.April 15, 1899.

Record and Guide

:f

66s

DtAjet TO (^ E:8T)jE.BoiLDqi> *ppKnECTV)vj{o(raiaiiPDearii{ioi

BitsdAess AibluEMBs or CEjio^ iKTOipi,

PRICE PER TEAR IN ADVANCE SIX DOLLARS

Publithed every Saturday.

TbLBFHOKR, COBTI.Ain>T 1370.

Communications should be addresEed to

C. W. SWEET, 14-lG Vesey'Street

J. 7. LINDSEY, Business Manager,

"Entered at the Post-O^iee at New York, N. Y,, asseeond-elasB matter."

Vol. LXIIL

APRIL 15, 1899.

No. 1,622.

THE rapid recovery in Transits and Industrials that has

marlced this week's stock market is due to a speculative

reactive movement hased on an unexpected ease in money.

Wtiether it can be continued or maintained for long is doubtful.

If further advances are possible the Transits have the best show

for making them, but neither they or the Industrials will receive

Bupportfrom any but speculative buyers. The prices to which they

have already been put, fully discounts all their future that can

be seen and if there is any good In them to which the attention

of the public has not been called, which ie very unlikely, that

also. Easy money rates encourage speculation and for the mo¬

ment speculation favors those issues which have the moat sen¬

sational movements, but the moment there is any sign of a pinch

it is these very issues that are likely to suffer most and quick¬

est. They are marked for banning as soon as danger is appre¬

hended. Good railroad issues may not promise so large, or so

rapid a return, but they will be less likely to interfere with sleep

in times of uncertainty regarding the conditions that are to pre¬

vail in the money market. It is a little early yet to say what the

spring demands for agricultural and commercial purposes will be,

but while there will be moments of disturbance in the call money

section at any rate, we do not look for a stringent money market

in view of the large amounts of funds that must be still available,

It cannot be that the expansion of business experienced so far,

whether in the speculative, or more legitimate fields of enterprise,

has already used up the immense capital resources with which we

started the year. When the needs of trade and commerce are sup¬

plied there should be stiil ample for other purposes, but we are

entering upon the period of disturbance and cannot look for even

rates, even if there is no likelihood for very high ones; except on

what may be called emergency loans, such as put up rates last

week. The announcement that the Treasury Department will

make systematic withdrawals of funds from the market for some

weeks to come, must, of course, have its influence on- rates, al¬

though these withdrawals are to be made in the way least likely

to do harm. Tliere is a tendency to make the most of the unfav-

orable crop reports recently issued by the government, and this

tendency wiil affect the grangers more particularly if it is ef¬

fective at all. Regarding the crop conditions themselves, it should!

be noticed that the increased acreage under cultivation ought to

more than offset the decline in percentage of average condition,

and that a backward spring though it has a tendency that way,

does not necessarily imply a small crop. Still, whatever may be

the favorable points of the situation, the fact that the market haa

proved susceptible to bear attacks proves that the bull feeling ia

no,longer sustained by entire confidence and that reactive mov©^

ments are more to be expected: than advances.

SO well sustained is the demand for money in the Buropeani

market that financial circles are discussing the probability

for advances in the bank rates, the point of extremest tension be¬

ing again Berlin. A matter to which no little attention is due ia

the budget just presented in the British House of Commons. Mr.

Goschen was able to report a small surplus for the fiscal year Just

closed, though early in the present calendar year the chances

pointed to a deficiency. But, instead of being able to meet extra

naval allowances out of surpluses, Mr. -Goschen ia compelled to

resort to taxation to procure the additional ships claimed to be

needed to maintain the traditional margin of superiority of the

British fleet over that of the two largest European naval powers.

That the people will care to have these expenditures continued

along with the slackening of commercial activity which the de¬

cline in the government's receipts shows Is extremely doubtful.

The withdrawal of governmental ship building would in turn In-

cpease the falling off Id business. Such a contingency is among

the high probabilities; In fact it Is a national expectation thatthe

withdrawal of extra naval expenditures, which expenditures

started the boom in British business in '94, should be the Blgn

- fhat the extreme point of activity had been reached, and that a

.reaction was in order. The Australian loans were uot as suc¬

cessful as was hoped, which is another indication of changing

conditions. Australian federation, however, seems to be getting

along in good shape, already in anticipation of its being accom¬

plished proposals for a uniform tariff, which promises to be pro¬

tective, are being formulated. The conclusion of the African

agreement between France and England may be immediately fol¬

lowed by negotiations on the Madagascar duties, a matter in

which the United States is directly interested, because trade with

this country has been as much injured by the French regulations

in Madagascar as has that of Great Britain. Just at the moment

both the United States and Great Britain are more likely to be

occupied with Germany in the settlement of the Samoan difBculty.

In this connection it may not he useless to utter a caution against

the too literal acceptance of the harsh things said by the German

press whether applied to Great Britain or ourselves. The can¬

dor of Bismarck in his memoirs and of bis Eosweli, Dr. Busch,

have shown us the crude work required from the German press

in the discharge of its duty toward tbe state—a sort of argumen¬

tation that had currency in our backwoods fifty years ago, and

whicb had to be profusely diluted before being taken.

-----------^-----------

THE AUCTION MARKET.

IT is clear to everyone who frequents the auction room that the

business there has In the past sixty days undergone a very vig¬

orous revival. Instead of the lounging apathetic crowd who occu¬

pied the room all, last year, except upon the comparatively few

special occasions when some unusually attractive property was

offered, and property that was rather attractive from tbe specula¬

tive than the investment point of view, there Is now to be seen at

noon of each business day a bustling, active, eager throng, among

whom are many new faces. The last statement explains the

change that has come over the room and the increased volume

of transactions completed under the sign of the hammer. With¬

out new blood, the possibilities of an active auction market three

months ago were very remote. As a matter of fact the purchases

of the old stagers this spring have been comparatively small.

