July 16, 1904

RECORD ANB GUIDE

"ey -^ ESTABUSHED-^JAfcRpHSLii^lBea.

Dev&tzD to RfA.L EIsTAit. Building ApoKtTEcnuRE ,}{m snlom DEBOffnoil.

Bush/ess Aji) Themes OF GETiER^I iKiti^sT.

PRICE PER YEAR IN ADVANCE SIX DOLLARS

Published eVerp Saturday

Communicatlona should be addressed to

C. W. SWEET, 14-16 Vesey SJreet. New Yorh

J, T. LINDSEY, Business Mann-or Telephone, Cortlandt 3157

"Entered at tlie Post OJi:-e at N'eio York, Jf. Y., as second-class inalter."

Vol. LXXIV.

JULY IG, 1904.

THE stocli market does well to be more cheerful, for it is

bpcoming more than ever apparent that the year 1905 will

see a restoration of .'ictivp. and profitable business. It is in¬

credible tbat the excellent crops which are promised, and

v/hich will be sold at good prices, will not give the West and

the South a new period of prosperity. Of course, the present

crop prospects may not be fulfilled; but it is a fair gamble that

they will be, and a man who can buy stoclis now and can afford

to carry them into the new year, has as good a chance of malting

money as often occurs. No doubt he should limit bis purchases

to gcod railroad securities—particiilariy of the better Western

roads; but eventually the continued prosperity of the West and

* the South must react upon the great industries of the Middle

West and the East, and restore the value of the industrial

securities. It is evident, also, tbat the financial community will

take the election without much perturbation or disturbance.

The ex'isting monetary standard is .secure, in any event; and the

tariff or the trusts cannot be issues in any very genuine sense

of that word. The big issue will be the personality of the

President, which W^all Street does not altogether like, but

which it does not fear as much as it once did. The election,

consequently, will not stand in the way of a recovery in values,

which is in other respects justified. And if the market should

recover completely during the next six mcnths, it will be an

extraordinarily rap>id recuperation from a malady that looked at

one time about as serious as possible.

"p HE EVENING POST, in a recent comment upon the real

■^ estate situation, makes a good deal out of a table showing

the real estate transactions for the first six months of the last

four years. The table runs as follows:

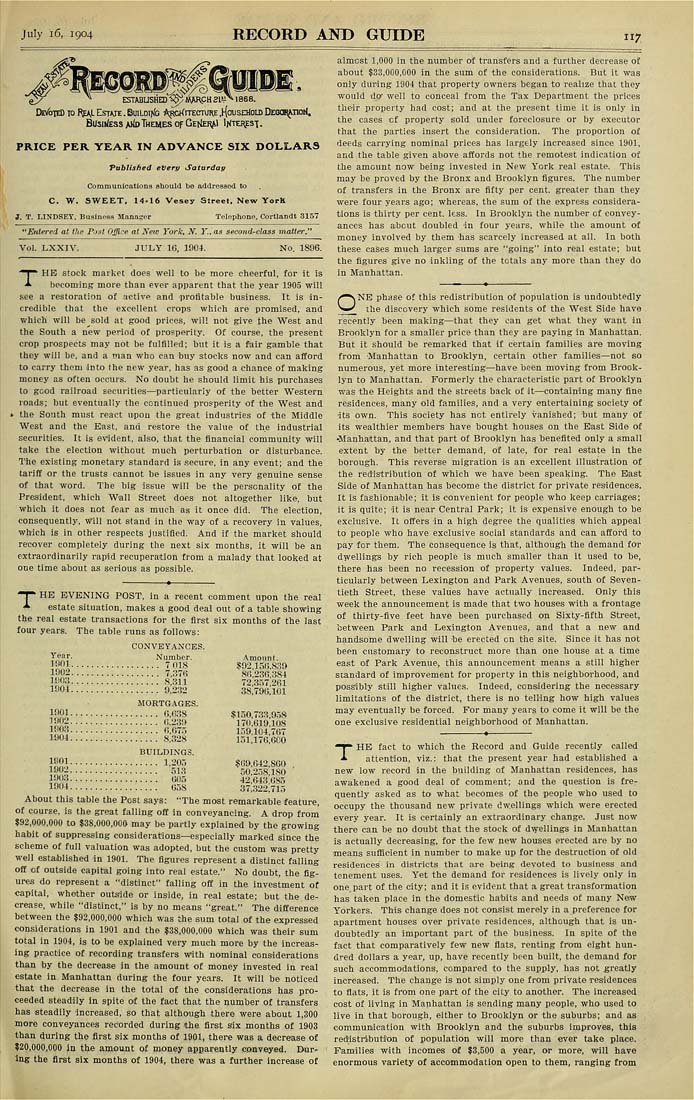

CONVEYANCES.

Year. Number. Amoiinl

1™".................. 7 0IS .?02,150.83!)

19(>2.................. 7,37fi 815.230,384

J^«-?.................. S.HU 72.357.261

1904.................. 9,2:J2 38,700,101

MORTGAGES.

