Real Estate Record

AND BUILDERS' GUIDE.

Vol. XXYI.

NEW YORK, SATURDAY, AUGUST 7, 1880.

No. 647

Published Weekly by

Clje ^cal (JBstaU Eecorb J^ssoriation.

TERMS.

ONK YKAK, in advance___$10.00.

Comnmnications should be addressed to

C. W. SAV EET,

No. Vi7 Broa IV a\

REAL ESTATE INVESTMENTS BY COR¬

PORATIONS.

A))()ut a year ago tlie New A'ovk Herald.

with an eiiteri)rise peculiarly its own, laid be¬

fore tlie general public a statement, collated

from the official records at Albany, showing

up in detail tlie amount of bond and inort-

luages held by the various life insurance

com])anves in tliis city. That |)ublication had

the effect of showing to those who were

])()sted in regard to realty values liow the va¬

rious com])anies were managed and the .judg¬

ment thev exercised in regard to the selection

of properties on which tiiey loaned ca.sh

money. As tlu' beginning of 1879 was, per-

iiaps. the best opportunity to test the .judg¬

ment of the various insurance companies

wiien doulit, fear and hojie alternately took

possession of the real estate market, the ope¬

rations which tlien saw the light became a .sure

test ol: the intelligence and business capacity

that ])resided over institutions having charge

and (-(mtrol oC milliims of the people's money.

Tlie critical year, howciver, proved to be, as

it iirogressed, a boon. witJi slight exceptions,

to inost of the insurance companies. Proper¬

ties that liad been foreclosed some time pre¬

vious were sold liere and there advantage¬

ously at jirivate contract, and yet loans even

on im])ro^-ed real estate were granted with

more c'i]-cums]:)ection and caution than had

been tlie case in the past.

In view of tliese facts, and in the absence

of any ell'orts on tiie part of the daily press

to supply the general public this year with

information in regard to the 1880 investments

in real estate and bond and mortgages by the

various msurance companies, The Real Es¬

tate Record, ever on the alert to supply in-

formati(wi of importance to owners of realty,

hei-eby congratulates property liolders gen¬

erally at the increased interest taken by these

flourishing financial mstitutions in New York

and suburban real estate, as shown by their

sworn detailed statements filed in tlie insur¬

ance departments of the various states in

which they transact business. The confi¬

dence entertained by tliese concerns in. the

real estate of oui- own and other cities can

best be arrived at by analyzing the items con¬

stituting their gross assets, as sworn to by

them in detail since the beginning of this

year, 1880. It wUl be conceded that the pos¬

session of real estate, estimated at market

value, and the amount of money loaned at a

fair margin of values on bond and inortgage,

is a pretty good test of the estimation in

which real estate is held by these various

financial institutions. We have, therefore,

selected nine of the leading life insurance

companies in this State and Connecticut, and

reproduce from their lengtliy detailed reports.

as filed in the departments at Albany and

Hartford, the various items, showing how

far in this year, 1880, they are interested in

real estate by actual possession or by cash

loans on realty as security. It will there be

seen that real estate and bond and mortgage

continue to be, more so than in the past, the

jirincipal items of their gross assets.

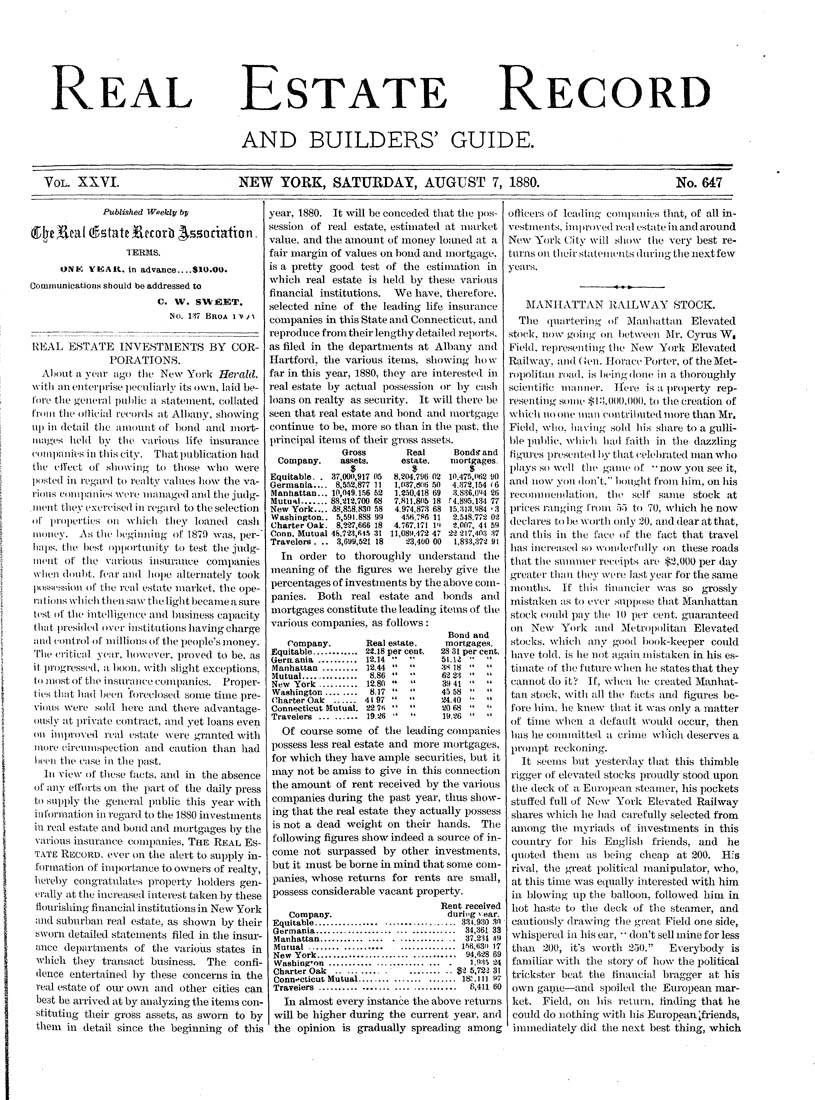

Gross Real Bonds' and

Company. assets. estate. mortgages.