Accustomed to great fluctuations in values as a result of wild

speculation and weak financial conditions,he has been waiting for

the bargains of ten and twenty years ago, oblivious of the

changes tbat have been produced by local conditions, which, to¬

gether with the great increase in the wealth of the community

and concurrent reduction In interest rates, have established val¬

ues for New York realty on a new and permanently higher plane,

BO that old-time prices will never return. A significant feature of

tbe auction market has been the competitive local buying, or

buying by residents or business men in the immediate vicinity

of the property offered. This buying is the most satisfactory

■ that can. be obtained, inasmuch as it is based on a thorough

knowledge of the conditions surrounding the parcels bought, and

Is often for use and as often for investment. The buyers In these

cases can, naturally, always outbid the professional operator.

First let us draw attention' to the foreclosure sales, which are

eummarized in the following table:

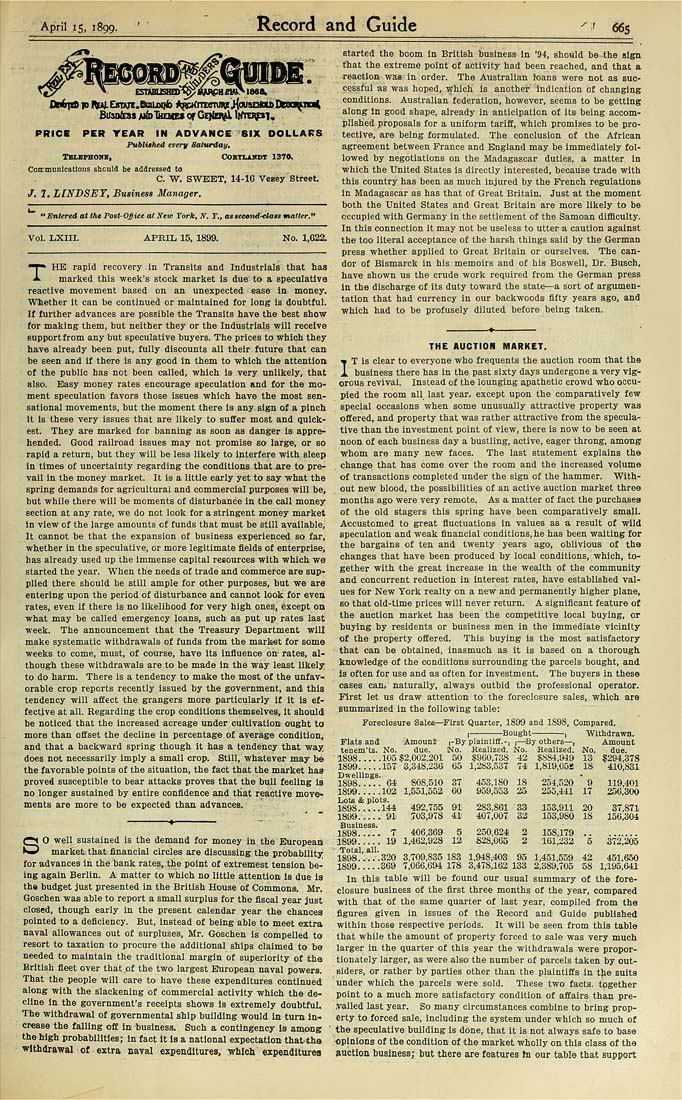

Foreclosure Sales—First Quarter, 1899 and 1S9S, Compared.

I----------Bought----------, ■Withdrawn.

Flata and -Amounl! j-By plaintiff.-, (—'By others—, Amount

tenem'ta. No. due. [No. Realized. No, Realized. No. due.

1898.....105 $2,002,201 50 $960,73S' 42 $S&i,9i9 13 $294,373

1899.....157 3,348,236 65 l,2S3,o3T 74 1,819,052 IS 410,831

Dwellings.

1898.....64 808,510 37 453,180 IS 254,520 9 119.401

1899.....102 1,551,552 60 959,553 25 255,441 17 256,300

LotA & plots.

1898.....144 492,755 91 283,861 33 153,911 20 37,871

1899...... 91 703,978 4Ji 407,007 33 153,980 IS 156,30i

Business.

1898...... T 406,369 5 250,624 2 158,179 .........

■1899.....19 1,462,928 12 828,065 2 161,233 5 372,205

- Total, all.

18&S____.320 3,709,835 183 1,948,403 95 1,451.559 42 451.650

1899.....S69 7,066.694 178 3,478,162 133 2,389,705 58 1,195,641'

In this table will be found our usual summary of the fore¬

closure business of the flrst three months of the year, compared

with that of the same quarter of last year, compiled from the

figures given in issues of the Record and Guide published

within those respective periods. It wiil be seen from this table

that while the amount of property forced to sale was very much

larger in the quarter of this year the withdrawals were propor¬

tionately larger, as were also the number of parcels taken by out¬

siders, or rather by parties other than the plaintiffs in tjie suits

under which the parcels were sold. These two facts, together

point to a much more satisfactory condition of affairs than pre¬

vailed last year. So many circumstances combine to bring prop¬

erty to forced sale, including the system under which so much of

the speculative building Is done, that It is not always safe to base

opinions of the condition of the market wholly on this class of the

auction business; but there are features fn our table that support

I