70

The Real Estate Record.

any improvements that may be attainable in

form or substance.

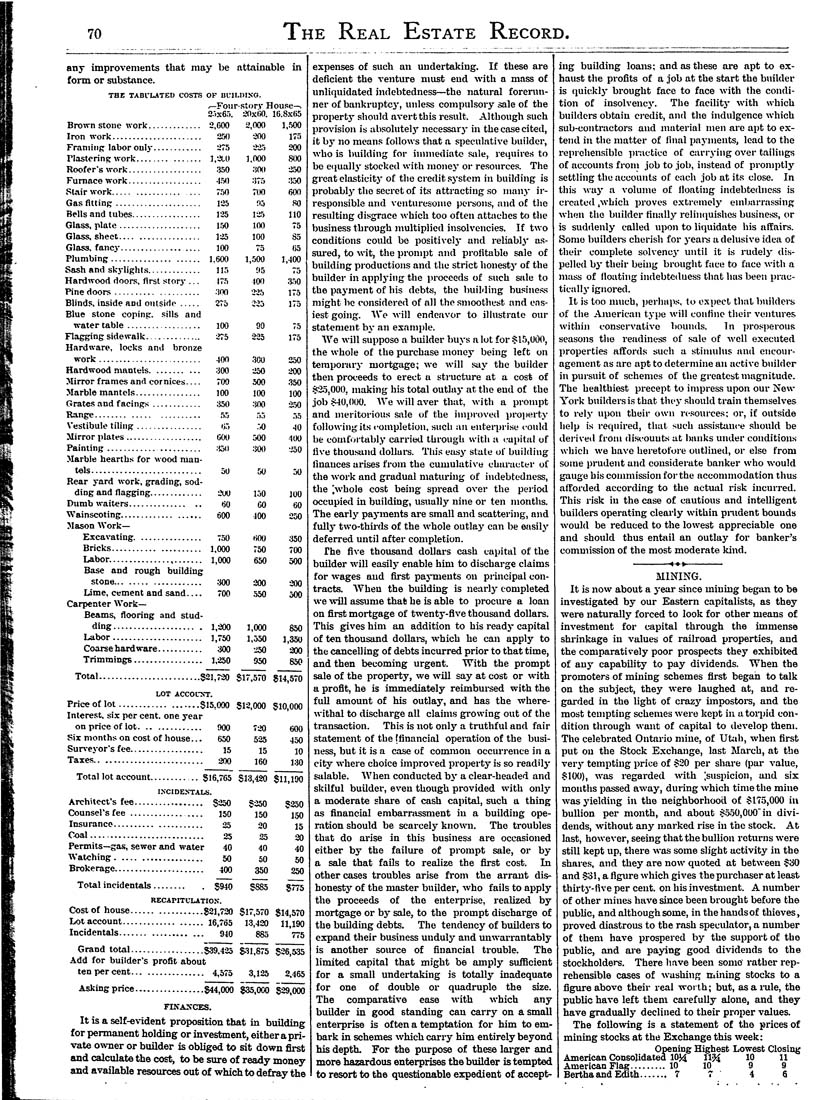

THE TABl'LATED COSTS OF nL-lLI)IXO.

