148

RECORD AND GUIDE

January 22, 1916

CURRENT BUILDING OPERATIONS,

MATERIALS AND SUPPLIES

DUILDING materials are emerging

*-' from their dull season with a healthy

inquiry, but actual orders are being de¬

ferred pending clearance of railroads

and more certain delivery dates for metal

products. According to distributors in

the wholesale market the high price of

materials has not interfered with spring

delivery orders, but there are some re¬

tailers who are convinced that the reason

building projects as shown by plan fil¬

ings so far this year make no better com¬

parisons with those ruling in January of

last year, is directly traceable to hesi¬

tancy on the part of speculative builders.

Mr. Howland's Opinion.

Francis N. Howland, President of the

Building Material Dealers .-Association of

New York and former president of the

Building Material Exchange, expressed

the thought of dealers when he said:

"The manufacturers of building ma¬

terials ought not be deluded by appear¬

ances of present building prosperity. It

is still in the middle of winter and while

the inquiry is good the prospective build¬

ers for the most part are merely feeding

the market. High prices of building

materials will be sure to frighten off

the speculative builder and the big

operator who contemplates construction

is going to be tied up by non-arrival of

steel and other metals entering into big

building construction. It is all right to

excuse the present tendency to inflate

market prices of building commodities

on the plea that supplies are low, labor is

costing more and fuel is costly and has

to be laid in now to anticipate possible

coal shortages in the spring, but unless

the manufacturers heed the advice of wise

heads among them they are going to

stifle what building demand does exist

and will end by having their stocks on

their hands.

"We have an operation on 28th street

that was started last September, but we

have not been able to get a pound ot

steel to the job since then. That is only

one instance, but it shows just what is

happening in all departments of con¬

struction. It is no time to check build¬

ing. Quite on the other hand it would

be most advantageous all around to meet

the situation half way."

Stiffness Well Justified,

On the other hand, there is a stiffness

to market prices that seems well justi¬

fied, according to a brick manufacturer.

"We are laying in coal now in anticipa¬

tion of difficulty of getting it later in the

season when we open up," said a Hudson

river manufacturer yesterday. "Suppose

a strike does occur in April at the coal

mines, where would the price of com¬

mon brick go with the scanty supply on

hand now and the still lower reserves

after the building season opens, espec¬

ially if we were unable to get coal. Coal

bought at winter prices costs more than

when it is bought far in advance, but it

has to be stored and somebody has to

pay the additional cost.

Portland cement exports continue to

strengthen, thereby helping to further

stiffen domestic prices by further drain¬

ing the mill supplies. The demand on

Lehigh Valley mill capacities for the first

twenty days in January is three times as

great as it was in January of last year.

Two orders for Portland cement for ex¬

port are now being filled totalling in all

more than 20,000 barrels. There are in¬

quiries for appro.ximately 3,000,000 bar¬

rels now pending.

Plate and window glass have sharply

advanced. In some cases the change

amounts to between 20 and 30 per cent,

upward. Window glass has stiffened on

quotations here. Further increases are

expected. Linseed oil has gone far above

normal prices, being quoted today av

73 and 76 cents a gallon. Structural

steel has passed the twenty cent mark

and is now quoted at tidewater on a

2.169c level. Tin plate is expected to

move up to $4. Comon brick from the

Hudson district is now quoted at $8.50,

but the supply here is low, and the Hud¬

son has eight inches of ice above Haver¬

straw with little chance of it breaking up

for five days at least. Raritan river

brick is out of the market as far as the

Sayre & Fisher Company is concerned,

with relation to new business. It is not

tcxking orders until it has caught up with

pending contract deliveries. The Staten

Island plants are well filled and no Con¬

necticut brick is available here.

COMMON BRICK.

Ot,

Cold Weather Halts Riding and Checks

Advance.

^N Monday, Tuesday and Wednesday

_ was too cold even for teams to

work, and the Hudson was frozen from

Haverstraw north, thereby effectively

shutting off all supplies from that

quarter. Sayre & Fisher reported that it

was out of the market for new business

until it was able to catch up with de¬

liveries on present contracts. The

Newark situation remained dull. Prices

were without change. TheJlO level has

apparently vanished, for the time being,

although there are some who believe that

the present $8.50 and $9.50 level for open

and covered barges will be of short dur¬

ation. Thursday it was possible to lay

brick, but it was not possible to get more

down the river. Therefore upon the de¬

pletion of the present supply the price

may be expected to advance.

