890

RECORD AND GLIDE

April 26, 1913

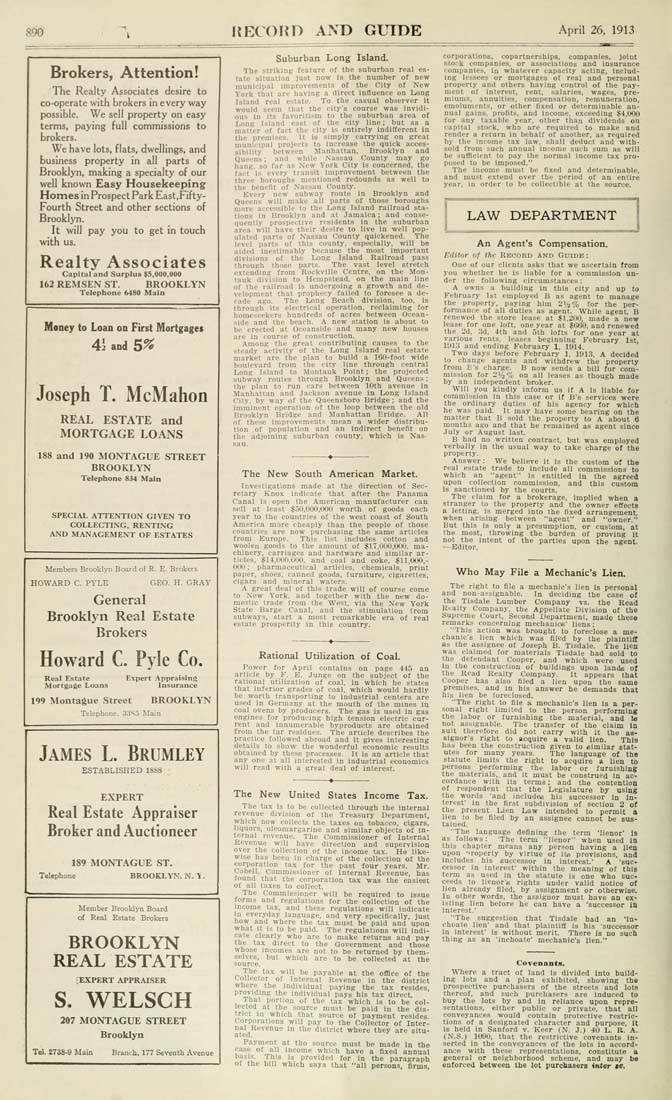

Brokers, Attention!

The Realty Associates desire to

co-operate with brokers in every way

possible. We sell property on easy

terms, paying full commissions to

brokers.

We have lots, flats, dwellings, and

business property in all parts of

Brooklyn, making a specialty of our

well known Easy Housekeeping

Homes in Prospect Park East.Fif ty-

Fourth Street and other sections of

Brooklyn.

It wiil pay you to get in touch

with us.

Realty Associates

Capital and Surplus $5,000,000

162 REMSEN ST. BROOKLYN

Telephone 6480 Main

Money to Loan on First Mortgages

42 and 5^

Joseph T. McMahon

REAL ESTATE and

MORTGAGE LOANS

188 and 190 MONTAGUE STREET

BROOKLYN

Telephone 834 Main

SPECIAL ATTENTION GIVEN TO

COLLECTING, RENTING

AND M.\NAGEMENT OF ESTATES

Members Brooklyn Board of R. E. Brokers

HOWARD C. PVLE GEO. H. GRAY

General

Brooklyn Real Estate

Brokers

Howard C. Pyle Co.

Real Estate Expert Appraising

Mortgage Loans Insurance

199 Montague Street BROOKLYN

Telephone, 33So Main

James L. Brumley

ESTABLISHED ISSS

EXPERT

Real Estate Appraiser

Broker and Auctioneer

189 MONTAGUE ST.

Telephone BROOKLYN. N. ^.

Meinber BrooklyTi Board

of Real Estate Brokers

BROOKLYN

REAL ESTATE

:EXPERT APPRAISER

S. WELSCH

207 MONTAGUE STREET

Brooklyn

Tel. 273S-9 Main Branch, 177 Seventh Avenue

Suburban Long Island.

The striking feature of the suburban real es¬

tate situation just now Is the number of new

muniiipal im|)rovements of the City of New

York that are having a direct influence on Long

Island real e.state. To the casual observer it

would seem that the city's course was invidi¬

ous in its favoritism to the suburban area ot

Long Island east of the city line; but as a

matter of fact the city is entirely indifferent in

the premises. It is simply carrying on great

municipal projects to increase the quick acces¬

sibility between Manhattan. Brooklyn and

Queens; and while .Vassau County may go

hang, so far as New York City is concerned, the

fact is every transit improvement between the

three boroughs mentioned redounds as well to

the beneflt of Nassau County.

