L. -_^®5F"ebruary 21, 1885

The Record and Guide.

179

— Pp

THE RECORD AND GUIDE,

Published every Saturday.

191 Broad-way, KT. Y.

TERMS:

OIVE TEAR, in advance, SIX DOLLARS.

Commmiications should be addressed to

C. W. SWEET, 191 Broadway.

J. T. LINDSEY, Business Manager.

FEBRUARY 21, 1885.

To Whom it may Concern.

The prowth of the statistical and tabiUar departments of The Recoiid

AND Guide has been so great that the mechanical difficulties of getting out

correctly without errors of greater or less degree so much printed matter

in one issue have become quite serious. Whether the times are good or bad

New York continues to grow. Every year shows an increase in the Con¬

veyances, the Real Estate and Chattel Mortgages and the plans for New

Buildings.

Take the Conveyances {done—in 1874 they numbered 6,191, in 1884 we pub¬

lished 12,2(53. The Mortgages—real estate and chattel^the Judgments and

the plans for New Buildings, have all nearly doubled within the same period.

While giving less than one-third the matter than we do now-a-days the

price of the paper was then $8 per annum. We have recently been pub¬

lishing a journal covering far more ground and triple the size for $6 per

annum. AA'e have been enabled to do this by the very much larger sub.

scription list and the increased value of the paper as an advertising medium.

But this increase of the statistical departments gives the impression that

The .Record and Guide is a catalogue rather than a live journal, although

every line, outside of the advertising pages, is written and printed fresh in

each issue.

Some of our readers have complained of the bulky size of the paper.

Our " Business World," notes on trade and editorials have greatly

widened the circle of our readers, particularly out of town, and many of

them are not interested in tho technical matter which real estate dealers,

financial institutions and nioney lenders generally find indispensable to the

prosecution of their business.

There is but one way out of th3 dilemma. The matter must be

separated; the more important departments being given in The Record

AND Guide, pubUshed on Saturday, and the other e.ssential features in the

Chronicle, published on AVednesday. After this week, therefore, the former

paper will be found to contain tho New York Conveyances and Mortgages,

the Judgments, the plans for New BuUdings, as well as everything

that relates to real estate and general business, while the Chronicle

wiU give the out-of-town real estate, including Kings County, the Chat¬

tel Mortgages and the other departments heretofore published. The

price ot The Record and Guide will as before be $6.00 a year, the

Chronicle $5.00 a year, but should anyone wish both papers, they will be

furnished for .?8.00 per annum, which is just about the increased eipen.se for

white paper and printing.

Spring elections are no protection against municipal misgovern¬

ment. People forget that we had spring elections before, and that

under the city officers then chosen were perpetrated some ot the

worst evil acts of the Tweed regime. There should, indeed, be

fewer elections, as proposed by Mr. Heath's bill now before the

Assembly. A city election in the spring would cost a quarter of a

million dollars, at least, to be paid by the city treasury, while the

election expenses and loss of time would cost individuals probably

a million more. We are now trying responsible government by

lodging large powers in the Mayor. Let us test this plan thoroughly

by giving our local executive the authority to remove, as well as

appoint. Let us have single heads of departments, responsible to

and removable by the Mayor. Should the latter prove to be cor¬

rupt, or grossly inefficient, let power be given the Governor of the

state to remove him and call a new election. AU this is practical,

but spring elections are a quack remedy for municipal abuses, for

they have already been tried and proved worse than useless.

There is much just complaint at the increased valuations on real

estate in the lower part of the city, especially in the First ward.

The figures show an increase over last year out of all proportion to

the natural increment of values. The assessor, we believe,

claims that he has been guided by the consideration named in the

deeds upon record in the Register's office ; but these are often mis¬

leading, because of the dishonest practices of certain speculators,

who deliberately put false considerations in the deed in order to

enhance the apparent value of adjoining property which they hold

for sale, or on which to make a claim for mortgages more than the

property really ought to command. Then, in trading one piece of

property for another, either or both of the parties are apt to put

down extravagantly high figures as the price of each parcel

exchf^nged. This makes no difiference to the traders, but it gives

an entirely erroneous idea of real estate values when the figures are

published. This practice opght to b? stopped h^ hvr,

L'ns and Pis.

