Real Estate Record

AND BUILDERS' GUIDE.

Vol. XXI.

NEW YOIIK, SATUEDAY, MAIICH 2H, 1878.

No. 528.

Publislied Weekly by

CIjc liciil (Estate Sftarb i^ssoctatbu.

TERMS.

OWE I'EAn, in advance....SIO.OO.

Coinmunications should he addressed to

C. \V. S^VEET,

Nos. 315 ANO :M7 Broadwav.

The Recoki is printed and sent to the Post Office

in time to be delivered in every part of New York

City and Brooklyn by the earner's lli-st early delivery.

Any subscriber who does not receive from the letter

enrrier his paper by the earliest delivery- will please

report the fact imniediatelv.

STATE TAXATION.

There have been many jiiid great discu.ssions

during the past five years concerning State

taxatirjn, tho merits of which we will venture to

stij- are'entirelj- unluiown to tho general reader be¬

yond the allegation that in the apportionment of

State taxation the city is being defrauded by tho

country. Tho bases of this allegation are neither

easily accessible nor readilj- comprehensible. We

purpose, however, to,present to our readers a

connected and intelligible account of the contro-

vei-sy. Great reputations have been founded in

an abilitj' to handle this question, and e.xcellent

men have talked themselves hoarse in dilating

iilion its intricacies. It is to bo feared that one of

our Tax Commi.ssioners has actuallj- impaired his

health in blowing a fog-horn upon this recondite

subject. A proper analysis and discussion of this

theme are comparable only to the study of

liuinan anatomy, so articulated and ramified are

its is.sues. The pillars of the main questions in

di.spute rest upon the foundation «f assessed and

.ipportioned values, and of their ratios, upon com¬

parisons of population and acreage, and tlieir

productiveness, all duly formulated in dreary and

hcwildering columns of numerals, which are

supposed to furnish tho ammunition for a deadlv

aim at the very heart of the controvei-sy.

