REAL ESTATE

BUILDERS

AND

NEW YORK, APRIL 26, 1913

ililllfll,!!;,!

P1IIIIIIII!1I1I!IIII!III!BI!1!II1!I!IM^^^^

llllllllilililliiBllilii^^^^^^^

THE COST OF GOVERNMENT IN NEW YORK CITY

A Study of the Principal Causes of the 98 Per Cent. Budget Increase

Which Has Taken Place in the Last Ten Years—Remedies Suggested.

I

By HENRY BRUERE, Director, Bureau of Municipal Research.

■■WIMIIMIMMMIlllBillBlllBlll!^^^^^^

NEW YORK CITY'S gross funded

debt is $1,122,690,042.75. Its an¬

nual interest and debt redemption bill,

as shown in the 1913 budget, is $54,977,-

381.34. Its budget is rising toward the

$200,000,000 mark, and its taxes continue

to increase. Since 1903, as indicated by

budget appropriations, the expenditures

of the city and county governments in¬

cluding State taxes have increased from

$98,119,031.10 to $192,711,441.16, or 98.43

per cent. In this time the population of

the greater city has increased from 3,-

781,423 to 5,372,983, or 42.09 per cent.

Obviously the outgo of dollars is out of

proportion to the income of population.

Mere growth in the number of persons

to be served by the government, there¬

fore, does not furnish a complete ex¬

planation of why taxes increase. From

1908, the year when the budget-making

and accounting reorganization began, the

annual budget has risen from $143,572,-

266.17 to $192,711,441.16, a 34.23 per cent,

increase. Here again, the rise in the cost

uf government has outsped the growth

of population, which in this period was

21.49 per cent. If the average annual

rate of increase in the past five years

holds good for 1913, the 1914 budget will

be something over $205,000,000.

A Business Administration's Expendi¬

tures.

Five years ago Comptroller Metz an¬

nounced that the city could be put on a

self-paying basis, were business methods

adopted. Since then it has been repeat¬

edly proclaimed by men in touch with

city affairs that the waste in supplies and

payrolls approximated from $20,000,000

to $25,000,000 a year. With the convic¬

tion that this Avaste could be eradicated

the present administration went into of¬

fice pledged to business management.

For the past three years this administra¬

tion has made the city budget. What is

the result? The 1911 budget, the first

budget made by the present administra¬

tion was $174,079,335.16. In 1913 it is

$192,711,441.16, having increased $18,632,-

106, or 75 per cent, of the $25,000,000 esti¬

mated waste of four years ago. Ques¬

tions such as the following inevitably

come to mind:

Who Is Responsible?

Who is responsible for this increase?

Was it unavoidable?

Have the activities of government in¬

creased in proportion to these increased

expenditures?

Is the city now run on business lines?

Will city expenditures continue to

grow?

These questions and others of interest

to taxpayers and citizens who wish effi¬

cient government, this and following

articles will attempt to answer.

It is only by analyzing the budget in

some detail that responsibility can be

Ttte present article is the first of a series

of five, written by Mr. Bruere at the request

of the Record and Guide. The purpose of

the series is to discover why taxes are in¬

creasing out of proportion to the growth ot

population. If the causes of the dispropor.

tionate increase in taxes can be ascertained,

there should be no great difficulty In getting

the men of public spirit in tbe community to

cooperate toward obtaining effective reme¬

dies.

Mr. Bruere's first article, the second in'

stattment of which will follow next week

analyzes the increased cost of government,

locating il) tbe divisions of governmental

activity in which tbe principal Increases

have occurred and (2) the causes of these

increases, ft emphasizes the important

fact that the concentration of fiscal respon¬

sibility supposed to exist in the city admlnls

tration Is more apparent than real, as the

Board of Estimate has "more or less furls

diction" over only $85,000,000 In a budget

of nearly $193,000,000.

The second article will discuss what will

be shown to be a principal factor In tbe

rising cost of government—the mounting

bonded indebtedness of the city. The third

article will describe present efforts under

way to eliminate waste and to obtain £

dollar's worth of service for a dollar's taxes,

and results already obtained from tbem.

The fourth will deal with obvious next steps

for taxpai'crs to Insist upon In bringing

about greater efficiency and economy In city,

government The fifth article will forecast

tendencies in development of city activities J

prospective undertakings and methods of

financing them. I

placed for increases in expenditure. Let

us begin with the budget for 1913.

The budget is made up of mandatory

and discretionary items. The mandatory

items are those fixed by act of Legisla¬

ture or those representing binding legal

commitments, as the debt charges. An

illustration of expenditures compelled by

statute is the product of the three-mill

ta.x which the city must impose for edu¬

cational purposes. The discretionary

part of the budget consists of items

which the board may deny, but never

does; as, for example, minimum allow¬

ances for running the necessary business

of the city, and of items providing for

the extension of activities or the en¬

largement of working forces.