Specie.

t<*»fr. tend.

Oircurn.

Feb.

14,

18.S5..

. $299,4.53,100

$103;29a,8aO

$37,674,500

$11,024,000

l-eh.

It),

1884..

.. 34.5,K94,200

78,319,800

82,577,100

14,.'-v-JS,200

Keh

17,

1R8.S. .

. 32,1.352.100

59.99«,.300

2l,.^^3,fiO0

16.M3,000

Feb.

18,

1882..

.. 3-38,659,300

59,479,000

18,065,000

19.975.1)00

l-'eb.

IIP,

isai..

.. 3.>0,807,300

«5,(M9,6flO

14.887.200

lK,i»9..«)00

Feb.

21,

18,S0..

.. 290,091,200

59,«87,!»0

15,.-K'6,.W0

21,'iH2.200

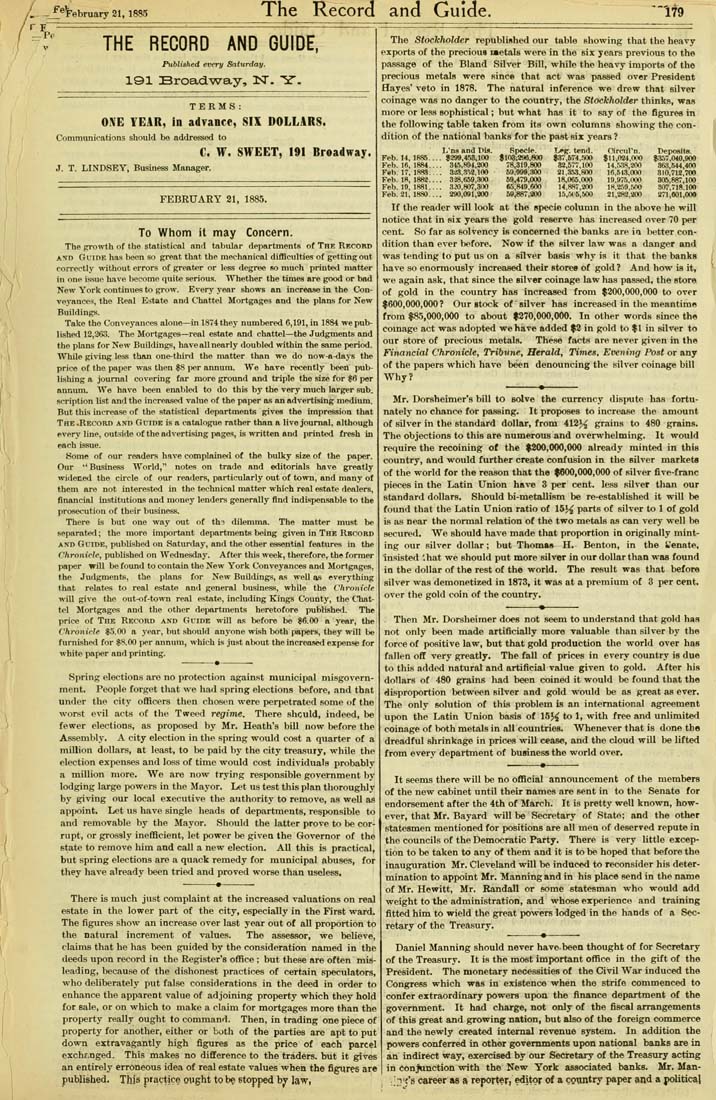

The Stockholder republished our table showing that the heavy

exports of the precious laetals were in the six years previous to the

passage of the Bland Silver Bill, while the heavy imports of the

precious metals were since that act was passed over President

Hayes' veto in 1878. The natural inference we drew that silver

coinage was no danger to the country, the Stockholder thinks, was

more or less sophistical; but what has it to say of the figures in

the following table taken from its own columns showing tho con¬

dition of the national banks for the past six years ?

