October 20, 1888

The Record and Guide.

807

The Appreciation of Gold.

THB REASON rOR THE DKCLIKi: IN VALUES AND THE NUMEROUS FAILURES

KOW TAKING PLACE-PROPOSITIONS FROM THE BANKS TO UNITE

AND RUIN THE BUSINESS COMMUNITY.

The following address was dehvered by Mr. E. C. Bohne, cashier of tbe

Third National Bank of Louisville, Kentucky, at the National Convention

of Bankers, on the appreciation of gold, as money, or representative of all

value aud all property; on the consequent depreciation of commodities;

on the infiueuce of that depreciation upon bonds, stocks, commerce and

traffic; with some suggestions as to the action of banks in the premises.

This address was suppressed by all the New York papers.

AUDHESS OP MR. E. G. BOHNE, OF KENffUCKY, ON THE APPRECIATION OF

GOLD.

Whether or not it was wise for this country and several leading Euro¬

pean nations to adopt the monometallic system as the base and measure of

commerce of the world, thus wiping out a large part of the total currency

and making gold the sole standard of values in traffic intercourse, is a

question I cannot satisfacto'-ily answer. In my own judgment every

creditor has heen benefited by the introduction of the yold basis, and

every defctor's interest has been, damaged. As far a^ banks and other

moneyed institutions are concerned, the intrinsic value of their stocks has

been enhanced by the discarding of silver as money, because tbey are

creditors of the public. Whether or not their earning capacity would not

have been larger if the general prosperity (which suffered by the contrac¬

tion of tbe measure of valuea—monej) bad been greater, is an open ques¬

tion, I believe that the failure of the commercial powers to agree upon

some fixed basis of interchange of gold into silver and silver into gold,

which would have made bi-metallisio, practicable, was a great mistake,

because the maiority of tbe people are debtors. There can be no dnubt

but tbat such a fixed basis of interchange between the two metals cnuld

bave been from time to time revised and satisfactorily rearranged without

great disturbance of the monetary system. The Congress of Commerce

and Industry held lately at Amsterdam was of the sarae opinion. It passed

aresohiiion declaring that the principal cause of lhe depreciation of

commodities results from the demonetizing of silver, and expressed a

wish for the adoption of a common double standard throughout Europe

and America. While, in my opinion, the bulk of tbe people have not been

benefited by the adoption of monometallism, it is said, on the other side,

tbat tbe decrease of the cost of all articles of consumption and of luxury,

firoduced by tbe appreciation of money bas tended to decrease the cost of

iving to all classes, a benefit equally felt by tbe debtor and the creditor.

But it must be recollected that tbe manner and mode of living has been

raised; that people live better now than tbey did some time ago, and tbat

the increased expense of the present mode of life bas offset any savings

from the depreciation of commodities, and that the man with a fixed debt

on his shoulders has to make a greater effort now to pay interest or prin¬

cipal than what be bad to do formerly.

