Please note: this text may be incomplete. For more information about this OCR, view

About OCR text.

M.ny 13, 1905

RECORD AND GUIDE

1057

gence or in bad faith or with malice in making the assessment

complained of. If the writ shall be quashed or the [prayer of the

petitioner denied] assessment confirmed, ov if the assessment com¬

plained of shall be reduced by an amount less than half the re¬

duction claimed before the assessing officers costs and disburse¬

ments shall be awarded against the ptlitioner [not exceeding

the costs and disbursements taxable in ar. action upon the trial

of an issue of fact in the supreme court]. If the assessment

shall be reduced by an amount greater than half the reduction

claimed before the assessing officers, costs and disbursements

shall be awarded ugainsl the lax district represented by the of¬

ficers whose proceedings may be reviewed. The cost and dis¬

bursements shall not exceed those taxable in an action upon the

trial of an,issue of fact in tbe supreme court, except that if evi¬

dence shall be taken there shall be included in the taxable costs

and disbursements the expense of furnishing to the court or to

the referee a copy of the stenographer's minutes of the evidence

taken."

Legislature and Taxation

liow the State Met the Problems that Confronted It

By LAWSON PU RDY

WHEN the New York legislature met it was con¬

fronted by a tax problem which was rendered

difficult of solution by the ' policy adopted by

G'overnor Odell and endorsed by the Republican party

of raising all state revenue by various special taxes,

ins.tead of by a direct tax levied on the real and personal

property subject to taxation for local purposes. Governor Hig¬

gins, in his campaign before election, endorsed this policy anJ

pledged himself that there should be no direct tax for stale

purposes. 'By reason of a decision of tbe highest court of the

state invalidating a tax on certain premiums of life insurance,

by which the revenue from this source was reduced, and because

of the increased need of the state for canal purposes, the state

was in need for increased revenue to the amount of flve million

dollars or more.

A plan of raising this revenue was presented a year ago to the

New Tork Tax Reform Association and endorsed by the leading

commercial organizations of the state. By this plan mortgages

were to be exempted from local taxation and taxed once at the

time of recording at the rate of one-half of one per cent,; while

other securities were to remain subject lo local taxation unless

a tax of one-half of one per cent, were paid and the instrument

stamped. This plan was presented in the form of two bills, which

it was said would raise more than five million dollars a year.

Nothing was done by the legislature until the middle of Feb¬

ruary, when a bill was introduced by the Commiitee on Taxation

of the Senate, providing for a tax on sales of all shares of stock

at the rate of two cents on each $100 of nominal value. After

much criticism this bill was amended, and in spite of the un¬

animous opposition of all the commercial bodies it was passed

early in April. . .

Near the first of March the bills of the Tax Reform Association

for a recording tax on mortgages and an optional tax on securi¬

ties were introduced by the Senate Committee on Taxation, and

at the same time a bill prepared by the committee imposing an

annual tax on mortgages at the rate of one-half of one per cent.

The annual tax was imposed only on future mortgages and exist¬

ing mortgages were left subject to existing taxation as at present.

In its general structure the bill was largely taken from similar

bills of previous years, which have been introduced annually

since 1900. The public was so used to this mortgage tax pro¬

posal and it had been defeated so often that those most inter¬

ested did not awake to the importance and danger of the situa¬

tion until the Republican members of the legislature had voted

to make the bill a caucus measure; then opposition was too late

to defeat it. It was passed on the oth of April, but the Governor

was so impressed by the arguments of those who opposed the bill

that he held it for ten days, then had it re-called by the legis¬

lature, and sent back to him within ten days of adjournment,

so that it would become what it called a thirty-day bill, giving

bim thirty days to consider it after the legislature had adjourned.

At the same time amendments were hastily prepared by the Sen

ate Committee, a bill embodying these amendments introduced

last Monday, and sent to the Governor on Thursday.

The annual mortgage tax bill, as amended, takes effect the first

of July, By its terms a mortgage recorded on or after July 1st

will be subject to a tax at the time of record at the rate of one-

half of one per cent, for the period remaining of the year ending

July 1st. On the first of the following July an annual tax of one-

half of one per cent, will become a lien. This annual tax may be

paid at any time after July 1st, and becomes payable the first of

the following October. If not paid by the first of January the

mortgage may be advertised and sold. In the opinion of many

good lawyers the tax cannot be collected from non-resident

holders of mortgages, although that is the intent of the bill.

If the Governor approve the Mortgage Tax bill efforts wili

undoubtedly be made at the next session of the legislature to pro¬

cure the repeal of the annual tax, leaving only the provision for

a recording tax.

The tax on sales of stock is generally regarded as an unfor¬

tunate innovation in methods of taxation, imposing for the flrst

time in the State of New York, a tax on a process of trade.

There is no argument made for the bill which would not also

apply to the sale of any other property. It is said that the

effect of the law will not be immediately felt in all its seriousness,

as the hope of repeal will check the natural diversion of business

to other states. The enactment of tbese two measures has con¬

verted many of the supporters of the policy of special taxes for

state purposes to tbe belief that this policy is unwise and unsafe,

and that there must be a return to the policy of direct taxation,

the old difficulty of equalization being obviated in some othei

Another revenue raising measure was adopted by which the

decision of the Court of Appeals in relation to the taxation ot

insurance premiums was designed to be nullified, and all pre¬

miums of insurance whether paid on account of old or nevt

policies are subject to a tax of one per cent. There was com¬

paratively little oiiposition to this bill, due probably to the fact

that the large insurance companies in New York are not in good

odor at present, and because the great army of the Insured do

not fully realize that a tax on life Insurance premiums Is paid by

those who Insure their lives.

