872

RECORD AND GUIDE

November 9, 1912

BUILDINGJIATERIALS

Sand to Advance Ten Cents January 1

—Cement Demand Light.

Distributors Send Sleuths Into Brick

Manufacturing Districts to Discover

Available Quantities on Hand—Little

Call for Building Stone—Slow Metal

Embarrasses Fabricators—Coal Situa¬

tion Aggravating to Building Manag¬

ers—Car Shortage Hits Lumber.

THE straws which point the way the

building material zephyrs blow were

found in preliminary reports of detect¬

ives sent up the river to discover how

much a reserve supply the manufacturers

have. Every common brick plant in the

eastern district is now closed for the

season, with not more than 1,000,000,000

as the season's output. Of this total

900,000,000 came in by barge load, the

remainder by schooner. This will make

the available quantity of brick in the

North River district approximately 350,-

000,000 to last until the new brick mak-;

ing season opens. This figure excludes

brick in shed that has been contracted

for. Bluntly speaking, this is not

enough brick to meet current require¬

ments. Prices, therefore, of Hudson

river brick will be higher than present

prices, plus covering charges in March

and April, Turning to the Raritan riv¬

er manufacturing center, the heavy

drains of the past season, coupled with

bad weather conditions and a scarcity

of labor, have combined to prevent the

accumulation of even a healthy normal

supply and there is not any too many

brick on hand to supply the probable

winter's requirements.

Portland cement is not in heavy de¬

mand now. The dealers are well cov¬

ered in this district, which accounts for

the few sales reported at the new $1.58

level. But this does not imply that this

price is weak. Mills have less than nor¬

mal stocks on hand and there is a heavy

prospective winter demand. While it

is always unconservative to predict price

trends in the Portland cement field,

there is every reason to believe that as

the season wears on greater stiffness

will be reported in this department.

Building managers who came into the

market this week for steam sizes of

coal found a rising market. Those cov¬

ered for the year on contracts, of course,

are protected in a measure, but even

they, are up against the stiffening mar¬

ket, only in an indirect, instead of a

direct, way. Many managers who con¬

tract for their coal by the year have

the railroads for themselves as parties

of the first part. A reservation usually

is made making it optional with the rail¬

road whether they will deliver from the

Jersey City freight yards or not. Just

now they are not delivering and some

managers holding such contracts are

paying cartage, although they are get¬

ting their coal at the contract price

agreed upon early in the summer. The

railroads are now accused of holding

back on shipments, whereas a few weeks

ago the coUeries were accused of crimp¬

ing production. The railroads declare

they are shipping as fast as they can,

btit that the shortage of cars, coupled

with heavy reserve buying on the part

of manufacturers and building managers,

is really responsible for the slow trans¬

portation afforded this commodity.

Sand is scheduled to move up ten

cents a cyd., on January first td fifty

cents, to proper dock. New York, in¬

cluding Gowanus canal, Newtown creek

and Harlem river. Increased demand,

due to vast quantity of new concrete

Work required for the new subway,

higher cost of mining and increased cost

of transporting the sand, owing to

higher prices of coal and labor, have

combined to make the new price level

imperative.

Lumber users are complaining about

the difficulty of getting cars enough to

ship the finished products of the mills to

market, and so acute has this become

that some mills are facing a shut-down

unless they can move their stock more

rapidly and, indeed, actual cases of shut¬

down have been reported to the New

York Lumber Trade Association.

Fabricators of structural steel are re¬

porting an increasing difficulty in get¬

ting shapes from the mills and in con¬

sequence they are embarrassed in their

deliveries here. The slowness of steel

receipts at six out of every ten building

operations in the district is solely re-

responsible for the unprecedented condi¬

tion now prevailing of generally stiffen¬

ing price levels with a sharp restriction

in volume of materials moving.

BRICK BUYING HE.VVIER.

.*1I Plants No-nr Closed for the Season—

Reserves Ijl{:;ht.

COMMON brick -was In a more active

market this week. All of the brick

plants in the North and Karitan River

districts closed for the season. Conse¬

quently the market is now being- supplied

from sheds and buying is increasingly ac¬

tive owing to the short time between now

and closing of navigation. The market

for common brick is short. Buying, how¬

ever, is cautious. Last week the sales

and arrivals of North River common brick

were even as far as numbers were con¬

cerned, and the current week opened

strong.