Equitable. .

37,0011,917 05

8.204.796 02

10.475,062 90

Germania...

8,5.^2,877 11

1,(I37,*16 .50

4.372,154 i6

Manhattan..

10,049.156 52

1.2.50,418 69

3.83r),0<J4 26

Mutual.......

88,212.700 68

7,811,805 18

r4.895.134 77

New York...

38,858.830 58

4.974,873 68

15.313.984 -3

Washington.

.5,591.888 99

4.5K.7P6 11

2.548.772 02

Charter Oak

8.2-27,666 18

4.767.171 V\

2.007, 44 59

Conn. Mutual 4&.723,fil.'5 31

11,089.472 47

22 217,403 37

Travelers . .

3,699,521 18

23,400 00

1,833,372 91

In order to thoroughly understand the

meaning of the figures we hereby give the

percentages of investments by the above com¬

panies. Both real estate and bonds and

mortgages constitute the leading items of the

various companies, as follows :

Bond and

Company. Real e.state. mortgage.s.

Equitable............ 22.18 percent. 28 31 per cent.

Gern-ania .......... 12.14 *• *' 51.12 " "

Manhattan ......... 12.44 " " 3K 18 " "

Mutual.............. 8.86 " " 62 23 " "

New York.......... 12.80 " " 39 41 " "

Washington........ 8.17 " " 45 58 " "

<^harterOak ...... 4197 " " 24.40 '• "

Connecticut Mutual. 22.7H " " 20 68 " "

Travelers......... 19.26 ' " 19.26 " "

Of course some of the leading companies

liossess less real estate and more mortgages,

for which they have ample securities, but it

may not be amiss to give in this connection

the amount of rent received by the various

companies during the past year, thus show¬

ing that the real estate they actually possess

is not a dead weight on their hands. The

following figures show indeed a source of in¬

come not surpassed by other investments,

but it must be borne in mind that some com¬

panies, whose rettirns for rents are small,

possess considerable vacant property.

Rent received

Company. during vear.

Equitable.................................. 334.930 30

Germania................................. 34,36133

Manhattan............................. 37.2U 49

Mutual .................. ............... 1.56.631)17

New York.................................. 94,628 69

Washington........................... 1.985 24

CharterOak............ ..........$2 5,722 31

Conu'^cticut Mutual...................... 185.11] 97

Travelers ................................ 8,41160

In almost every instance the above returns

wUl be higher during the current year, and

the opinion is gradually spreading among

officers of leading comjiaiiies that, of all in¬

vestments, improved real estate iu and around

New York City will show the very best re¬

turns on their statements during the next few

years.

MANHATTAN RAILWAY STOCK.

Tlie quartering of Manhattan Elevated

stock, now going on between Mr. Cyrus W,

Field, representing the New Y(n-k Elevated

Railway, and (.Wn. Horace P(jrtt>r, of the Met¬

ropolitan road, is being done in a thoroughly

scientific manner. Here is a property rep¬

resenting some .tniOOO.OOO, to the creation of

whicli no one man contributed more than Mr.

Field, who. liaving sold his share to a gulli-

l)le public, whiclv hail faith in the dazzling

figures presented by tliat (-eh'Iirated man who

plays so well the game of "now you see it,

and now you don't," liought from liini, on his

recommeiulation, the self .same stock at

prices ranging from 55 to 70, which he noAV

declares to be worth only 20, and dear at that,

and this in the face of the fact that travel

has increased so wonderfully on these roads

that the summer receipts are $2,000 per day

greater than they were last year for the same

months. If this financier Avas so grossly

mistaken as to ever sup[)ose that Manhattan

stock ('ould pay the 10 per cent, guaranteed

(m New York and Metropolitan Elevated

stocks. A\'hicli any good book-keeper could

haA'e told, is he not again mistaken in his es¬

timate of the future when he states that they

cannot do it? If, Avhen he created Manhat¬

tan stock, with all the facts and figures be¬

fore him, he knew that it was only a matter

of time when a default would occur, then

has he committed a crime wliich deserves a

prompt reckoning.

It seems but yesterday that this thimble

rigger of elevated stocks proudly stood upon

the deck of a European steamer, his jiockets

stulfed full of New York Elevated Railway

shares which he had carefully selected from

among the myriads of investments in this

country for his English friends, and he

quoted them as being cheap at 200. Hfs

rival, the great political manipulator, who,

at this time was equally interested with him

in blowing up the balloon, followed him in

hot haste to the deck of the steamer, and

cautiously drawing the great Field one side,

whispered in his ear, • • don't sell mine for less

than 200, it's worth 250." Eveiybody is

familiar with the story of liow the political

trickster beat the financial bragger at his

own game—and spoiled the Eiu-opean mar¬

ket. Field, on his return, finding that he

could do nothing witli his Etiropeanlfriends,

immediately did the next best thing, which