Every new subway route in Brooklyn and

Queens will make all parts of those boroughs

more accessible to the Long Island railroad sta¬

tions in Brooklyn and at Jamaica; and conse-

(luently prospective residents in the suburban

area will have their desire to live in well pop¬

ulated parts of Xassau County quickened. The

level parts of this county, especially, will be

aided inestimably because the most important

divisions of the Long Island Railroad pass

through those parts. The vast level stretch

e.'ctending from Rockville Centre, on the Mon¬

tauk division to Hempstead, on the main line

of the railroad is undergoing a growth and de¬

velopment that prophecy failed to foresee a de¬

cade ago. The Long Beach division, too. is

through its electrical operation, reclaiming for

honieseekers hundreds of acres between Ocean-

side and the beach. .A. new station is about to

be erected at Oceanside and many new bouses

are in course of construction.

Among the great contributing causes to the

steady activity of the Long Island real estate

market are the plan to build a 160-foot wide

boulevard from the city line through central

Long Island to Montauk Point; the projected

subway routes through Brooklyn and Queens :

the plan to run cars between lOtb avenue in

Manhattan and Jackson avenue in Long Island

City, by way of the Queensboro Bridge ; and the

imminent operation of the loop between the old

Brooklyn Bridge and Manhattan Bridge. All

of these improvements mean a wider distribu¬

tion of population and an indirect beneflt on

the adjoining suburban county, which is Nas¬

sau.

The New South American Market.

Investigations made at the direction of Sec¬

retary Knox indicate that after the Panama

Canal is open the American manufacturer can

sell at least 5:30,000,000 worth of goods each

year to the countries of the west coast of South

America more cheaply than the people of those

countries are now purchasing the same articles

from Europe. This list includes cotton and

woolen goods to the amount of $17.000,O(.i0. ma¬

chinery, carriages and hardware and similar ar¬

ticles, $14,000.(100, and coal and coke, $11,000,-

000: pharmaceutical articles, chemicals, print

paper, shoes, canned goods, furniture, cigarettes,

cigars and mineral waters.

A great deal of this trade will of course come

to New York, and together with the new do¬

mestic trade from the West, via the New York

State Barge Canal, and the stimulation from

subways, start a most remarkable era of real

estate prosperity in this country.

Rational Utilization of Coal.

Power for April contains on page 443 an

article by F. B. Junge on the subject of the

rational utilization of coal, in which he states

that inferior grades of coal, which would hardly

be worth transporting to industrial centers are

used in Germany at the mouth of the mines in

coal ovens by producers. The gas is used in gas

engines for producing high tension electric cur¬

rent and innumerable byproducts are obtained

from the tar residues. The article describes tbe

practice followed abroad and it gives interesting

details to show the wonderful economic results

obtained by tbese processes. It is an article that

any one at all interested in industrial economics

will read with a great deal of interest.

The New United States Income Tax.

The tax is to be collected through the internal

revenue division of the Treasury Department,

which now collects the taxes on tobacco, cigars,

liquors, oleomargarine and similar objects of in¬

ternal revenue. Tbe Commissioner of Internal

Revenue will have direction and supervision

oyer the collection of the income tax. He like¬

wise has been in charge of the collection of the

corporation tax for the past four years. Mr.

Cobell, Commissioner of Internal Revenue, has

found that the corporation tax was the easiest

of all taxes to collect.

The Commissioner will be required to issue

forms and regulations for the collection of the

income tax. and these regulations will indicate

in everyday language, and very specifically, just

how and where the tax must be paid and upon

what It is to be paid. The regulations will indi¬

cate clearly who are to make returns and pay

the tax direct to the Government and those

whose incomes are not to be returned by them¬

selves, but which are to be collected at the

source.

The tax will be payable at the office of the

Collector of Internal Revenue in the district

where the individual paying the tax resides,

providing tbe individual pays his tax direct.

That portion of the tax which is to be col¬

lected at the source must be paid in the dis¬

trict in which that source of payment resides

Corporations will pay to tbe Collector ot Inter¬

nal Revenue in the district where they are situ¬

ated.

