Real Estate Recor

AND BUILDERS' GUIDE.

Vol. XXYIII.

NEW YOEK, SATUEDAY, DECEMBEE 24, 1881.

No. 719

Published Weekly by The

Real Estate Record Association

TERMS:

ONE YEAR, in advance.....$6.00

Communications should he addressed to

C. W. SWEET, 137 Broadway.

J. T. LINDSEY'Business Manager.

THE GENERAL MARKETS.

The bears have complete possession of the

Stock Exchange. Stock after stock is at¬

tacked and prices steadily gravitate towards

lower figures. It is understood that Mr. Jay

Gould is once more a pronounced bear, a

part that fits him much better than as a bull,

trying to maintain the market. Why the

market should go down in the face of every

material condition to advance it, is the

question which at present is being much

discussed in financial circles. Labor is

abundantly and profitably employed, man¬

ufacturing industries were never so active,

immigi-ation is unprecedentedly large, rail¬

roads are doing an immensely increased bus¬

iness, and yet here are stock values reced¬

ing.

Of course this drift of things must be due

to some general cause, quite apart from the

ordinary material conditions. The very ac¬

tivity of trade and manufacturing industries

is taking money away from Wall street. In

ordinary years the money sent out to move

the crops during the fall begins to return in

December. But this year exchanges are

against New York from nearly every point.

The surplus money of the country is being

invested in land, in manufacturing enter¬

prises, in building, and in a thousand spec¬

ulative ways outside of the stock markot.

Then, it is not to be disguised that the pro¬

posed silver legislation, urged by President

Arthur and Secretary Folger, has had a

depressing effect upon prices. Even conced¬

ing that in order to secure the consent of

other nations to bi-metallism it is desir¬

able for the United States to stop the coin¬

age of silver, still the fact remains that a

practical withdrawal of $100,000,000 of

currency, which is about the amount of fAl-

ver and certificates afloat, would necessarily

cause a drop in stock values from 20 to 30

points. Any withdrawal of currency, gold,

silver or paper, is contraction, and the stop¬

page of the issue of silver certificates was

immediately felt in this market. This is a

matter well understood abroad, and since

the receipt of Secretary Folger's report, and

Tiesident Arthur's message in Europe, there

have been heavy sales in this market upon

European account. The German bankers,

heretofore great bulls on American securities,

have been heavy sellers recently, hence the

weakness in Denver & Rio Grande, St. Paul,

New York Central, and the other stocks

dealt in at Hamburg, Berlin and Amster¬

dam. The terrible shrinking caused by the

withdrawal of silver as money in Germany,

in 1873, has not been lost upon German

financiers. There is no more gold coming

this way, and without gold importations we

have never had a bull market in our ex¬

change since resumption.

The grain and cotton markets are also weak

in sympathy. The break in prices may have

one good effect, in stimulating the export

of our agricultural products.

Of course there will be a recovery of prices

sometime early next year. From the com¬

position of the committees of the House, it

is clear that there will be no disturbance of

the tariff, and then it is almost certain that

an effort will be made to revive our foreign

commerce by means of generous subsidies

to steamship lines. Liberal appropriations

will also be made for river and harbor im¬

provements, while doubtless some internal

taxes will be taken off. Should there even

be a good prospect of Mr. Randall's funding

biU passing, it may begin quite a formidable

bull movement. If the depression in Wall

street continues up to the time that Congress

reassembles, some legislation will be

attempted to help prices, for a lowering in

Wall street casts a gloom over all the mar¬

kets.

