Real estate record and builders' guide: v. 17, no. 409: January 15, 1876

| Issue list for this volume | Browse all volumes | « previous search result | next search result » |

false

Please note: this text may be incomplete. For more information about this OCR, view About OCR text.

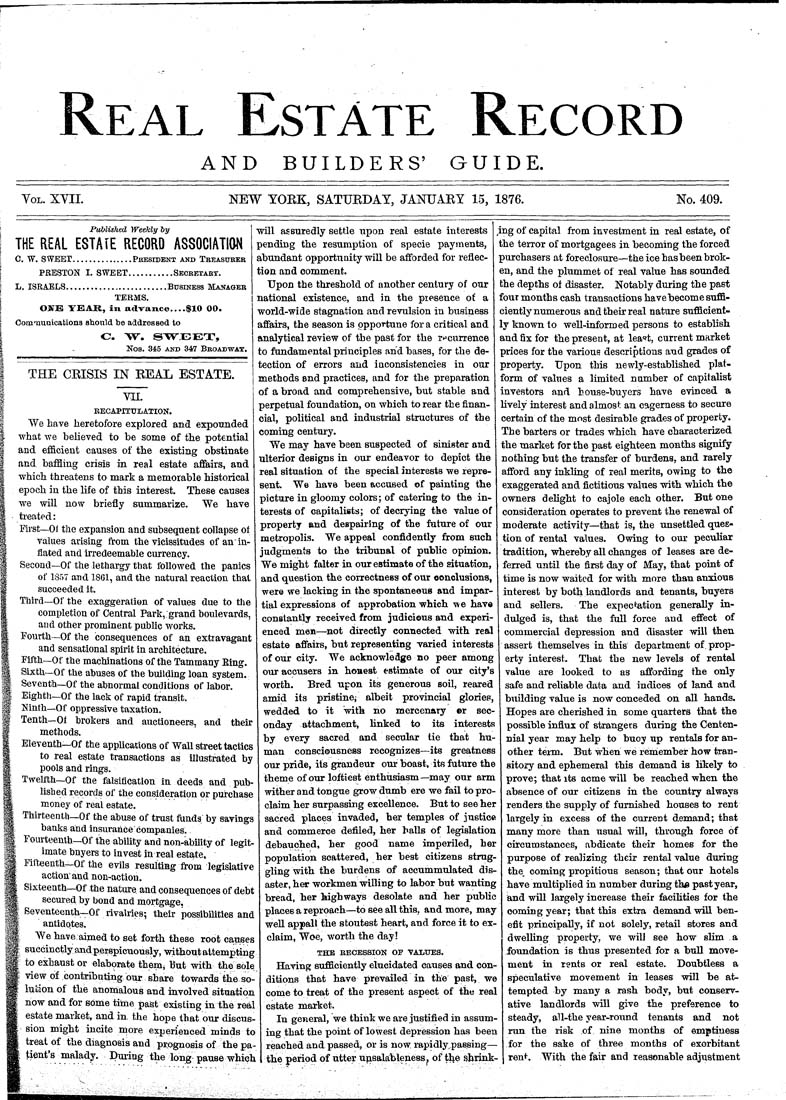

Real Estate Record AND BUILDERS' GUIDE. YoL. XVII. NEW YOKE, SATUKDAY, JANUARY 15, 1876. No. 409. jPublished "Weekly by THE REAL ESTAfE RECORD ASSOCIATION C. W. SWEET...............Peesident and Teeasueer PflESTON I. SWEET...........Secbetaet. L. ISRAELS.........................Business Managee TERMS, ONE YKAR, in advance___$10 00. Comnaunicatlons should be addressed to Nos. 345 AND 34i7 Beoadwat. THE CRISIS IN REAL ESTATE. YII. BECAPITULATION. We have heretofore explored and expounded what we believed to be some of the potential and efficient causes of the existing obstinate and baffling crisis in real estate affairs, and which threatens to mark a memorable historical epoch in the life of this interest. These causes we wUl now briefly summarize. We have treated: First—Of the expansion and subsequent collapse of values arising from the vicissitudes of an' in¬ flated and irredeemable currency. Second—Of the lethargy that followed the panics of 1857 and 1861, and the natural reaction that succeeded it. Third—Of the exaggeration of values due to the completion of Central Park, grand boulevards, aud other prominent public works. Fourth-Of the consequences of an extravagant and sensational spMt in architecture. Fifth—Of the machinations of the Tammany King. Sixth—Of the abuses of the building loan system. Seventh—Of the abnormal conditions of labor. Eightli—Of the lack of rapid transit. jSinth—Of oppressive taxation. Tenth—Of brokers and auctioneers, and their methods. Eleventh—Of the appUcations of Wall street tactics to real estate transactions as Illustrated by pools and rings. Twelfth-Of the falsification in deeds and pub¬ hshed records of the consideration or purchase money of real estate. Thirteentli—Of the abuse of trust fiinds by savings banks and insurance companies. Fourteenth—Of the abihty and non-ability of legit¬ imate buyers to invest in real estate, -Of the evils resuitiag from legislative action'and non-action. Sixteenth—Of the nature and consequences of debt secm-ed by bond and mortgage. Seventeenth—Of rivalries-, their possibilities and antidQtes. We have aimed to set forth these root causes succinctly and perspicuously,-without attempting to exhaust or elaborate thenii But with the sole view of eontributihg oiir share towards the so¬ lution of the anomalous and involved situation now and for some tiine past existing in the real estate market, and in. the hope that our discus¬ sion might incite more experienced minds to treat of the diagnosis and prognosis of the pa¬ tient's malady. Dm-ing the long pause which Fifteenth- will assuredly settle upon real estate interests pending the resumption of specie payments, abundant opportunity will be afforded for reflec¬ tion and comment. Upon the threshold of another century of our national existence, and in the presence ot a world-wide stagnation and revulsion in business affairs, the season is opportune for a critical and analytical review of the past for the rt^currence to fundamental principles and bases, for the de¬ tection of errors and inconsistencies in our methods and practices, and for the preparation of a broad and comprehensive, but stable and perpetual foundation, on which to rear the finan¬ cial, political and industrial structures of the coming century. We may have been suspected of sinister and ulterior designs in our endeavor to depict the real situation of the special interests we repre¬ sent. We have been accused of painting the picture in gloomy colors; of catering to the in¬ terests of capitalists; of decrying the value of property and despairing of the future of our metropolis. We appeal confidently from such judgments to the tribunal of public opinion. We might falter in our estimate of the situation, and question the correctness of our conclusions, were we lacking in the spontaneouB and impar¬ tial expressions of approbation which we have constantly received from judicious and experi¬ enced men—^not directly connected with real estate affairs, but representing varied interests of our city. We