Please note: this text may be incomplete. For more information about this OCR, view

About OCR text.

m^,

VoL LXXXVIII

AUGUST 5, iQii

No. 2264

HOW THE TAX DEPARTMENT DOES ITS WORK.

By Adopting a Highly Efficient Staff Organization and Introducing Modern

Office Equipment, It Has Reduced Real Estate Appraising to a Science.

To most persons the Department of

Taxes and Assessments merely sig¬

nifies a huge impersonal govermental ma¬

chine, which year after year remorselessly

demands a greater and greater share of

rents or profits under the name of taxes.

Of course, as a matter of ti^ct it is not

impersonal at all. It is a corps of highly

specialized men. working accordiiig to

definite rules and carefuly considering

each one of the more than half a million

separate assessments which it places upon

the tax roll.

PERSONNEL OF THE DEPARTMENT.

At the head of the department is the

Board of Taxes and Assessments, com¬

posed of seven commissioners acting as a-

hoard. They appoint the deputies when

vacancies occur, assign deputies to the

respective districts, supervise their worlt,

By EDWARD L. HEYDECKER,

Assistant Tax Commissioner

is actively engaged in preparing the new

roll.

The Real Estate Bureau is under the

general direction and supervision of the

Chief Deputy of Real Estate and the As-

si.stant Chief Deputy. Each bureau is in

charge of a deputy in charge of the bor-

ougli. The territory in each borough is

divided into assessment districts, to each

of which is assigned a deputy. There

are seventy-two districts in all. Each

district deputy has a clerk and there is

a staff of general ofiice clerks. The as¬

sessments are made by the district depu¬

ties, each of whom exercises his own dis¬

cretion in determining the value which

he will place upon the land and upon the

land with improvements thereon in the

case of each lot separately assessed. Thus

the assessment roll consists of the values

placed upon each parcel hy the deputy of

far-reaching and called for a wide knowl¬

edge of real estate values and real estate

conditions. The deputies have heen in

ofiice for long periods. Some have served

for twenty years. The average term of

service is probably about seven or eight

years, and would be much higher were it

not for the gradual yearly increase in tlie

number. Tt is to be noted, however, that

most of those who pass the examination

successfully and are in turn appointed

deputies are the clerks in the department

wlio thus bring to the work as dsputy the

knowledge which tliey have been gather¬

ing as associates with the deputies in

their field work.

ASSESSMENT OF LAND VALUES.

The charter provisions require a sepa¬

rate statement of the value of land

wholly unimproved. This has proved to

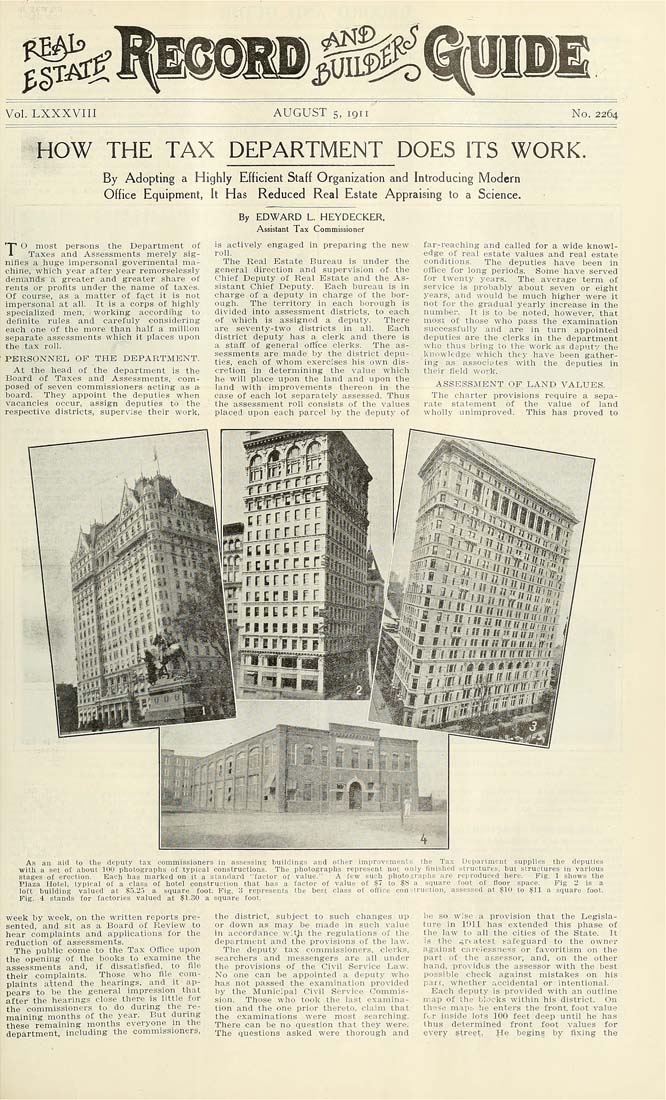

As an aid to the deputy tax commissioners in assessing buildings and other improvements the Tax DeparLhient supplies the deputies

with a set of atiout KIO photographs o£ typical constructions. Tlie photographs represent not only finished structures, hut structures in various

stages o£ erection. Baeli has marked on it a standard "factor of value." A few such photographs are reproduced here. Fig. 1 shows the

Plaza Hotel, typical of a class of hotel construction that lias a lactor of value of JfT to ?S a square foot ol floor space. Fig 2 is a

loCt huilding valued at ^5.'2a a square fool. Fig. 3 represents tbo best class of oflice conslruclion, assessed at IflO fo IfU a square fool.

Fig. 4 stands for factories valued at .^1.30 a square foot.

week by week, on the written reports pre¬

sented, and sit as a Board of Review to

hear complaints and applications for the

reduction of assessments.

The public come to the Tax Office upon

the opening of the books to examine the

assessments and, if dissatisfied, to file

their complaints. Those who file com¬

plaints attend the hearings, and it ap¬

pears to be the general impression that

after the hearings close there is little for

the commissioners to do during the re¬

maining months of the year. But during

these remaining months everyone m the

department, including the commissioners,

the district, subject to such changes up

or down as may be made in such value

in accordance wltji the regulations of the

department and the provisions of the law.

The deiJuty tax comniissioners, clerks,

searchers and messengers arc all under

the provisions of the Civil Service Law.

No one can be appointed a deputy who

has not passed the examination provided

by the Municipal Civil Service Commis¬

sion. Those who took the last examina¬

tion and the one prior thereto, claim that

the examinations were most searching.

There can be no question that they were.

The questions asked were thorough and

be so wise a provision that the Legisla¬

ture in 1911 has extended this phase of

the law to all the cities of the State. It

is tho .;rtatest safeguard to the owner

against carelessness or favoritism on the

part of the assesso)', and, on the other

hand, provides the assessor with the best

possible check against mistakes on his

part, whether accidental or intentional.

Each deputy is provided with an outline

map of the blocks within his district. On

lh'^5,3 maps he enters the front foot value

ft.r inside lots IOO feet deep until he has

thus determined front foot values for

every street, He begins by fixing the