Transactions last -week for Hudson

River common brick with comparisons

for the corresponding week in 1911 fol¬

low-;

1912.

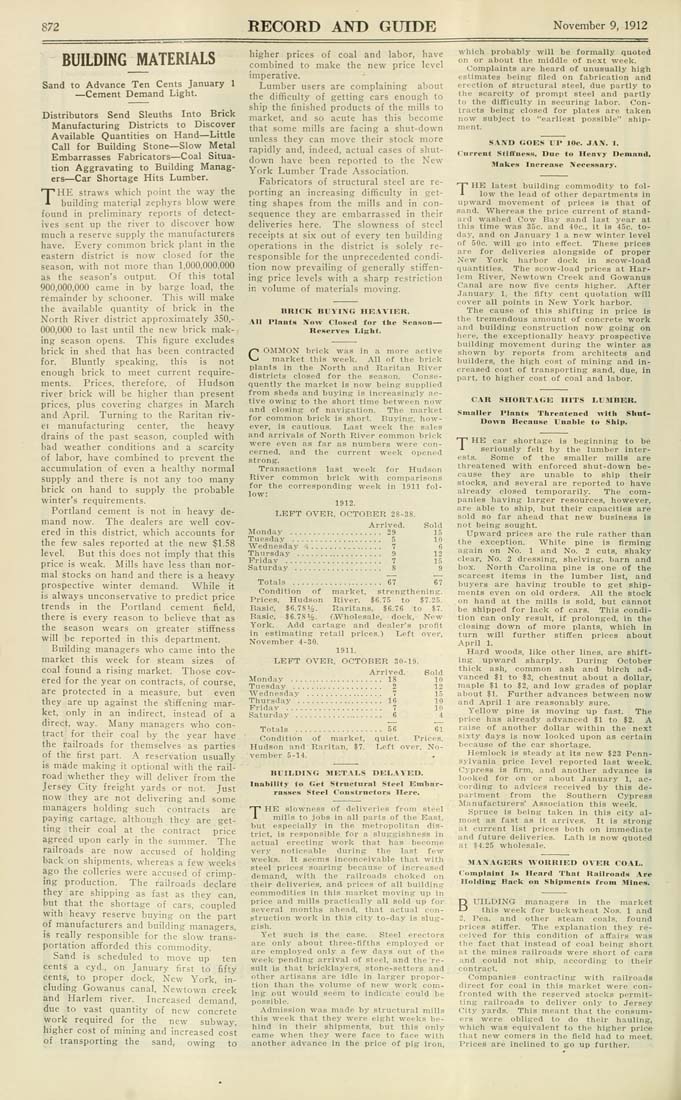

LEFT OVER, OCTOBER 28-38.

Arrived. Sold

Monday .................... 29 15

Tuesday .................... 5 10

"Wednesday '4................ 7 6

Thursday ................... 9 12

Friday ..................... 7 15

Saturday ................... 8 9

Totals .................... 67 67

Condition of market, strengthening.

Prices, Hudson River, $6.75 to $7.25.

Basic, $6.78%. Raritans, $6.76 to $7.

Basic, $6.78%. (.Wholesale, dock. New

Tork. Add cartage and dealer's profit

in estimating retail prices.) Left over,

November 4-30.

1911.

LEFT 0"VER, OCTOBER 30-19.

Arrived. Sold

Monday ..................... 18 10

Tuesday .................... 2 12

AVednesdav ................. 7 15

Thursday ................... 16 10

Friday ..................... 7 10

Saturday .................... 6 4

Totals ................... 56 61

Condition of market, quiet. Prices.

Hudson and Raritan, $7. Left over, No¬

vember 5-14.

BUILDING METALS DE1,A"\'ED.

Inability to Get Strnctnral Steel Embar¬

rasses Steel Constructors Here.

THE slo-wness of deliveries from steel

mills to jobs in all parts of the East,

but especially in the metropolitan dis¬

trict, is responsible for a sluggishness in

actual erecting work that has become

very noticeable during the last few

weeks. It seems inconceivable that with

steel prices soaring because of increased

demand, with the railroads choked on

their deliveries, and prices of all building

commodities in this market moving up in

price and mills practically all sold up for

several months ahead, that actual con¬

struction work in this city to-day is slug¬

gish.

