Please note: this text may be incomplete. For more information about this OCR, view

About OCR text.

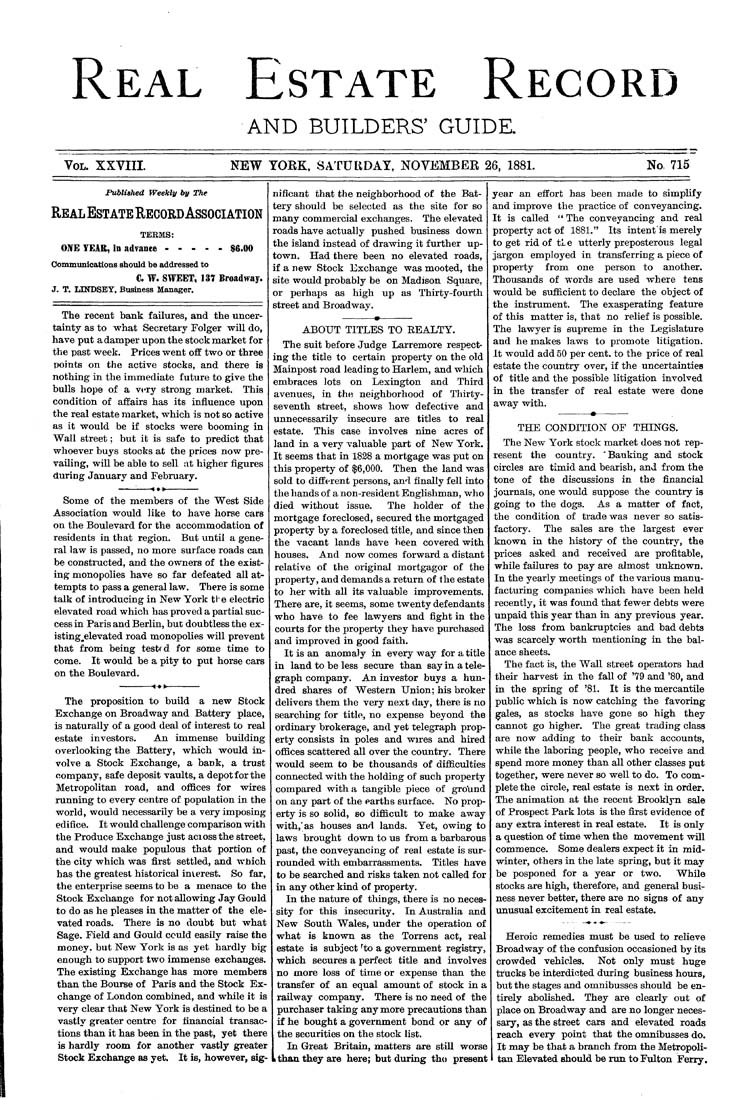

Real Estate Record

AND BUILDERS' GUIDE.

Vol. XXVIII.

NEW YORK, SATUUDAY. NOVEMBER 26, 1881.

No. 715

Published Weekly by The

Real Estate Record Association

TERMS:

OIVE YEAR, in adrance.....$6.00

Oommunications should he addressed to

C. W. SWEET, 137 Broadway.

J. T. LINDSBY. Busmess Manager.

The recent bank failures, and the uncer¬

tainty as to what Secretary Folger will do,

have put a damper upon the stock niarket for

the past week. Prices went off two or three

points on the active stocks, and there is

nothing in the immediate future to give the

bulls hope of a very strong market. This

condition of affairs has its influence upon

the real estate market, which is not so active

as it would be if stocks were booming in

Wall street; but it is safe to predict that

whoever buys stocks at the prices now pre¬

vailing, will be able to sell ;it higher figures

during January and February.

Some of the members of the West Side

Association would like to have horse cars

on the Boulevard for the accommodation of

residents in that region. But until a gene¬

ral law is passed, no more surface roads can

be constructed, and the owners of the exist¬

ing monopolies have so far defeated all at¬

tempts to pass a general law. There is some

talk of introducing in New York tie electric

elevated road which has proved a partial suc¬

cess in Paris and Berlin, but doubtless the ex-

isting_elevated road monopolies will prevent

that from being tested for some time to

come. It would be a pity to put horse cars

on the Boulevard.

The proposition to buUd a new Stock

Exchange on Broadway and Battery place,

is naturally of a good deal of interest to real

estate investors. An immense building

overlooking the Battery, which would in¬

volve a Stock Exchange, a bank, a trust

company, safe deposit vaults, a depot for the

Metropolitan road, and offices for wires

running to every centre of population in the

world, would necessarily be a very imposing

edifice. It would challenge comparison with

the Produce Exchange just across the street,

and would make populous that portion of

the city which was first settled, and which

has the greatest historical interest. So far,

the enterprise seems to be a menace to the

Stock Exchange for not allowing Jay Gould

to do as he pleases in the matter of the ele¬

vated roads. There is no doubt but what

Sage. Field and Gould cculd easily raise the

money, but New York is as yet hardly big

enough to support two immense exchanges.