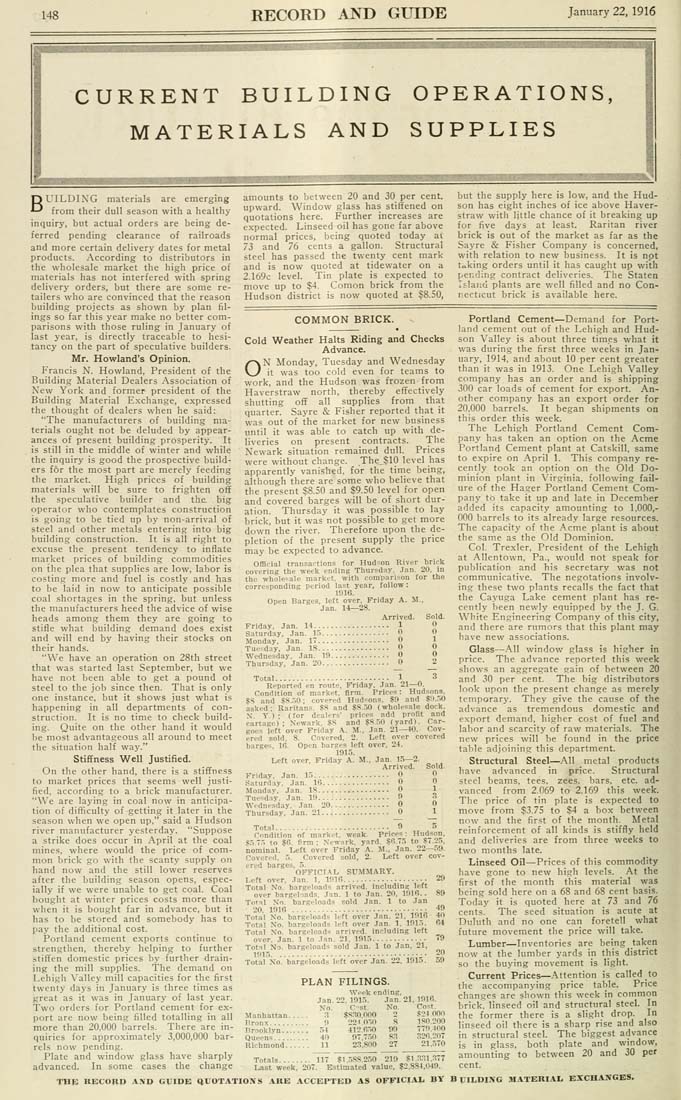

Official transactions tor Hudson River brick

covering the week ending Thursday, Jan. 20, in

the wholesale market, with comparison for the

corresponding period last year, follow:

1916.

Open Barges, left over. Friday A. M.,

Jan. Ii—28.

Arrived. Sold.

Friday, Jan. 14.................. 1 0

Saturday, Jan. 15................ 0 0

Monday, Jan. 17................. 0 1

Tue=day, Jan. IS................. 0 0

Wednesday. Jan. 19.............. 0 0

Thursday, Jan. 20................ 0 2

Total........................... 1 3

Reported en route, Friday, Jan. 21—0.

Condition of market, firm. Prices: Hudsons.

$S and $S..JO; covered Hud=ons. $9 and $!)..)0

asked; Raritans. .?.S and $8.50 (wholesale dock.

X Y); (for dealers' prices add profit and

cartage); Newark, .$8 and $S..50 fyard). Car¬

goes left over Friday -A.. M., Jan. 21—JO. Cov¬

ered sold, 8. Covered. 2. Left over covered

barges, 16. Open barges left over, 24.

1915.

Left over, Friday A. M., Jan. 15—2.

Friday, Jan. 15.....

Saturday, Jan. 16...

Monday, Jan. IS....

Tuesday. Jan. 19....

Wfdiipsday, Jan. 20.

Thursday, Jan. 21...

ived.

