Real Estate Record

AND BUILDERS^ GUIDE.

Vol. XXI.

NEW YOEK, SATUEDAY, MARCH 9, 1878.

No. 521.

I

te

i

l£

Publi.<;hed IFeeUy by

Che Ecii( (IBsiiitc Jlecartr ^.ssocmtton.

TERMS.

«XK YRiVK, in advance....SIO.OO.

Coinmunications should be addressed to

G. W. SAVEET,

Nos. :1J5 AND *1~ Broadway.

CITY TAXES, WHO SHOULD PAY THEM?

Judging from precedent efforts, the subject of

t'l.Ktition can Jje properly discussed ouly in frotn

oii;» hmidred to five hundred pages of octavo size.

We may be pardoned, however, iu nialdug ai-asli

a-id fool hardj-attempt to condense the subject

within a few paragraphs. We have previously

imderttiken to show tho sout-ces from whieh the

ta.-^ levy of last j-ear was derived.

Tlte mcagrencss of the iuformtition vouchsafed

through public documents, compels us to exercise

oiir inventive faculty iu attempting to expound

t!ic item of personal taxation. In our previous

tiuilorlaking we think we have furnished a fair

aiitilysis of the toiiic. At all events, our expo¬

sition remains unchallenged to this daj-, aud after

careful and critical study of the subject, it seems

the only warrantiible aud patent one that we can

suggest. We will reproduce it here for the sake

iif clearness and as apposite to our present tlietnc.

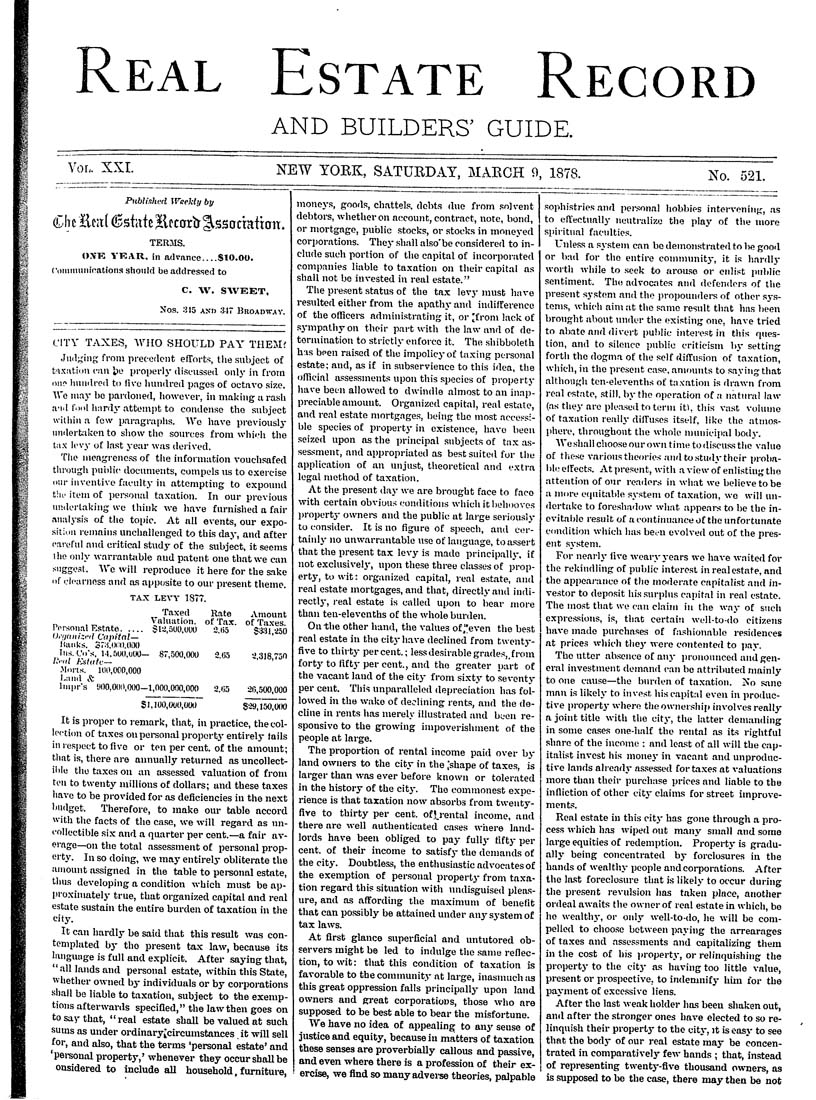

TAX LEVY 1877.

