Columbia University Libraries Digital Collections: The Real Estate Record

Use your browser's Print function to print these pages.

Real estate record and builders' guide: v. 32, no. 814: October 20, 1883

Text version:

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

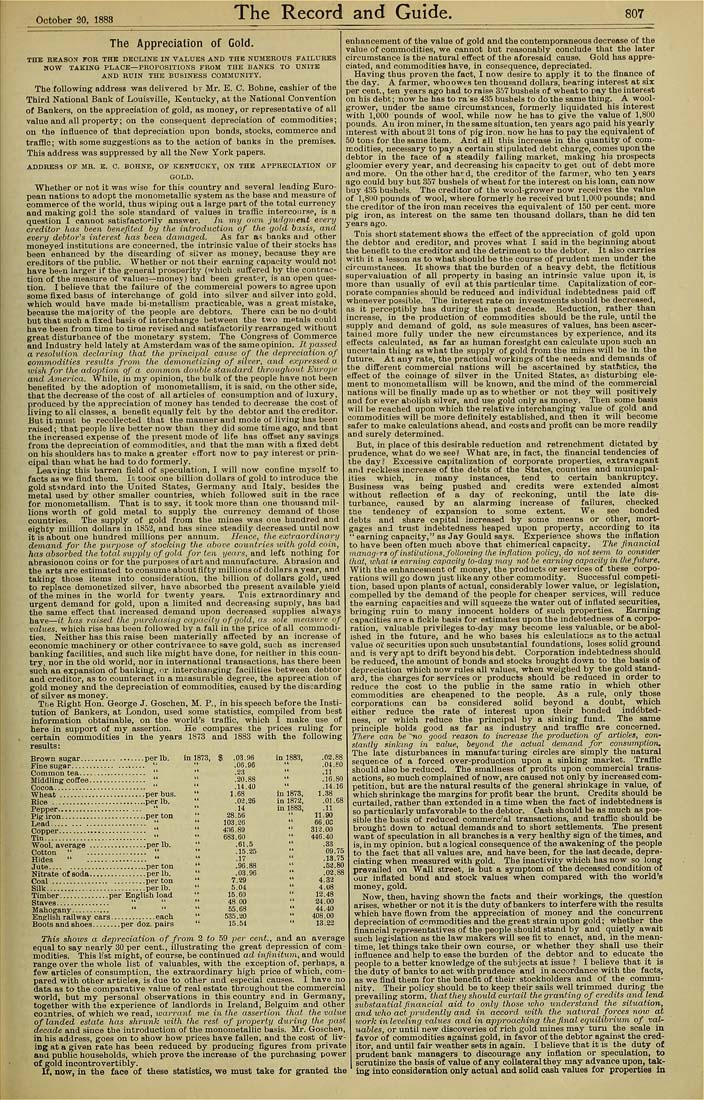

October 20, 1888 The Record and Guide. 807 The Appreciation of Gold. THB REASON rOR THE DKCLIKi: IN VALUES AND THE NUMEROUS FAILURES KOW TAKING PLACE-PROPOSITIONS FROM THE BANKS TO UNITE AND RUIN THE BUSINESS COMMUNITY. The following address was dehvered by Mr. E. C. Bohne, cashier of tbe Third National Bank of Louisville, Kentucky, at the National Convention of Bankers, on the appreciation of gold, as money, or representative of all value aud all property; on the consequent depreciation of commodities; on the infiueuce of that depreciation upon bonds, stocks, commerce and traffic; with some suggestions as to the action of banks in the premises. This address was suppressed by all the New York papers. AUDHESS OP MR. E. G. BOHNE, OF KENffUCKY, ON THE APPRECIATION OF GOLD. Whether or not it was wise for this country and several leading Euro¬ pean nations to adopt the monometallic system as the base and measure of commerce of the world, thus wiping out a large part of the total currency and making gold the sole standard of values in traffic intercourse, is a question I cannot satisfacto'-ily answer. In my own judgment every creditor has heen benefited by the introduction of the yold basis, and every defctor's interest has been, damaged. As far a^ banks and other moneyed institutions are concerned, the intrinsic value of their stocks has been enhanced by the discarding of silver as money, because tbey are creditors of the public. Whether or not their earning capacity would not have been larger if the general prosperity (which suffered by the contrac¬ tion of tbe measure of valuea—monej) bad been greater, is an open ques¬ tion, I believe that the failure of the commercial powers to agree upon some fixed basis of interchange of gold into silver and silver into gold, which would have made bi-metallisio, practicable, was a great mistake, because the maiority of tbe people are debtors. There can be no dnubt but tbat such a fixed basis of interchange between the two metals cnuld bave been from time to time revised and satisfactorily rearranged without great disturbance of the monetary system. The Congress of Commerce and Industry held lately at Amsterdam was of the sarae opinion. It passed aresohiiion declaring that the principal cause of lhe depreciation of commodities results from the demonetizing of silver, and expressed a wish for the adoption of a common double standard throughout Europe and America. While, in my opinion, the bulk of tbe people have not been benefited by the adoption of monometallism, it is said, on the other side, tbat tbe decrease of the cost of all articles of consumption and of luxury, firoduced by tbe appreciation of money bas tended to decrease the cost of iving to all classes, a benefit equally felt by tbe debtor and the creditor. But it must be recollected that tbe manner and mode of living has been raised; that people live better now than tbey did some time ago, and tbat the increased expense of the present mode of life bas offset any savings from the depreciation of commodities, and that the man with a fixed debt on his shoulders has to make a greater effort now to pay interest or prin¬ cipal than what be bad to do formerly. Leaving this barren field of speculation, I will now confine myself to facts as we find them. Ir, took one billion dollars of gold to introduce the gold standard into the United States, Germany and Italy, besides the metal used by other smaller countries, wbich followed suit in the race for monometallism. That is to say. it took more than one thousand mil¬ lions worth of gold metal to supply the currency demand of those countries. Tbe supply