Sold

0

n

0

n

0

M

9

.3

0

0

0

1

Total........................... 9 5

Condition of market, weak. Prices: Hudson,

S.'i 75 to $6. firm; Newark, yard. $6.75 to $7.2.i,

nominal. Left over Friday A. M., Jan. 22—f>9.

Covered. 5. Covered sold, 2. Lett over cov¬

ered barges, 5.

OFFICIAL SUMMARY.

Left over, Jan. 1, 1916.................... 29

Total No. bargeloads arrived, including left

over bargelnads. Jan. 1 to Jan. 20, 1916.. 89

Tntil No. bargeloads sold Jan. 1 to Jan

20, 1916 ................................ 49

Total No. bargeloads left over Jan. 21. 1916 40

Total No. bargeloads left over Jan. 1. 1915. 64

Total No. bargeloads arrived, including left

over. Jan. 1 to Jan. 21, 1915............. 79

Totnl No. bargeloads sold Jan. 1 to Jan, 21,

1915....................................

Total No. bargeloads left over Jan. 22, 191o.

20

59

PLAN FILINGS.

WppU. ending.

Jan. 22. 1^15. Jan. 21, IHlfi.

Ko.

Manhattan..... 3

Bronx.......... 0

Brooklyn....... o4

Queens......... 40

Richmond...... 11

Totals........llT $1,588,250 210 -SI .?.?.1."T7

Last week, 207. Estimated value, $2.SS4.(.V10.

C-st.

No.

Cost.

$sso.ooo

o

S24 noo

22J 0"0

8

180,200

41''.fi50

W

779.400

97,750

8.3

326.207

2.3.800

27

21.570

THB RECORD AXD GUIDE QUOTATIONS ARE ACCEPTED AS OFFICIAI. BY

Portland Cement—Demand for Port¬

land cement out of the Lehigh and Hud¬

son Valley is about three times what it

was during the first three weeks in Jan¬

uary, 1914, and about 10 per cent greater

than it was in 1913. One Lehigh Valley

company has an order and is shipping

300 car loads of cement for export. An¬

other company has an export order for

20.000 barrels. It began shipments on

this order this week.

The Lehigh Portland Cement Com¬

pany has taken an option on the Acme

Portland Cement plant at Catskill, same

to expire on April 1. This company re¬

cently took an option on the Old Do¬

minion plant in Virginia, following fail¬

ure of the Hager Portland Cement Com-

panj' to take it up and late in December

added its capacity amounting to 1.000,-

000 barrels to its already large resources.

The capacity of the Acme plant is about

the same as the Old Dominion.

Col. Trexler, President of the Lehigh

at Allentown, Pa., would not speak for

publication and his secretary was not

communicative. The negotations involv¬

ing these two plants recalls the fact that

the Cayuga Lake cement plant has re¬

cently been newly equipped by the J. G.

White Engineering Company of this city,

and there are rumors that this plant may

have new associations.

Glass—."Ml window glass is higher in

price. The advance reported this week

shows an aggregate sain of between 20

and 30 per cent. The big distributors

look upon the present change as merely

temporary. They give the cause of the

advance as tremendous domestic and

export demand, higher cost of fuel and

labor and scarcity of raw materials. The

new prices will be found in the price

talile adjoining this department.

Structural Steel—All metal products

have advanced in price. Structural

steel beams, tees, zees, bars, etc. ad¬

vanced from 2.069 to 2.169 this week.

The price of tin plate is expected to

move from $3.75 to $4 a box between

now and the first of the month. Metal

reinforcement of all kinds is stiffly held

and deliveries are from three weeks to

two months late.

Linseed Oil—Prices of this commodity

have gone to new high levels. At the

first of the month this material was

being sold here on a 68 and 68 cent basis.

Today it is quoted here at 73 and 76

cents. The seed situation is acute at

Duluth and no one can foretell what

future movement the price will take.

Lumber—Inventories are being taken

now at the lumber yards in this district

so the buying movement is light.

Current Prices—Attention is called to

the accompanying price table. Price

changes are shown this week in common

brick, linseed oil and structural steel. In

the former there is a slight drop. In

linseed oil there is a sharp rise and also

in structural steel. The biggest advance

is in glass, both plate and window,

amounting to between 20 and 30 per

cent.

BpiLDING MATERIAIj EXCHANGES.