is exceedingly wise as a

theorist, but when it " gets into tho game " it loses its head aa completely

as a "fresh" operator on'Change, And wben it awakens to a sense of

its follies it is as zealous and fauatic a reformer aa a repentant profligate

who rushes from debauchery into a monastery.—E,vchange,

The Fall Trade.

The latest conclusions arrived at by aome of the best posted manufac¬

turers and merchants in this city indicate a slight improvement in con¬

fidence as to the volume of the late autumn and early winter business. The

moderate distribution of dry-goods continues. Carpets are active and

mills are busy. Hosiery^ is dull and over-production is still complained

of. Clothing is coming into betler demand nud more labor is at present

engaged in its manufacture than since June. The hat and cap establish¬

ments of this city and Reading and iu New Jersey are quite busily

employed, although much more work could be done if demand was made

Trunk-makers have had a comparatively busy season. Boot and shoe¬

makers report moderate activity and a little freer movement in low-

priced goods. The notion manufacturers are very busy on holiday wear.

The reports from traveling agents representing all tbese interests are in

the main encouraging, but rttailers are indisposed to moke extensive

purchases, and competition ia very sharp and margins correspondingly

close. In the other direction there is less to say. The iron trade_ is

weak and the barest requirements are being provided for. Restriction

is forcing itself upon tbe trade and iu time some good will come of it.

There are indications of considerable improvement in railroad building

next spring. Piiees show an upward tendency, but a greater demand

than is now apparent would be necessary in order to prevent a decline

in prices to their August level. The coal trade lacks animation despite

the curtailment. It is evident tbat prices will continue unsatisfactory

until there is a general revival in the industries. Crop reporia continue

encouraging, but shipments from the Nortbwebt are still below expecta¬

tions, Abundance ou ail sides is a guarantee for a reign of low prices.

Speculation is at a standstill in all except two or three channels. The

foundations are being laid for a broad and permanent improvement in

values and in the volume of business. At present the country's manu¬

facturing facilities are somewhat in excess of its agricultural resources,

but thia inequality is being gently remedied, and tbe two great factors

will soon work in harmony.—Philadelphia Times,

The Cause of Small Eailroad Earnings.

The theory has been generally accepted that tbe smallness of the earnings

of tbe railroads for July, Auguat and September was due to the Western

farmer's disinclination to sell his wheat at the prices offered, but data col¬

lected by the Eailroad Gazette show clearly that the movement of wheat

to the primary markets bas been larger this year than ever before iu the

history of the country. The receipts at Chicago, St. Louis, Milwaukee,

Peoria, Duluth, Detroit, Toledo and Cleveland for the month of August

and for the three weeks ending September 20, when compared with those

of the same period in years extending as far back as 1370, nre found, for

the seven weeks, to be 22 per cent, greater thau those of lb80, when the

country was in the full flush of prosperity. Tbe August receipts were

never equaled, and the September receipts were exceeded only iu IbTO and

1873. Thesame increase for tbe present year is found to apply also to

flour. The decrease of railroad earnings must therefore be attributed to

other causes. These causes the GareHe flnds in diminished railroad con¬

struction and the stoppage of other productive enterprises tbat give them

the bulk of their freights. Manufactures of all kinds are comparatively

inactive. When will the revival come? Not tbis year, says the Gaseiti:

The big crops of 1873 did not avert the panic of that year, nor will the flne

cropa of 18S4show immediate results, " We may reasonably hope to grow

better soon, but we shall have to wait a wbile."

San Fraueisco Losing Business.