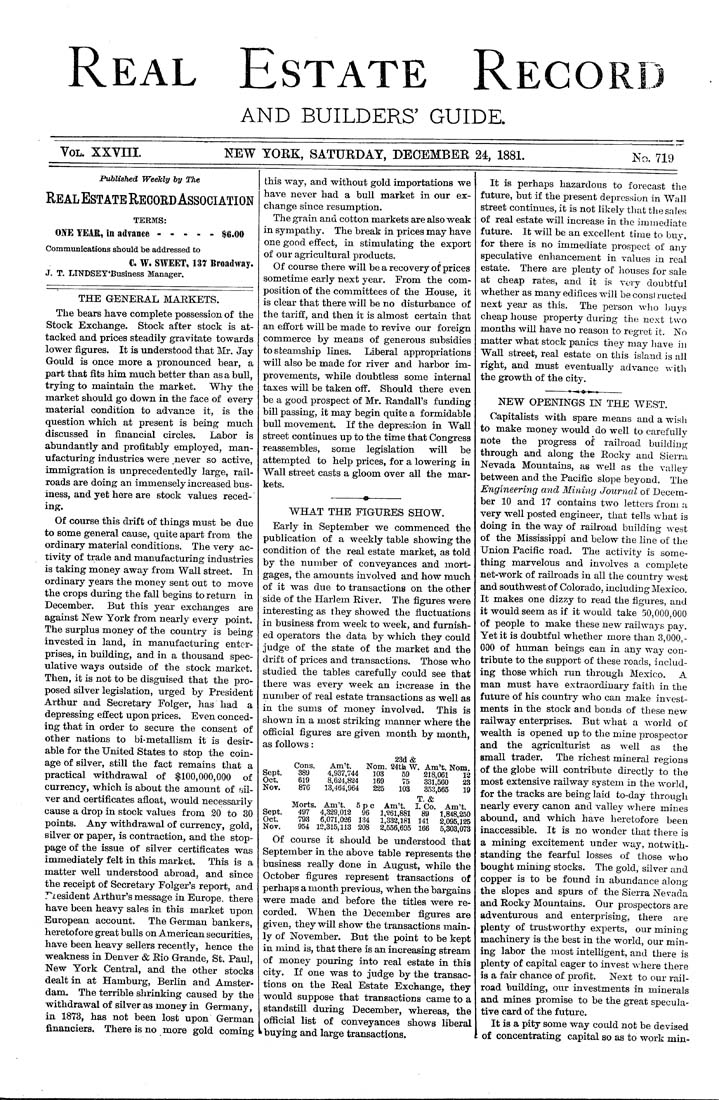

WHAT THE FIGURES SHOW.

Early in September we commenced the

publication of a weekly table showing the

condition of the real estate market, as told

by the number of conveyances and mort¬

gages, the amounts involved and how much

of it was due to transactions on the other

side of the Harlem River. The figures ^vere

interesting as they showed the fluctuations

in business from week to week, and furnish¬

ed operators the data by which they could

judge of the state of the market and the

drift of prices and transactions. Those who

studied the tables carefully could see that

there was every week an increase in the

number of real estate transactions as well as

in the sums of money involved. This is

shown in a most striking manner where the

oflacial figures are given month by month,

as follows:

23d &

Cons. Am't. Nom. 84th W. Am't. Nom

Sept. 389 4,937,744 103 59 218 061 12

Oct. 619 8,6.24,824 169 75 331560 23

Nov. 876 13.464,964 225 103 353,565 19

T. &

Morts. Am't. 5 p c Am't. 1. Co. Am't.

Sept. 497 4,329,012 96 1,261,881 89 1.848,250

Oct. 793 6,071,026 134 1,332,181 141 2,095125

Nov. 954 12,315,113 208 2.556,695 166 5,303,073

Of course it should be understood that

September in the above table represents the

business really done in August, while the

October figures represent transactions of

perhaps a month previous, when the bargains

were made and before the titles were re¬

corded. When the December figures are

given, they will show the transactions main¬

ly of November. But the point to be kept

in mind is, that there is an increasing stream

of money pouring into real estate in this

city. If one was to judge by the transac¬

tions on the Real Estate Exchange, they

would suppose that transactions came to a

standstill during December, whereas, the

ofiacial list of conveyances shows liberal

^ buying and large transactions.

It is perhaps hazardous to forecast the

future, but if the present depression in Wall

street continues, it is not likely that the sale.s

of real estate will increase in the immediate

future. It will be an excellent time to buy,

for there is no immediate prospect of any

speculative enhancement in values in real

estate. There are plenty of houses for sale

at cheap rates, and it is very doubtful

whether as many edifices will be constructed

next year as this. The person wlio l)uys

cheap house property during the next two

months will have no reason to regret it. No

matter what stock panics they may liave in

Wall street, real estate on this island is all

right, and must eventually advance vritli

the growth of the city.

NEW OPENINGS IN THE WEST.

Capitalists with spare means and a wish

to make money would do well to carefully

note the progress of railroad building

through and along the Rocky and Sierra

Nevada Mountains, as well as the valley

between and the Pacific slope beyond. The

Engineering and Mining Journal of Decem¬

ber 10 and 17 contains two letters from a

very well posted engineer, that tells what is

doing in the way of raflroad building west

of the Mississippi and below the line of the

Union Pacific road. The activity is some¬

thing marvelous and involves a complete

net-work of railroads in all the country west

and southwest of Colorado, including Mexico.

It makes one dizzy to read the figures, and

it would seem as if it would take 50,000,000

of people to make these new railways pay.

Yet it is doubtful whether more than 3,000.-

000 of human beings can in any way con¬

tribute to the support of these roads, includ¬

ing those which run through Mexico. A

man must have extraordinary faith in the

future of his country who can make invest¬

ments in the stock and bonds of these new

railway enterprises. But what a world of

wealth is opened up to the mine prospector

and the agriculturist as well as the

small trader. The richest mineral regions

of the globe will contribute directly to the

most extensive railway system in the world,

for the tracks are being laid to-day through

nearly every canon and valley where mines

abound, and which have heretofore been

inaccessible. It is no wonder that there is

a mining excitement under way, notwith¬

standing the fearful losses of those who

bought mining stocks. The gold, silver and

copper is to be found in abundance along-

the slopes and spurs of the Sierra Nevada

and Rocky Mountains. Our prospectors are

adventurous and enterprising, there are

plenty of trustworthy experts, our mining

machinery is the best in the world, our min¬

ing labor the most intelUgent, and there is

plenty of capital eager to invest where there

is a fair chance of profit. Next to our rail¬

road building, our investments in minerals

and mines promise to be the great specula¬

tive card of the future.

It is a pity some way could not be devised

of concentrating capital so as to work min-