acknowledge no peer among our accusers in honest estimate of our city's worth. Bred upon its generous soil, reared amid its pristine; albeit provincial glories, wedded to it "with no mercenary or sec- onday attachment, linked to its interests by every sacred and secular tie that hu¬ man consciousness recognizee—its greatness our pride, its grandeur our boast, its future the theme of our loftiest enthiisiasm—may our arm wither and tongue grow dumb ere we fail to pro¬ claim her surpassing excellence. But to see her sacred places invaded, her temples of justice and commerce defiled, her balls of legislation debauched, her good name imperiled, her population scattered, her best citizens strug¬ gling with the burdens of accummulated dis¬ aster, her workmen willing to labor but wanting bread, lier highways desolate and her public places a reproach—to see all this, and more, may well appall the stoutest heart, and force it to ex¬ claim. Woe, worth the day! THE SECESSION OP VALTTES. Having sufficiently elucidated causes and con¬ ditions that have prevailed in the past, we come to treat of the present aspect of the real estate market. In general, we think we are justified in assum¬ ing that the point of lowest depression has been reached and passed, or is now rapidly passing— the period of utter ujisalableness^ of tl^e shrink¬ ing of capital from investment in real estate, of the terror of mortgagees in becoming the forced purchasers at foreclosure—the ice has been brok¬ en, and the plummet of real value has sounded the depths of disaster. Notably during the past four months cash transactions have become suffi¬ ciently numerous and theu' real nature sufficient¬ ly known to well-informed persons to establish and fix for the present, at lea«t, current market prices for the various descriptions aud grades of property. Upon this newly-established plat¬ form of values a limited number of capitalist investors and house-buyers have evinced a lively interest and almost an eagerness to secure certain of the most desirable grades of property. The barters or trades which have characterized the market for the past eighteen montlis signify nothing but the transfer of burdens, and rarely afford any inkling of real merits, owing to the exaggerated and fictitious values with which the owners delight to cajole each other. But one consideration operates to prevent the renewal of moderate activity—that is, the unsettled ques¬ tion of rental values. Owing to our peculiar tradition, whereby all changes of leases are de¬ ferred until the first day of May, that point of time is now waited for with more than anxious interest by both landlords and tenants, buyers and sellers. The expect-ation generally in¬ dulged is, that the full force and effect of commercial depression and disaster will then assert themselves in this department of. prop¬ erty interest. That the new levels of rental value are looked to as affording the only safe and reliable data and indices of land and building value is now conceded on all hands. Hopes are cherished in some quarters that the possible influx of strangers during the Centen¬ nial year may help to buoy up rentals for an¬ other tenn. But when we reniember how tran¬ sitory and ephemeral this demand is likely to prove; that its acme will be reached when the absence of our citizens in the country always renders the supply of furnished houses to rent largely in excess of the current demand; that many more than usual wUl, through force of circumstances, abdicate their homes for the purpose of realizing their rental value during the_ coming propitious season; that our hotels have multiplied in number during the past year, iand will largely increase their facilities for the coming year; that this extra demand wiU ben¬ efit principally, if not solely, retail stores and dwelling property, we will see how slim a foundation is thus presented for a bull move¬ ment in rents or real estate. Doubtless a speculative movement in leases will be at¬ tempted by many a rash body, but conserv¬ ative landlords will give the preference to steady, all-the year-round tenants and not run the risk of nine months of emptiness for the sake of three months of exorbitant rent. With the fair and reasonable adjustment

| Issue list for this volume | Browse all volumes | « previous search result | next search result » |