Tet such is the case. Steel erectors

are only about tliree-fifths employed or

are employed only a few days out of the

week pending arrival of steel, and the re¬

sult is that bricklayers, stone-setters and

other artisans are idle in larger propor¬

tion than the volume of new work com¬

ing out would seem to indicate could be

possible.

Admission was made by structural mills

this week that they were eight weeks be¬

hind in their shipments, but this only

came when they were face to face with

another advance in the price of pig Iron,

which probably will be formally, quoted

on or about the middle of next week.

Complaints are heard of unusually high

estimates being filed on fabrication and

erection of structural steel, due partly to

the scarcity of prompt steel and partly

to the difficulty in securing labor. Con¬

tracts being closed for plates are taken

now subject to "earliest possible" ship¬

ment.

SAND GOES UP 10c. JAN. 1.

Current Stiffness. Due to Heavy Deniand,

makes Increase Necessary.

THE latest building commodity to fol¬

low the lead of other departments in

upward movement of prices is that of

sand. 'Whereas the price current of stand¬

ard washed Cow Bay sand last year at

this time was 35c. and 40c., it is 45c. to¬

day, and on January 1 a new winter level

of 50c. will go into effect. These prices

are for deliveries alongside of proper

New Tork harbor dock in scow-load

quantities. The scow-load prices at Har¬

lem River, Newtown Creek and Gowanus

Canal are now five cents higher. After

January 1, the fifty cent quotation will

cover all points in New Tork harbor.

The cause of this shifting in price is

the tremendous amount of concrete work

and building construction now going on

here, the exceptionally heavy prospective

building movement during the winter as

shown by reports from architects and

builders, the high cost of mining and in¬

creased cost of transporting sand, due. In

part, to higher cost of coal and labor.

CAR SHORT.IGE HITS LUMBER.

Smaller Plants Threatened with Shnt-

Don-n Because Unable to Ship.

THE car shortage is beginning to be

seriously felt by the lumber inter¬

ests. Some of the smaller mills are

threatened with enforced shut-down be¬

cause they are unable to ship their

stocks, and several are reported to have

already closed temporarily. The com¬

panies having larger resources, however,

are able to ship, but their capacities are

sold so far ahead that new business is

not being sought.

Upward prices are the rule rather than

the exception. White pine is firming

again on No. 1 and No. 2 cuts, shaky

clear, No. 2 dressing, shelving, barn and

box. North Carolina pine is one of the

scarcest items in the lumber list, and

buyers are having trouble to get ship¬

ments even on old orders. All the stock

on hand at the mills is sold, but cannot

be shipped for lack of cars. This condi¬

tion can only result, if prolonged, in the

closing down of more plants, which in

turn will further stiffen prices about

April 1,

Hard -woods, like other lines, are shift¬

ing upward sharply. During October

thick ash, common ash and birch ad¬

vanced $1 to $3, chestnut about a dollar,

maple $1 to $2, and low grades of poplar

about $1. Further advances between now

and April 1 are reasonably sure.

Tellow pine is moving up fast. The

price has already advanced $1 to $2. A

raise of another dollar within the next

sixty days is now looked upon as certain

because of the car shortage.

Hemlock is steady at its new $23 Penn¬

sylvania price level reported last week.

Cypress is firm, and another advance is

looked for on or about January 1, ac¬

cording to advices received by this de¬

partment from the Southern Cypress

Manufacturers' Association this week.

Spruce Is being taken in this city al¬

most as fast as it arrives. It is strong

at current list prices both on immediate

and future deliveries. Lath is now quoted

at $4.25 wholesale.

AIAN.VGERS WORRIED OVER COAL.

Complaint Is Heard That Railroads Are

Holding Back on Shipments from Mines.

BUILDING managers in the market

this week for buckwheat Nos. 1 and

2, Pea, and other steam coals, found

prices stiffer. The explanation they re¬

ceived for this condition of affairs was

the fact that instead of coal being short

at the mines railroads were short of cars

and could not ship, according to their

contract.

Companies contracting with railroads

direct for coal in this market were con¬

fronted with the reserved stocks permit¬

ting railroads to deliver only to Jersey

City yards. This meant that the consum¬

ers were obliged to do their hauling,

which was equivalent to the higher price

that new comers in the field had to meet.

Prices are Inclined to go up further.