In the fii-st place we will present to our reatlers

II table showing the aggregate of the State tax

levy for I.S77, and tho manner of its apportion¬

ment between the city and the countrj-.-

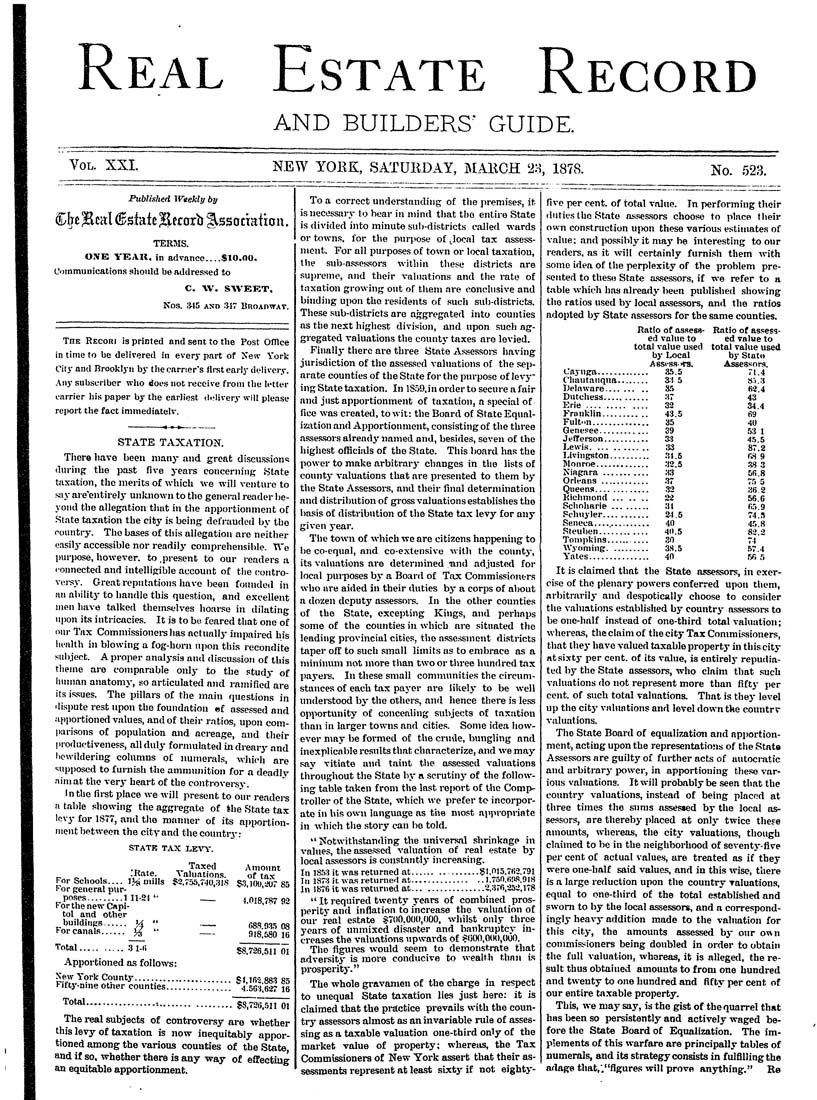

STATE T.,VX LEVY.

• t, . -.. Taxed Amount

^ „ , , -Rate. A ahiation.s. of tax

For Schools.... i;^ mills ?2.755,740,31R S,3,1(10 r.^ 85

lor general pur-

„ P^,f«......---111-21'- ----- 4,018,787 92

For the new Cnpi-

tol and other

buildings...... H " ----- fias.93,';08

^or canals......^ '• ----- fli8;580 16

'"'"'^al..........9F0 58,726.511 01

Apportioned as follows:

New York County................ *j irr-) 883 8=>

Fifty-nine other counties.........'.'.'.'.'.'.'. ^4'.5G:V.6-27 le

'^'^t*'.................■•.................$8,72^511 01

The i-eal subjects of controversy are whether

this levy of taxation is now inequitably appor¬

tioned among the various counties of the State,

and if so. whether there is any -way of effecting

an equitable apportionment.

To a correct understanding of the premises, it

is necessary to hear in mind that the entire State

is divided into minute sub-districts called w-ards

or t«wns. for the purpose of Jocal tax assess¬

ment. For all purposes of town or local taxation,

the sub-a,sse.s.sors within these districts are

supreme, and their valuations and the rate of

taxation growhig out of them are conclusive and

binding upon tho residents of such sub-districts.

These sub-districts are aggregated into counties

as the next highest division, and upon such ag¬

gregated valuations the county taxes aro levied.

Fiuallj- there aro three State Assessoi-s having

jurisdiction of tho assessed valuations of the sep¬

arate counties of the State for the purpose of levy¬

ing State taxation. In lS.")9,in order to secure a fair

and just apportionment of taxation, a special of

fice w-as created, to wit: the Board of State Equal-

iziition and Apportionment, consisting of the three

assessors already named and, besides, seven of the

highest oiliciids of tho State. This board has the

power to make arbitrary changes in the lists of

county valuations that are presented to them by

the State Assessoi-s, and their final determination

and distribution of gross valuations establishes tho

basis of distribntion of the State tax levy for any

given year.

The town of w-)iieh we are citizens happening to

be co-equal, and co-extensive with the county,

its valuations are determined -and adjusted for

local pui-poses bj- a Board of Tax Commissioners

who are aided in their duties by a corps of about

a dozen deputy assessoi-s. In the other counties

of the State, excepting Kings, and perliaps

some of the counties in which are situated the

leading provincial cities, the assessment di.stricts

taper off to such small limits as to embrace as a

mininum not more than two or three hundred tax

paj-ei-s. In these small communities the circnm-

staiicea of each tax payer are likely to be w-ell

understood by the others, and hence there is le.ss

opportunity of concealing subjects of taxation

than in larger towns and cities. Some idea how¬

ever may be formed of the crude, bungling and

inexplicable results that characterize, and we may

say vitiate and taint the a.ssesscd valuations

throughout tho State by a scrutiny of the follow¬

ing table taken from the last rojiort of the Comp¬

troller of the State, which we prefer to incorpor¬

ate in his own language as t'ne most appropriate

in which the story can bo told.

