Please note: this text may be incomplete. For more information about this OCR, view

About OCR text.

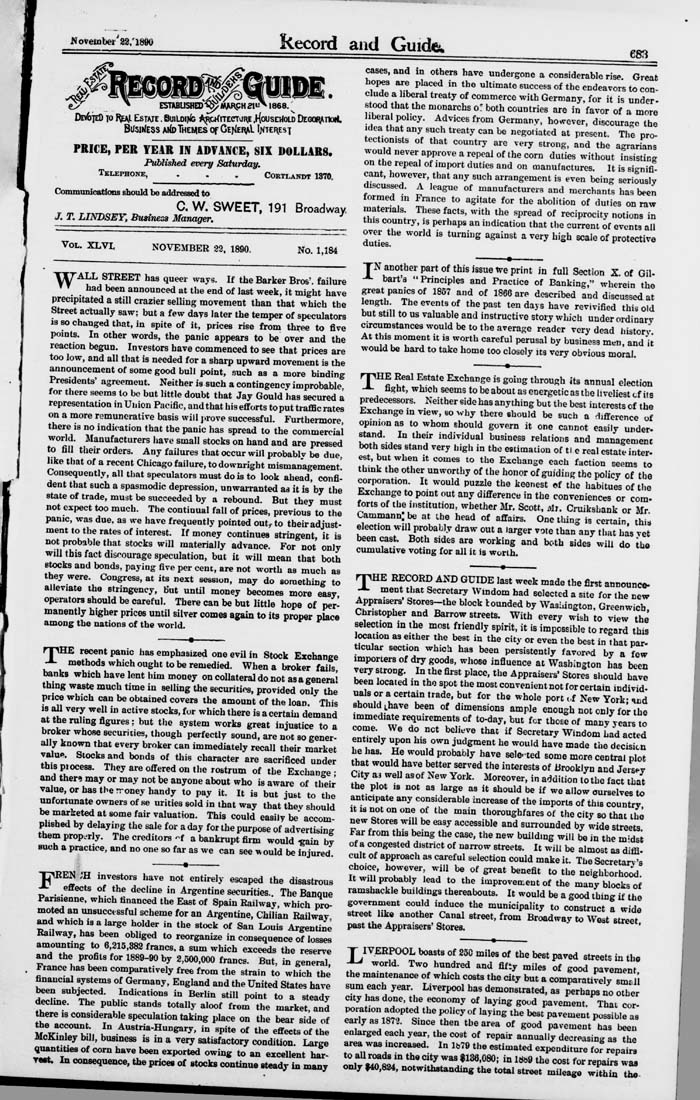

Noveinbei'^aS.'lSeO

Record and Guides

4^7

Dp^teD to I^ Estate . BuiLoi^ AppKiTEcrrvjR^ .HouseiIold Degoi^iioiI.

BUsiifESS Alb Themes or Ce^Iei^I Ij<t£i\es7

PRICE, PER TEAR IIV ADTANCE, SIX DOLLARS,

Published every Stxturday.

TeMPHONE, . . . CJORIXAKDT 1870.

Commanlcattona sbould be addresaed to

, ^ „ C. W. SWEET, 191 Broadway

J. T. LINDSEY, Businesa Manager,

68H

Vol. XLVI.

NOVEMBER 22. 1890.

No. 1,184

cases, and in others bave undergone a considerable rise. Great

ho^s axe placed in the ultimate success of the endeavors to con-

elude a liberal treaty of commerce with Germany, for it is under,

stood that the monarchs o! both countries are in favor of a more

liberal policy. Advices from Germany, ho^rever, discourage the

Idea that any such treaty can be negotiated at present. The pro¬

tectionists of that country are very strong, and the agrarkns

would never approve a repeal of the corn duties without insisting

on the repeal of import duties and on manufactures. It is signifi-

cant, however, that any such arrangement is even being seriously

discussed. A league of manufacturers and merchants has been

formed in France to agitate for the abolition of duties on raw

materials These facts, with the spread of reciprocity notions in

this country, is perhaps an indication that the current of events all

over the world is turning against a very high scale of protective

TjU^ALL STREET has queer ways. If the Barker Bros', failure

' ▼ had been announced at the end of last week, it might have

precipitated a still crazier selling movement than that which the

Street actually saw; but a few days later the temper of speculators

13 so changed that, in spite of it, prices rise from three to five

points. In other words, the panic appears to be over and the

reaction begun. Investors have commenced to see that prices are

too low, and all that is needed for a sharp upward movement is the

announcement of some good bull point, such as a more binding

Presidents' agreement. Neither is such a contingency improbable

for there seems to be but little doubt that Jay Gould has secured a

representation in Union Pacific, and that his eflforts to put traffic rates

on a more remunerative basis will prove successful. Furthermore

there is no indication that the panic has spread to the commercial

world. Manufacturers have small stocks on hand and are pressed

to fill their orders. Any failures that occur will probablv be due

like that of a recent Chicago failure, to downright mismanagement'

Consequently, all that speculators must do is to look ahead, confi¬

dent that such a spasmodic depression, unwarranted as it is by the

state of trade, must be succeeded by a rebound. But they must

not expect too much. The continual fall of prices, previous to the

panic, was due, as we have frequently pointed out, to their adjust¬

ment to the rates of interest. If money continues stringent, it is

not probable that stocks will materially advance. For not only

will this fact discourage speculation, but it wiU mean that both

stocks and bonds, paying five per cent, are not worth as much as

they were. Congress, at its next session, may do something to

alleviate tho stringency, but unUl money becomes more easy

operators should be careful. There can be but little hope of per¬

manently higher prices until silver comes again to its proper place

among tbe nations of the world.