By all odds the largest group of ex¬

penditures in the entire budget is dis¬

cretionary in its origin, but becomes a

mandatory charge upon the city once the

initial step is taken, namely, charges for

the payment of interest on and for the

redemption and amortization of the city

debt- The growth of the city debt

charges explains approximately one-third

of the growth of the total budget, as is

indicated by Table I-

The Corporate Stock Budget.

In the 1913 budget the debt charges

amount to $54,977,381-34, or 28.53 per

cent, of the total. Problems involved

in the city's $1,000,000,000 debt, of which

the annual debt service appropriations

furnish only a part, are so numerous

that they will be treated in a separate

article. It may be said here, however,

that the present enormous debt service

appropriation results largely from an

utterly chaotic method of initiating and

financing public improvements during

previous administrations. One of the

first steps taken by the present adminis¬

tration was the establishment of a cor¬

porate stock budget which, for the first

time in the history of the city, coordi¬

nated public improvement authorizations

with the actual borrowing capacity of

the city. In 1909 at one time the out¬

standing authorizations for the issue of

corporate stock amounted to $180,000,-

000 as compared with a borrowing ca¬

pacity of $3,000,000. This condition the

present administration has sucessfully

corrected.

Deducting city debt services from the

total budget there is left $137,734,059.82.

The next largest single item of e-xpen-

diture is for educational purposes. The

educational budget for this year is $35,-

206,846.96. Of this sum $24,614,587.29 or

69.91 per cent, is a mandatory charge

representing the product of the three mill

school ta.x. Since 1908 the discretionary

part of the school budget has increased

$7,735,994.34, or 270.84 per cent. A part

of this increase is attributable to the fact

that except in the purchase of supplies

no one has ever attempted to apply scien¬

tific principles of administration to the

schools. Studies made as part of the

recent school inquiry show that there is

considerable waste in school manage¬

ment. An expert engineer, after sttidy-

ing the heating plants of the various

school buildings, reported that an annual

saving of $350,000 could be effected if

the department of education adopted as

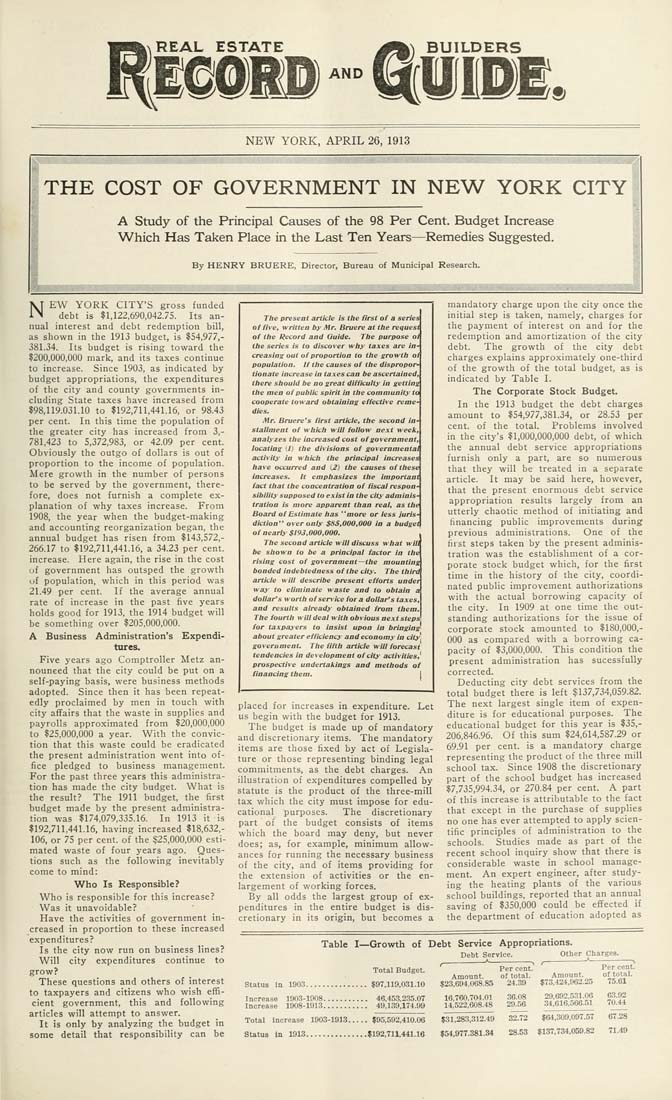

Table I—Growth of Debt Service Appropriations.

Debt Service.

Other Charges.

Total Budget.

Status in 1903...............$97,119,031.10

Increase 1903-1908........... 46,453.235.07

Increase 1908-1913........... 49.139,174.99

Total increase 1903-1913.....$95,592,410.06

Status In 1913...............$192,711,441.16

Per cent.

Amount. of total.

$23,694,068.85 24.39

16.760.704.01

14.522.608.48

$31,283,312.49

$54,977,381.34

36.08

29.56

Amount.

$73,424,962.25

29,692.531.06

34,616,566.51

32.72 $61,309,097.57

28.53 $137,734,059.82

Per cent.

o£ total.

75.61

63.92

70.44

67.28

71.49