San Francisco bas been to some extent superseded by other cities in the

markets of the Paciflc Coast, Tbe Northern Pacific and the Southern

Paciflc have made Oregon and Southern California as much tributary to

Chicago and St. Louia, respectively, as they are to San Francisco, The

monopoly that has thus been lost will never be regained. We must

recoup ourselves by reaching out for new fields, and, if possible, by

invading those of the rivals who have invaded ours. With a great many

classes of goods this ia, of course, not possible. But it is posaible and

practicable to a far greater extent than our manufacturers and merchants

are accustomed to think. Because Eastern cities have the advantage of

UB in wagea and other elements in the cost of production, it does not

follow that we cannot occasionally invade their markets, if we ahow

the proper spirit of enterprise. Raw materials of manufacture are in

some cases cheaper on this coast than in the East, aud where that is

not true, quality is oftentimes more important than price. Then there

ia a long line of manufactures in which patents negative the advantages

of coat of production. Any one who will study the list of our domestic

exports, aa furnished by the monthly statements of railroad shipments,

will be surprised at tbe variety of articles with wbich we are already

supplying the East, and will b-i likely to get at the same time a vivid

perception of what we might do in this line if we only tried a little

harder,-.42(«.

Checks Upon Over-credits.

Bankers cannot afford to dispense with auy convenient and practical

metbodscalculated to improve their security without needlessly encum¬

bering honest trade. Ic is rendered convenient aud practicable to estab¬

lish a check upon over-credit at bank by tbe system now being operated

by flfteen of the banks of Louisville, though the value of the system is

Impaired by the refusal of six banks to enter the association. If tbis sys¬

tem was practiced by all the banka it would be impossible for a borrower

to go beyond his means, but without it a aharp fellow who can show up

for $25,000 can borrow say $10,000 from each of a dozen banks. As to the

lecurity and value of commercial collateral, and the guarantee against

over-issue of collateral, the system generally practiced in all our large

cities ia supposed to be entirely aatisfactory. One of the principal sources

from which loose banking may gradually arise is excessive competition,

and this increases in proportion to the number of managing establishments

fixed upon the aggregate banking fuud of a city, needlessly increasing tho

fired charges to be met before profits can begin, subdividiog the separate

Interests so much as to fritter away resources in paying needless salaries

and rents which might go to dividends aud to reducing the ratei of inter-

eit and to tbe incidental expenses of more efficient management. But

according to tbe experience of some cities in the current year, though

these considerations would appear to be conclusive, the principal evil

appears to be tbat a man may multiply the amount which he may steal by

the numher of banka, or thereabouts,—Louisville Courier.

Locomotive Works.

There are at present sixteen locomotive works in the country, not

including tbe shops owned by railway companies. Pennsylvania has five

of theso, New Jersey and Massachusetts three each, New York two,

Rhode Idand, New Hampshire and Maine one each. These works give

employment to 14,C0I) men, and every year add about 2,(j00 to the 20,000

now iu daily use. At present five men have to work an entire year to

complete one of these huge machines, Theengines cf the best kind weigh

about fifty tons, have steel axles, driving wheels 6P inches in diameter,

or as tall as the average man, run on paper trucks, have few polished sur¬

faces and are guaranteed to make 60 miles an hour with a train of seven

cars. The tanks hold 3,000 gallons of water. Even the minutest parts are

interchangeable, and the greatest pieces are mada with microscopical

exactness, bo that a broken or worn out part can be immediately replaced.

—Exchange.

Cnrions Facts aboat Japanese Money.

Andrew Murray Hunt, assistant engineer of tbe United Statea flagship

Richmond, who recently returned from Japan, talking with the reporter

of the Indianapolis Journal said: " When I went to Japan two years ago

the paper currency tbere was at a discount of about 5b per cent. It held

at that rate for a year, and then began gradually to increase ia value, and

io tbe course of two months bad appreciated so tbat it was discounted only

4 or 5 per cent. There was no apparent cause for this appreciation, and

Europeans and Americans could uot understand it. There had beeu a

plentiful rice crop, aud it was expected by foreigners as well as natives

that tbe price of rice and other commodities, which are generally paid for

in paper money, would fall. The only thing which did fall at all in price

was rice, and that merely to a slight extent. The Japanese government

closed up all the shops where silver is exchanged for paper money, and in

some manaer forced the price of paper up to the place it held, and aa