Leaving this barren field of speculation, I will now confine myself to

facts as we find them. Ir, took one billion dollars of gold to introduce the

gold standard into the United States, Germany and Italy, besides the

metal used by other smaller countries, wbich followed suit in the race

for monometallism. That is to say. it took more than one thousand mil¬

lions worth of gold metal to supply the currency demand of those

countries. Tbe supply of gold from the mines was one hundred and

eighty million dollars in 1852, and bas since steadily decreased until now

it is about one hundred millions per annum. Hence, lhe extraordinary

demand for the purpose of stocking the above countries with gold coin,

has absorbed the total supply of gold for ten years, and left nothing for

abrasionon coins or for the purposes of art and manufacture. Abrasion and

tbe arts are estimated to consume about fifty millions of dollars a year, and

taking those items into consideration, the billion of dollars gold, used

to replace demonetized silver, bave absorbed the present available yield

of tbe minea in the world for twenty years. Tuis extraordinary and

urgent demand for gold, upon a limited and decreasing supniy, bas had

the same effect that increased demand upon decreased supplies always

have—it has raised ihe j^f-rehasing capacity of gold, "s sole measure of

values, which rise bas been followed by a fall in the price of all commodi¬

ties. Neither bas this raise been materially affected by an increase of

economic machinery or other contrivance to save gold, suuh es increased

banking facilities, and such like might bave done, for neither in this coun¬

try, nor in the old world, nor in international transactions, has there been

such an expansion of banking, or interchanging facilities between debtor

and creditor, as to counteract in a measurable degree, the apDrec:ation of

gold money and tbe depreciation of commodities, caused by the discarding

of silver as money,

Tfje Right Hon. Georee J. Goschen, M. P., in his speech before the Insti¬

tution of Bankers, at London, used some statistics, compiled from best

information obtainable, on tbe world's traffic, which I make use of

here in support of my assertion. He compares the prices ruling for

certain commodities in the years 1S73 and 1833 with the following

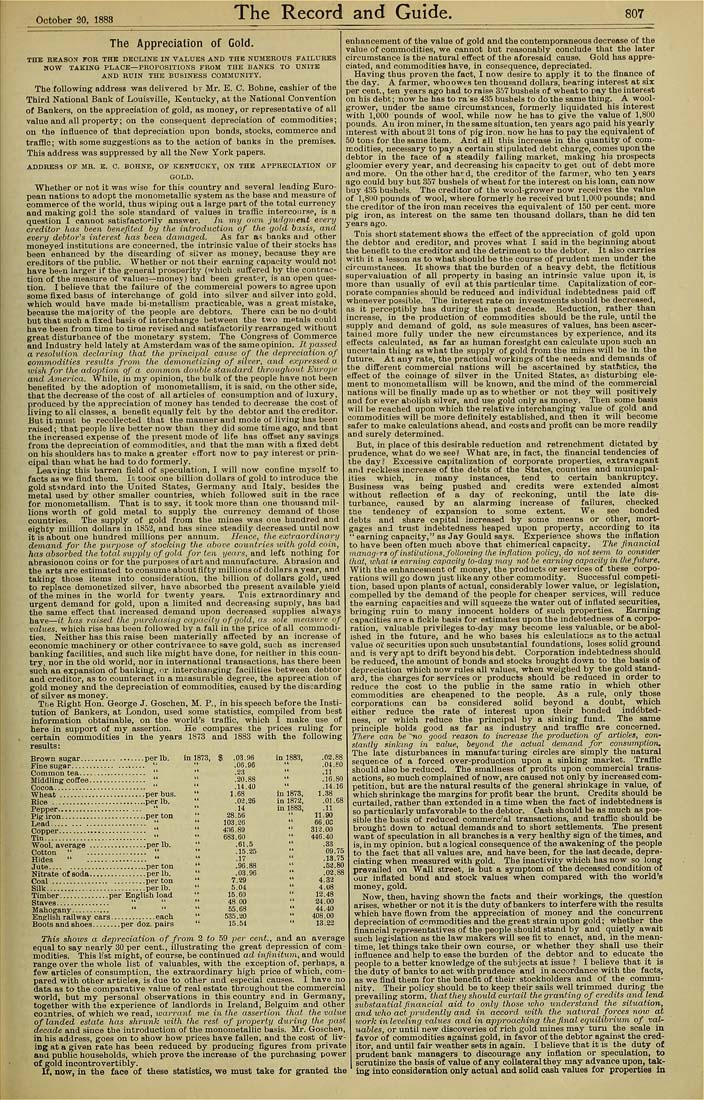

results:

Brown sugar.................per lb. in 1873, 8

Flnesugsr.................... '" "

Comnion tea.................. " "

Middling coffee................ " ''

Cocoa.......................... " '

Wheat ........................per bus, "

Bice ..........................per lb. "

Pepper....................... " "

Pig iron........................per ton "

Lead......................... " "

Copper........................ "

Tin............................. "

Wool, average ................per lb. "

Cotton " ................. " "

Hides " ...... .......... " "

Jute..........................per ton "

Nitrate ofsoda................per lb.

Coal .........................per ton "

Silk............................per lb. ''

Tioiber..............per Eoglibb load "

Staves............... " " "

Mahogany........... " " "■

EnKl'sb railway oars.............eacb "

Boots and Bboes........per doz. pairs "

This shows a depreciation of from 2 to 59 per cent., and an average

equal to say nearly 30 per cent., illustrating tbe great depression of com¬

modities. This list might, of course, be continued ad infinitum, and would

range over the whole list of valuables, with the exception of. perhaps, a

few articles of consumption, the extraordinary high price of wbich, com¬

pared with other articles, is due to other und especial causes. I have no

data as to tbe comnarative value of real estate throughout the commercial

world, but my personal observations in this country snd in Germany,

together with tbe experience of landlords in Ireland, Belguim and other

comtries, of which we read, (uctn'ttjif ■me in the assertion that the value

of landed estate has shrunk with the rest of projierty during the past

decade and since the introduction of the monometallic basis. Mr. Goschen,

in his address, goes on to show how prices have fallen, and the cost of liv¬

ing at a given rate has been reduced by producing figures from private

and public households, w^bich prove the increase of the purchasing power

of gold incontrovertibiy.