The existing Exchange has more members

than the Bourse of Paris and the Stock Ex¬

change of London combined, and while it is

very clear that New York is destined to be a

vastly greater centre for financial transac¬

tions than it has been in the past, yet there

is hardly room for another vastly greater

Stock Exchange as yet. It is, however, sig¬

nificant that the neighborhood of the Bat¬

tery should be selected as the site for so

many commercial exchanges. The elevated

roads have actually pushed business down

the island instead of drawing it further up¬

town. Had there been no elevated roads,

if a new Stock Exchange was mooted, the

site wotild probably be on Madison Square,

or perhaps as high up as Thirty-fourth

street and Broadway.

ABOUT TITLES TO REALTY.

The suit before Judge Larremore respect¬

ing the title to certain property on the old

Mainpost road leading to Harlem, and which

embraces lots on Lexington and Third

avenues, in the neighborhood of Thirty-

seventh street, shows how defective and

unnecessarily insecure are titles to real

estate. This case involves nine acres of

land in a very valuable part of New York.

It seems that in 1828 a mortgage was put on

this property of $6,000. Then the land was

sold to different persons, and finally fell into

the hands of a non-resident Englishman, who

died without issue. The holder of the

mortgage foreclosed, secured the mortgaged

property by a foreclosed title, and since then

the vacant lands have been covered with

houses. And now comes forward a distant

relative of the original mortgagor of the

property, and demands a return of the estate

to her with all its valuable improvements.

There are, it seems, some twenty defendants

who have to fee lawyers and fight in the

courts for the property they have purchased

and improved in good faith.

It is an anomaly in every way for a title

in land to be less secure than say in a tele¬

graph company. An investor buys a hun¬

dred shares of Western Union; his broker

delivers them the very next day, there is no

searching for title, no expense beyond the

ordinary brokerage, and yet telegraph prop¬

erty consists in poles and wires and hired

offices scattered all over the country. There

would seem to be thousands of difficulties

connected with the holding of such property

compared with a tangible piece of ground

on any part of the earths surface. No prop¬

erty is so solid, so difficult to make away

with,'as houses and lands. Yet, owing to

laws brought down to us from a barbarous

past, the conveyancing of real estate is sur¬

rounded with embarrassments. Titles have

to be searched and risks taken not called for

in any other kind of property.

In the nature of things, there is no neces¬

sity for this insecurity. In Australia and

New South Wales, under the operation of

what is known as the Torrens act, real

estate is subject ^to a government registry,

which secures a perfect title and involves

no more loss of time or expense than the

transfer of an equal amount of stock in a

railway company. There is no need of the

purchaser taking any more precautions than

if he bought a government bond or any of

the securities on the stock list.

In Great Britain, matters are still worse

k than they are here; but during tho present

year an effort has been made to simplify

and improve the practice of conveyancing.

It is called " The conveyancing and real

property act of 1881." Its intent'is merely

to get rid of tLe utterly preposterous legal

jargon employed in transferring a piece of

property from one person to another.

Thousands of words are used where tens

would be sufficient to declare the object of

the instrument. The exasperating feature

of this matter is, that no relief is possible.

The lawyer is supreme in the Legislature

and he makes laws to promote litigation.

It would add 50 per cent, to the price of real

estate the country over, if the uncertainties

of title and the possible litigation involved

in the transfer of real estate were done

away with.

THE CONDITION OF THINGS.

The New York stock market does not rep¬

resent the country. 'Banking and stock

circles are timid and bearish, and from the

tone of the discussions in the financial

journals, one would suppose the country is

going to the dogs. As a matter of fact,

the condition of trade was never so satis¬

factory. The sales are the largest ever

known in the history of the country, the

prices asked and received are profitable,

while failures to pay are almost unknown.

In the yearly meetings of the various manu¬

facturing companies which have been held

recently, it was found that fewer debts were

unpaid this year than in any previous year.

The loss from bankruptcies and bad debts

was scarcely worth mentioning in the bal¬

ance sheets.

The fact is, the Wall street operators had

their harvest in the fall of '79 and '80, and

in the spring of '81. It is the mercantile

public which is now catching the favoring

gales, as stocks have gone so high they

cannot go higher. The great trading class

are now adding to their bank accounts,

while the laboring people, who receive and

spend more money than all other classes put

together, were never so well to do. To com¬

plete the circle, real estate is next in order.

The animation at the recent Brooklyn sale

of Prospect Park lots is the first evidence of

any extra interest in real estate. It is only

a question of time when the movement will

commence. Some dealers expect it in mid¬

winter, others in the late spring, but it may

be posponed for a year or two. While

stocks are high, therefore, and general busi¬

ness never better, there are no signs of any

unusual excitement in real estate.

Heroic remedies must be used to relieve

Broadway of the confusion occasioned by its

crowded vehicles. Not only must huge

trucks be interdicted during business hours,

but the stages and omnibusses should be en¬

tirely abolished. They are clearly out of

place on Broadway and are no longer neces¬

sary, as the street cars and elevated roads

reach every point that the omnibusses do.

It may be that a branch from the Metropoli¬

tan Elevated should be run to Fulton Ferry.