Payment at tho source must be made in the

case of all income which have a fixed annual

basis. This is provided tor in the paragraph

of the bill which says that "all persons. Arms

corporations, copartnerships, companies, joint

stock companies, or associations and insurance

companies, in whatever capacity acting, includ¬

ing lessees or mortgages of real and personal

property and others having control of tbe pay¬

ment of interest, rent, salaries, wages, pre¬

miums, annuities, compensation, remuneration,

emoluments, or other fixed or determinable an¬

nual gains, proflts, and income, exceeding $4,000

for any taxable year, other than dividends on

capital stock, who are required to make and

render a return in behalf of another, as required

by the income lax law, shall deduct and witli-

sold from such annual income such sum as will

be sufficient to pay the normal income tax pro¬

posed to be imposed."

The income must be fixed and determinable,

and must extend over the period of an entire

year, in order to be collectible at the source.

An Agent's Compensation.

Editor of the Record and Guide :

One of our clients asks that we ascertain from

you whether he is liable for a commission un¬

der the following circumstances:

A owns a building in this city and up to

February 1st employed B as agent to manage

the property, paying him 2i/j7t, for the per¬

formance of ali duties as agent. While agent. B

renewed the store lease at $l.l'Oii. made a new

lease for one loft, one year at $000, and renewed

the I'd. od. 4th and 5th lofts for one year at

various rents, leases beginning February 1st,

lill.'l and ending February 1, 1014.

Two days before February 1, 1013. A decided

to change agents and withdrew the property

from E's charge. B now sends a bill for com¬

mission for 2Vi7 on all leases as though made

by an independent broker.

Will you kindly inform us if A Is liable for

commission in this case or if B's services were

the ordinary duties of his agency for which

he was paid. It may have some bearing on the

matter that B sold the property to A about 6

months ago and that he remained as agent since

July or August last.

B had no written contract, but was employed

verbally in the usual way to take charge of the

property.

Answer : We believe it is the custom of the

real estate trade to include all commissions to

which an "agenf is entitled in the agreed

upon collection commission, and this custom

is sanctioned by the courts.

The claim for a brokerage, implied when a

stranger to the property and the owner ettecta

a letting, is merged into the fixed arrangement,

when arising between "agent" and "owner."

But this is only a presumption, or custom, at

the most, throwing the burden of proving it

not the intent of the parties upon the agent.

^Editor.

Who May File a Mechanic's Lien.

The right to file a mechanic's lien is personal

and non-assignable. In deciding the case of

the Tlsdale Lumber Company vs. the Read

Realty Company, the Appellate Division of the

Supreme Court, Second Department, made these

remarks concerning mechanics' liens:

"This action was brought to foreclose a me¬

chanic's lien which was filed by the plaintiff

as the assignee of Joseph B. Tlsdale. The lien

was claimed for materials Tlsdale had sold to

the defendant Cooper, and which were used

in the construction of buildings upon lands of

the Read Realty Company. It appears that

Cooper has also filed a lien upon the same

premises, and in his answer he demands that

his lien be foreclosed.

"The right to file a mechanic's lien is a per¬

sonal right limited to the person performing

the labor or furnishing the material, and Is

not assignable. The transfer of the claim ia

suit therefore did not carry with it the aa-

signor's right to acquire a valid lien. This

has been tbe construction given to eimilar stat¬

utes for many years. The language ol the

statute limits the right to acquire a lien to

persons performing the labor or furnishing

the materials, and it must be construed in ac¬

cordance with its terms; and the contention

of respondent that the Legislature by using

the words 'and includes his successor in in¬

terest' in the first subdivision of section 2 of

the present Lien Law intended to permit a

lien to be flled by an assignee cannot be sus¬

tained.

"The language defining the term 'lienor' is

as follows: 'The term "lienor" when used in

this chapter means any person having a lien

upon -Property by virtue of its provisions, and

includes his successor in interest.' A 'suc¬

cessor in interest' within the meaning of this

term as used in the statute is one who sue

ceeds to lienor's rights under valid notice of

lien already flled, by assignment or otherwise.

In other words, the assignor must have an ex¬

isting lien before he can have a 'successor in

interest.'

"The suggestion that Tlsdale had an 'In¬

choate lien' and that plaintiff is his 'successor

in interest' is without merit. There is no such

thing as an 'inchoate' mechanic's lien."

Covenants.

Where a tract of land is divided into build¬

ing lots and a plan exhibited, showing tha

prospective purchasers of the streets and lots

thereof, and such purchasers are induced to

buy the lots by and in reliance upon repre¬

sentations, either public or private, that all

conveyances would contain protective restric¬

tions of a designated character and purpose, it

is held in Sanford v. Keer (N. J.) 40 L. R. A.

(.\'.S.) 1090, that the restrictive covenants in¬

serted in the conveyances of the lots in accord-

an^e with these representations, constitute a

general or neighborhood scheme, and may be

enforced between the lot purchasers infer te.