If, now, in the face of these statistics, we must take for granted the

.03.<I5

in

I8B3.

.03.88

.09.88

'*

,04,SO

.a.'J

"

.11

.30.88

*'

.16.80

.14.40

"

,14.16

1.68

in 1873,

1.38

.03,26

tn

1S73.

.01.68

.14

in

isKa,

.11

28.56

"

11.90

103.3«

"

66.OC

4:16,89

"

313,00

683.60

"

446.40

.61.5

"

,33

.15,35

"

09.75

.17

"

.13.75

.95.88

"

.5-J.80

.03.96

**

.03.88

7.39

"

4.3a

5.04

"

4.U8

15.60

"

12.48

48.00

"

34.00

55.68

"

44.40

535.30

^*

408.00

15.54

"

13.23

enhancement of the value of gold and the contemporaneous decrease of the

value of commodities, we cannot but reasonably conclude that the later

circumstance is tbe natural effect of the aforesaid cause. Gold haa appre¬

ciated, and commodities have, in consequence, depreciated.

Having thus proven tbe fact, I now desire to apply it to tbe finance of

the day. A farmer, whoowta ten thousand dollars, bearing interest at six

per cent., ten years ago bad to raise 357 bushels of wheat to pay the interest

on bis debt; now he has to rase 435 bushels to do tbe same thing. A wool-

grower, under tbe same circumstances, formerly liquidated his interest

with 1,000 pounds of wool, while now be has to give the value of 1,800

pounds. An iron miner, in the same situation, ten years ago paid his yearly

interest with about 21 tons of pig iron, now he has to pay the equivalent of

50 tons for tbe same item. And ail this increase in the quantity of com¬

modities, necessary to pay a certain stipulated debt charge, comes upon the

debtor in the race of a steadily falling market, making his prospects

gloomier every year, and decreasing his capacitv to get out of debt more

and more. Ou tbe other hard, the creditor of the farmer, who ten years

ago could buy but 357 bushels of wheat for tbe interest on his loan, can now

buy 435 bushels. The creditor of the wool-grower now receives the value

of 1,800 pounds of wool, where formerly he received but 1,000 pounds; and

tbe creditor of the iron man receives the equivalent of 150 per cent, more

pig iron, as interest on the same ten thousand dollars, than he did ten

years ago.

This short statement shows the effect of tbe appreciation of gold upon

the debtor and creditor, and proves what I said in the beginning about

the benefit to the creditor and the detriment to tbe debtor. It also carries

with it a lesson as to what should be tbe course of prudent men under the

circumstances. It shows tbat the burden of a heavy debt, the fictitious

supervaluatiou of all prnperty in basing an intrinsic value upon it, is

more than usually of evil at thia particular time. Capitalization of cor¬

porate companies should be reduced and individual indebtedness paid off

whenever possible. The interest rate on investments should be decreased,

as it perceptibly has during the past decade. Reduction, rather than

increase, in the production of commodities should be the rule, until the

supply aud demand of gold, as sole measures of values, has been ascer¬

tained more fully under the new circumstances by experience, and its

effects calculated, aa far as human foresight can caiculate upon such an

uncertain thing as what the supply of gold from tbe mines will be in tbe

future. At any rate, the practical workings of the needs and demands of

the different commercial nations will be ascertained by statfstics, the

effect of the coinage of silver in the United States, a^ disturbing ele¬

ment to monometallism will be known, and the mind of the commercial

nations will be finally made up as to whether or not tbey will positively

and for ever abolish sdver, and use gold only as money. Then some basis

will be reached upon wbich the relative interchanging value of gold and

commodities will be more definitely establisbed, and then it will become

safer to make calculations ahead, and costs and profit can be more readily

aod surely determined.