" Notwithstanding the universal shrinkage in

values, the asse-ssed valuation of real estate by

local as-sessors is constantly increasing.

In 1.S.V1 it was returned at................§1,015.76-3.791

In 187-1 it was returned at................1.750.6aS.918

In 1876 it was returned at.................2,:i7fi,'i52,l78

" It required twenty years of combined pros¬

perity and inflation to increase tho valuation of

our real estate §71)0,0(10,000, wliilst only three

years of unmixed disaster and bankruptcy- in¬

creases the valuations upwai-ds of 6(J00,01M),(K)0.

Tho figures would seem to demonstrate that

advei-sity is more conducive to wealth than is

prosperity."

The whole gravamen of tho charge in respect

to unequal State taxation lies just here: it is

claimed that the practice prevails with the coun¬

try assessors almost as an invariable rule of asses¬

sing as a taxable valuation one-third only of tho

market value of property; whereas, the Tax

Commissioners of New York assert that their as-

se-ssments represent at least sixtj- if not eighty-

five per cent of total value. In performing their

duties tho State a-ssessors choose to place their

own con.struction u[K)n these various estimates of

value; and pos.sibly it may be interesting to our

readers, as it will certainly furnish them with

some idea of the perplexity of the problem pre¬

sented to theso State a.s,«essors, if we refer to a

table w-hich has already been published showing

the ratios used by local a.sses.sors, and the ratios

adopted by State as-sessore for the same counties.

Ratio of assess- Ratio of assess¬

ed value to ed value to

total value used total value used

by Local bj- State

Assess. ITS. Assessors,

Cayuga............. .%.5 ri.4

Chautauqua........ ai 5 8.").:i

Delaware......... S-I tii.4

Dutchess........... ;i7 43

Erie------......... 32 34.4

Franklin........... 43.5 69

Fult-m.............. 35 40

Genesee............ 39 53 1

Jefferson........... 3:1 45.5

Lewis............ 33 87.2

Livingston.......... .'{t5 ftS 9

Monroe............. .'12.5 3,8 3

Niagara ........... :f3 5fi.8

Orleans ............ .37 75 5

Queens............. ,32 :i(> 2

Richuiond....... 22 56.6

Schoharie......... 31 fi5.9

Schuyler........... at5 74.5

Seneca.............. 40 45 8

Steuben............ 40.5 82.2

Tompkins........... .30 74

Wyomiiig.......... 38.5 .57.4

Yates............... 40 m r,

It is claimed that the State assessors, in exer¬

cise of the plenarj' powers conferred upon them,

arbitrarily and despotically choose to consider

the valuations established bj' country assessors to

be one-half instead of one-third total valuation;

whereas, the claim of the city Tax Commissioners,

that they have valued taxable property in this city

at sixty per cent, of its value, is entirely repudia¬

ted by the State assessors, who claim that such

valuations do not represent more than fifty per

cent of such total valuations. That is they level

up the city valuations and level down the coimtrv

valuations.

Tho State Board of equalization and apportion¬

ment, acting upon the representations of the State

Assessors are guilty of further acts of autocratic

and arbitrary power, in apportioning the-so var¬

ious valuations. It will probably be seen that the

country valuations, instead of being placed at

three times the sums assessed by the local as¬

sessors, are thereby placed at onlj- twice these

amounts, whereas, the citj- valuations, though

claimed to be in the neighborhood of seventj--five

per cent of actual values, are treated as if they

were one-half said values, and in this wise, there

is a large reduction upon the country valuations,

equal to one-third of the total established and

sworn to by the local assessors, and a correspond¬

ingly heavj- addition made to the valuation for

this citj-, the amounts asses.sed bj- our own

commissioners being doubled in order to obtain

the full valuation, whereas, it is alleged, the re¬

sult thus obtained amounts to from one hundred

and twenty to one hundred and fifty per cent of

our entire taxable propertjr.

This, we may say, is the gist of the quarrel that

has been so persistently and actively waged be¬

fore the State Board of Equalization. The im¬

plements of this warfare are principally tables of

numerals, and its strategy consists in fulfilling the

adage that,'."figures will prove anjrthing." Re