Having described al! the objectionable "tax bills which have

been enacted, it r<.-mains only to describe the one good measure

which became a law tbat affects a large number of people.

Hitherto those wh.) have been obliged to institute certiorari pro¬

ceedings to procure a reduction on oppressive assessments on real

or persona! propel ty, have been obliged to pay the costa of the

pni'^eeding, and cculd not recover either their costs or disburse¬

ments. A bill prepared by tha New York Tax Reform Association

wa.l enacted which gives costs to the petitioner in case the

assessment complained of is reduced by an amount equal to more

than half of the reduction which was demanded at tbe hearing

by the assessors. This bill is a measure of justice to those whose

asficssmcnts are excessive, and will tend to make assessors more

cautiDus and careful about their work, and more prudent In re¬

fusing to accede to just claims for reduction.

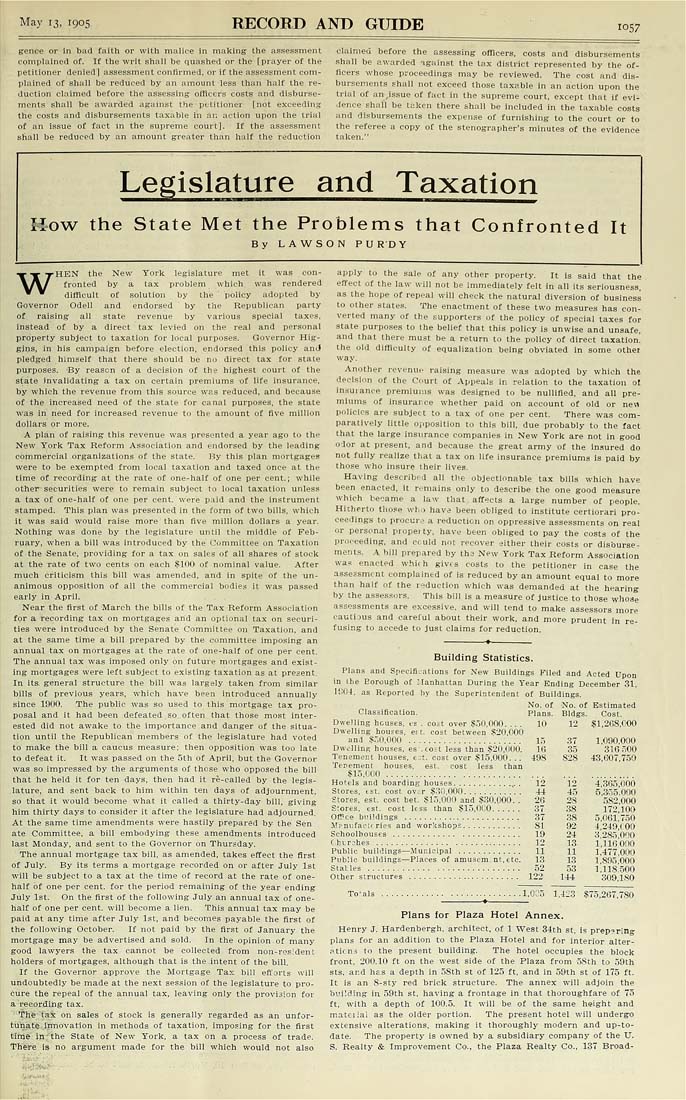

Building Statistics.

Plans and Specifi.ations for New Buildings Piled and Acted Upon

in the Eorough of Manhattan During the Year Ending December 31,

U)0-1, as Reported by the Superintendent of Buildings.

No. of 'No. of Estimated

Classification. Plans. Bldgs. Cost.

Dwelling houses, es . cost over Sf.50.0(^___ 10 12 $1,2I38,C00

Dwelling houses, est. cost between $20,000

and .i;.-,ll.Ofl(l ....................... 15 37 1,090,000

Dw.-lling houses, es .cost less than .i;20,UOO. 16 35 316-lOO

Tenement houses, e.'t. eost over .t;ir),000. .. 49S 828 43,607.750

Tenement houses, est. cost less than

$15,€(10...........................................

Hotels and boarding houses.............. 12 12 4 3Go 000

Stores, tst. cost ov;r $:.{0,000............ 44 45 5,3no.000

Stores, est. cost bet. .'Jl-j.OOO and $.^0,0O0. . 20 28 582 000

Stores, est. cost less than $15,0t:0...... 37 38 172 100

Of!ice buildings ........................ 31 38 5,06L7.^0

M^nufacKries and workshops............ Sl 92 4 240(00

Schoolbouses ......................... 19 24 3!28o!000

Chtrohes ............................. 12 13 1,116000

Puhiic buildings—Municipal ............. 11 n 1,477,000

Public buildings—Places of amusem.nt, etc. 13 13 1,895000

Stalles .............................. 52 53 1,118.500

Olher structures ....................... 122 144 309.180

To'als ............................l,ti:',-j 1,4:;3 $75,267,780

Flans for Plaza Hotel Annex.

Henry J. Hardenbergh, architect, of 1 West 34tb st, is prepTing

plans for an addition to tbe Plaza Hotel and for interior alter-

aticns to the present building. The hotel occupies the block

front, 200.10 ft on the west side of tbe Plaza from oSth to 59th

sts, and has a depth in 58th st of 125 ft, and in 59th st of 175 ft.

It is an 8-sty red brick structure. The annex will adjoin the

building in 59th st, having a frontage in that thoroughfare of 75

ft, with a depth of 100.5, It will be of the same height and

mateiial as the older portion. The present hotel will undergo

extensive alterations, making it thoroughly modern and up-to-

date. The property is owned by a subsidiary company of the TJ.

S, Bealty & Improvement Co., the Plaza Realty Co., 137 Broad-