of gold from the mines was one hundred and eighty million dollars in 1852, and bas since steadily decreased until now it is about one hundred millions per annum. Hence, lhe extraordinary demand for the purpose of stocking the above countries with gold coin, has absorbed the total supply of gold for ten years, and left nothing for abrasionon coins or for the purposes of art and manufacture. Abrasion and tbe arts are estimated to consume about fifty millions of dollars a year, and taking those items into consideration, the billion of dollars gold, used to replace demonetized silver, bave absorbed the present available yield of tbe minea in the world for twenty years. Tuis extraordinary and urgent demand for gold, upon a limited and decreasing supniy, bas had the same effect that increased demand upon decreased supplies always have—it has raised ihe j^f-rehasing capacity of gold, "s sole measure of values, which rise bas been followed by a fall in the price of all commodi¬ ties. Neither bas this raise been materially affected by an increase of economic machinery or other contrivance to save gold, suuh es increased banking facilities, and such like might bave done, for neither in this coun¬ try, nor in the old world, nor in international transactions, has there been such an expansion of banking, or interchanging facilities between debtor and creditor, as to counteract in a measurable degree, the apDrec:ation of gold money and tbe depreciation of commodities, caused by the discarding of silver as money, Tfje Right Hon. Georee J. Goschen, M. P., in his speech before the Insti¬ tution of Bankers, at London, used some statistics, compiled from best information obtainable, on tbe world's traffic, which I make use of here in support of my assertion. He compares the prices ruling for certain commodities in the years 1S73 and 1833 with the following results: Brown sugar.................per lb. in 1873, 8 Flnesugsr.................... '" " Comnion tea.................. " " Middling coffee................ " '' Cocoa.......................... " ' Wheat ........................per bus, " Bice ..........................per lb. " Pepper....................... " " Pig iron........................per ton " Lead......................... " " Copper........................ " Tin............................. " Wool, average ................per lb. " Cotton " ................. " " Hides " ...... .......... " " Jute..........................per ton " Nitrate ofsoda................per lb. Coal .........................per ton " Silk............................per lb. '' Tioiber..............per Eoglibb load " Staves............... " " " Mahogany........... " " "■ EnKl'sb railway oars.............eacb " Boots and Bboes........per doz. pairs " This shows a depreciation of from 2 to 59 per cent., and an average equal to say nearly 30 per cent., illustrating tbe great depression of com¬ modities. This list might, of course, be continued ad infinitum, and would range over the whole list of valuables, with the exception of. perhaps, a few articles of consumption, the extraordinary high price of wbich, com¬ pared with other articles, is due to other und especial causes. I have no data as to tbe comnarative value of real estate throughout the commercial world, but my personal observations in this country snd in Germany, together with tbe experience of landlords in Ireland, Belguim and other comtries, of which we read, (uctn'ttjif ■me in the assertion that the value of landed estate has shrunk with the rest of projierty during the past decade and since the introduction of the monometallic basis. Mr. Goschen, in his address, goes on to show how prices have fallen, and the cost of liv¬ ing at a given rate has been reduced by producing figures from private and public households, w^bich prove the increase of the purchasing power of gold incontrovertibiy. If, now, in the face of these statistics, we must take for granted the .03.