^Four-storv House—,

2:.x65. aoxm. l().8.\ti5

Brown stone work............. 2,600 2,000 L.'iOO

Iron work....................., 2.''j0 -.JOO 175

Framing labor only............ 275 'J-i's 200

Plastering work........ ....... 1,'XO 1,000 800

Roofer's work.................. .3,50 :i00 '250

Furnace work.................. 4.50 .175 :550

Stair work.................... 7,50 7(10 600

Gas fitting..................... 125 03 80

Bells and tubes................. V25 l-i5 110

Glass, plate.................... 1,50 100 75

Glass, sheet................... 125 100 S5

Glass, fancy...............___ 100 75 65

Plumbing..................... 1,600 1,500 1,-100

Sash and skylights............. 115 1(5 75

Hardwood doors, first storj-... 175 100 ;i.50

Pine doors.................... 'lOO 'iib 175

Blinds, inside and outside..... 275 225 175

Blue stone coping, sills and

water table.................. 100 90 75

Flagging sidewalk.............. 275 2-25 175

H.irdware, locks and bronze

work......................... 400 .300 250

Hardwood mantels........... 300 -250 200

Jlirror frames and cornices___ 700 500 ,350

Marble mantels................ lOO IOO 100

Grates and facing.s............ 350 ;i00 2,50

Range....................... ,55 55 .55

A'estibule tiling................ 65 7,0 40

Mirror plates................... 000 500 ■■100

Painting............ .......... :i5il :J0O rioO

JIarble hearths for wood man¬

tels........................... 50 50 50

Bear yard work, grading, sod¬

ding and flagging............. 200 150 100

Ehimb waiters................ 60 60 60

Wainscoting................... 600 400 -250

JIason Work-

Excavating................ 750 600 350

Bricks..................... 1,000 750 700

Labor....................... 1,000 650 500

Base and rough building

stone.................... 300 200 -200

Lime, cement and sand___ 700 .550 500

Carpenter Work-

Beams, flooring and stud¬

ding..................... 1,200 1,000 850

Labor...................... 1,750 1,550 1,350

Coarse hard ware.......___ 300 -250 300

Trimmings................. 1,-250 950 850

Total.........................§21,720 $17,570 gl4,570

LOT ACCOC>T.

Priceoflot...................815,000 Sl-2,000 §10,000

Interest, si.v per cent, one year

on priee of lot.............. 900 <-20 600

Six months on cost of house... 650 5-25 450

Surveyor's fee.................. 15 15 jq

Taxes.......................... 200 160 130

Total lot account............ §16,765 §13,420 §11,100

INCIDENTALS.

Architect's fee................. §250 §250 §250

Counsel's fee .................. 150 150 150

Insurance..................... iS 20 15

Coal............................ 25 25 20

Permits—gas, sewer and water 40 40 40

Watching.................... 50 50 50

Brokerage...................... 400 350 250

Total incidentals......... §940 §885 §775

RECAPITULATION.

Cost Of house.................§21,720 §17,570 §14,570

Lot account................... 16,765 1-3,420 11,190

Incidentals................... 940 885 775

Grand total..................§39,4-25 §31,875 §-26,5-35

Add for builder's profit about

tenpercent................. 4,575 3,125 2.465

Askingprice.................§44,000 §35,000 §29,000

FIXAXCES.

It is a self-evident proposition that in building

for permanent holding or investment, either a pri¬

vate ow-ner or builder is obliged to sit down first

and calculate the cost, to be sure of ready money

and available resources out of which to defray the

expenses of such an undertaking. If these are

deficient the venture must end with a mass of

unliquidated indebtedness—the natural forerun¬

ner of bankruptcj', unless compulsory sale of the

property should avert this result. Although such

provision is absolutelj'- necessarj- in the case cited,

it by no means follows that a speculative builder,

who is building for iiiiiiiediate sale, requires to

be eiiuallj- stocked with money or resources. The

great elasticity of the credit system in building is

probablj'- the secret of its attracting so many ir¬

responsible and veuturesoiue persons, and of the

resulting disgrace which too often atttiches to the

business through multiplied insolvencies. If two

conditions could be positivelj- and reliably' as-

sm-ed, to wit, the prompt and profitable sale of

building productions and the strict honest)- of the

builder in applj-ing the proceeds of such sale to

the payment of his debts, the building busincivs

might be considered of all the smoothest and eas¬

iest going. AVe will endeavor to illustrate oiir

statenient by an example.

We will suppose a builder buys a lot for Sl,5,000,

the whole of the purchase money being left on

teraporarj- mortgage; we will say the builder

then prot^eeds to erect a structure at a cost of

§-3.5,000, making his total outlay at the end of the

job .*^0,000, We will aver that, with a prompt

and meritorious sale of the improved property

following its completion, such an eiitet-pri.se could

be comfortably carried through with a capital of

five thousand dollai-s. This eiLsy state of building

finances arises from the cumulative character of

the work and gradual maturing of indebtedness,

the [whole cost being spread over the period

occupied in building, usually nine or ten months.

The early payments are small and scattering, and

fully two-thii-ds of the whole outlay can be easilj'

deferred until after completion.

The five thousand dollars cash capital of the

builder will easily enable him to discharge claims

for wages aud first payments on principal con¬

tracts. When the building is nearly completed

w-e will assume that he is able to procure a loan

on first mortgage of twenty-five thousand dollars.