rpHE recent panic has emphasized one evU in Stock Exchange

-*- methods which ought to be remedied. When a broker fails

banks which have lent him money on collateral do not as a general

thing waste much time in selling the securities, provided only the

price which can be obtained covers the amount of the loan. This

18 all very well in active stocks, for which there isacertaiu demand

at the ruling flgures; but the system works great injustice to a

broker whose securities, though perfectly sound, are not so gener¬

ally known that every broker can immediately recall their market

value. Stocks and bonds of this character are sacrificed under

this piocess. They are oflfered on the rostrum of the Exchange •

and there may or may not be anyone about who is aware of their

value, or has the rroney handy to pay it. It is but just to the

unfortunate owners of se urities sold in that way that thev should

be marketed at some fair valuation. This could easily be' accom¬

plished by delaying the sale for a day for the purpose of advertising

them property. The creditors -f a bankrupt firm would -gain by

such a practice, and no one so far as we can see would be injured.

---------m------—

JpREN iB investors have not entirely escaped the disastrous

effects of the decline in Argentine securities.. The Banoue

Pansienne. which financed the East of Spain Railway, which pro¬

moted an unsuccessful scheme for an Argentine, Chilian Railwav

and which 18 a large holder in the stock of San Louis Argentine

RaUway, has been obliged to reorganize in consequence of losses

amounting to 6,215,882 francs, a sum which exceeds the reserve

and the profits for 1889-90 by 2,500,000 francs. But, in general.

France has been comparatively free from the strain to which the

financial systems of Germany, England and the United States have

been subjected. Indications in Berlin still point to a steady

declme. The public stands totally aloof from the market and

^ere IS considerable speculation taking place on the bear side of

ttie account. In Austria-Hungary, in spite of the effects of the

McKinley bill, business is in a very satisfactory condition. Large

quantities of com have been exported owing to an exceUent hi-

rmt, Jn consequence, the prices of stocks continue steady in many

TN another part of this issue we print in full Section X. of Gil-

-*- harts "Principles and Practice of Banking," wherein the

great panics of 1857 and of 1866 are described and discussed at

length The events of the past ten days have revivified this old

but still to us valuable and instructive story wWch under ordinary

curcumstances would be to the average reader very dead history

At this moment it is worth careful perusal by business men, and it

would be hard to take home too closely its very obvious moral.

•---------

rpHE Real Estate Exchange is going through its annual election

-*- fight, which seems to be about as energetic as the liveliest cf its

predecessors. Neither eide has anything but the best interests of the

Exchange in view, so why there should be such a 'lifference of

opinion as to whom should govern it one cannot easily under-

stand. In their individual business relations and management

both sides stand very high in the estimation of ti e real estate inter-

est, but when it comes to the Exchange each faction seems to

thmk the other unworthy of the honor of guiding the policy of the

corporation. It would puzzle the keenest of the habitues of the

Exchange to point out any difference in the conveniences or com-

forts of the institution, whether Mr. Scott, Mr. Cruikshank or Mr

Cammann be at the head of affairs. One thing is certain, this

election will probably draw out a larger vote than any that has vet

been cast. Both sides are working and both sides wiU do the

cumulative voting for all it is worth.

rpHE RECORD AND GUIDE last week made the first announce.

-*- ment that Secretary Wmdom had selected a site for the new

Appraisers' Sto^s-the block lounded by Wasidngton. Greenwich.

Christopher and Barrow streets. With every wish to view the

selection m the most friendly spirit, it is impossible to regard this

location as either the best in the city or even the best in That par-

ticular section which has been persistently favored by a few

importers of dry goods, whose influence at Washington has been

very strong In the first place, the Appraisers' Stores should have

been located m tho spot the most convenient not for certain individ-

uals or a certain trade, but for the whole port vt New York; nnd

should Lhave been of dimensions ample enough not only for the

immediate requirements of to-day. but for those of many years to

come We do net believe that if Secretary Windom had acted

entirely upon his own judgment he would have made the decisicn

he has. He would probably have sele-ted some more central plot

that would have better served the interests of Brooklyn and JeLv

City a:, well asof New York. Moreover, in addition tithe fact that

the plot is not as large as it should be if we allow ourselves to

anticipate any considerable increase of the imports of this countrv

It IS not on one of the main thoroughfares of the city so that the

new Stores will be easy accessible and surrounded by wide streets

Far from this being the case, the new building will be in the m'dst

of a congested district of narrow streets. It will be almost as diffl.

cult of approach as careful selection could make it. Tbe Secretarv's

choice, however will be of great benefit to the neighborhood.

It will probably lead to the improvement of the many blocks of

ramshackle buildings thereabouts. It would be a good thing if the

government could induce the municipality to construct a wide

street like another Canal street, from Broadway to West street

past the Appraisers' Stores.

T IVERPOOL boasts of 250 miles of the beet paved streets in the

-^ world. Two hundred and fifty miles of good pavement

the maintenance of which costs the city but a comparatively smM

sum each year. Liverpool has demonstrated, as perhaps no otber

city has done, the economy of laying good pavement. That cor-

"^^'Z^Ti' '""^ ^"'^f '^^'"^ '^' ^« P^^-'^ent possible as

early as 1872 Since then tbe area of good pavement has been

enlarged each year, the cost of repair annually decreasing as the

area was increased. In lb79 the estimated expenditure fofrepairs

Iv^^"" th'cijr was $136,080; in W.9 the cost for repairs was

only 140,834, notwithstanding the total street mileage within the