Taxed

Valuation.

iVi-sonal Estate..... Sl5i,500,UOO

0,gauixed Capital—

Banks. 3r;^.0i;o.0i'K)

Ins. Co's. 1-1.500,01)0— 87,500,000

I'eid I':.<itate—

-Moris. 100,000,000

Land &

liiipr's !H)0,000,000—1,000,000,000

51,100,000,000

Rate

of Tax.

2.05

Amount

of Taxes.

S*1!,^250

•2.05 -..',318,750

•2.07, 20,J500,000

8-29,150,000

It is proper to remark, that, hi practice, the col¬

lection of taxes ou personal property entirely tails

in re.siiect to five or ten per cent, of the amount;

tliat is, there are annually returned as uncollect-

iiile the taxes ou an a.ssessed valuation of from

ten to twenty millions of dollars; and these taxes

have to be provided for as deficiencies in the next

huilget. Therefore, to make our table accord

with the facts of the ca.se, we will regard as un¬

collectible six and a quarter per cent.—a fair av¬

erage—on the total a.sse.ssment of personal prop¬

erty. In so doing, we may entirely obliterate the

amount assigned in the table to pei-sonal estate,

thus developing a condition which must be ap¬

proximately true, that organized capital and real

estate sustain the entire burden of taxation in the

city.

It can hardly be said that this result was con¬

templated by tho present tax law, because its

language is full and explicit. After saying that,

"alllandsand personal estate, within this State,

whether owned bj- individuals or by corporations

shall be liable to taxation, subject to the exemp¬

tions afterwards specified," the law then goes on

to say that, "real estate shall be valued at such

sums as under ordinaryicircumstances it will sell

for, and also, that the terms 'personal estate' and

'pei-sonal property,' whenever they occur shall be

onsidered to include all household, furniture,

moneys, goods, chattels, debts due from solvent

debtoi-s, whether on account, contract, note, bond,

or mortgage, public stocks, or stocks in moneyed

corporations. They shall also'be considered to in¬

clude such portion of the capital of incorportited

companies liable to taxation on their capital as

shall not be invested in real estate."

The present status of the tax levy must have

resulted either from the apathy and indifference

of the officei-s administrating it, or ^f rom h\ck of

sj-mpathyon their part with the law and of de¬

termination to strictly enforce it. The .shibboleth

has been raised of the impolicy of taxing personal

estate; aud, as if in subservience to this idea, the

official a-ssessments upon this species of property

have been allowed to dwindle almost to an inap¬

preciable amount. Organized capital, real estate,

aud i-eal estate mortgages, being the most accessi¬

ble species of property in existence, have been

seized upon as the principal .subjects of tax a.s-

sessment, and appropriated as best suited for the

application of an unjust, theoretical aud extra

legal method of taxation.

At tlie present day we are brought face to faco

with certain obvious conditions w-hich it behooves

projjcrty owners and the public at large seriously

to consider. It is no figure of speech, and cer¬

tainly no unwarrantable use of language, toa.ssert

that the present tax levy is made principalh*. if

not exclusively, upon these three ckisses of prop¬

erty, to wit: organi-/.ed capital, real estate, aud

real estate mortgages, and that, directly and indi¬

rectly, real estate is called upon to bear more

than ten-elevenths of the whole burden.

On-the other hand, the values of "even the best

real estate in the citj- have declined from twcntj--

five to thirty percent.; le.ssdesirablegrades,.from

forty to fifty per cent., and the greater part of

the vacant land of the city from sixty to seventy

per cent. This unparalleled depreciation htts fol¬

lowed in the wake of declining rents, and the de¬

cline in rents has merely illusti-ated tuid be-on re¬

sponsive to the growing impoverishment of the

people at large.