This gives him an addition to his ready capital

of ten thoustmd dollai-s, which he can apply to

the cancelling of debts incurred prior to that time,

and then becoming urgent. With the prompt

sale of the property, we will say at cost or with

a profit, he is immediately reimbui-sed with the

fuU amount of his outlay, and has the where¬

withal to discharge all claims growing out of the

transaction. This is not only a truthful and fair

statement of the [financial operation of the busi¬

ness, but it is a case of common occurrence in a

city where choice improved property is so readily

salable. When conducted bj- a clear-headed and

skilful builder, even though provided with only

a moderate share of cash capital, such a thing

as financial embarrassment in a building ope¬

ration should be scarcely known. The troubles

that do arise in this business are occasioned

either by the failure of prompt sale, or by

a sale that fails to realize the first cost. In

other cases troubles arise from the arrant dis¬

honesty of the master builder, who fails to apply

the proceeds of the enterprise, realized by

mortgage or by sale, to the prompt discharge of

the building debts. The tendency of builders to

expimd their business unduly and unwarrantably

is another source of financial trouble. The

limited capital that might be amply sufficient

for a small undertaking is totally inadequate

for one of double or quadruple the size.

The comparative ease with which any

builder in good standing can carry on a small

enterprise is often a temptation for him to em¬

bark in schemes which carry him entirely beyond

his depth. For the purpose of these larger and

more hazardous enterprises the builder is tempted

to resort to the questionable expedient of accept¬

ing building loans; and as these are apt to ex¬

haust tlie profits of a job at the start the builder

is quicklj- brought face to face w-ith the condi¬

tion of insolvency. The facility with which

builders obtain credit, antl the indulgence w-hich

sub-contractors and material men are apt to ex¬

tend in the matter of final iiaj-ments, lead to the

reprehensible practice of ctirryiug over tailings

of accounts from job to job, instead of promptly

settling the accounts of each job at its close. In

this wtiy a volume of floating indebtedness is

created .which proves extremely embarrassing

when tho builder finally reliiuxuishes business, or

is sudtlenly called upon to liquidate his affairs.

Some buildei-s cherish for yeai-s a delusive idea of

their complete solvencj- until it is rudely di-s-

pelled by their being brought face to face with a

mass of floating indebteduess that has been prac-

tictillj' ignored.

It is too much, perhaps, to expect that buildei-s

of the American type will confine their ventures

within conservative bounds. In jirosperous

seasons the readiness of sale of well executed

properties affords such a stimulus and encour¬

agement as are apt to deterniine an active builder

in pursuit of schemes of the greatest magnitude.

The healthiest precept to impress upon our New

York buildei-s is that they should train themselves

to rely upon their own resources; or, if outside

help is required, that such assistance should be

derived from disi-ouuts at banks under conditions

which we have heretofore outlined, or else from

some prudent and considerate banker who would

gauge bis commission for the accommodation thus

afforded according to the actual risk incurred.

This risk in the case of cautious and intelligent

builders operating cleai-ly within pnident bounds

would be reduced to the lowest appreciable one

and should thus entail an outlay for banker's

commission of the most moderate kind.

MINING.

It is now about a year since mining began to be

investigated by our Eastern capitalists, as they

were naturally forced to look for other means of

investment for capital through the immense

shrinkage in values of railroad properties, aud

the comparatively poor prospects they exhibited

of any capability to pay dividentis. When the

promoters of mining schemes first began to talk

on the subject, they were laughed at, and re¬

garded in the light of crtxzy impostoi-s, and the

most tempting schemes were kept in a toi-jiid con¬

dition through want of capital to develop them.

The celebrated Ontario mine, of Utah, when first

put on the Stock Exchange, last March, at tho

very tempting price of §20 per share (pai- value,

§100), was regarded with [suspicion, and six

months passed avi'ay, during which time the mine

was yielding in the neighborhood of §175,000 iu

bullion per month, and about §550,000" in divi¬

dends, without any marked rise in the stock. At

last, however, seeing that the bullion returns were

still kept up, there w-as some slight activity in the

shares, and they are now quoted at between §30

and §'31, a figure which gives the purchaser at least

thirtj--five per cent, on his investment. A number

of other mines have since been brought before the

public, and although some, in the hands of thieves,

proved diastrous to the rash speculator, a number

of them have prospered by the support of tbe

public, and ai-e paying good dividends to the

stockholders. There have been some' i-ather rep¬

rehensible cases of washing mining stocks to a

figure above their real worth; but, as a i-ule, the

public have left them cai-efully alone, and they

have gradually declined to their proper values.

The following is a statement of the prices of

mining stocks at the Exchange this week:

Opening Highest Lowest Closing

American Consojidated lOJ^ ""'

American Flag......... 10

Bertha and Edith.

Jo«