But, in place of this desirable reduction aud retrenchment dictated by

prudence, what do we see? What are, in fact, the financial tendencies of

the day? Excessive capitalization of corporate properties, extravagant

and reckless increase of the debts of the States, counties and municipal¬

ities wbich, in many instances, tend to certain bankruptcy.

Business was being pushed and credits were extended almost

without reflection of a day of reckoning, until the late dis¬

turbance, caused by an alarming increase of failures, checked

tbe tendency of expansion to some extent. We see bonded

debts and share capital increased by some meaus or other, mort¬

gages and trust indebtedness heaped upon property, according to its

"earning capacity," as Jay Gould aays. Experie^nce shows tbe iofiation

to bave been often much above that chimerical capacity. The financial

raanag'-rsofinstilutions, following Ihe inflation policy, do noi seem to consider

that, what is enrniitg capacity to-day may nol be earning capacily in lhe future.

With the enhancement of money, the products or services of these corpo¬

rations will go down just like any other commodity. Successful competi¬

tion, based upon plants of actual, considerably lower value, or legislation,

compelled by tbe demand of the people for cheaper services, will reduce

the earning capacities and will squeeze the water out of inflated securitiea,

bringing ruin to many innocent holdera of such properties. Earning

capacities are a fickle basis for estimates upon the indebtedness of a corpo¬

ration, valuable privileges to-day may become less valuable, or be abol¬

ished in the future, and he who bases hia calculations as to the actual

value oi securities upon such unsubstantial foundations, loses solid ground

and is very apt to drift beyond hia debt. Corporation indebtedness sbould

ba reduced, the amount of bonds and stocks brought down to the basis of

depreciation wbich now rules all values, when weighed by the gold stand¬

ard, the charges for services or products should be reduced in order to

reduce the cost to the public in the same ratio in which other

commodities are cheapened to the people. As a rule, only those

corporations can be considered solid beyond a doubt, which

either reduce tbe rate of interest upon their bonded indebted¬

ness, or which reduce the principal by a sinking fund. The same

principle holds good aa far as industry and traffic are concerned.

There can be 'no good reason to increase the production of at-licles, con¬

stantly sinking in value, beyond lhe actual demand for oonsumption.

The late disturbances in manufarturing circles are simply the natural

sequence of a forced over-production upon a sinking market. Traffic

should also be reduced. The sroallness of profits upon commercial trans¬

actions, so much complained of now, are caused not only by increased com¬

petition, but are the natural results of the general shrinkage in value, of

wbich shrinkage the margins for profit bear the brunt. Credits should be

curtailed, rather than extended in a time when the fact of indebtedness is

so particularly unfavorable to the debtor. Cash should be as much as pos¬

sible the basis of reduced commerc-al transactions, and traffic sbould be

brought down to actual demands and to short settlements. The present

want of speculation in all branches is a very healthy sign of the times, and

is.iamy opinion, but a logical consequence of the awakening of the people

to the fact tbat all values are, and have been, for the last decade, depre¬

ciating wben measured with gold. Tho inactivity which has now so long

prevailed on Wall street, is but a symptom of the deceased condition of

our inflated bond and stock values when compared with the world's

money, gold.

Now, then, having shown the facts and their workings, the question

arises, whether or not it is tbe duty of bankers to interfere with the resulta

which have fiown from the appreciation of money and the concurrent

depreciation of commodities and the great strain upon gold; whether the

financial representatives of the people should stand by and quietly await

such legislation as the law makers will see flt to enact, and, in the mean¬

time, let things take their own course, or whether they shall use their

influence and help to ease the burden of the debtor and to educate^ the

people to a better knowledge of the subjects at issue ? I believe that it is

the duty of banks to act with prudence and in accordance with tbe facts,

as we find tbem for the benefit of their stoekholdera and of the commu¬

nity. Their policy should be to keep their sails well trimmed during the

prevailing storm, that they should curtail the granting of credits and lend

substantial financial aid to only those who understand the situation,

and \vho act prudently and in accord with the natural forces notu at

work in leveling values and in approaching the final eguilibriutn of val¬

uables, or until new discoveries of rich gold mines may turn tbe scale in

favor of commodities against gold, in favor of the debtor against the cred¬

itor, and until fair weather sets in again, I believe that it is tbe duty of

prudent bank managers to discourage any infiation or speculation, to

scrutinize the basis of value of any collateral they may advance upon, tak¬

ing into consideration only actual and solid cash values for properties in