Deposits.

$.357,040,900

863,544,400

310,712,700

30S,887,100

307.718.100

271,801,000

If the reader will look at the specie column in the above he will

notice that in six years the gold reserve has increased over 70 per

cent. So far as solvency is concerned the banks are ia better con¬

dition than ever before. Now if the silver law was a danger and

was tending to put us on a silver basis why is it that the banks

have so enormously increased their stores of gold ? And how is it,

we again ask, that since the silver coinage law has passed, the store

of gold in the country has increased from $200,000,000 to over

$600,000,000? Our stock of silver has increased in the meantime

from $85,000,000 to about $270,000,000. In other words since the

coinage act was adopted we have added $2 in gold to $1 in silver to

our store of precious metals. These facts are never given in the

Financial Chronicle, TYibune, Herald, Times, Evening Post or any

of the papers which have been denouncing the silver coinage bill

Why?

Mr. Dorsheimer's bill to solve the currency dispute has fortu¬

nately no chance for passing. It proposes to increase the amount

of silver in the standard dollar, from 412}^ grains to 480 grains.

The objections to this are numerous and overwhelming. It would

require the recoining of the $200,000,000 already minted in this

country, and would further create confusion in the silver markets

of the world for the reason that the $600,000,000 ot silver five-franc

pieces in the Latin Union have 3 per cent, less silver than our

standard dollars. Should bi-metallism be re-established it wiU be

fovmd that the Latin Union ratio of 15J^ parts of silver to 1 of gold

is as near the normal relation ot the two metals as can very well be

secured. We should have made that proportion in originally mint¬

ing our silver dollar; but Thomas H. Benton, in the Senate,

insisted '.hat we should put more silver in our dollar than was found

in the dollar of the rest ot the world. The result was that before

silver was demonetized in 1873, it was at a premium ot 3 per cent,

over the gold coin of the country.

Then Mr. Dorsheimer does not seem to understand that gold has

not only been made artificially more valuable than silver by the

force of positive law, but that gold production the world over has

fallen off very greatly. The fall of prices in every coimtry is due

to this added natural and artificial value given to gold. After his

dollars of 480 grains had been coined it would be found that the

disproportion between silver and gold would be as great as ever.

The only solution of this problem is an international agreement

upon the Latin Union basis ot 15J^ to 1, with free and unlimited

coinage ot both metals in all countries. Whenever that is done tho

dreadful shrinkage in prices will c«ase, and the cloud will be lifted

from every department of business the world over.

It seems there will be no official announcement of the members

of the new cabinet until their names are sent in to the Senate for

endorsement after the 4th of March. It is pretty well known, how¬

ever, that Mr. Bayard will be Secretary of State; and the other

statesmen mentioned for positions are all men of deserved repute in

the councils ot the Democratic Party. There is very little excep¬

tion to be taken to any of them and it is to be hoped that before the

inauguration Mr. Cleveland will be induced to reconsider his deter¬

mination to appoint Mr. Manning and in his place send in the name

of Mr. Hewitt, Mr. Randall or some statesman who would add

weight to the administration, and whose experience and training

fitted him to wield the great powers lodged in the hands ot a Sec¬

retary of the Treasury.

—-----•-------

Daniel Manning should never havebeen thought of for Secretary

ot the Treasury. It is the most important office in the gift ot the

President. The monetary necessities of the Civil War induced the

Congress which was in existence when the strife commenced to

confer extraordinary powers upon the finance department of the

government. It had charge, not only ot the fiscal arrangements

of this great and growing nation, but also of the foreign commerce

and the newly created internal revenue system. In addition the

powers conferred in other governments upon national banks are in

an indirect way, exercised by our Secretary of the Treasury acting

in Conjunction with the New York associated banks. Mr. Man-

.'.'.yt's career as a reporter, editor of a cowitry paper and a pditical

Prev

Prev