S.................. O.'ISS $150,738,958

^™2.................. (i.23i> 170.619.10S

1«03.................. 0.0-5 159,104,767

l'J04.................. S.328 151.176.6CO

BUILDINGS.

li'll.................. 1.205 $69,642,860

} "l;.................. 51.3 50.258.180 '

1^ -J.................. «1"' 42.G43.6S5

19U4.................. 658 37,322.715

About this table the Post says: "The most remarkable feature,

of course, is the great falling off in conveyancing. A drop from

$92,000,000 to $38,000,000 may be partly explained by the growing

habit of suppressing considerations—especially marked since the

scheme of full valuation was adopted, but the custom was pretty

well esta,blished in 1901. The figures represent a distinct falling

off of outside capital going into real estate." No doubt, the fig¬

ures do represent a "distinct" falling off in the investment of

■capital, whether outside or inside, in real estate; but the de¬

crease, while "distinct," is by no means "great." The difference

between the $92,000,000 which was the sum total of the expressed

considerations in 1901 and the ?38,000.000 which was their sum

total in 1904, is to be explained very much more by the increas¬

ing practice of recording transfers with nominal considerations

than by the decrease in the amount of money invested in real

estate in Manhattan during the four years. It will be noticed

that the decrease in the total of the considerations has pro¬

ceeded steadily in spite of the fact tbat the number of transfers

has steadily increased, so that although there were about 1,300

more conveyances recorded during the first Six months of 1903

than during the first six months of 1901, there was a decrease of

$20,000,000 in the amount of money apparently conveyed. Dur¬

ing the first six months of 1904, there was a further increase of

almost 1,000 in the number of transfers and a further decrease of

about $33,000,000 in the sum of the considerations. But it was

only during 1904 that property owners began to realize that they

would do" well to conceal from the Tax Department the prices

their property bad cost; and at the present time it is only in

the cases cf property sold under foreclosure or by executor

that the parties insert the consideration. The proportion of

deeds carrying nominal prices has largely increased since 1901.

and the table given above aftords not the remotest indication of

the amount now being invested in New York real estate. This

may be proved by the Bronx and Brooklyn figures. The number

of transfers in the Bronx are fifty per cent, greater than they

were four years ago; whereas, the sum of the express considera¬

tions is thirty per cent. less. In Brooklyn the number of convey¬

ances has about doubled 'in four years, while the. amount of

money involved by them has scarcely increased at all. In both

these cases much larger sums are "going" into real estate; but

the figures give no inkling of the totals any more than they do

in Manhattan.

ONE phase of this redistribution of population is undoubtedly

___ [be discovery which some residents of the West Side have .

recently been making—that they can get what they want in

Brooklyn for a smaller price than they are paying in Manhattan.

But it should be remarked that if certain families are moving

from Manhattan to Brooklyn, certain other families—not so

numerous, yet more interesting—have been moving from Brook¬

lyn to Manhattan. Formerly the characteristic part of Brooklyn

was the Heights and the streets back of it—containing many fine

residences, many old families, and a very entertaining society of

■its own. This society has net entirely vanished; but many of

its wealthier members have bought houses on the East Sid© of

■Manhattan, and that part of Brooklyn has benefited only a small

extent by the better demand, of late, for real estate in the

borough. This reverse migration is an excellent illustration of

the redistribution of which we have been speaking. The East

Side of Manhattan has become the district for private residences.

It is fashionaible; it is convenient for people who keep carriages;

It is quite; it is near Central Park; it is expensive enough to be

exclusive. It offers in a high degree the qualities which appeal

to people who have exclusive social standards and can afford to

pay for them. The consequence is that, although the demand far

dwellings by rich people is much smaller than it used to be,

there has been no recession of property values. Indeed, par¬

ticularly between Lexington and Park Avenues, south of Seven¬

tieth Street, these values have actually increased. Only this

week the announcement is made that two houses with a frontage

of thirty-five feet have been purchased on Sixty-fifth Street,

between Park and Lexington Avenues, and that a new and

handsome dwelling will be erected en tbe site. Since it has not

been customary to reconstruct more than one house at a time

east of Park Avenue, this announcement means a still higher

standard of improvement for property in this neighborhood, and

poss'ibly still higher values. Indeed, considering tbe necessary

limitations of the district, there is no telling bow high values

may eventually be forced. For many years to come it will be the

one exclusive residential neighborhood of Manhattan.

THE fact to which the Record and Guide recently called

attention, viz.: that tbe present year had established a

new low record in the building of Manhattan residences, has

awakened a good deal of comment; and the question is fre-

auently asked as to what becomes of the people who used to

occupy the thousand new private dwellings which were erected

every year. It is certainly an extraordinary change. Just now

there can be no doubt that the stock of d^yellings in Manhattan

is actually decreasing, for the few new houses erected are by no

■means sufBcient in number to make up for the destruction of old

residences in districts that are being devoted to business and

tenement uses. Yet the demand for residences is lively only in

one part of the city; and it is evident that a great transformation

has taken place in the domestic ha'bits and needs of many Neiw

Yorkers, This change does not consist merely in a preference for

apartment houses over private residences, although that is un¬

doubtedly an important part of the business. In spite of the

fact that comparatively few new fiats, renting from eight hun¬

dred dollars a year, up, have recently been built, the demand for

such accommodations, compared to the supply, has not greatly

increased. The change is not simply one from private residences

to flats, it is fi'om one part of the city to another. The increased

cost of living in Manhattan is sending many people, who used to

live in that borough, either to Brooidyn or the suburbs; and as

communication with Brooklyn and the suburbs improves, this

red'istriibution of population will more than ever take place.

Families with incomes of $3,500 a year, or more, will have

enormous variety of accommodation open to them, ranging from