The proportion of rental income paid over by

land owners to the city in the [shape of taxes, is

larger than was ever before known or tolerated

in the history of the city. The commonest expe¬

rience is that taxation now absorbs from tw-enty-

five to thirty per cent, ofjj-ental income, and

there are ivell authenticated cases where land¬

lords have beeu obliged to pay fully fifty per

cent, of their income to satisfy the demands of

the city. Doubtless, the enthusiastic advocates of

the exemption of personal property from taxa¬

tion regard this situation with undisguised pleas¬

ure, and as affording the maximum of benefit

that can po-ssibly be attained under any system of

tax laws.

At first glance superficial and untutored ob¬

servers might be led to indulge the .same reflec¬

tion, to wit: that this condition of taxation is

favorable to the community at large, inasmuch as

this great oppression falls principally upon land

owners and great corporations, those who are

supposed to be best able to bear the misfortune.

We have no idea of appealing to any seu.se of

justice and equity, because in matters of taxation

these senses are proverbially callous and passive

and even where there is a profession of their ex¬

ercise, we find so many advei-se theories, palpable

.sophistries and pei-sonal hobbies intervening, as

to effectually neutralize the play of the more

spiritual fticiilties.

Unless a system can be demonstrated to be good

or b:ul for tho entire coinmunitj-, it is hardlj-

worth while to .seek to arou.se or enlist public

sentiment. The advocates and defenders of the

present system and the propouiiders of other sys¬

tems, w-hich aim tit the same result that has been

brought about under the existing one, have tried

to abate and divert public interest in this ques¬

tion, and to silence public criticism bj- setting

forth the dogma of the self diffusion of taxation,

which, in tho present case, amounts to saying that

although ten-elevenths of ta.nation is drawn from

real estate, .still, by tho operation of ti natural law

(astliey are plea.sedtoterui it!, this va.st volume

of taxiition retUly dilfu.sos itselL like the atmo.s-

phere, throughout the w-hole immicipal bodj-.

AVe shall choose our own t ime to discuss the value

of these various theories and to study their proba¬

ble elfects. At present, w-ith a view- of enlisting the

titteution of our readers in ivhat we believe to be

a more eiiuitable system of taxation, we will nn-

dertakc to foreshadow w-hat appeai^s to be the in¬

evitable resultof a continuance of the unfortunate

condition which has been evolved out of the pi-es-

ent system.

For nearh- five w-eary years we have -ivaited for

the rekindling of public interest in real estate, and

the appearance of the moderate capitalist and in¬

vestor to deposit his surplus capital in real estate.

The most that we can claim in the w.ay of such

expressions, is, that certain well-to-do citizens

have mado purchases of fashionable residences

at prices which thej' were contentetl to pay.

Tbe utter aKscnce of anj- pronounced and gen¬

eral investment demand can be attributed mainly

to one cause—the burden of taxation. No s^me

man is likely to invest his ctxpittil even in produc¬

tive property where the owner.ship involves really

a joint title with the citj-, the latter demanding

in some cases one-half the rental as its rightful

share of the income : and least of all will the ctip-

italist invest his money in vacant and unproduc¬

tive lands alre.adj- a.s.sessed for ta.xes at valuations

more than their purchase prices and liable to the

infliction of other city claims for street improve-

ment-5.

Real estate iu this citj- has gone through a pro¬

cess which h.is w-iped out many small and some

lai-ge equities of redemption. Property is gradu¬

ally being concentrated by forclosures in the

hands of wealthy people and corporations. After

the last foreclosure that is likely to occur during

the present revulsion has taken place, another

ordeal aw-aits the owner of real estate in which, be

ho wealthy, or only well-to-do, he will be com¬

pelled to choose between p.iying the arrearages

of taxes and assessments and capitalizing them

in the cost of his jiroperty, or relinquishing the

property to the citj- as having too little value,

present or prospective, to indemnify hun for the

paj-ment of excessive liens.

After the last weak holder has been shaken out,

and after the stronger ones have elected to so re¬

linquish their property to the citj-, it is easy to see

that the bodj- of our real estate may be concen¬

trated in comparatively few hands ; that, insitead

of representing twentj--five thousand owners, as

is .supposed to be the case, there may then be not